Winter rent growth cooldown: Which markets will perform the best in 2023?

Reports on the apartment market continue to show declining rent performance at the national level, but there is considerable variation among different markets, with midwestern markets receiving more attention for their strong, positive performance compared to many of the previously high performing markets in the South and West. In the broader economy, middling jobs numbers could mean that the Federal Reserve is less inclined toward another sharp increase in the Federal Funds Rate, but we have not yet felt the full effects of this year’s rate hikes, which will continue to shape the multifamily market throughout 2023.

ADP: “Employment Report” – https://adpemploymentreport.com/

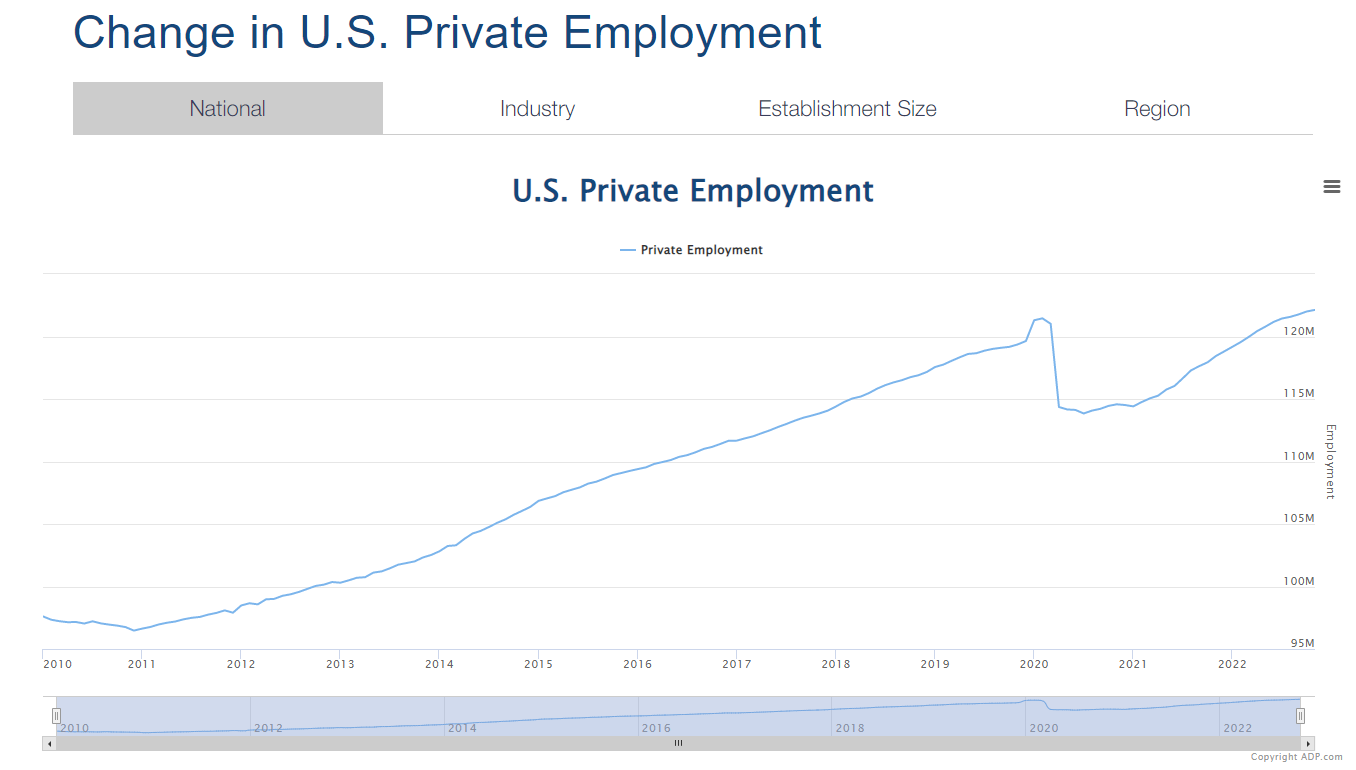

We added 127,000 jobs last month, “well below estimate[s]” according to another source analyzing the numbers. The Dow Jones was estimating 190k jobs added, specifically. The labor department is releasing their own numbers in a couple of days from this recording, and the expectation there is for 200,000 jobs added, but if this ADP jobs report came in under expectation, there’s a possibility that the labor department report could be below what’s expected as well.

