Will High Interest Rates Ruin the CRE Comeback?

Amid news of a powerful upswing in apartment demand, rising investor interest, and increasing consumer confidence, the rising yields for 10-year treasuries are a dark cloud that promises to make CRE investment interesting, if not straightforwardly difficult for investors looking for a larger spread between cap rates and debt costs. Likewise, CRE borrowers with loan maturities in 2025—perhaps even some who faced loan maturities in 2023 and were already granted extensions from their lenders—could face an even tougher path. There is optimism among multifamily investors, but 2025 will have its share of challenges alongside opportunities.

Multifamily, the Nation, and the Economy

Why is 2025 Likely to Have Strong Apartment Demand if Job Growth Has Slowed?

RealPage: Job growth, improving affordability, too-high home prices, improving consumer sentiment, and improving apartment retention point to strong renter demand in the multifamily market in 2025.

- Rising 10-Year Treasury Yield Sparks Concern in CRE Market (GlobeSt)

- 6 Major Landlords Accused Of Anticompetitive Behavior In DOJ’s Reinvigorated RealPage Investigation (Bisnow)

- Real Estate in 2025: “Multifamily . . . to ease the challenges of housing supply and affordability” (The Wharton School)

Multifamily and the Housing Market

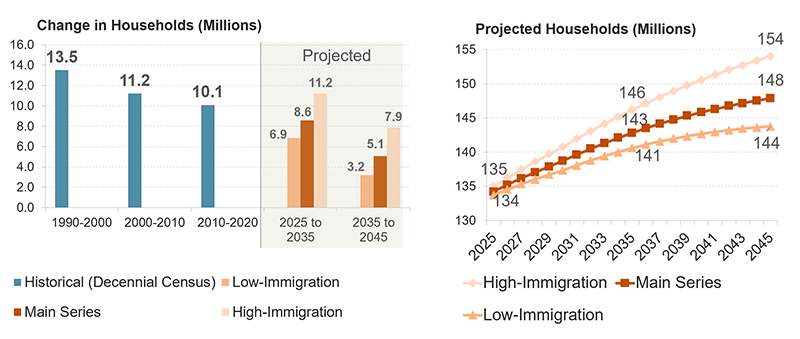

New Projections Anticipate a Slowdown in Household Growth and Housing Demand

Via Harvard Joint Center for Housing Studies: “[T]he US is expected to increase by 8.6 million, or approximately 860,000 per year between 2025 and 2035. This would be far less growth in the next ten years than in recent decades, including the sluggish 10.1 million households added in the wake of the Great Recession in the 2010s.”

- Housing Sentiment Finishes 2024 Higher Despite December Dip (Fannie Mae)

- USA Median Home Prices and Mortgage Payments by County (NAR)

- America’s frozen housing market is finally starting to thaw (MarketWatch)

