Trump Tariffs Paused: Will Multifamily Rally?

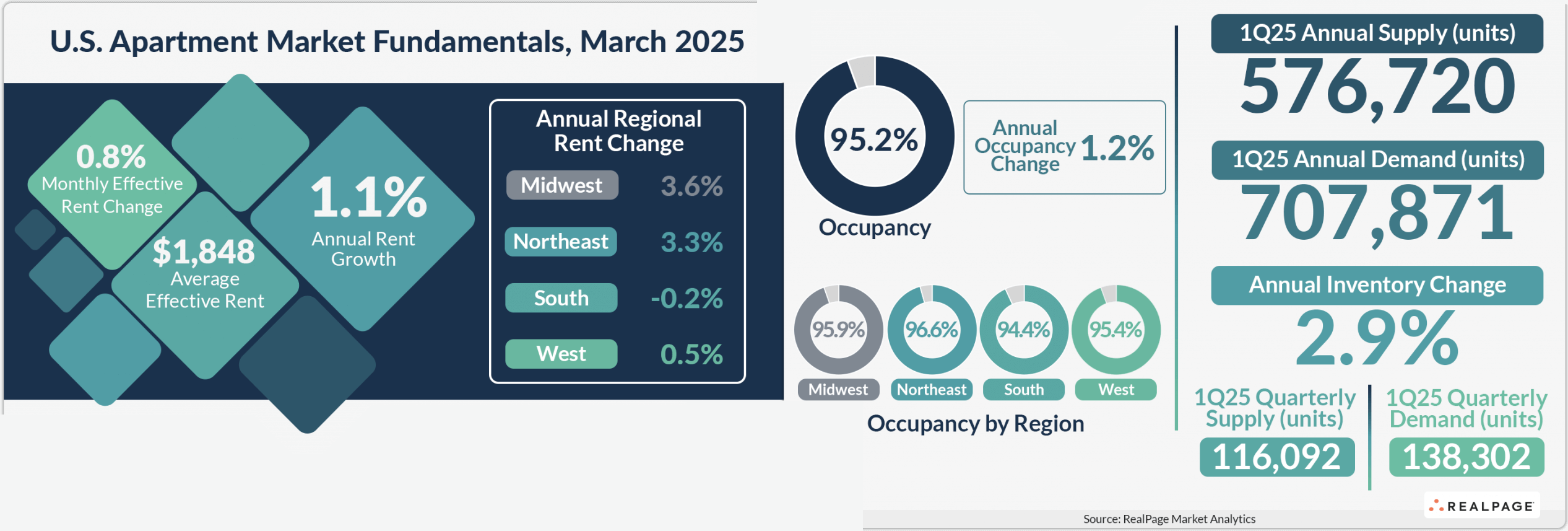

In the space of a week, the Trump administration’s tariff policies set off a stock market downturn and spurred expectations of a recession before the President Trump announced a 90-day pause on most tariffs, sending markets soaring upwards again. With recent reports on the apartment market showing record levels of demand in Q1 of 2025 along with a reduction in apartment supply, there’s some reason to expect stronger performance in 2025 should the economy maintain its footing.

Multifamily, the Nation, and the Economy

- Healthy 1st Quarter Demand Boosts Rent Growth as Supply Ebbs

- RealPage: “In the January to March quarter, the U.S. absorbed over 138,000 market rate apartment units, marking the highest 1st quarter demand on record in the RealPage data set, which goes back over 30 years.”

- Trump says he decided on 90-day tariff pause because people were ‘yippy’ and ‘afraid’ (Yahoo Finance)

- Fannie Mae fires more than 100 employees for unethical conduct, including the facilitation of fraud (The Hill)

- What a Recession Could Mean for the Housing Market (Realtor.com)

Multifamily and the Housing Market

Multifamily Shows Positive Signs Amidst Economic Uncertainty

Yardi Matrix: “Early indicators suggest resilience for multifamily in 2025, but the looming impact of new policies and economic uncertainty casts a shadow.”

