Recession Fears vs. Multifamily Stability

Tariffs and other new policy changes led to a stock market downturn this past week and fears of a recession that could have dramatic negative effects throughout the economy, including the multifamily market. These near-term fears are now coming up against long-term trends in the housing and multifamily market of gradually increasing housing demand and decreasing housing construction. Amid this volatility and uncertainty, apartment investment opportunities will emerge for those with a long-term view and a proven operational solution able to weather the current high-expense environment—no easy task in itself.

Multifamily, the Nation, and the Economy

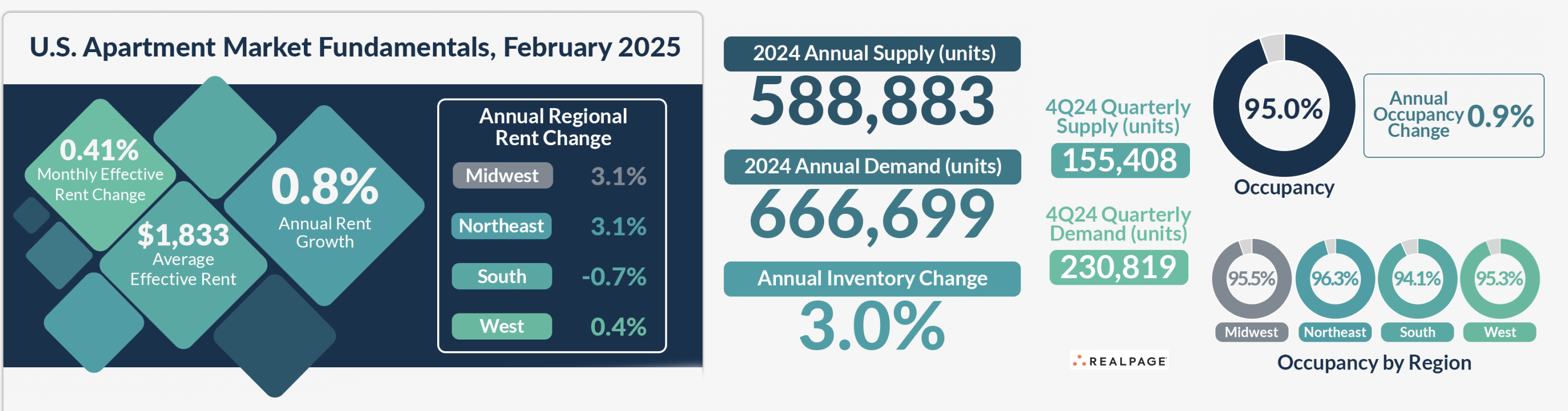

- Momentum Builds in February Rent Growth, Occupancy Readings

- Via RealPage: “Apartment rents gained a modicum of momentum in February, on the heels of a similar trend in January, altogether pointing toward stabilization in rent change after almost two years of near-stagnant growth.”

- Wary Markets Rebound as Europe and Canada Retaliate Against Trump Tariffs (NYT)

- Given so many headwinds, what will drive housing demand in the near term? (JBREC)

- Multifamily Poised for Best Buying Opportunity in Years (GlobeSt) [Webinar Link]

Multifamily and the Housing Market

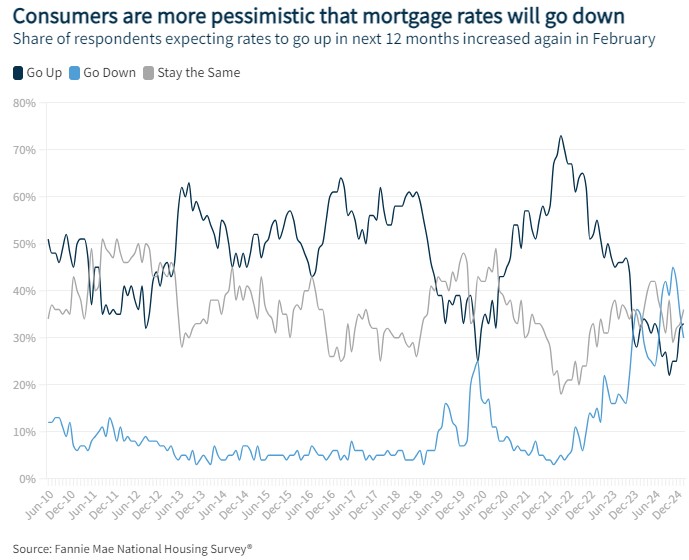

Consumer Housing Sentiment Down Year over Year for First Time Since 2023

Fannie Mae: “While some consumers may be slowly acclimating to the higher mortgage rate environment, the vast majority continue to believe it is a ‘bad time’ to buy a home – with high home prices cited as the primary sticking point.”

