Will Markets Thrive in 2025?

Improving consumer sentiment, growing investor confidence, and continued signs of a robust, stable economy have informed a more optimistic investment outlook on commercial real estate and the multifamily market in particular. Apartment asset performance is as lackluster in 2024 as it was in 2023, but housing demand trends and the steady decrease of newly-delivered apartments point to greater strength in the multifamily market in 2025.

Multifamily, the Nation, and the Economy

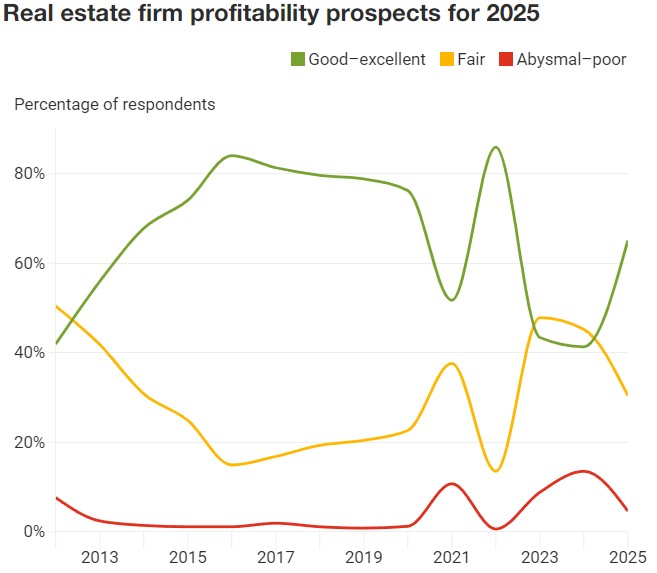

Emerging Trends in Real Estate 2025: The time has come for an upturn

Via PwC: “Real estate investors and developers should be poised for an upturn in industry trends as the post-pandemic disruption abates and positive cyclical forces gain strength.”

- Confidence Rebounded in October as Consumers Regained Faith in the US Economy (The Conference Board)

- Core and Value-Add Multifamily Metrics Improve in Q3 (CBRE)

- Midwestern Indy, Columbus, and Kansas City Join Top Markets for Multifamily Investment (Arbor)

Multifamily and the Housing Market

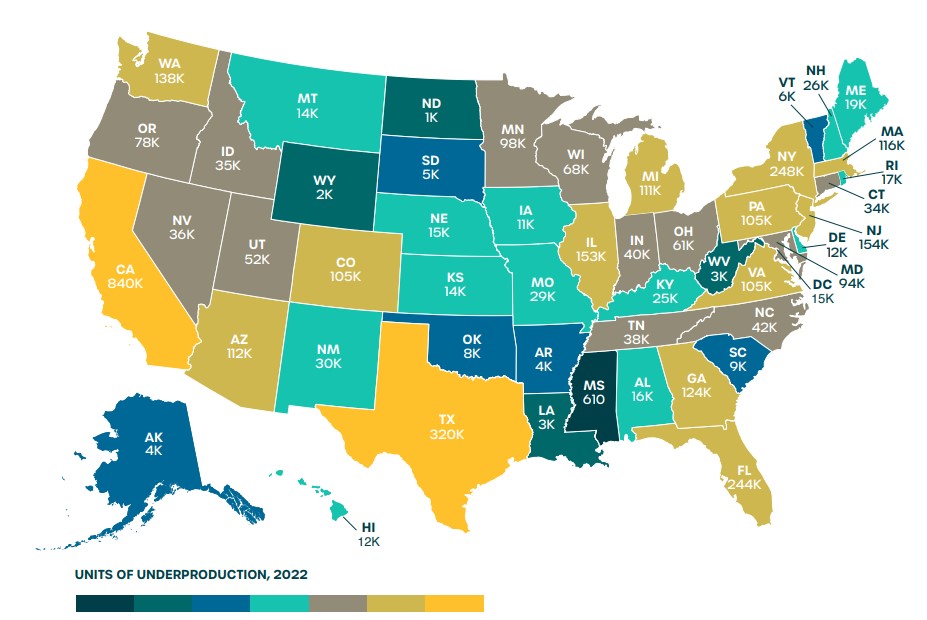

Housing Underproduction in the U.S.

