New President, Same Apartment Market?

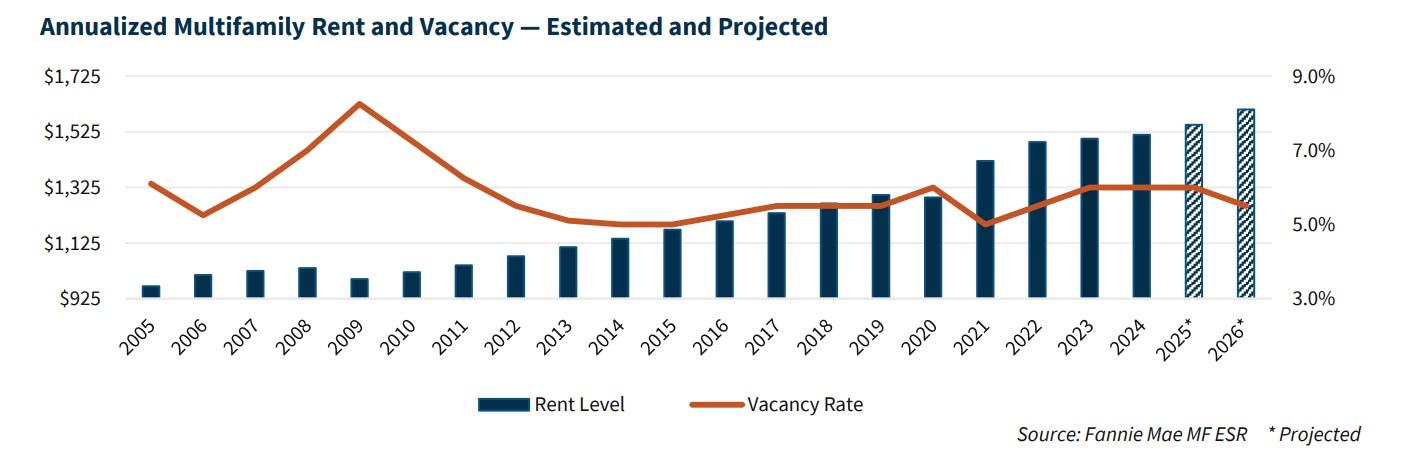

Amid the steady flow of executive orders from the new Trump administration, there remains some lingering uncertainty about the direction of the economy, but nothing that has overcome the prevailing economic optimism presently. The apartment market, while still working through a massive wave of new supply, has a clear positive trajectory for 2025, backed by high housing demand and an interest rate environment that continues to favor renters over homebuyers.

Multifamily, the Nation, and the Economy

2025 Multifamily Market Outlook: Clearer Skies Ahead

Fannie Mae: “Our expectations for higher rent increases are based on projected job growth along with positive demographic trends for the age 20- to 34-year-old segment of the population, which is the cohort most likely to rent multifamily units.”

- How Accelerating Economic Growth Could Shape CRE (Marcus & Millichap)

- The U.S. Government Has a Landlord, and Trump Isn’t a Fan (The Wall Street Journal)

- Trump’s First Executive Orders Target Office Mandates, Housing Affordability, Private Prisons (Bisnow)

Multifamily and the Housing Market

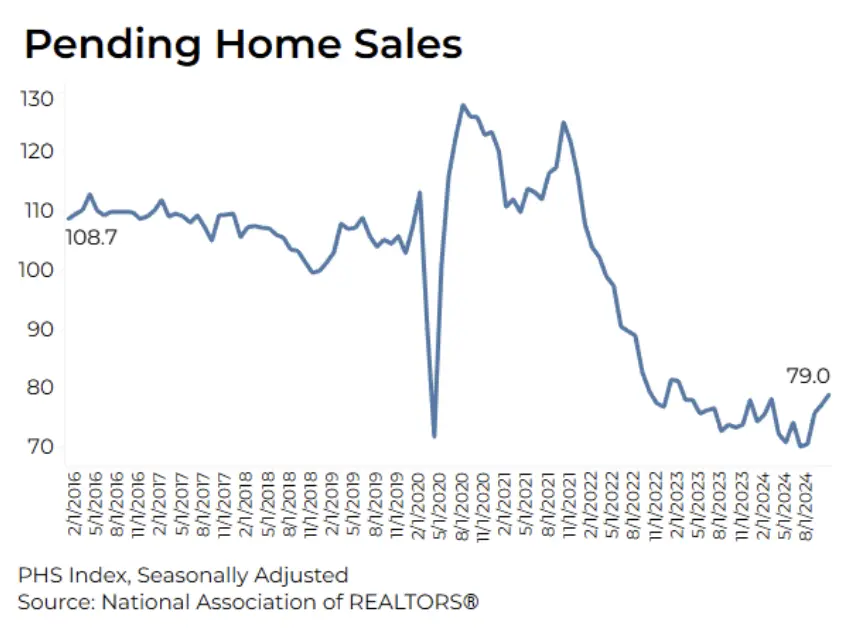

Housing Market Snapshot Shows Scale of Homebuying Market Slump

Via NAR: “More buyers are expected to enter the market as the economy adds more jobs and the housing supply increases,” but the homebuying market has a ways to go before sales activity returns to historical averages.