- Report: “The End of Compliance: Capital Needed to Preserve Affordable Housing” (Yardi Matrix)

- Affordable housing threatened as Trump halts $1 billion slated for extending life of aging buildings (AP)

- The Major Metros at Risk of a Slump Due to Foreclosures and Unemployment (Realtor.com)

Multifamily Markets and Reports

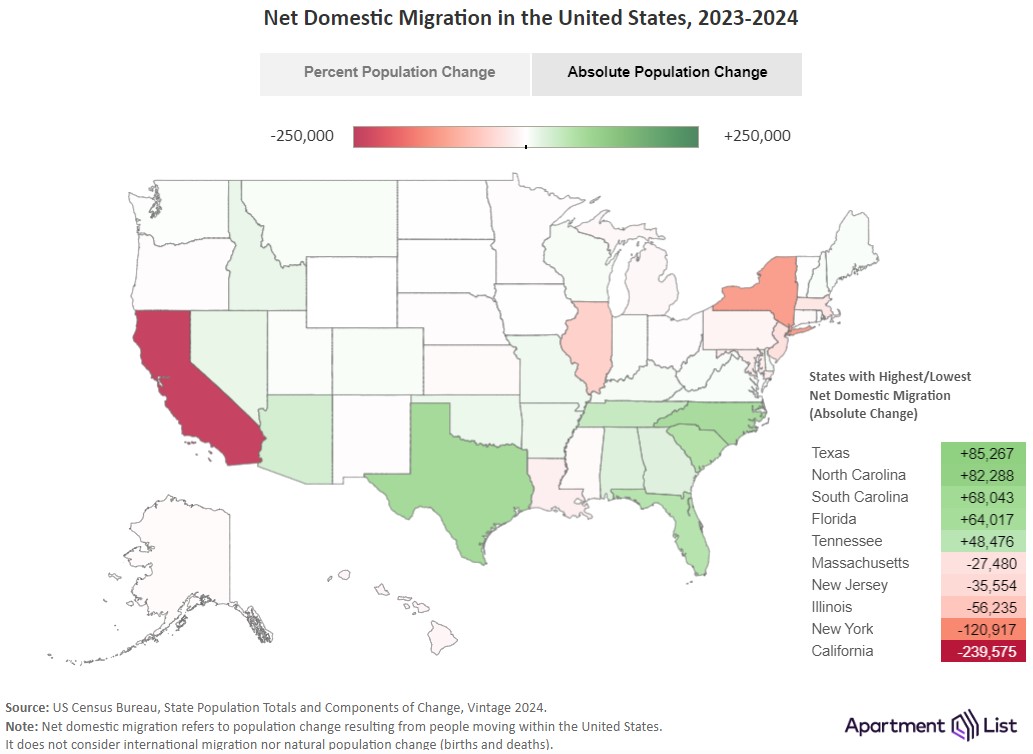

Apartment List Renter Migration Report: 2025

Apartment List: “Most notably, there have been outflows from some of the nation’s largest and most-expensive housing markets to more-affordable and less-densely populated ones. Overall migration has slowed somewhat, as have long-distance moves to a new state or a new metropolitan area.”

- What’s Driving the Increasing Importance Consumers Place on Their Homes (Fannie Mae)

- 83% Of Multifamily Investors Are Looking To Buy In 2025 (Bisnow)

- Multifamily distress rises slightly in February (Multifamily Dive)

