Who’s Renting Your Apartment? Demographic Cohort Breakdown.

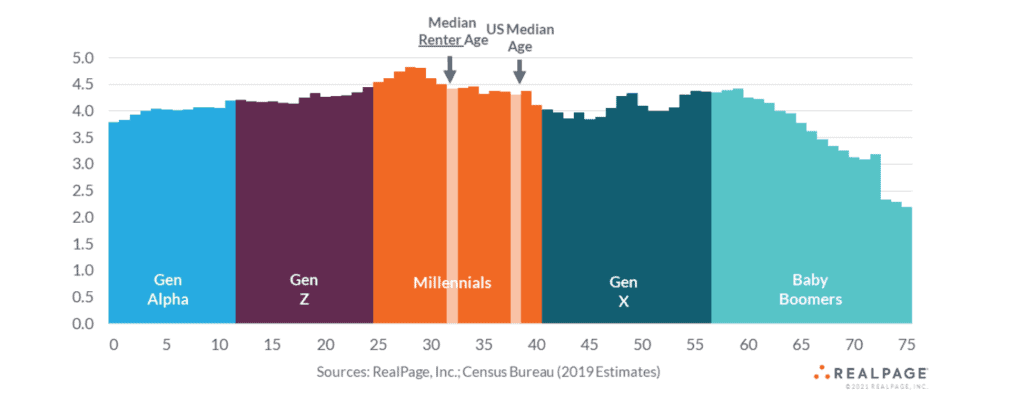

Berkadia has a nice write-up of the renter data that they use from RealPage, and RealPage put out a small report as well. The graph of the age-breakdown in renters is fairly appealing from an investment standpoint, and you can see this large group of younger millennials that will pass through peak renting years in the next 5 or so years.

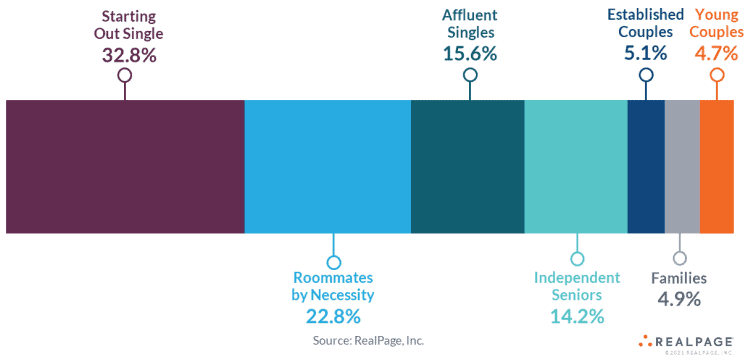

The graph of renter cohorts is equally interesting, outlining 7 groups of renters and their distribution among the full renter population: starting out singles, roommates by choice, affluent singles, independent seniors, young couples, families, and established married couples.

Yes, there’s a way to look at this and see a graph that severely favors unmarried singles as the prime renting population, which, yes, it is, but I don’t think it’s as severe as it looks. If you group married couples together, that’s a decent cohort in itself. But even if you include independent seniors in with the married couples, it’s about 70% singles to 30% married couples or families. One way that I read this graph is as a progression through life stages, and, when you look again at the graph of renter ages, there is a large population of people who will soon be in these roommate or young single stages of life in the next 5-7 years.

Looking at the preferences of each also points to different strategies that investors and owners can use for their properties. An apartment owner may not own a property that is perfectly suited to the younger singles that form the largest renter cohort, but they might have the floorplans and amenities set to draw other groups of renters. Looking at the local demographics of an area can really help owners and investors decide whether there is a sufficient population of renters to support a given strategy, and while Berkadia’s analysis covers a larger, national scope, their valuable insights can help investors shape their own projections for the multifamily market.