- Apartment Rent Growth Expectations at the Market Level for 2025 Show Indianapolis, Midwestern Markets on Top (RealPage)

- Demographic Analysis of Labor Force Participation Rate (NAHB)

- Modest Gains in 2025 Outlook for Home Remodeling (Harvard Joint Center for Housing Studies)

Multifamily Markets and Reports

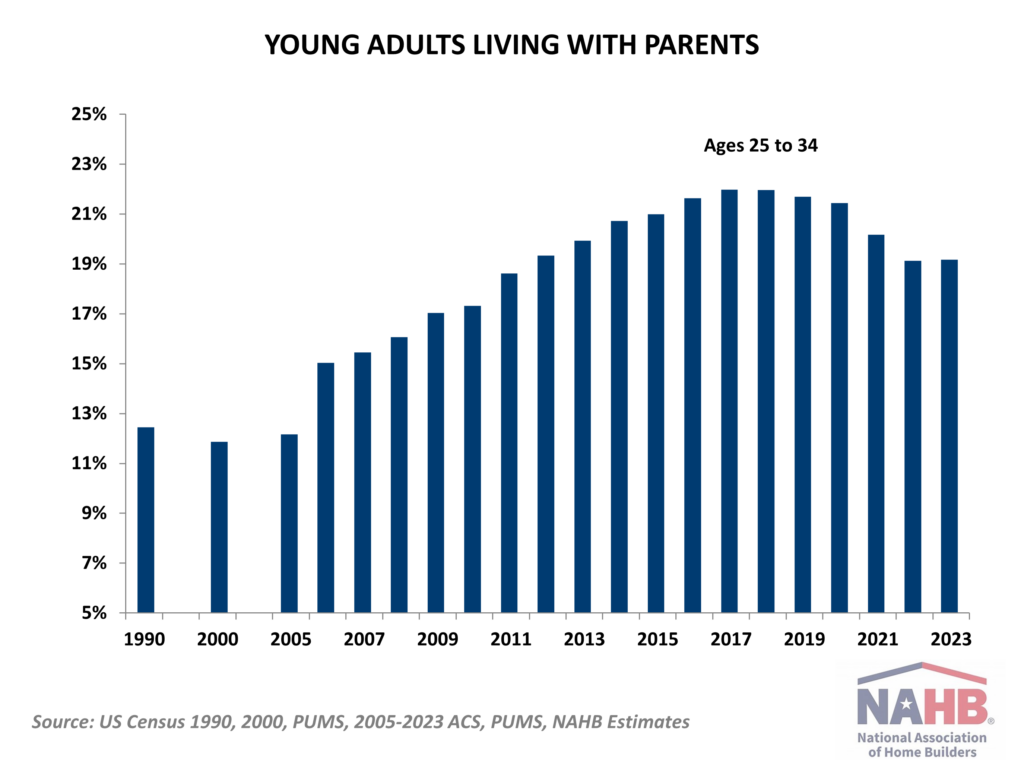

Moving Out of Parental Homes is On Hold

Via NAHB: “The worst on record rental affordability conditions, depleted “excess” savings of the pandemic era, and high mortgage rates halted the post-pandemic trend of young adults moving out of parental homes.”

- The Evolution of Florida’s Building Codes & Their Impact on Multifamily Housing (Trepp)

- Front Half of Student Housing Pre-Lease Season Shines, While Back Half Slumps (RealPage)

