Rent Growth and Multifamily Performance in 2023

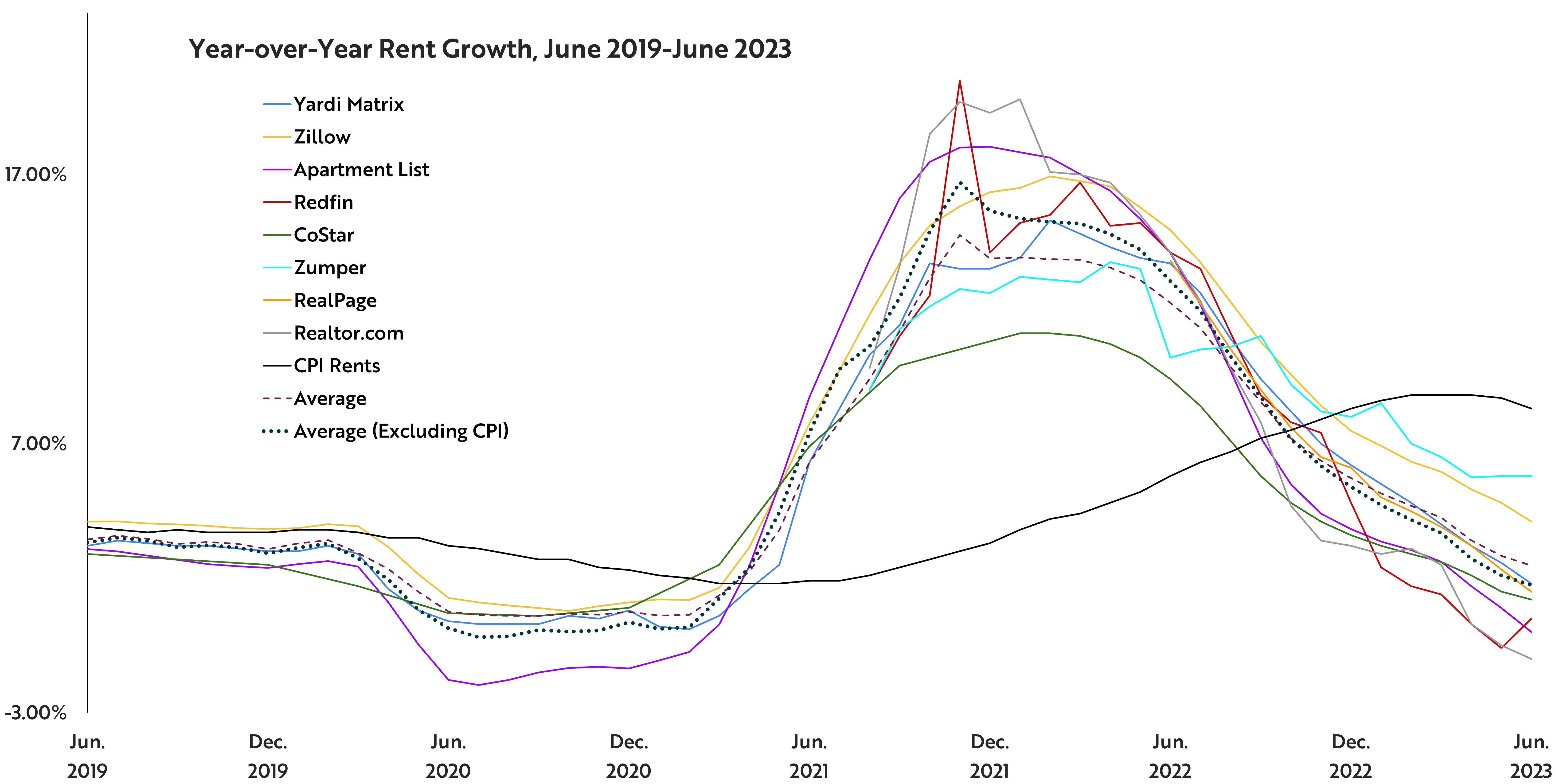

Rents are normalizing in the wake of the strongest rent growth surge in recorded history, but the Consumer Price Index’s measure of rent growth only tells part of the story. Unprecedented shifts in apartment asset performance demand greater attention to the tools used to measure rent growth, and Gray Capital’s report on multifamily rent growth compares data from private rent growth trackers as well as the Consumer Price Index.