Wage growth is moderating alongside smaller jobs gains:

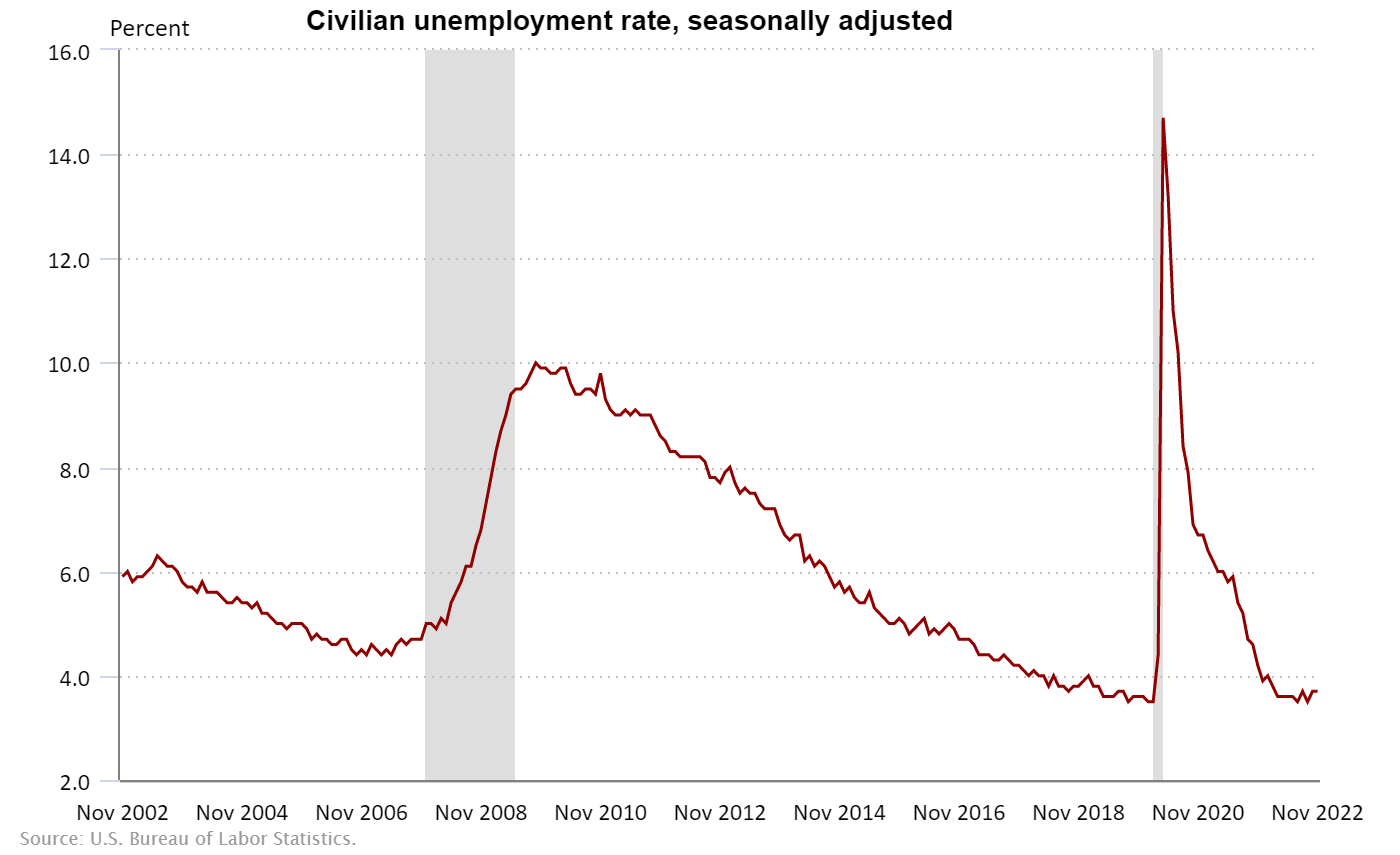

“Turning points can be hard to capture in the labor market, but our data suggest that Federal Reserve tightening is having an impact on job creation and pay gains. In addition, companies are no longer in hyper-replacement mode. Fewer people are quitting and the post-pandemic recovery is stabilizing.”

