Multifamily Real Estate Investing During COVID-19

The coronavirus pandemic has disrupted economies, upended daily life, strained social and political life, and most significantly, taken a toll on the life and health of millions. It has affected nearly every facet of our lives. Of course it has impacted the world of multifamily real estate. The economic environment alone has many analysts and investors looking back to the Great Recession for lessons we can apply today, and at the ground-level, property managers have adapted their operations and made changes to the buildings themselves in order to make these living spaces as safe and sanitary as possible.

COVID-19 has shifted the priorities of multifamily stakeholders, but in the vast majority of markets, multifamily real estate has remained relatively stable, especially compared to the volatility in the stock market and in other types of real estate investment. For investors, the most immediate reaction was uncertainty and a “wait-and-see” attitude, but many of the uncertainties in the multifamily sector have resolved into a clearer picture of the market both currently and for the near future. A great deal of uncertainty persists, and the pandemic is far from over; however, there are some things we do know, and the experience of these past few months has allowed many to discard the “wait-and-see” attitude and take real action.

This blog post is a brief overview of some of the significant developments in multifamily real estate during the coronavirus pandemic. Here’s a brief rundown of the reasons why investors have not lost confidence in multifamily properties in this crisis:

- This is NOT another 2008.

- Multifamily tenants are still paying rent

- Multifamily compares well against other real estate types

- Uncertainty is giving way to action

- Favorable lending from the Federal Reserve

- Smaller markets stable or improving as primary and gateway markets worsen

- Property management adapts with new technology and procedures

- Multifamily resilience amid government (in)actions

This Is NOT Another 2008

Our current economic crisis is fundamentally different from the previous one. The Great Recession in the late 2000s was caused by internal vulnerabilities within financial systems that directly affected the amount of equity of both banks and individuals. The coronavirus pandemic is an external factor, not an internal feature. Things are certainly more difficult for a large number of people, but we have not been seeing banks imploding or mortgages underwater.

Another, more relevant difference between now and then: We have not been through a housing crisis this time around. Far from it—it is very much a seller’s market right now, and the space of the home has become even more valuable with so many people working remotely. This does not mean that home buyers are eating into the number of multifamily renters, but it does mean that the opportunities of 2020 may be in a different location. Larger outdoor spaces away from downtown are a higher priority for people, and many of the larger, gateway markets are not performing as well as smaller cities.

Multifamily Tenants Are Still Paying Rent

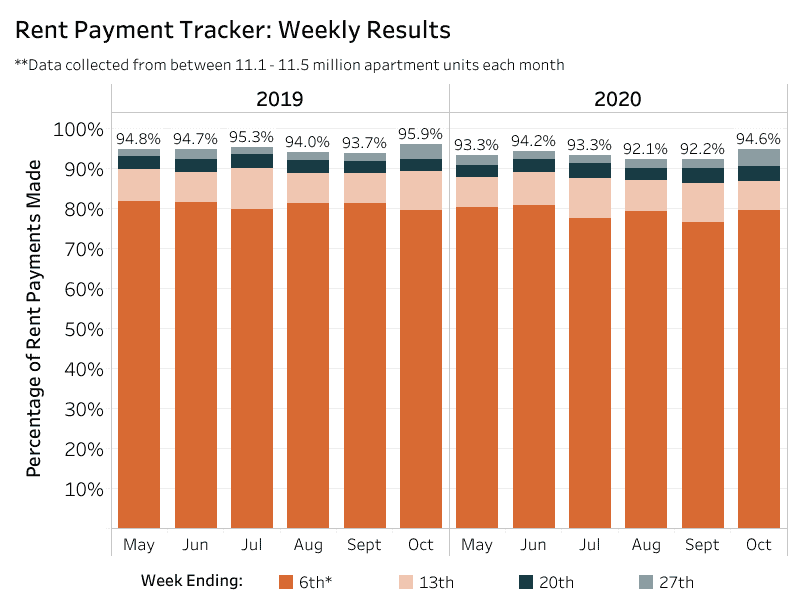

Starting in March, there has been a heightened, anxious level of attention dedicated to the rent payment rate. As March moved into April, there was nervous discussion that these numbers would soon fall off a cliff, and while the same feelings persisted as each month ended and a new one began, the payment rate numbers have proven doomsayers wrong again and again. Granted, the rent payment rate is down year-over-year, but outside of April’s 3.1% drop in rent payments, the payment rate for a given month has not decreased by more than 2% compared to 2019. Note, these are year-over-year reductions, so it is not as if rent payments are steadily decreasing. The latest numbers for September show that 92.2% of renters have paid September rent by the 27th, which is 1.5% less than the same time last year.