Via Up For Growth: “The U.S. housing market is at a crossroads. Without sustained and proactive efforts, the 3.85 million-unit housing deficit will continue to exacerbate economic inequality and limit opportunities for millions of people.”

- Single-Family Market Update: “Renting remains financially advantageous for many” (Berkadia)

- The Role of the Recent Immigrant Surge in Housing Costs [is weaker than it may appear] (Harvard Joint Center for Housing Studies)

- 10 Affordable Cities Poised To Become Million-Dollar Markets in a Decade (Realtor.com)

Multifamily Markets and Reports

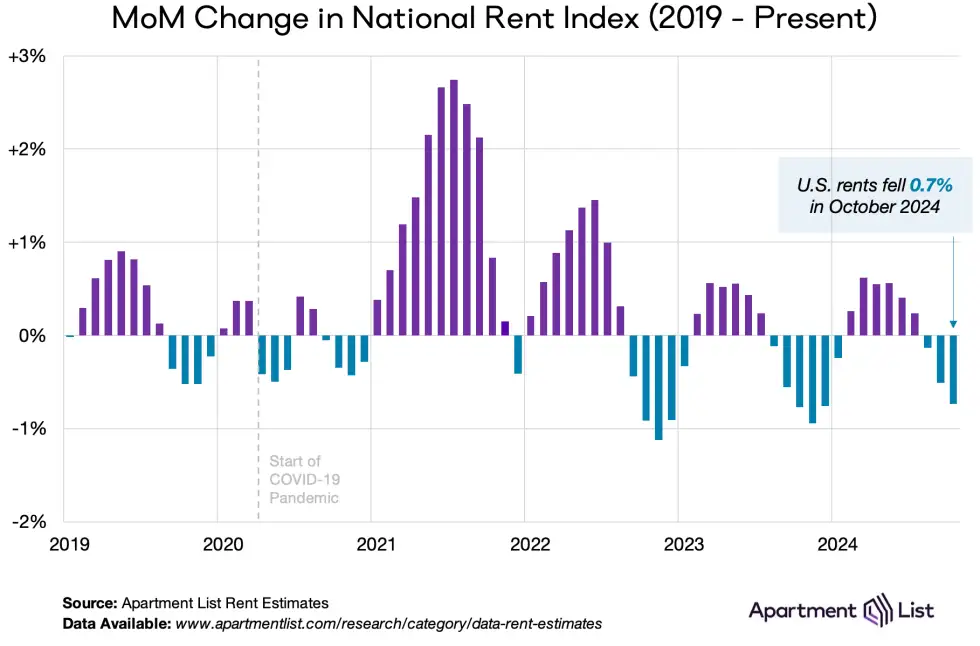

October 2024 National Rent Report

Apartment List: “The national median rent dipped by 0.7% in October, as we get further into the slow season for the rental market. The median monthly rent nationally fell by $10, putting it at $1,394, and we’re likely to see that number continue to dip modestly through the remainder of the year.”

- All-Cash Home Sales and Prices Decline in the Third Quarter (NAHB)

- Nightmare on Main Street: Unpacking 10 Scary Housing Trends (CoreLogic)

- Slowing Multifamily Hinders Total Residential Starts (RealPage)

Commercial Real Estate and the Macro Economy

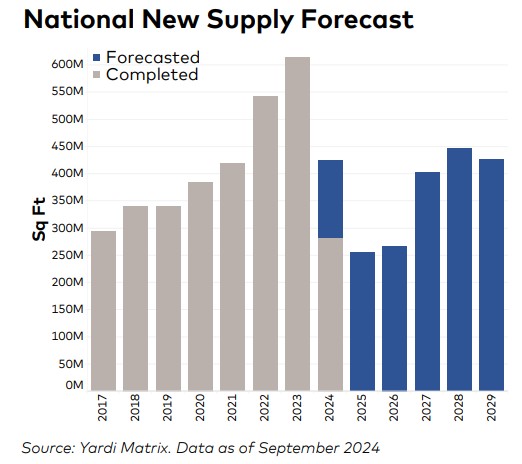

October 2024 National Industrial Report: Dock Labor Deal Good News for Industrial Markets

Via Yardi Matrix: “The reshoring and nearshoring push in manufacturing began in earnest this decade and has already begun to alter the dynamics of U.S. trade. Some of the move to relocate the production of goods to the U.S. or its North American trading partners is a response to tariffs imposed on Chinese goods and tax incentives that promote domestic manufacturing.”

