The Market Favors Multifamily

As multifamily starts continue to decline (far more than single family home starts) and both housing demand in general and apartment demand specifically show consistent strength, the case for multifamily asset strength continues to improve. While a recent decrease in 10-year treasury yields , elevated interest rates continue to inject a level of uncertainty into the market, but this same uncertainty will lead to some significant investment opportunities, with institutional investors like Apollo showing clear confidence in the multifamily market in their recent $1.5 billion acquisition of Bridge Investment.

Multifamily, the Nation, and the Economy

“Acute” Pullback in Multifamily Starts Supports Improving Apartment Asset Performance

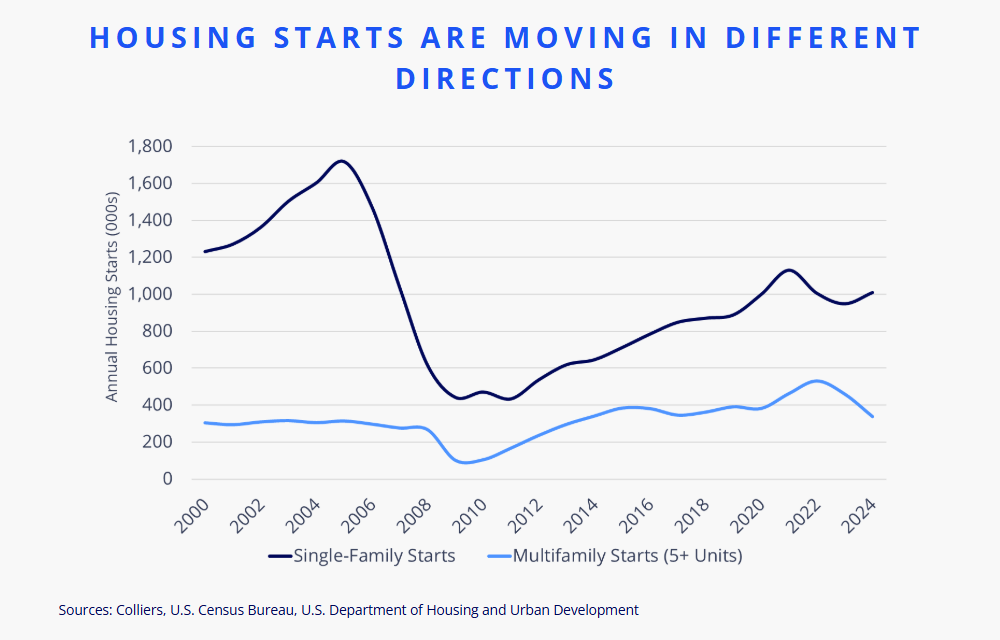

Via Colliers: “Multifamily starts totaled 337,000 units in 2024, down 36% from their 2022 peak, while single-family starts rose 6% last year, surpassing one million. With signs of unsold inventory building up, single-family rental platforms may have more options to expand their holdings.”

- Low supply is driving rising prices in the Midwest: Home price and rent growth remain solid (JBREC)

- Apollo to buy real-estate management firm Bridge Investment for $1.5 billion (Reuters)

- Trump’s Tariffs Create Uncertainty for Homebuilders Who Project Little Growth in New Construction in 2025 (Realtor.com)

Multifamily and the Housing Market

Economy Enters 2025 Strong While Facing Future Policy Uncertainty, Multifamily Prospects Improve

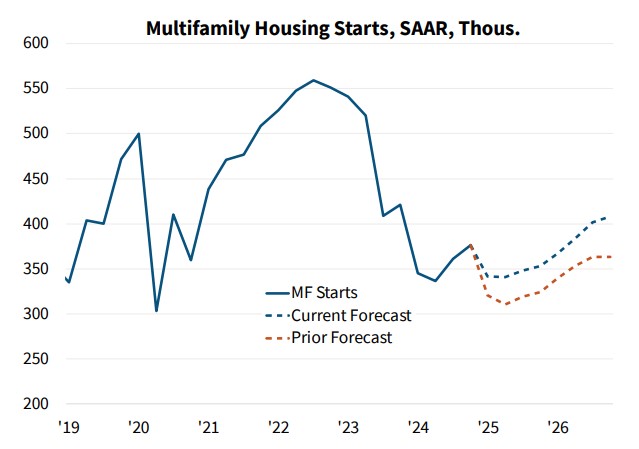

Fannie Mae: “Our multifamily housing starts forecast was revised upward following the strong December reading . . . [W]e continue to believe demographic trends will be supportive of multifamily construction in the longer term once the current high levels of units in the construction pipeline are completed.”

- Multifamily Unit Size Increases (NAHB)

- Rental Affordability for Minimum Wage Earners Improves Marginally (GlobeSt)

- December Annual Price Growth Reverses Course, Up 3.9% YOY (CoreLogic)

Multifamily Markets and Reports

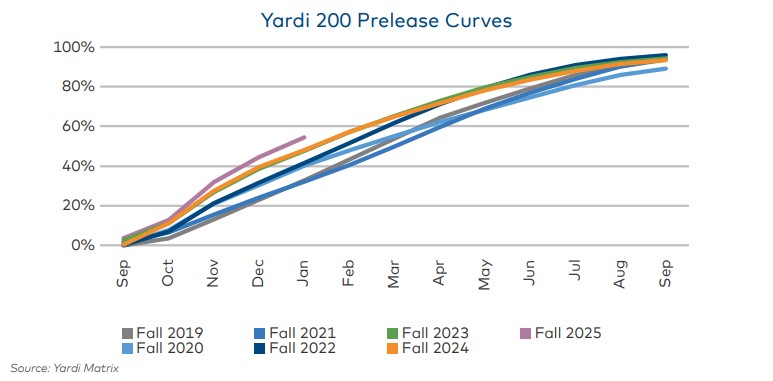

Feb. 2025 Student Housing Report: “Preleasing Tracks Last Year, Rent Growth Decelerates”

