Property Values, Renovations, and the Shrinking Homebuyer Pool

Interest rate pressures have settled the multifamily market considerably since the beginning of 2022, but the size and persistence of the housing shortage and unaffordability crisis all but ensures that home values will remain elevated in the future. While near-term economic uncertainty continues, the fundamentals of the multifamily market remain strong.

MSCI: “US Property Prices Fell in October from September” – https://www.msci.com/www/quick-take/us-property-prices-fell-in/03495605235

We follow a lot of regular, monthly rent reports, but not many of them include information on pricing trends for apartment properties.

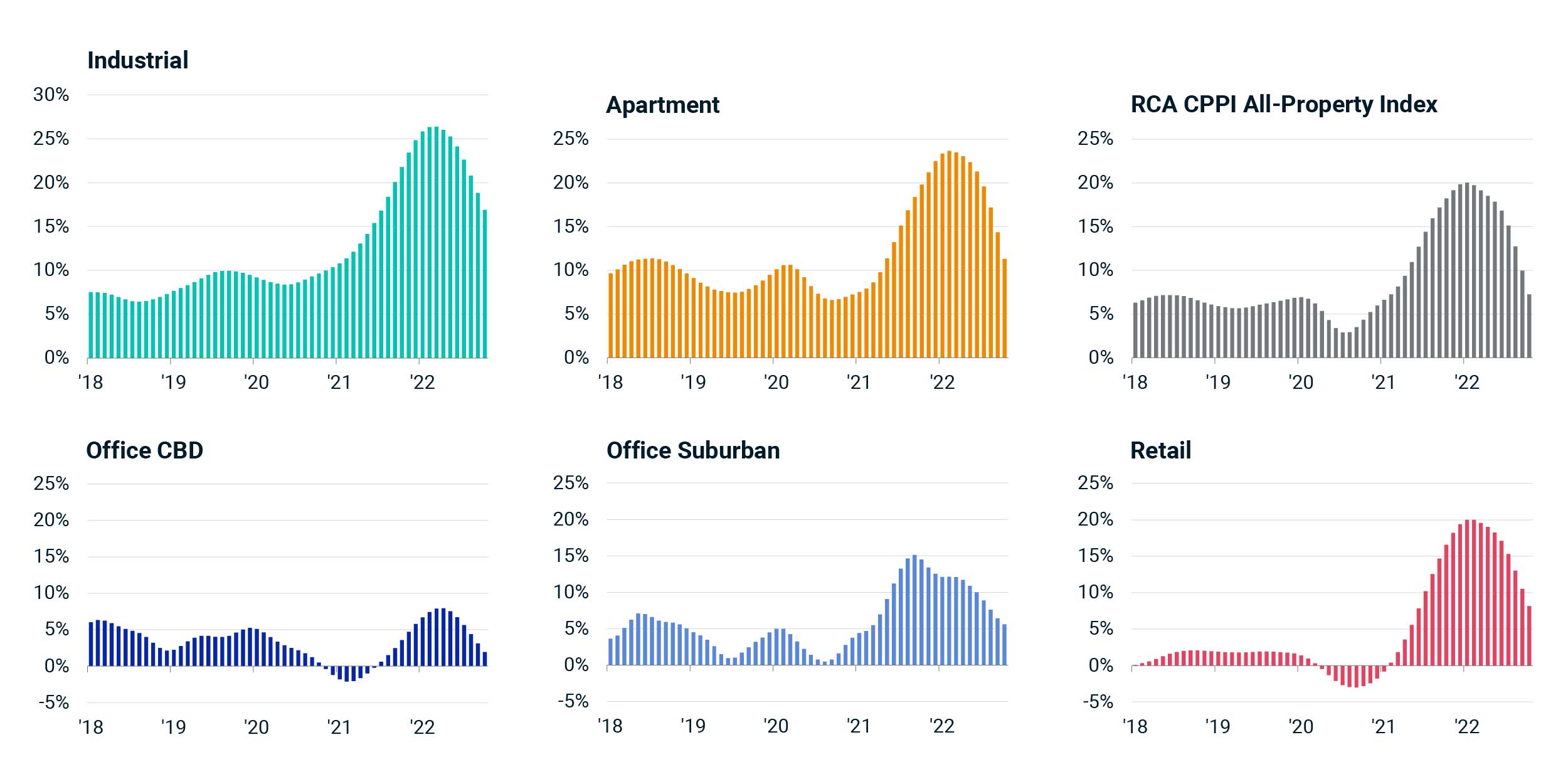

MSCI tracks these pricing trends, and the story for 2022—not that anyone needs reminding—is one of declining growth. The average price of multifamily properties is still up 11.3% year-over-year, but in October there wasn’t just declining growth there was an actual decline in prices of 0.6%, which, “when annualized, would be a drop of 7.0%.”

Will apartment prices keep dropping? Are apartment prices closely correlated with cap rates, or is some of this price decline associated with lower income from apartment properties?