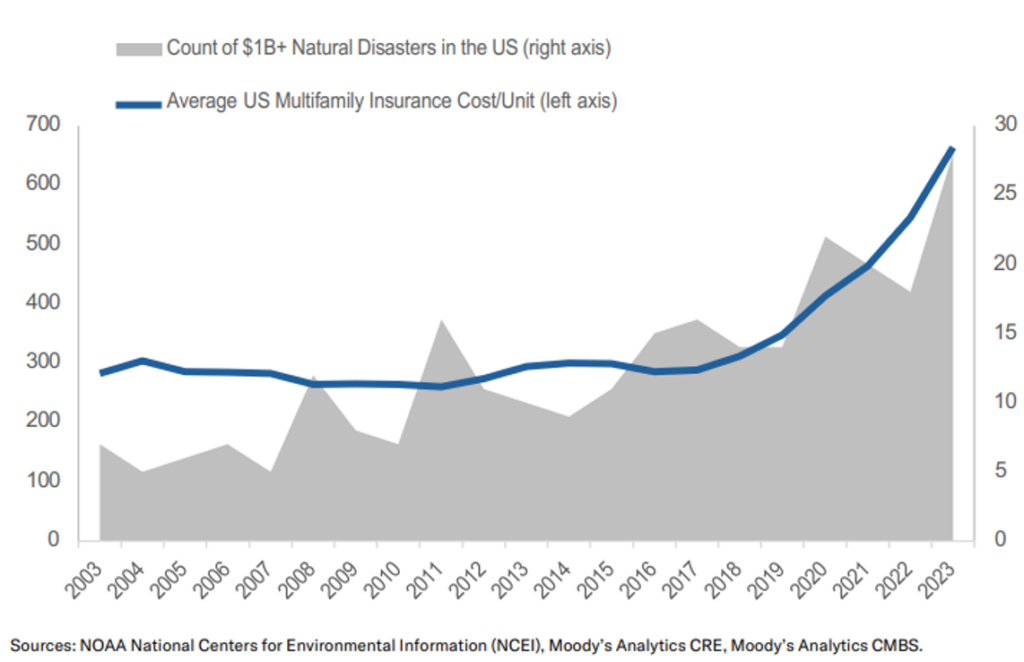

- The Homes the LA Wildfires Left: A Hidden Insurance Crisis? (CoreLogic)

- Ten Up-and-Coming Housing Boomtowns: All but One Are in the South (GlobeSt)

Commercial Real Estate and the Macro Economy

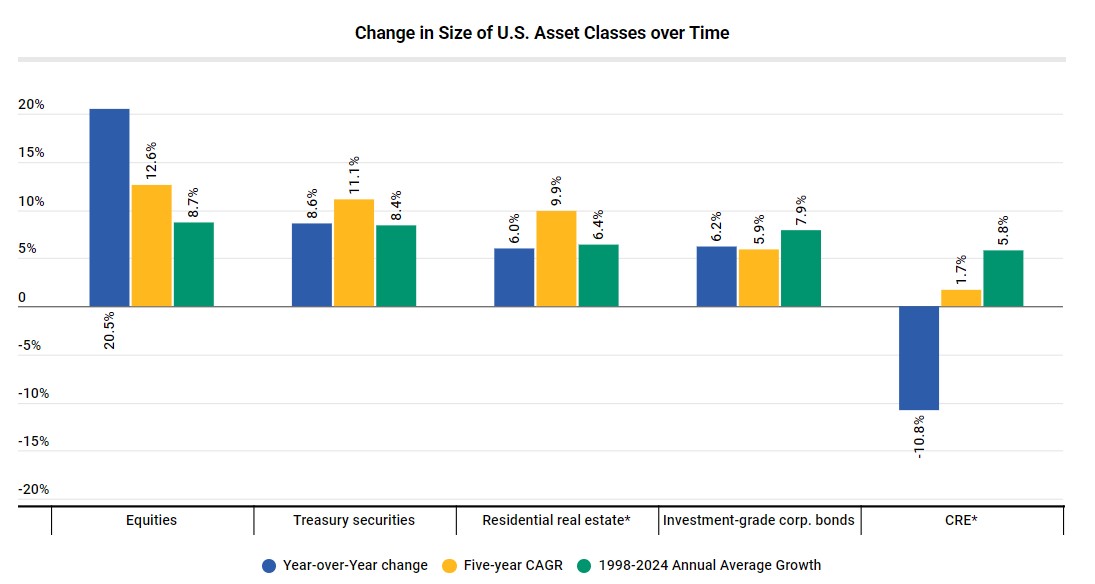

Federal Reserve Financial Stability Report: CRE Contracts While Equities Soar

Via Trepp: “While there is uncertainty regarding macroeconomic policies and the future of office properties, as overall economic growth forecasts are favorable, we expect CRE loan originations and investment sales to pick up in 2025. In short, we are likely getting closer to the beginning of the next real estate cycle, in contrast with the malaise experienced earlier last year.”

- Healthcare Sector Shows Promise in 2025 (Cushman & Wakefield)

- Foot Traffic Analysis: Retail Ends 2024 on a High Note (Colliers)

- CRE Finance Community Sees Positive Momentum as “Multifamily Takes Center Stage” (Trepp)

Other Real Estate News and Reports

Southern California Wildfires: Putting the Disaster Into Context

Via Moody’s Analytics: “The viability of rebuilding efforts will depend on insurance, including both the existing coverage and timeliness of payouts, as well as the ability to get affordable coverage in the future, since mortgages require insurance.”

- 2025 Trends in Private Capital: “Private-credit distress rates remained elevated” (MSCI)

- Managing Corporate Real Estate: Leading and Emerging Practices (CBRE)

- Fed Worker Return-to-Office: Trump’s Gift to the Office Market (Commercial Search)