- Where will new home construction grow beyond the usual hotspots? (John Burns Research and Consulting)

- Student Housing Preleasing Stays Flat as Rent Growth Cools (Yardi Matrix)

- Home Remodeling Impacts (NAR)

Multifamily Markets and Reports

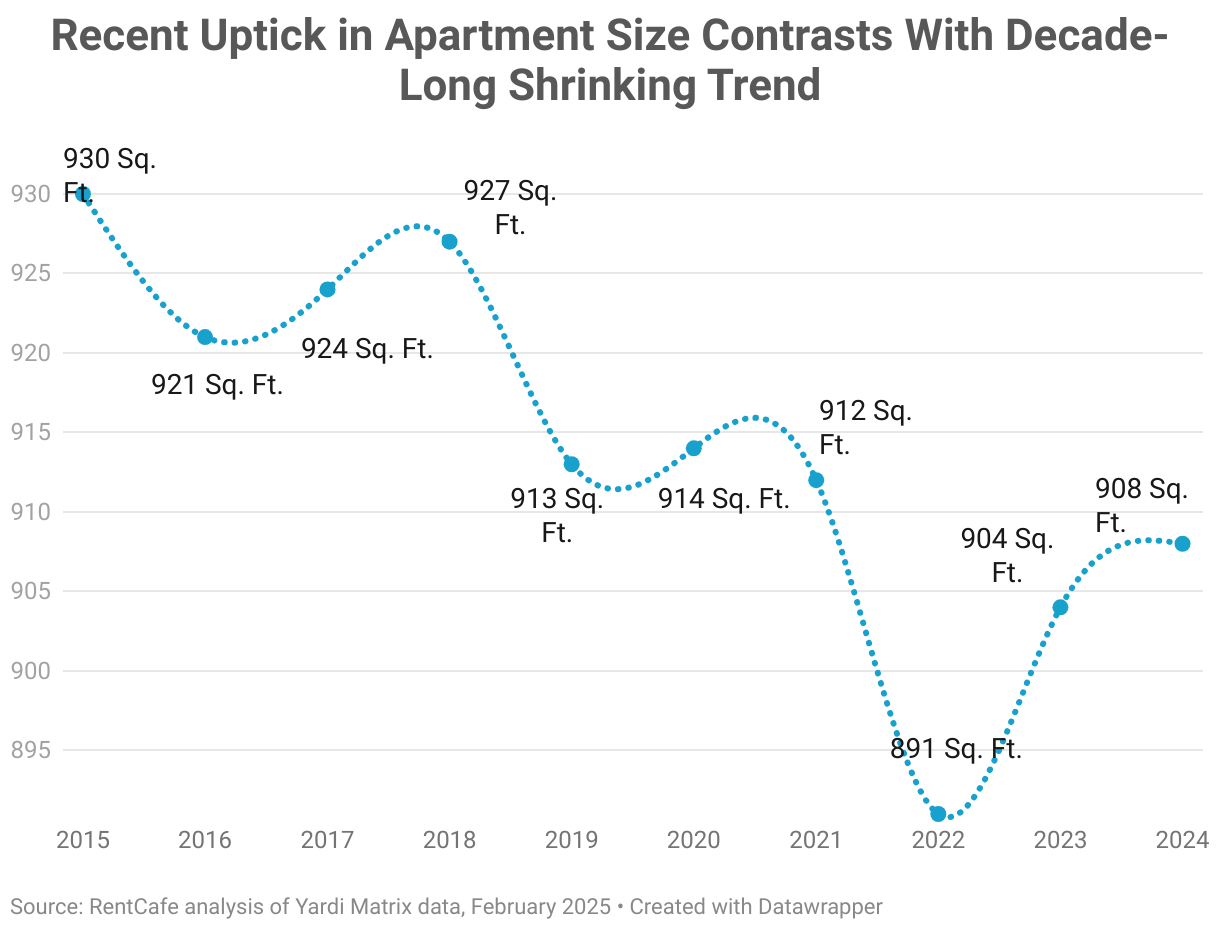

U.S. Average Apartment Size Is Increasing

RentCafe: “[T]he average size of new apartments expanded again in 2024, reversing a decade-long trend of shrinking floor plans. The most substantial space gains are appearing in several Coastal and Sunbelt cities, giving renters fresh options for more spacious living.”