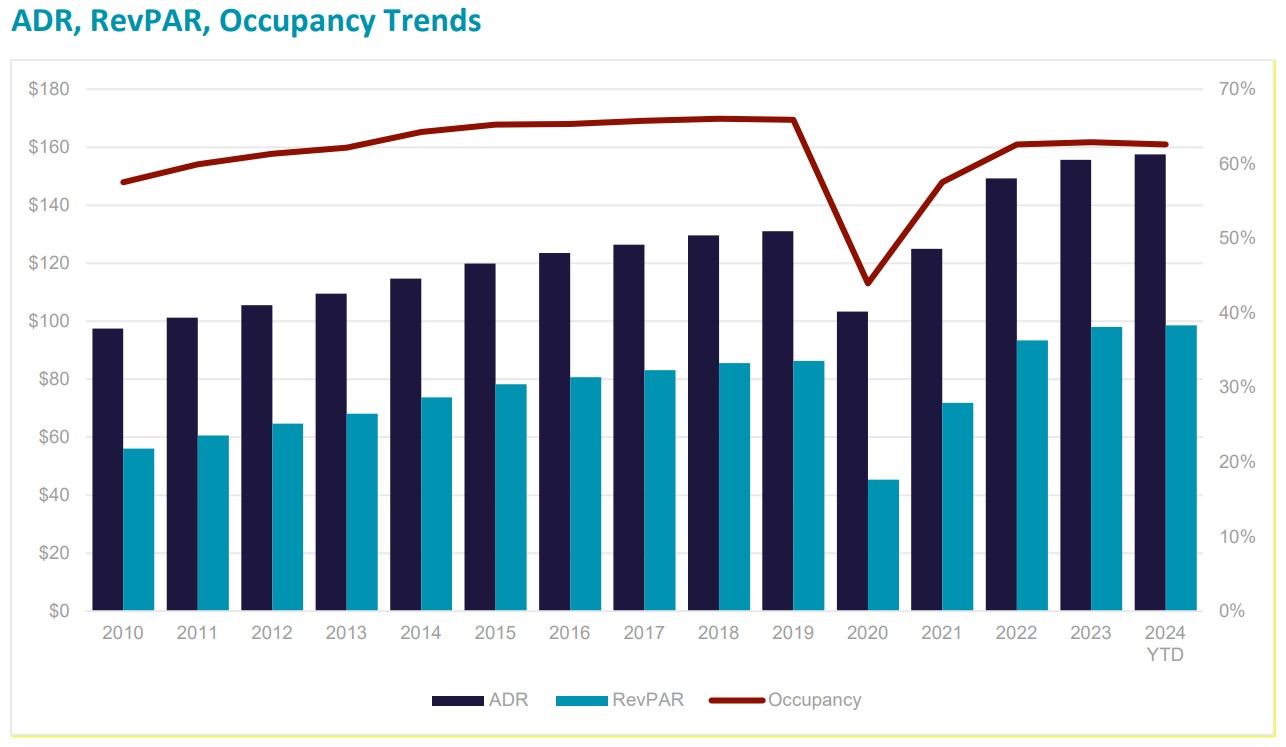

- Hotels and Hospitality Mid-Year 2024: Leveling Off or Bottoming Out? (Cushman and Wakefield)

- Divergence in Absorption Trends Likely to Persist (CBRE)

- Oct. 2024 National Office Report: Utilization Rates Plateau (Yardi Matrix)

Other Real Estate News and Reports

Via Cushman & Wakefield: “In the first quarter of 2024, the market’s performance moderated, but gains in the second quarter have supported RevPAR improvement compared to the first half of 2023, notably all driven by ADR.”

- Still Waiting for a Market Bottom for CRE (GlobeSt)

- Will Elevated Debt Threaten the Economy? (Marcus & Millichap)

- Foreclosures Pick Up, Starting With The Largest Landlords (Bisnow)