The Deals Are Coming Back

Lower (slightly) interest rates, improving fundamentals, positive investor sentiment, and a pending wave of loan maturities are among the factors contributing to a projected recovery in investment sales activity in 2025.

Multifamily, the Nation, and the Economy

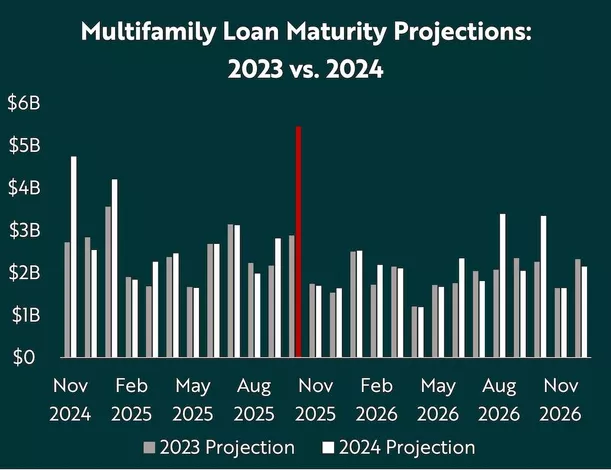

Extend-And-Pretend Has Grown The Multifamily Wall Of Maturities By 25%

Via Bisnow: Gray Capital’s latest research report looks at a new wave of multifamily loan maturities expected in 2025, the extend-and-pretend practices that contribute to it, and the changed environment within which these maturities will arrive.

- Is Fed Policy Still Too Tight? (Capital Spectator)

- 2024 election implications: Here’s what we are watching for housing (John Burns Research and Consulting)

- Trump 2.0 & Implications for Property (Cushman & Wakefield)

Multifamily and the Housing Market

Investing in the Real Estate Recovery

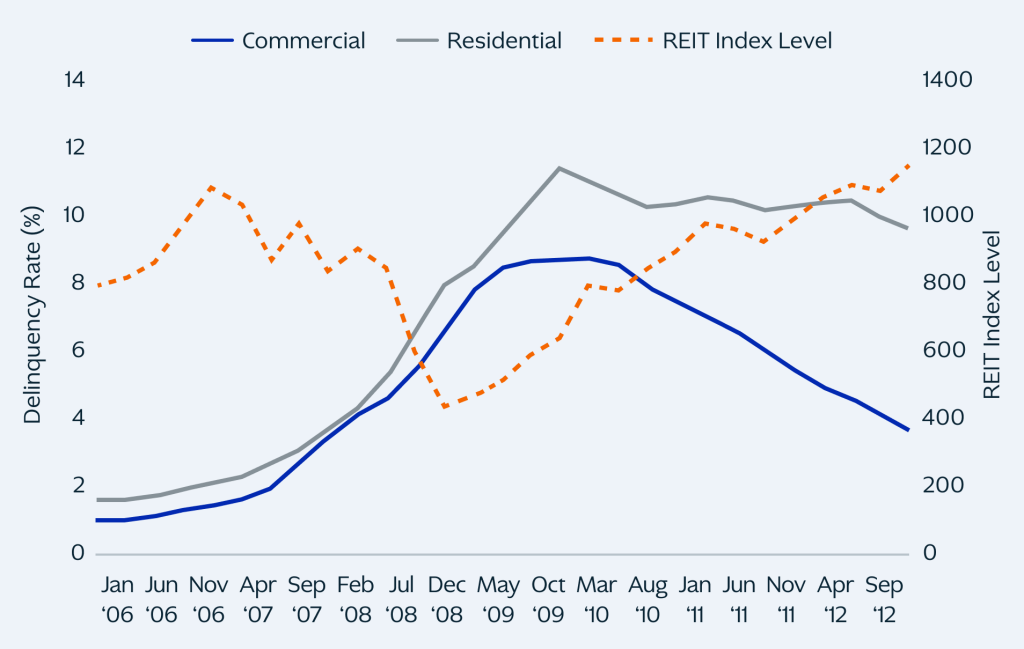

Via KKR: “All signs point to the recovery from the current real estate down cycle being underway, with U.S. commercial property prices up 3% since last year’s trough. Public REITs are up 11.5% year to date through October 4 and in many cases are trading above the value of their portfolios as equity markets have also rallied. If that trend continues, investors who stay on the sidelines risk leaving money on the table.”