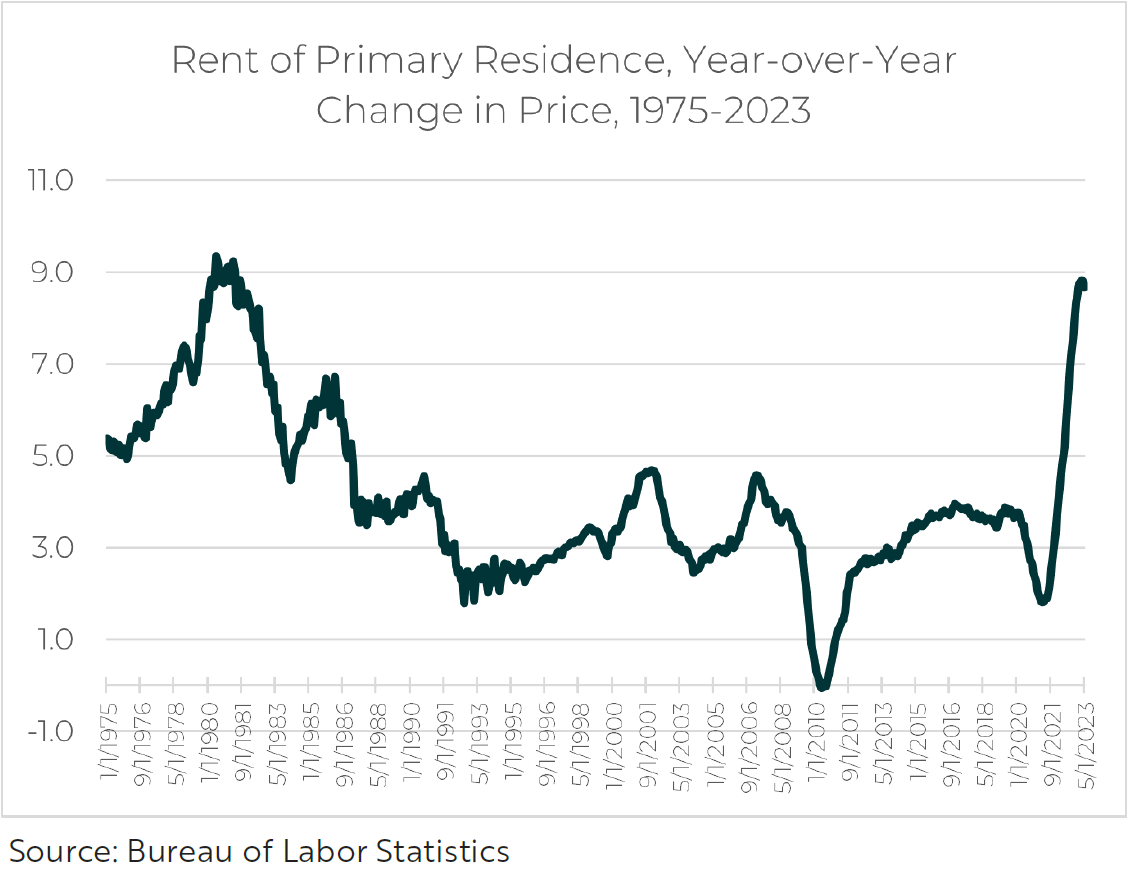

The rent price measurement used for inflation calculations, the Consumer Price Index’s Rent of Primary Residence metric, does not accurately reflect rent growth and lags new-lease market rents by roughly one year.

For data on current new leases, there is no single authority on rent growth, and that is a problem given that measuring rent growth has become so crucial in the midst of the rapid, transformative changes in the apartment market. Gray Capital has been following the data from 8 separate rent growth trackers alongside the CPI rent growth measurement, and comparing these data sources reveals valuable insights not present when looking at a single piece of data.

We expect CPI rent growth to continue to moderate through the end of 2023, but if the strong labor market continues, new lease rent growth could avoid sharp declines, with greater stability through 2024. Our full report reviews these rent growth trends as well as the apartment construction and greater economic trends that are driving rent growth in the United States. Download the report at this link or follow the button below.