Commercial Real Estate and the Macro Economy

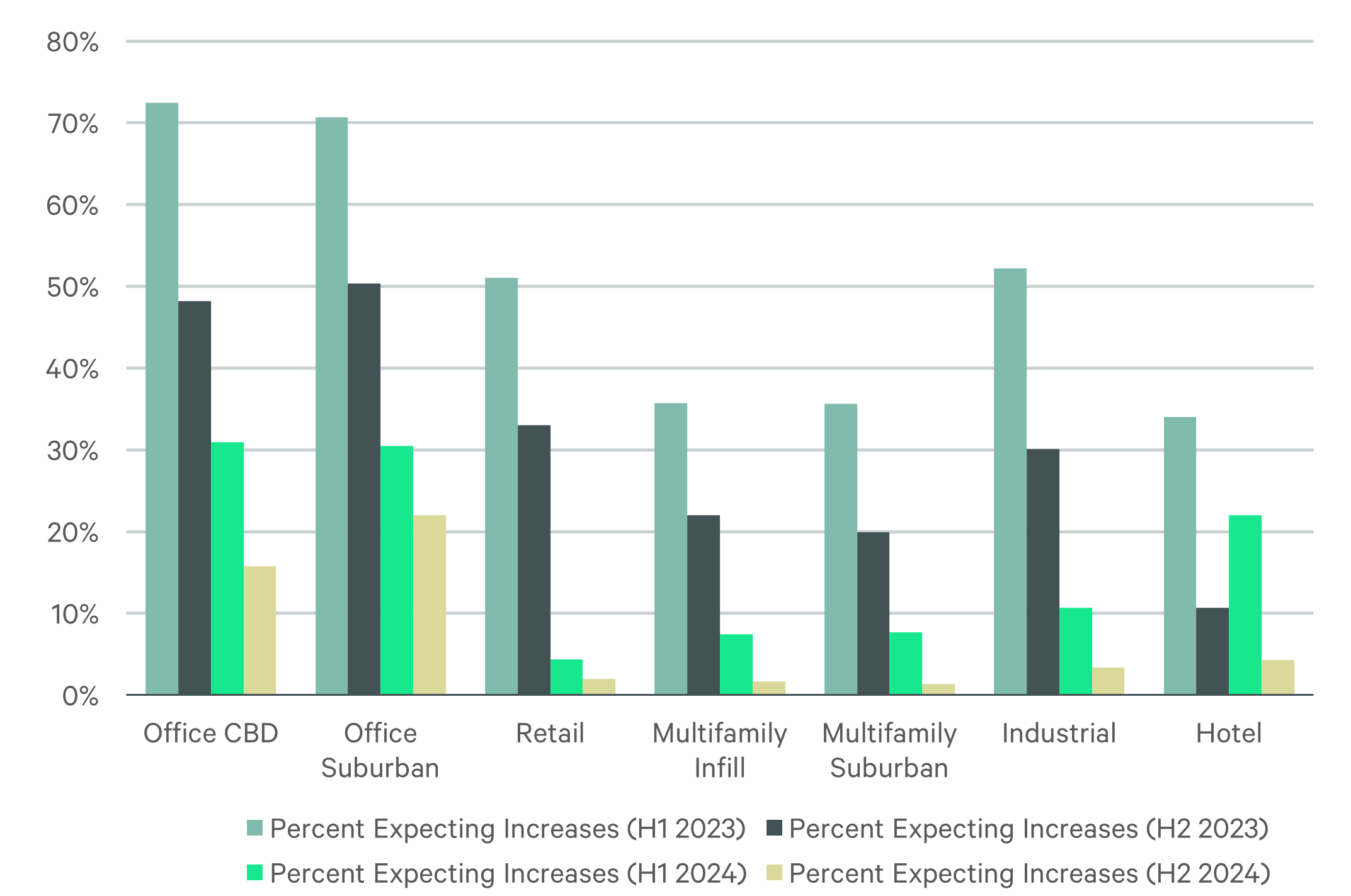

Capital Markets Pros Believe Cap Rates Have Peaked

Via CBRE: “[T]he outlook for offices continues to brighten, particularly for prime properties in gateway central cities. The outlook is less rosy in suburban office markets where investors continue to insist on a risk premium amid weak fundamentals and a paucity of prime spaces.”

- Retail kicked off 2025 with solid momentum (Colliers)

- Data Analysis: Commercial Real Estate Troubles Threaten U.S. Banks (Florida Atlantic University))

- From the Desk of Trepp’s Chief Economist: Inflation Pressures & CRE Implications (Trepp)

Other Real Estate News and Reports

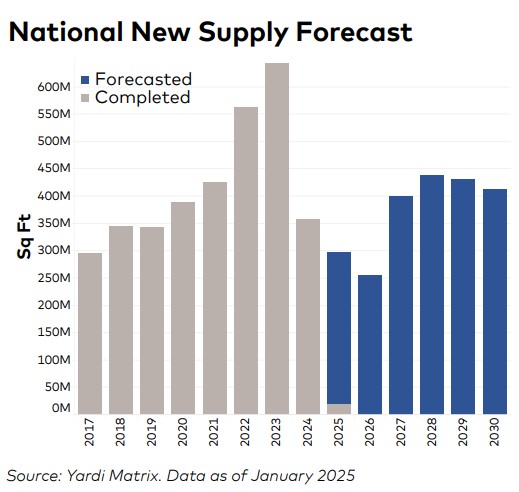

Feb. 2025 Industrial Market: “U.S. Manufacturing Expands Despite Challenges”

Via Yardi Matrix: “After facing one of the harshest volume declines, the asset class is now a leader in year-over-year sales gains. Distress is working its way through the system, bringing properties to market, at times, at substantial discounts to previous sales prices. Distress will remain at a steady pace for some time to come.”

- CPI Shows Inflation Decrease (BLS)

- Economic Uncertainty To Favor Real Estate? (Marcus & Millichap)

- Builders Stockpile Lumber, Swap Out Materials to Work Around Tariffs (WSJ)