- Resilience and Opportunity: The Future of Affordable Housing Investment (CBRE)

- How Housing Affordability Has Dropped Over 5 Years: 5 Metros Where Less Than 30% of Households Can Afford a Home (Realtor.com)

- Immigrant Share in Construction Sets New Record (NAHB)

Multifamily Markets and Reports

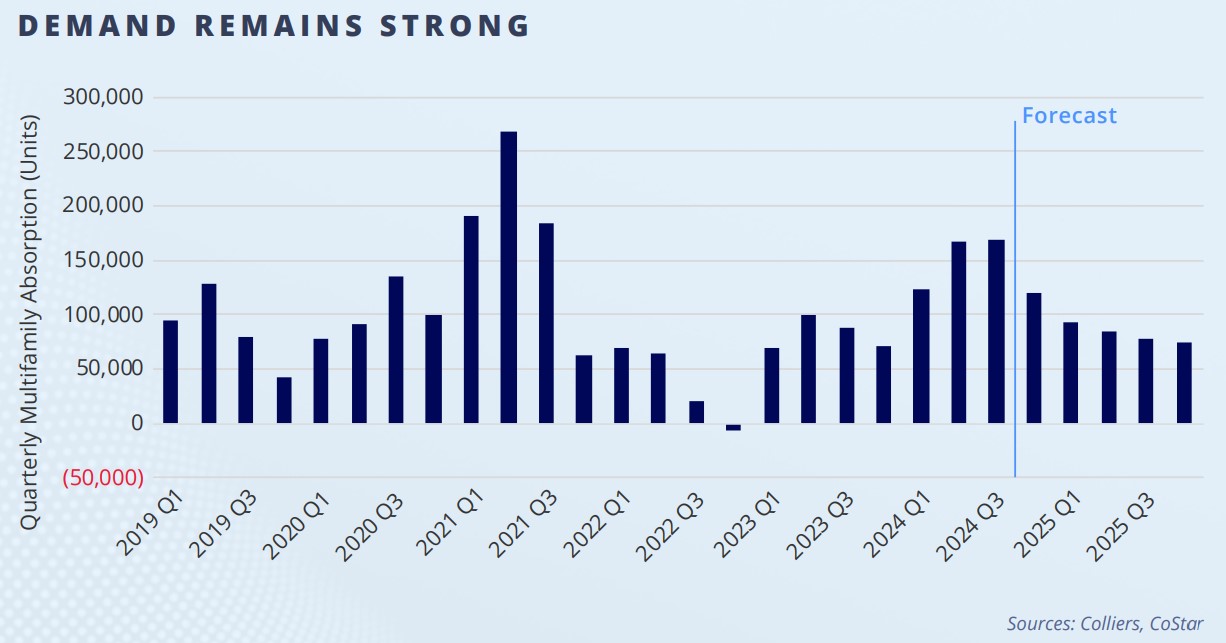

2025 CRE Capital Markets: Rate Cuts Shift Investor Sentiment

Colliers: “As this construction cycle abates, and limited groundbreakings follow, occupancies are projected to improve, supporting future rent growth in the quarters, and years ahead. This trend should bring additional capital off the sidelines as investors gain confidence in a near-term market rebound.”

- Rental Activity Report: Washington, D.C., Surges to #1 Spot, South Dominates Top 30 (RentCafe)

- Apartment Demand Catching Up to Supply in Southeast (RealPage)

- Fannie Mae investigates potential multifamily mortgage fraud (Multifamily Dive)

Commercial Real Estate and the Macro Economy

How the Election is Already Impacting CRE

Via Marcus & Millichap: Last week, we were talking about how the election could impact CRE. This week, we’re talking about how the election is already impacting CRE.

