Rent Growth in 2024: Much Like 2023

The wave of apartment construction and newly-delivered apartments is at or near its peak, and rent growth has continued to be as sluggish in 2024 as it was in 2023. That being said, the weakening apartment supply trends in 2025 suggest a stronger market in the coming year, and the stellar apartment absorption numbers are a strong indicator of apartment demand’s persistence moving forward.

Multifamily, the Nation, and the Economy

National Rent Report, November 2024: Looking a lot like 2023

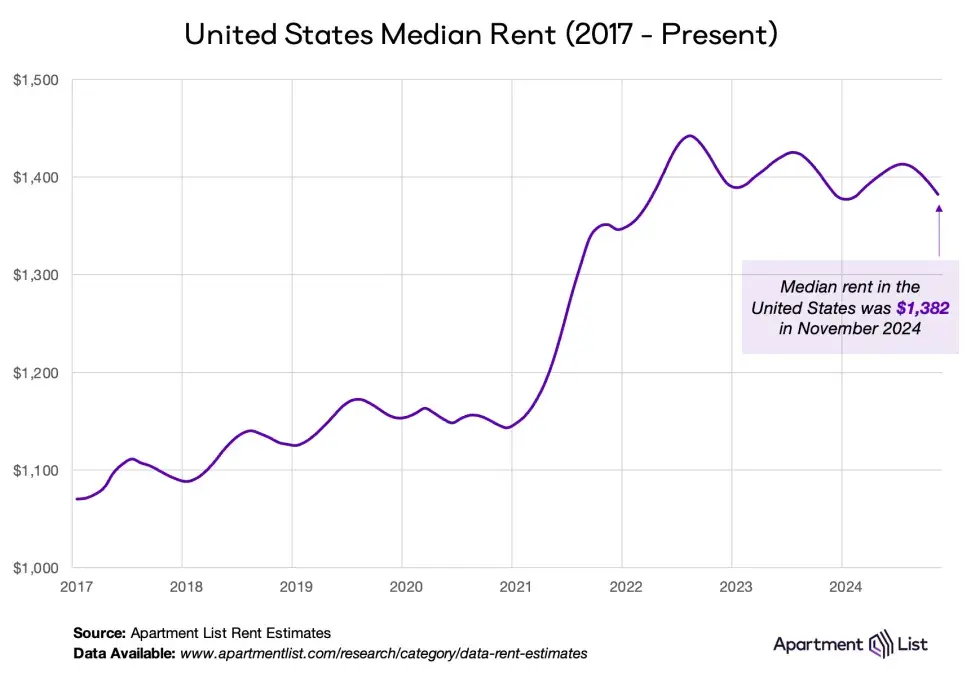

Apartment List: “Year-over-year rent growth nationally has been in negative territory since June 2023, and currently stands at -0.6 percent, a level where it has been hovering fairly consistently for the past year.”

- Report: Affordable Housing Expenses Rise, but Income Keeps Pace (Yardi Matrix)

- ‘Tug-of-war’ conditions could hinder a 2025 housing market recovery (Housingwire)

- October 2024 Rental Report: Rents Continue to Fall, With More New Units Expected in 2025 (Realtor.com)

- Are CRE Investment Returns Losing Their Luster? (Trepp)

Multifamily and the Housing Market

Rent-to-Income Levels Decrease, Boosting Affordability

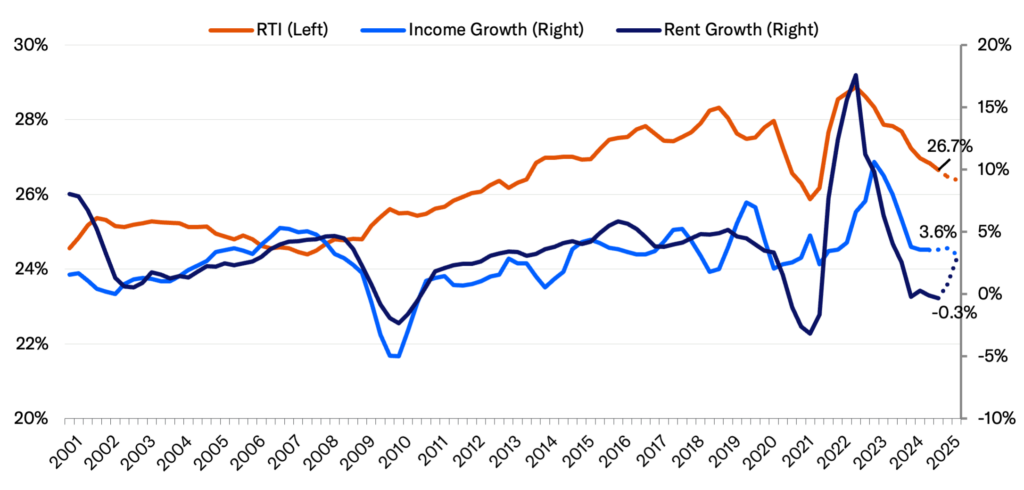

Via Moody’s Analytics: “On a year-over-year basis, while rent was 0.3% lower, income was 3.6% higher, providing reliefs on average in rent-burdened metros across the nation,” but steady increases in student housing rent growth is a particular area of concern.