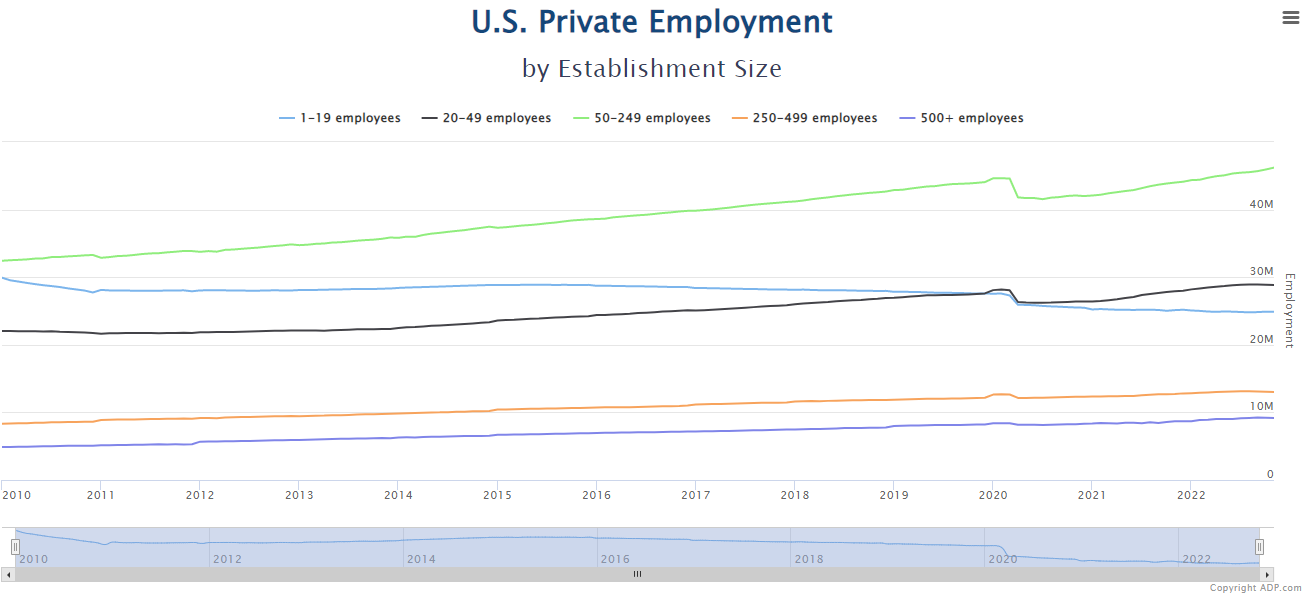

When it comes to the size of the companies doing the hiring, the real winners here are mid-size companies, 50-249 employees, hiring 283,000 employees compared to job losses in many of the larger and smaller companies here. Manufacturing companies are losing jobs according to the report, down 100,000, while hospitality is adding 224k and medical/education sectors adding 55k.

There was a realtor.com headline I came across that was asking the same question that I have been asking, especially as it relates to this podcast—what are the implications for this job market on the housing market and on multifamily in particular.

Now, the realtor.com article was specifically focused on the job losses in the tech sector, but you can say the same thing here about the job losses in the manufacturing sector, in the financial, information, and business services categories—all of these have seen some job losses.

I’ll say that the immediate subject I’m thinking about is interest rates. Is this the environment that the Federal Reserve has sought to create? The ADP economist is very much suggesting this.

I’ve mentioned it before, but there is a small consolation, however painful it’s going to be in the near-term, that a Federal Reserve-triggered recession may not be as bad as a recession that was caused by inherent aspects of the economy. That being said, my real fear is that the Fed is triggering an economic crisis that they can’t reel back in.

To nail down my point about relevance to multifamily, it all seems to come back to financing. That’s going to be such a big challenge in the next year or two. I mean, yes, there are going to be some deals out there with assumable loans or something like that, but I’m wondering how much prices will come down or cap rates come up because there are sellers that need to find a buyer in this new high interest rate environment.

Apartment List: “National Rent Report” – https://www.apartmentlist.com/research/national-rent-data

Apartment List calls this report their “December Rent Report,” but it’s got the data on November rents. I call it a “November Rent Report.” But then again, in our own reports to investors, we present data from the previous month in order to have the most accurate information.