Looking at the performance of different sectors here, apartment prices are doing better than everything except for industrial properties. Retail properties are closer than I expected to multifamily property price trends, coming in at 8.2% y-o-y growth compared to the 11.3% in the apartment market, and downtown office properties are doing the worst, up only 1.3% y-o-y after peaking around April of this year.

Fannie Mae: “Economic and Housing Outlook, November 2022” – https://www.fanniemae.com/research-and-insights/forecast

Fannie Mae’s monthly economic and housing outlook has several components, and I’m pulling out the multifamily commentary specifically. This report usually focuses on a single topic related to the multifamily market, so it’s not an overview of housing, but that doesn’t make it worthless!

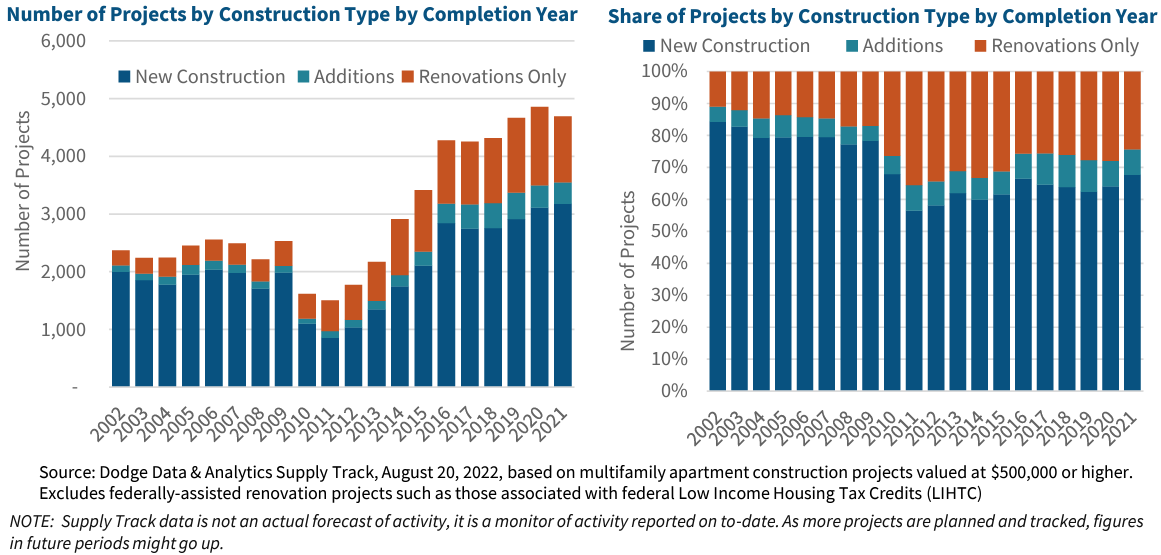

In the multifamily commentary, Fannie Mae looks at construction projects in the apartment project and notes the resilience of renovation projects compared to new construction and additions, finding that, in past years, renovations have either remained consistent or grown during years (like 2010-2015) with depressed numbers of new construction or additions.