- Home Prices up 3.4% Year-over-Year (CoreLogic)

- Housing Cost Burdens Climb to Record Levels (Again) in 2023 (Harvard Joint Center for Housing Studies)

- Housing Market Predictions for 2025 (Zillow)

Multifamily Markets and Reports

Sunbelt Cities Build Even More Apartments in 2025

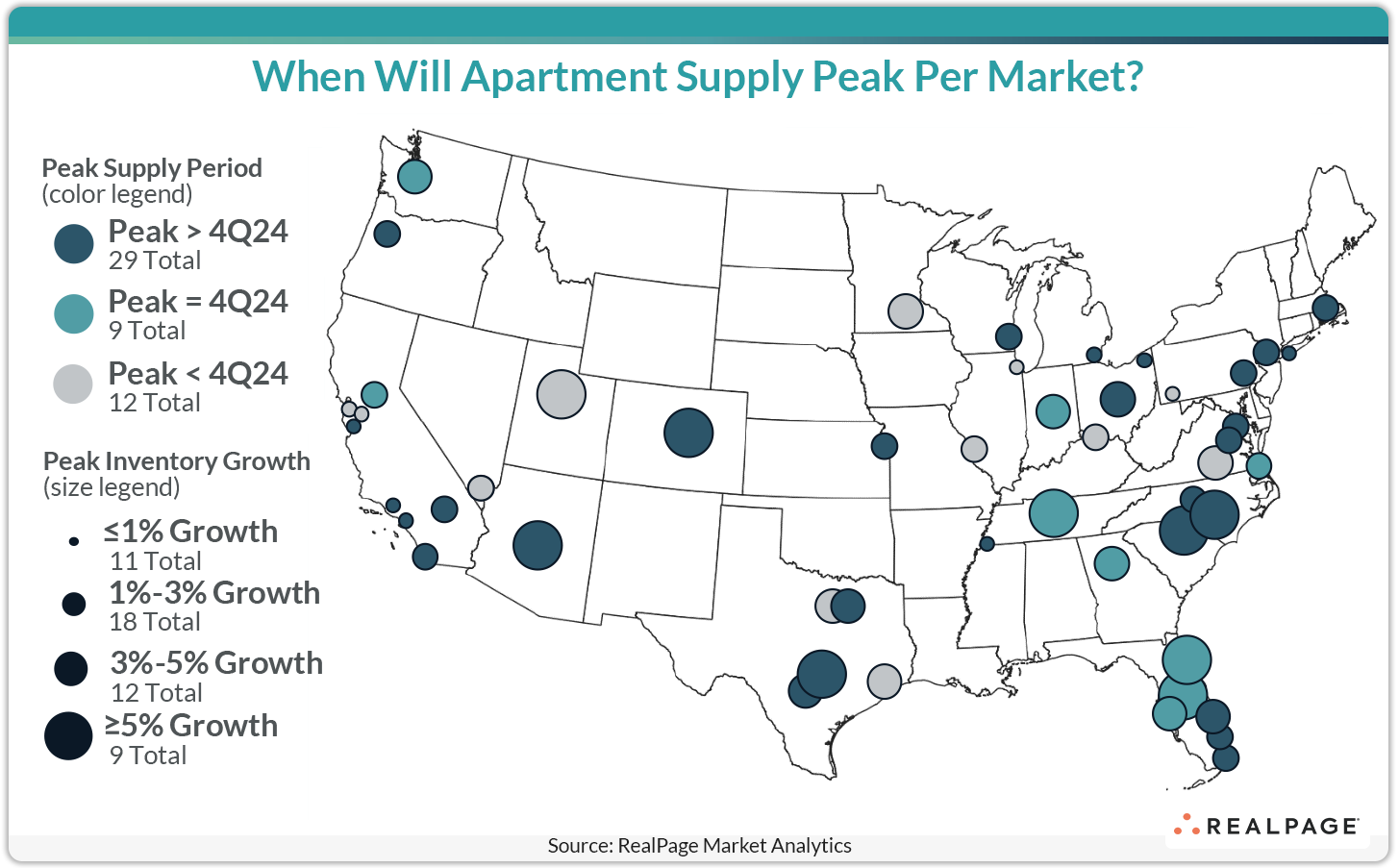

Via RealPage: A great deal of apartment markets have yet to hit their peak for supply growth, and most of this supply growth is happening in the Sunbelt, whereas markets further north and inland are more likely to have already passed their peak for newly delivered apartments.