I was almost tripped up trying to make a graphic for our reporting yesterday: We’re issuing a report on October information close to the start of December, so should the graphic call it an October report, a December report, or a November report?

In the end, we went with “Monthly Report,” which has a timeless, evergreen feel.

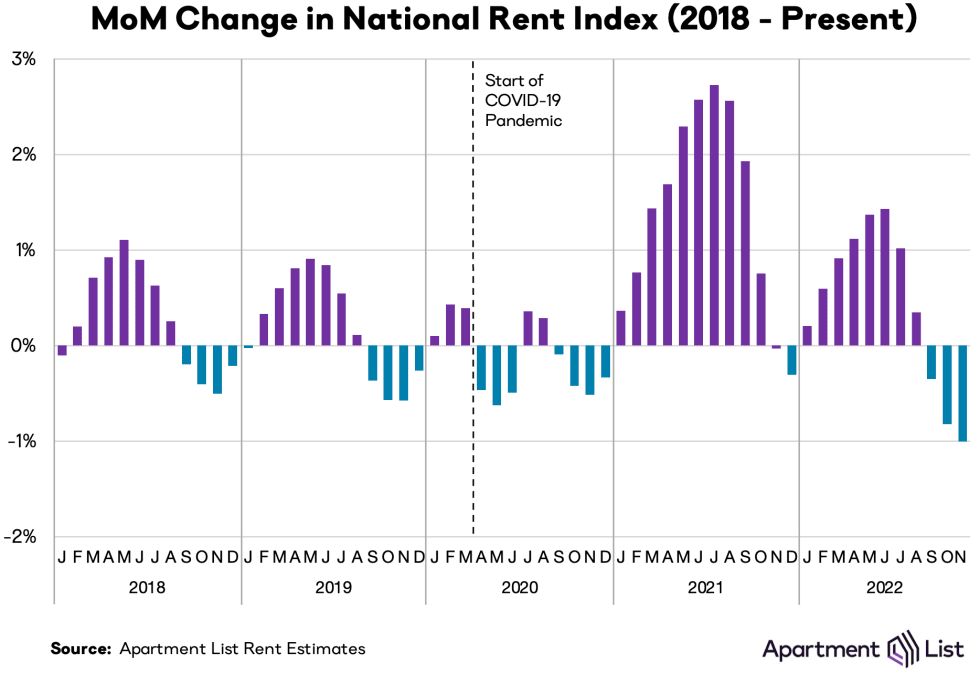

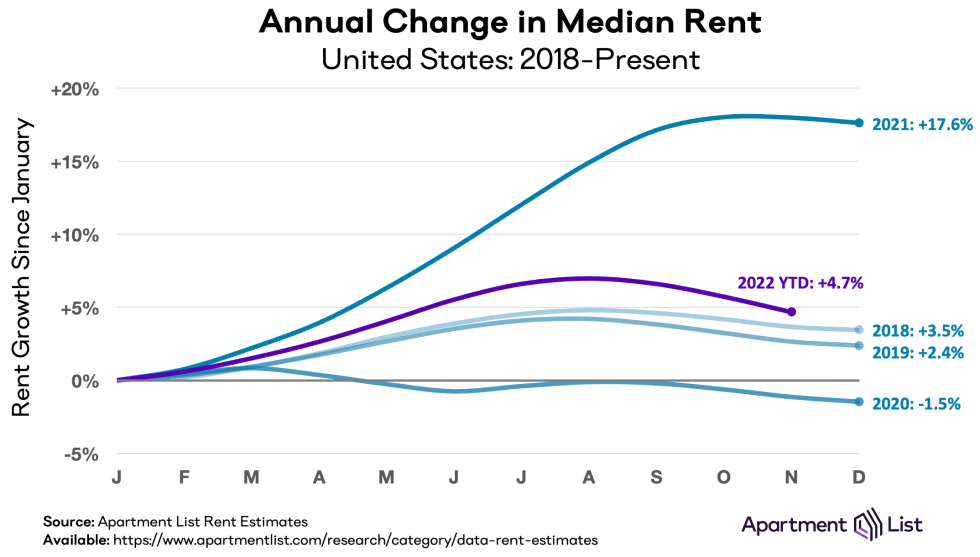

Topline numbers in this Apartment List report: We’re at 4.7% year-over-year rent growth now. Month-over-month rent growth was negative 1%.