This shouldn’t be much of a surprise to Value-Add investors, and Fannie Mae notes that many investment strategies involve a renovation component, and, as they write in their commentary, “purchasing an underperforming multifamily asset at a discount, implementing significant renovations, and then raising rents.”

Their multifamily commentary also looks at the relative size of construction projects completed in a given year, and they note an uptick in mid-sized construction projects of $1-5m, with a little more volatility for projects above and below that size.

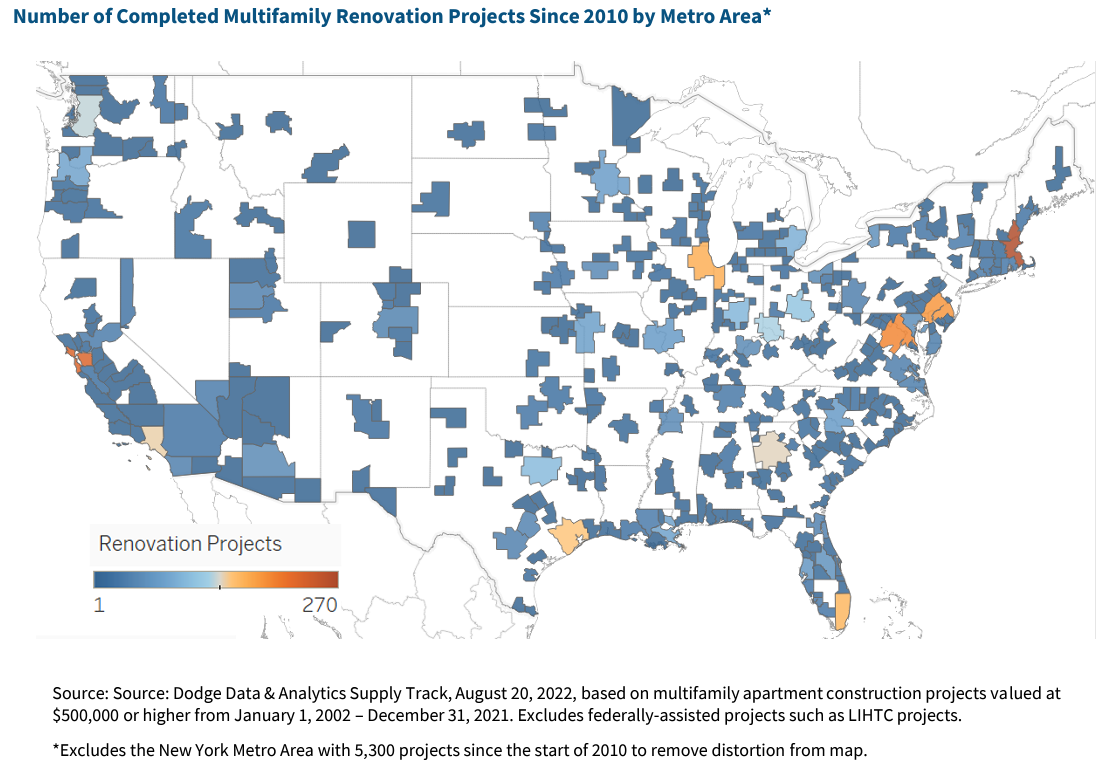

Returning back to renovation projects, the map on page 5 shows how these projects are markedly more common in larger metro areas. Now, these larger metro areas have more people, so they’re already more likely to have higher renovation numbers, but I am curious about the correlation between housing prices and renovation likelihood. San Francisco is smaller than LA, but it has much more renovation going on.

Notably the cost of renovation projects has been trending down since 2020, and I’m a little surprised that these prices weren’t impacted by the supply chain issues and labor shortages associated with the pandemic. With this in mind, Fannie Mae expects continued interest in renovation construction, especially as the cost of newly-built multifamily properties continues to rise.

Freddie Mac: “Do Rising Interest Rates Price Out Mortgage-Ready Borrowers?” – https://www.freddiemac.com/research/insight/20221121-do-rising-interest-rates-price-out-mortgage-ready

This research brief from Freddie Mac looks at the effects of “[m]ortgage rates [that] have increased at the fastest rate since the early 1980s.” Market confidence is down, with only 19% of survey respondents saying they’re buying a home, which is 5% lower than the previous quarter. But, as Freddie Mac asks, “at what point do higher rates become too high for consumers?”