- Remote Work Drop Signals Shift in Rental Market and Housing Trends (GlobeSt)

- March 2025 Home Price Insights: Homebuying demand remains weak as households address economic and policy uncertainty (Cotality)

- Almost Half of the Owner-Occupied Homes Built Before 1980 (NAHB)

Commercial Real Estate and the Macro Economy

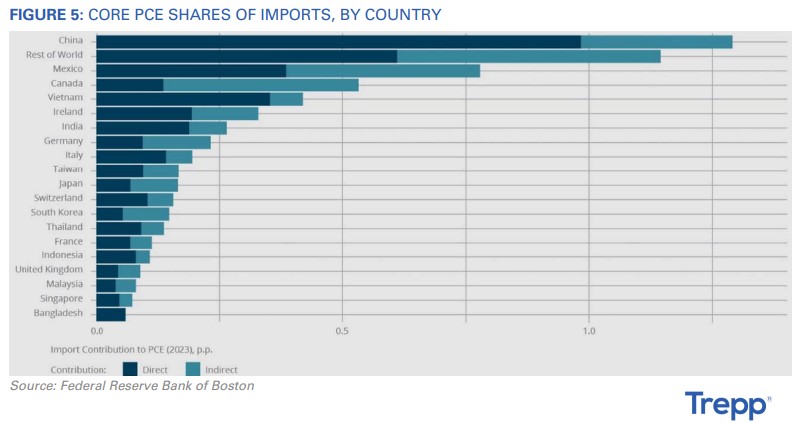

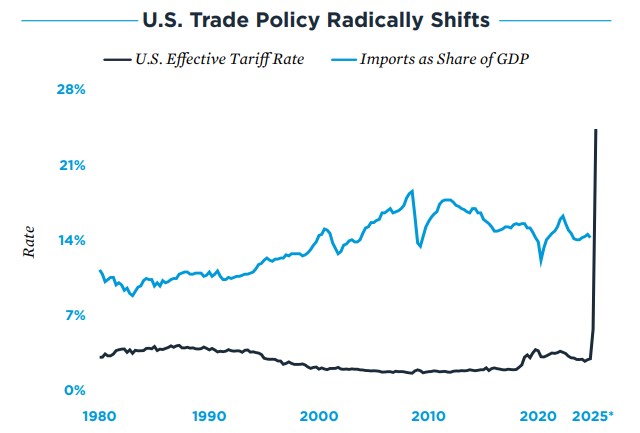

Tariffs Trigger Inflation, Uncertainty, & Market Shifts

Via Trepp: “The Trump administration announced a new tariff rollout on April 2 that will affect multiple dimensions of the economy. Their large and widespread nature will bring about significant changes that are crucial to understand.”

- Reduction in Federal Space to Have Minimal Impact on Emerging U.S. Office Market Recovery (CBRE)

- Liberation Day Volatility (Berkadia)

- Market Reacts to Tariffs – Implications for CRE? (Marcus & Millichap)

Other Real Estate News and Reports

Labor Market Strong Prior to Trade Policy Shift That Poses Implications for Commercial Properties

Via Institutional Property Advisors: “Total employment increased by 228,000 positions last month, above the mean from both last year and for the month of March from 2014 to 2019. Sustained hiring in health care and social assistance contributed the most to this growth.”

- March 2025 Industrial Report: Trade Questions Create Uncertainty for Industrial Sector (Yardi Matrix)

- Private-Credit Fundraising May Face Testing Times (MSCI)

- U.S. Leading Office Markets | Q1 2025 (Colliers)