Understanding Cap Rates and Interest Rates

Cap rates and interest rates are critical metrics to follow and understand when investing in commercial and multifamily real estate, and while each of these measurements will have its own impact on the analysis of an investment opportunity, looking at interest rates and cap rates together provides additional insight and can help investors identify the right opportunities at the right time.

What Are Cap Rates, and Why Are They Important?

A cap rate, or “capitalization rate,” is a metric primarily used to compare different commercial real estate properties based on value and income generated from the investment. Cap rates can also be considered the unlevered return for a commercial real estate property, measuring the return on investment if it was an all-cash purchase, without any debt and without additional closing costs.

As we explain in a separate post, a cap rate is derived from the net operating income of a property divided by the value of the property. The cost of any debt used on a property is not a part of the equation, so, unless the project uses little or no financing, being aware of interest rate(s) like the U.S. Ten-Year Treasury rate will help you determine whether an opportunity is worth your investment.

What is the 10-Year Treasury, and Why Is It Important?

The 10-Year Treasury is a bond issued by the US Department of Treasury with a 10-year maturity. The interest rate or yield that the bond pays is arguably the most important index or rate in all of capitalism and global finance. For many commercial loans, including real estate, the interest rate one pays is typically derived from the U.S. Ten-Year Treasury rate plus a spread over that rate, which is the lender’s profit.

The 10-Year Treasury rate can be an indicator for future inflation, and it is also the discount rate or the risk-free rate used in financial modeling to project future returns and the Net Present Value (NPV) of different investment opportunities as well as the risk premium on a particular investment. The 10-Year rate is considered the risk-free rate because it is considered the safest place to put one’s money, and you can use this risk-free rate in the risk premium formula below:

Risk Premium (RP) = Return – The Risk Free Rate

As the 10-Year Treasury moves up and down, the net present value for certain investments can vary as the risk free rate is a critical variable in NPV or net present value equation. In the 2020 recession, for example, as the 10-year Treasury plummeted to historic lows (bottomed at .52% on July 31st), the valuations of many assets, especially high-growth tech companies, skyrocketed as the risk-free rate was near zero. Conversely, as the 10-year Treasury has climbed during the first half of 2021, we have seen tech and growth valuations decline.

It is easier to see this price movement in public markets such as stock and bond markets, as there is ample high-frequency price data. For commercial real estate or other less liquid assets that can take 2-6 months for a transaction to close, that pricing information is much more opaque and is always backwards-looking compared to the forward looking public equities and bond markets.

Cap Rates and the 10-Year Treasury Rate

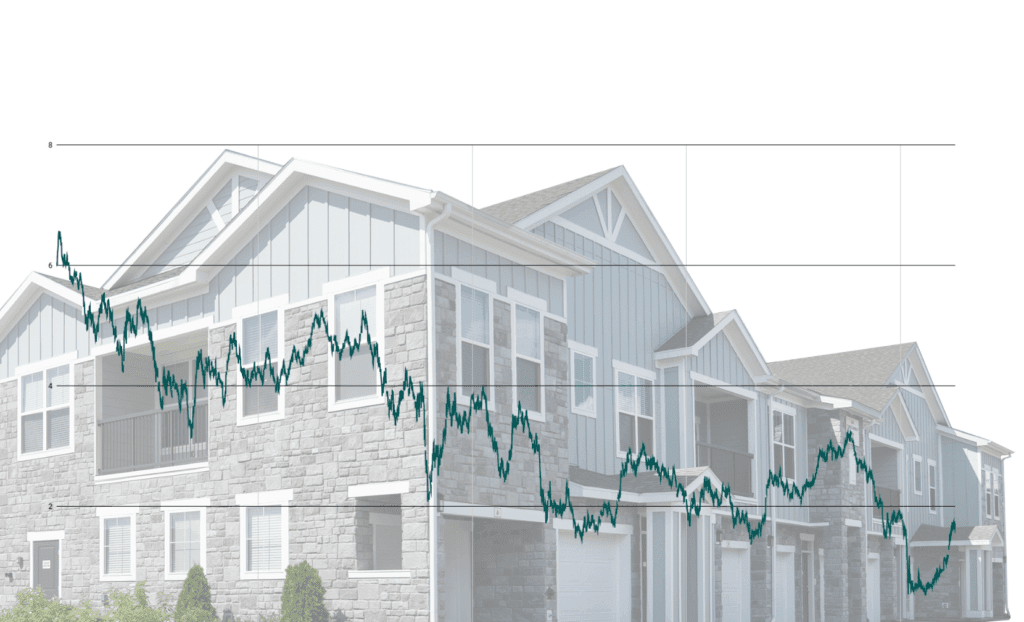

Commercial real estate cap rates and the 10-Year Treasury rate are historically highly correlated, and the relationship between cap rates and the 10-Year Treasury can give you inside information into the market and the potential yield for a particular real estate investment. As interest rates go up and down, cap rates also go up and down and vice-versa, with interest rates typically being a slightly leading indicator

Just looking at cost of debt or the cap rate on a property, while important and good information, doesn’t necessarily paint the full picture of the relative value and the potential yield of a particular investment. By knowing the spread, or difference between the cap rate and interest rate, one will be able to paint a more complete picture of the potential of the investment at that moment in time and in that environment.

For example, one may see a high cap rate and conclude that the yield on that investment will be high. However, if the interest rate, or the cost to borrow, is also high, the yield may be more muted compared to if one was just looking at the cap rate. You could have a potential property at a low cap rate with an even lower interest rate, the potential yield could be higher than that in the first example.

A brief comparison helps to further illustrate this idea. You could buy a property at a 7% cap rate with the 10-year Treasury at 5%, and your spread is 2% or 200 bps. On the other hand, you could buy a property at a 5% cap rate with the interest rate at 2% for a 300 bps spread. The higher the spread, the higher the potential levered yield.

The spread is also an indicator of perceived risk in the market. Like in all investing, return = risk, so a high spread between cap rates and interest rates also indicates a high degree of perceived risk. A low spread indicates a low perceived level of risk.

As an example, during the pandemic, Multifamily cap rates and interest rate spread were at a multi decade high as there was significant uncertainty in the economy. As we are into the recovery and multifamily has performed well during the pandemic and recession, contrary to perceived risk, spreads have now tightened back as confidence and FOMO have saturated the market.

Using the Right Metrics in the Right Context

As we have mentioned earlier and elsewhere, there is no single metric that is going to make your investment decision for you, even if that single metric is a spread between two individual metrics like cap rates and interest rates. What this spread does illustrate is the importance of reading your data in the right context, measuring your numbers relative to other relevant values, and understanding each investment opportunity from different perspectives so that you make the best decision for your goals.

Gray Capital is committed to sharing the most up-to-date information on the commercial and multifamily real estate markets. Click the button below to sign up for our free weekly newsletter to stay up to date on the latest research, reports, and current events; and if you are interested in becoming an investor with Gray Capital, click the button below to join the Gray Capital Investment Club.