- Strong Office Conversion Pipeline Will Boost Business-Centric Downtowns (CBRE)

- 2025 Global Investor Outlook (Colliers)

- Retail National Report 4Q 2024: Strength Coincides with Lower Interest Rate Trajectory (Marcus & Millichap)

Other Real Estate News and Reports

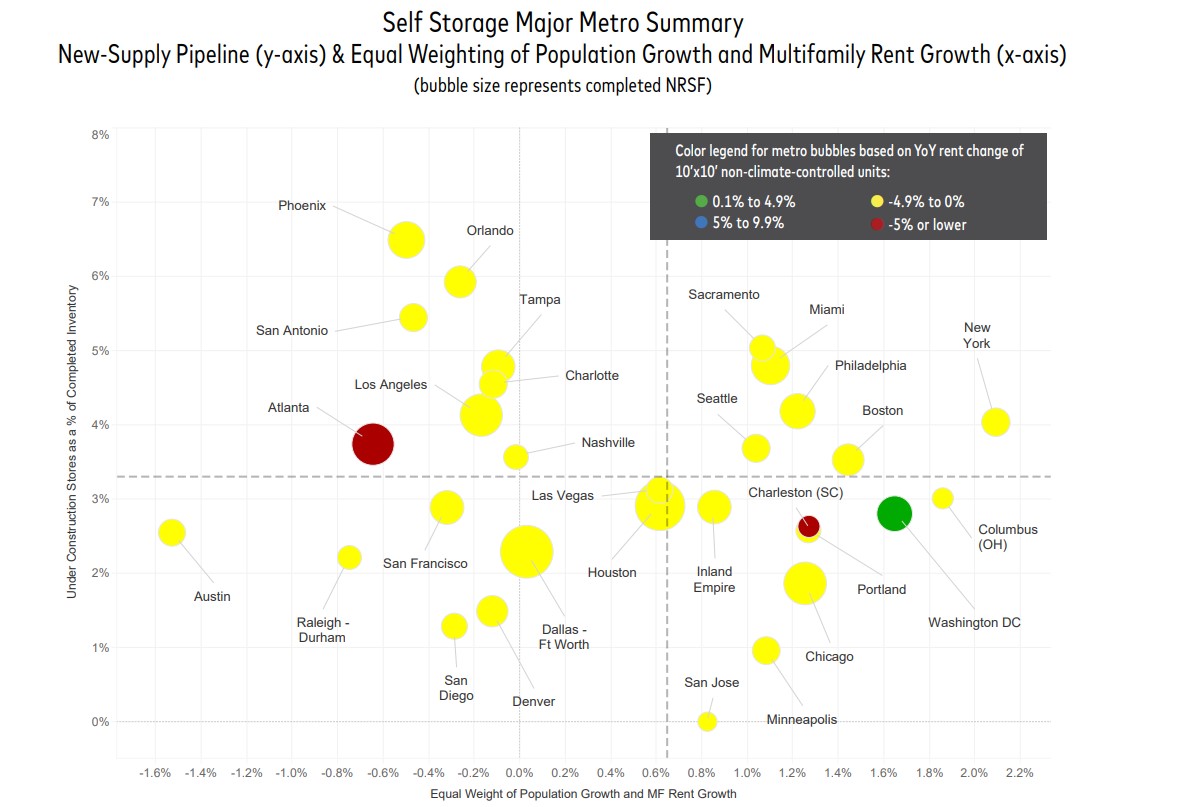

Self Storage National Report, November 2024

Via Yardi Matrix: “Faced with weakened demand fundamentals, particularly due to the housing market, the self storage REITs reported negative occupancy and revenue growth for Q3 2024.”

- Colliers Supply Chain Solutions | State of the Industry Report November 2024 (Colliers)

- The Insurance Industry’s Changing Dynamics and Implications for Corporate Real Estate Organization Design Trends (CBRE)

- Beyond the Menu: How Consumer Preferences Are Reshaping Casual Dining & Retail CRE (Trepp)