Yardi Matrix: “New supply of student housing has been dropping, with 35,703 off-campus, dedicated student housing beds completed in 2024, down from 44,746 beds delivered in 2023. Over the next several years, Yardi Matrix projects supply will continue to fall to 32,100 beds in 2025 and 33,995 beds in 2026.”

- Operators Defaulting to Longer Lease Terms Amid Record Supply Levels (RealPage)

- Year-over-Year Gain for Multifamily Missing Middle (NAHB)

- Rental Activity Report: Washington, D.C. Tops List Again as Southern Cities Attract More Interest (RentCafe)

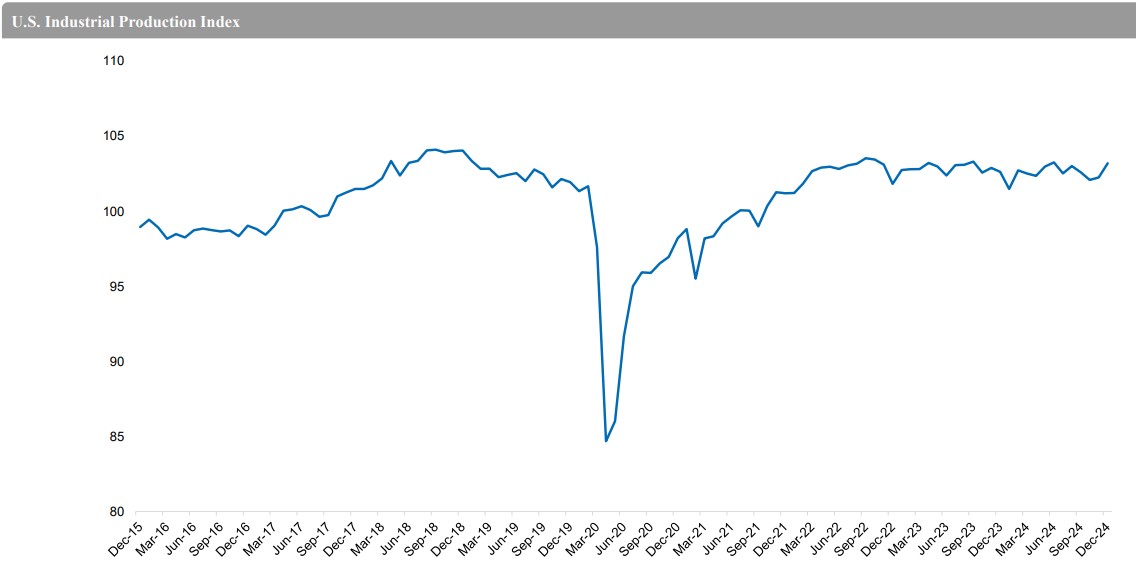

Commercial Real Estate and the Macro Economy

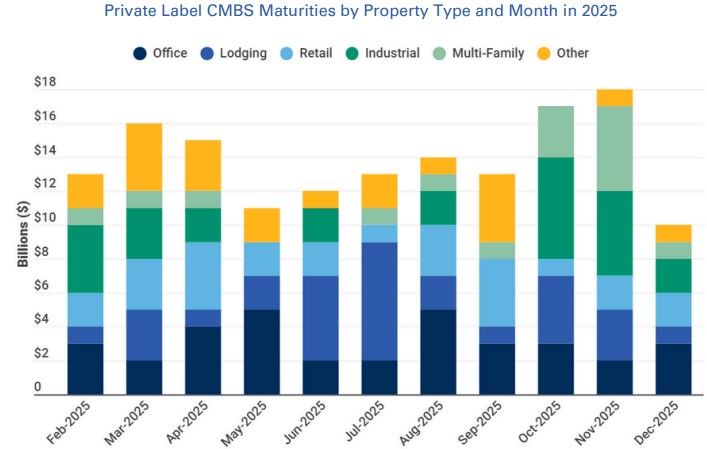

CMBS Loan Maturity Wave in 2025

Via Trepp: “[W]hile a meaningful portion of the hard maturities may transition into new CMBS issuance, a significant volume will require alternative financing solutions, loan modifications, or potential asset sales to resolve their debt obligations.”

- Annual North American Cargo Volume Increases by 13% (CBRE)

- The Rising Costs of Homeownership Are Increasing Burdens (Harvard JCHS)

- 4Q24 U.S. Retail Market: Trends & Conditions (Newmark)

Other Real Estate News and Reports

4Q24 U.S. Industrial Market Conditions and Trends

Via Newmark: “Demand softened in Q4, due to macro uncertainties, a persistent space overhang, and tenant move-outs stemming from credit loss. Yet, demand remained solidly positive, marking the 60th consecutive quarter of net positive absorption.”

- North America Data Center Trends H2 2024 (CBRE)

- Average “Office Sale Price Moves Lower” (Yardi Matrix)

- Has Office Space Demand Turned The Corner? (Marcus & Millichap)