- Sunbelt Housing Markets Weakening, Midwest and Northeast Gain Strength (Fast Company)

- Not all multifamily markets are created equal, rent growth soars in some, stagnates in others (REJournals)

- The Great Reshuffling Revisited: Why Are Americans Moving? (RentCafe)

Commercial Real Estate and the Macro Economy

A New Status Quo for the Geography of Residential Construction?

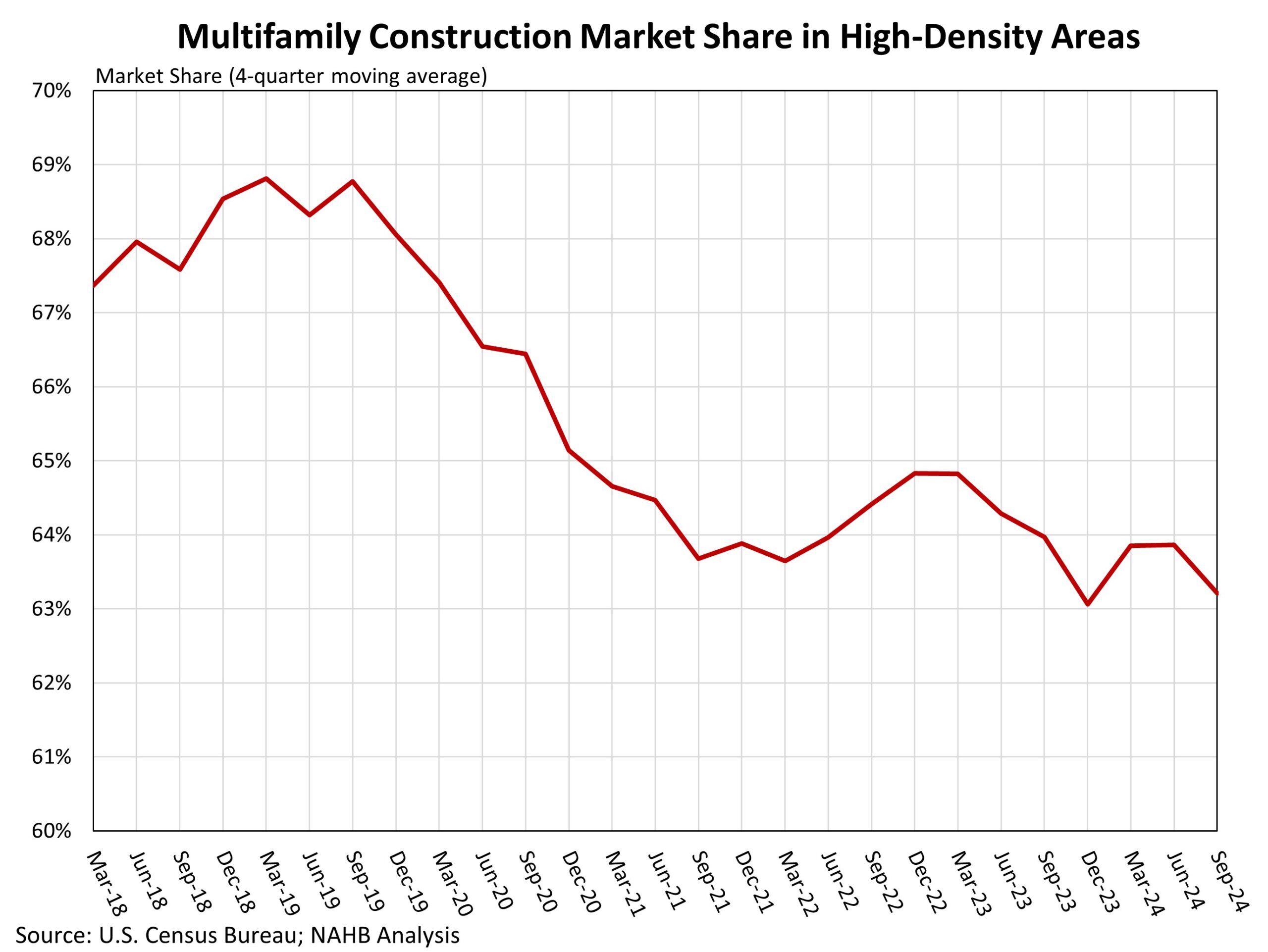

Via NAHB: “[N]ew analysis shows that counties with the highest population density have lost market share with respect to single-family construction. For this analysis, we define high-density areas to be counties in the top 10% with respect to population density. Approximately half of the total U.S. population lives in such counties.”