To figure this out, Freddie Mac looks at mortgage-ready potential homebuyers, which are defined as:

- Not having a mortgage

- Having a credit score of 661 or above

- No foreclosures or bankruptcies in the past 84 months and no severe delinquencies in the past 12 months

- 45 years old or younger with an estimated backend debt-to-income ratio less than 25%.

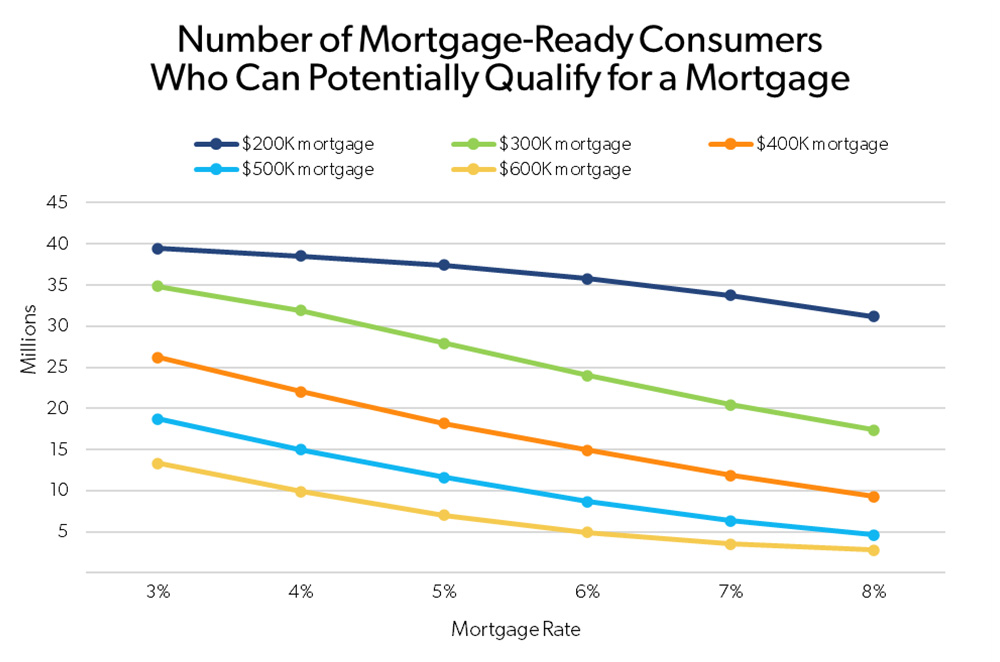

So, at what mortgage rate does this group really start to shrink? Well, it depends on the size of the mortgage.

For a 200k mortgage, the number of mortgage-ready potential homebuyers shrinks from just under 40 million at a 3% interest rate to just over 30 million at an 8% rate. It’s a much steeper curve for a $300k mortgage, going from 35m at 3% interest rate down to 17.5% at 8% interest—essentially shrinking the group of mortgage-ready homebuyers by half when mortgage rates go up by 5%.

The trends for $400k, $500k, and $600k show increasingly steep drops, and for $500k and $600k mortgages, you only need a 3% increase in rates (not 5%), for the number of mortgage-ready homebuyers to shrink by half or more.

Here’s the real kicker that takes it back to the multifamily market: “Based on the recent high mortgage rate, near 7%, and median home prices, approximately $400,000, only 12 million mortgage-ready potential homebuyers have the capacity to afford mortgages, compared to 26 million when rates were 3%. This means over the past year, around 15 million potential homebuyers may have been priced out.”

15 million homebuyers priced out.

Not all of these 15 million were going to buy a home anyways, but even so, this is a clear, numerical case where you can see the observable effect of rising interest rates on the housing market.

This may not lead to a surge of renters, but it would definitely support apartment demand in general, even if only a fraction of the shrinking group of mortgage-ready borrowers were really interested in buying a home.