We are deep into a winter slump, and it would be misleading to describe this as anything other than a cooldown. Three consecutive months of declining month-over-month rent growth, with the declines increasing as each month passes. It would be disingenuous to lean on the higher-than-average year-over-year growth as a reassuring distraction from the immediate cooldown in rent growth. Yes, rents had strong growth earlier this year, but that doesn’t help me assess the current situation. We’re in a new world now.

Now, looking at the trends from the pre-pandemic years of 2018 and 2019, I might also be reassured by the fact that the seasonal slump in rent growth eases up in December in those years, but again, we’re in a new world now, and I think it’s far more helpful to be realistic about the trends in the apartment market. NOT PESSIMISTIC, REALISTIC.

To put Apartment List’s numbers into perspective a little bit, they have been on the lower end of rent growth measurements compared to other monthly reporting we follow.

Last month, Apartment List posted 5.7% year-over-year rent growth, and the average of the 9 rent reports we follow was 7.58%. Apartment List has the second-lowest YoY numbers for last month, but Co-Star/Apartments.com was a full 0.9% below them at 4.8% last month. Apartments.com hasn’t released this month’s report yet, but I am curious to see how large the spread will be for this month.

So, if we are going to get real, what’s the best course of action here?

Freezing up counts as an action. A lot of investors are doing that. They’re waiting and seeing. If you don’t play, you don’t lose. You don’t win either, but you’ll avoid catastrophe. The difficulties created by the higher interest rate environment do make the wait-and-see model a little more attractive, but without an alternative investment, inflation has assigned a measurable cost to waiting.

So, if you’re interested in investing, then, what kinds of deals are worth pursuing in this environment?

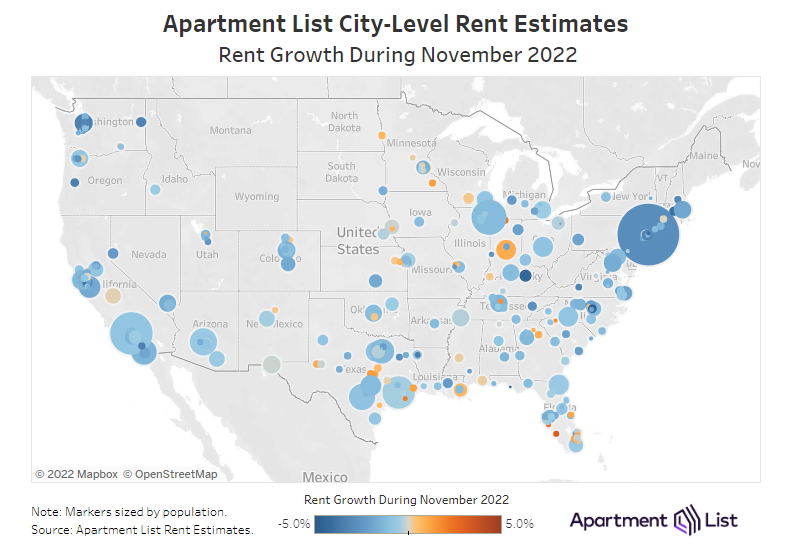

I’ll argue, again, for the Midwest. Apartment List would as well, listing several Midwestern markets on the top for year-over-year rent growth: Cincinnati, St. Louis, Indianapolis, Columbus, and Kansas City, in that order, are the top markets for rent growth in the past six months. All in the Midwest.

The biggest declines over the past 6 months are Las Vegas, Riverside, New Orleans, Providence, Sacramento, Phoenix, Detroit, Seattle, Tampa, and San Francisco. Phoenix, Las Vegas, and Tampa were some of the strongest markets of yesteryear, but it’s not 2021, it’s 2022.

With the declining markets down by 2-3% in the past 6 months and the fastest-growing markets up by 2-3%, it’s clear that the rent growth moderation that we’ve seen this year is distinctly different depending on which market you are looking at. The Sun Belt did extremely well in 2021 and is now snapping back somewhat. The Midwest may not have had the same spectacularly high rent growth in 2021 as Vegas or Tampa, to use two examples, but rents in those markets were considerably elevated during 2021 and were some of the most resilient markets early in the pandemic. Looking forward to 2023, these Midwestern markets may be the most attractive areas for apartment investment in the nation.