Valuable Data from CBRE Report

One month ago, CBRE published a report with some very useful data that provides a valuable perspective on the impacts of the COVID-19 pandemic on multifamily real estate. In the time since this report was published, there have been countless articles from widely respected sources, all of which openly speculated on a fraught and turbulent relationship among the immediate effects of the virus and its containment, the economic downturn, and the condition of the housing industry. These articles are by no means incorrect, and they play an essential role in tracking the changes in the market and guiding investors and property managers as they respond to the changing circumstances and “new normal” brought about by the virus.

While its early April publication seems like a lifetime away given the daily upheaval we are witnessing, we keep returning to this CBRE report because its scope and purpose look beyond the next few days and into the next quarter and the next year. Plus, it’s a quick read.

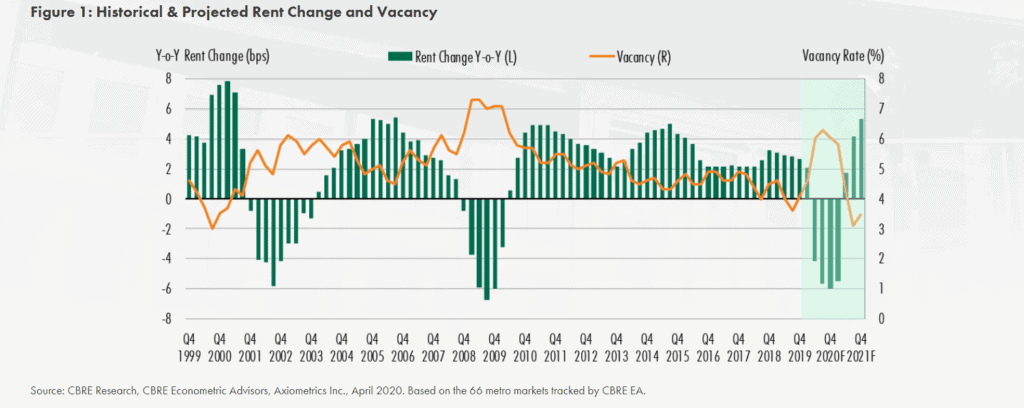

The researchers at CBRE do not need a whole lot of words to make some powerful claims about the future of the multifamily housing market. Specifically they predict a bottom for the multifamily valuation and rents in the third and fourth quarters of this year, respectively, a recovery extended throughout 2021 and into 2022, and the chance for worsening economic conditions to have an additional negative impact on multifamily investments. Increased unemployment and the potential for missed rent payments is of particular concern.

It may seem counterintuitive to describe such a sobering report as truly valuable, but it is this kind of data-driven clarity that we are drawn to, even if the results are not exactly pretty. Some of the studies and surveys over the past two months have highlighted a lower-than-expected amount of missed rental payments, a higher-than-expected level of interest in moving into a new multifamily unit, and region-specific success stories in the midst of the pandemic. These optimistic stories can help curb the impulse to make panicked decisions or adopt an overly cautious and inactive stance toward the market, but many of these accounts only reference our crisis indirectly, without providing an image of the realities against which these stories are framed. Without a clear view of our current situation, everyone from investors, to landlords, to residents are more vulnerable.

To be clear, our interest in this CBRE report is not because we are anticipating failure or sluggish performance from our own portfolio, nor does our interest reflect a pessimistic attitude toward the multifamily market in general. Instead, this report resonates with our broader investment thesis and the kind of analysis and decision-making process that has informed our investments from the very beginning of Gray Capital. The principle of wealth preservation against economic crisis has guided us in our creation of a resilient portfolio that we believe will continue to thrive over the long term.

To learn more about our investment process, follow this link for more information and insights.