- Comparing Drivers of Real Asset Performance: Social and Economic Infrastructure (CBRE)

- The In-Office Edge (Cushman & Wakefield)

- 2025 U.S. Retail Forecast Trends: Investor & Retailer Outlook (Colliers)

Other Real Estate News and Reports

Q4 2024 National Retail Report: “Potential headwinds could be negated.”

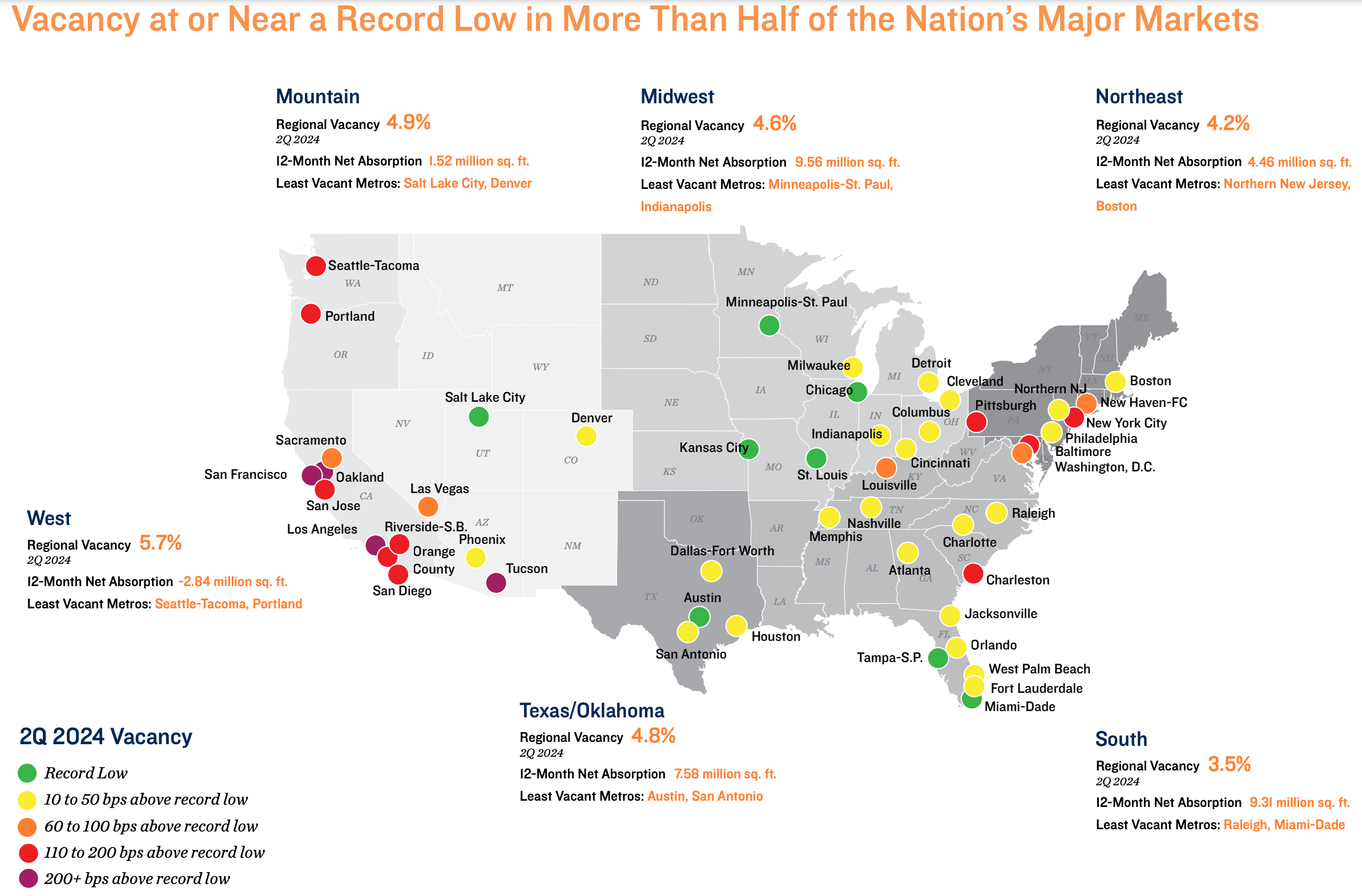

Via Marcus & Millichap: “The retail sector entered the second half of 2024 as the only major commercial real estate property type with a vacancy rate below its year-end 2019 recording. Consumer resiliency empowered standout tenant demand across the segment.”

- The relation of office performance to submarket property type distribution (Moody’s Analytics)

- ‘Peer Pressure Is Back’: Office Owners Say Renewed RTO Push Is Creating Demand (Bisnow)

- The Real CRE Pressures Banks Are Under (GlobeSt)