Multifamily Markets and Reports

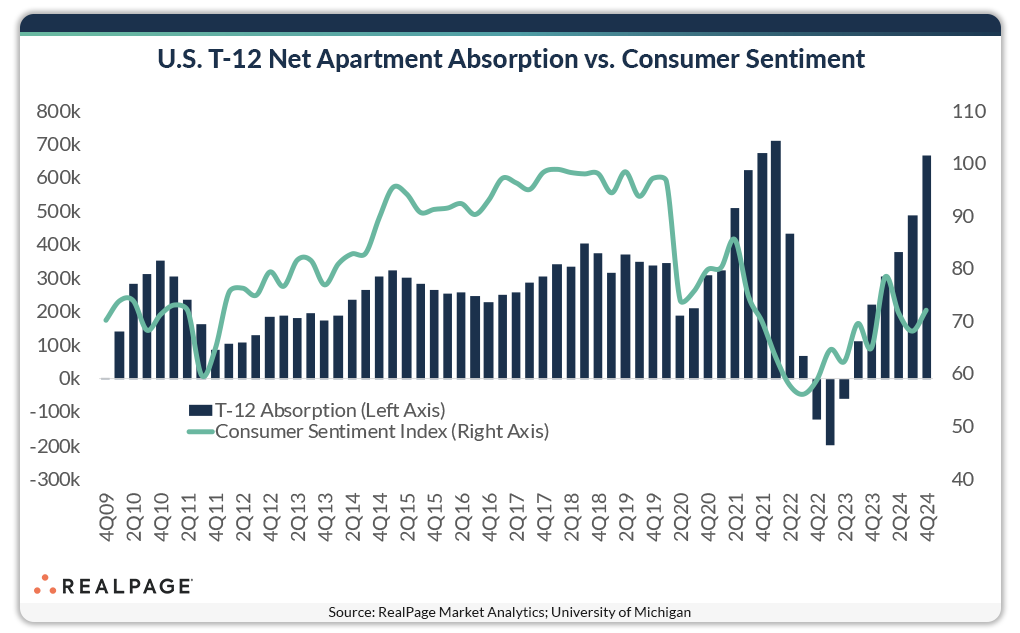

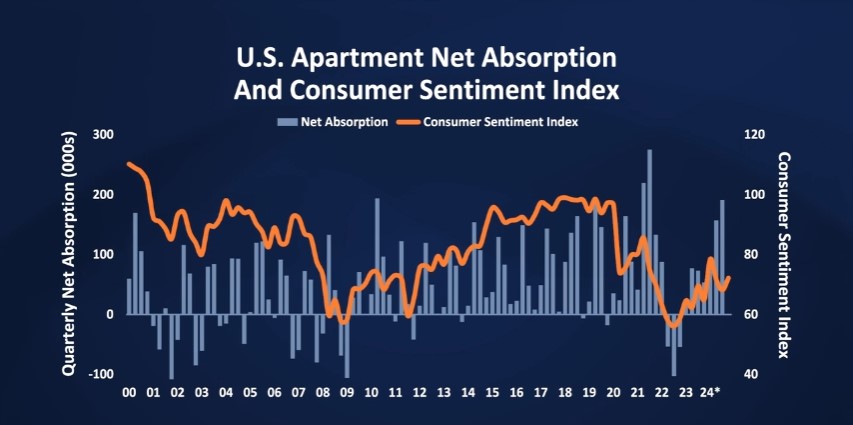

Surging Sentiment Could Favor CRE in 2025

Via Marcus & Millichap: “Multifamily demand [is] on the rise as consumer sentiment boosts household formation[, and the s]urge of small business optimism could portend strengthened CRE space demand.”

- Dec. 2024 Rent Report: Apartment Rents Down 0.6% for the Year (Apartment List)

- Resounding Appetite for Apartments Overtakes Oversupply Fears in 4th Quarter 2024 (RealPage)

- CRE Trends: “Multifamily Continued to Defy the Supply Shock” (Moody’s Analytics)

Commercial Real Estate and the Macro Economy

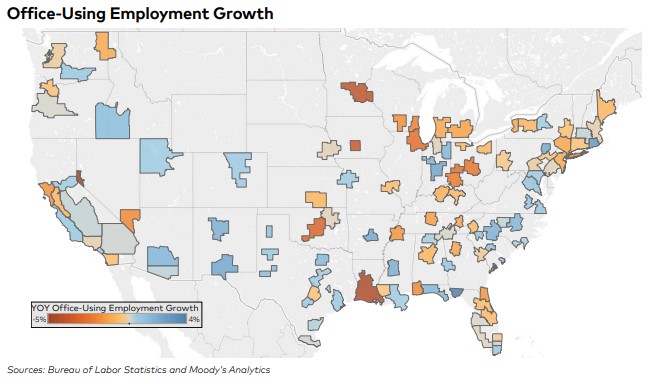

Another Tough Year for the Office Market

Via Yardi Matrix: Despite “high-profile announcements of return-to-office plans” the office sector continues to struggle, and “office utilization metrics . . . did not show a significant change this year.”

- Investment Trends Show Favorable Outlook for CRE (MSCI)

- Sustainability Practices Help Control Hotel Utility Costs (CBRE)

- Key Trends and Predictions Shaping of CRE in 2025 (Cushman & Wakefield)

Other Real Estate News and Reports

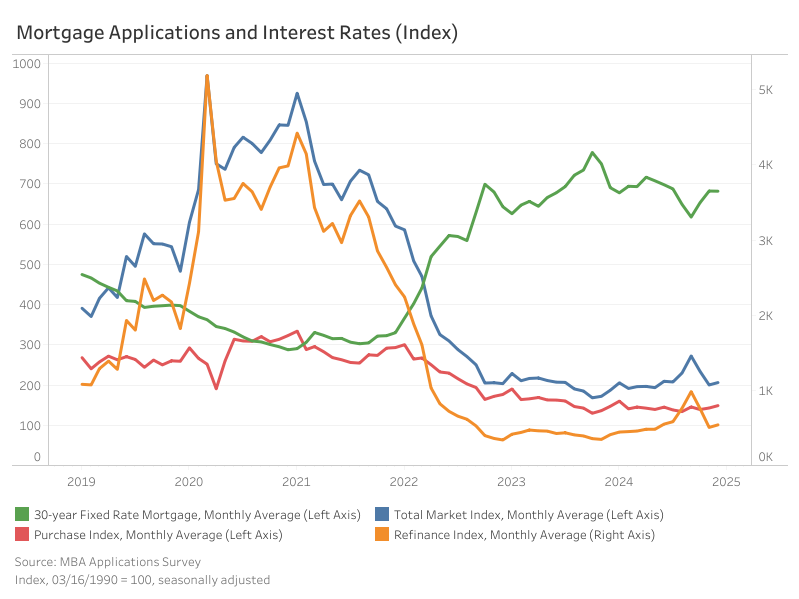

Mortgage Applications Increase Marginally in December

Via NAHB: “Average loan sizes, excluding refinance loans, saw slight declines in December. On a non-seasonally adjusted (NSA) basis, the average loan size (purchases and refinances combined) fell by 2.1% from November to $370,300.”

- Report: “Industrial Sector Stabilizes This Year” (Yardi Matrix)

- Real Estate in Focus: 2025 Trends to Watch (MSCI)

- Home Price Growth Forecast: Up 3.8% by Nov. 2025