A small drop in rent payments is not great news by any means, and that 1.5 – 2% drop represents a great deal of money. In the context of larger economy, one in which millions have lost jobs, the stock market has crashed and rebounded repeatedly, and sectors like retail and hospitality suffering massive losses, 1.5 – 2% looks like a bedrock of stability.

The one-time Federal stimulus made it easier for renters to make payments, but there was worry that renters would have more difficulty in subsequent months. A similar narrative played out upon the expiration of additional unemployment benefits and the enactment of a national eviction moratorium. None of these large-scale developments have had an impact greater than the outbreak of the virus in April. Reduced payment rates will mean that margins are smaller and budgets are tighter, but they do not negate the fundamental viability of the multifamily asset class.

Multifamily Compares Well Against Other Real Estate

Data gathered throughout the pandemic has put a hard number on the pandemic’s impact on all types of real estate assets, and it has become clear that not all industries and real estate sectors have been affected equally by COVID-19. Hospitality, dining, and retail have borne the brunt of the economic impact of the pandemic, and office real estate has also suffered, albeit to a lesser extend than the aforementioned areas. Along with industrial assets, multifamily real estate has been remarkably resilient throughout the pandemic.

Even on the surface level, these variations in performance make sense. More people are spending time at home, they are shopping online more and going to stores and restaurants less. They are taking less vacations and avoiding theaters; they are going out less and staying in more. The industrial sector is continuing to provide products, materials, and manufacturing, and people will always need a place to live. Given the continued stability of multifamily assets throughout the pandemic, investors are increasingly willing to pursue these projects.

Uncertainty Is Giving Way to Action

In the early months of the pandemic, the precautionary principle was the dominant force in the multifamily real estate market. Notwithstanding the effects of long-term inaction within the multifamily market, there was good reason for investors to stay away. We didn’t know what the economy would look like, and we didn’t know how the virus would affect peoples’ lives. There are still a number of persistent unknowns in this crisis, but we have more information now than we did in March. We have more room to act.

The progress in the multifamily market is a product of former uncertainties resolving into a clearer picture of what to expect in the months and years ahead. Many of the trends ascribed to the pandemic were in effect (albeit in a less pronounced form) before the spread of the coronavirus. An aging cohort of Millenials, for instance, was increasingly interested in suburban living over city life. Armed with a greater knowledge of what to expect, investors have been able to more accurately assess the risk associated with a given real estate asset and, in many cases, proceed confidently with their purchase. Developers have continued the construction of new apartment buildings, and activity is returning to the multifamily real estate sector.

Favorable Lending Rates from the Federal Reserve

A large factor in the surge in home buying, compellingly low interest rates have made it significantly easier to finance the purchase of a multifamily real estate property. To be sure, many lenders are taking a hard look at the deals that come their way, but capital is available for projects with a solid strategy and strong outlook. Moreover, these low rates expand the range of multifamily projects that are financially viable, as projects that were not feasible under higher interest rates are now within reach.

Smaller Markets Stable or Improving as Primary and Gateway Markets Worsen

The pandemic has had a disproportionately large effect on New York City. New Yorkers suffered an early and intense wave of infection in the first few months of the coronavirus’s spread, and while the infection rate in the city is much lower now, the real estate market continues to endure lingering damage. Multifamily rents in New York City are much lower than in other cities. Real estate investments that were once a sure thing, given the constant demand and attention from investors around the globe, are now much shakier propositions. Unencumbered by the need to be physically present in the office, many New Yorkers are moving elsewhere, to locations with more space and lower cost of living. New York is not dead—not by a long shot—but it is certainly not the same real estate market that it was in February of 2020.

Other large cities, like Los Angeles, Boston, and San Francisco, share a similar fate as New York City, if not in the specific spread of the coronavirus then in the ensuing disruption of the real estate market. Rents are flagging, and the market is suffering. This is pointedly not the case in smaller, secondary real estate markets. Indianapolis, Phoenix, and Columbus are doing quite well, and other smaller markets with stable job growth are doing equally well. There are sound, profitable opportunities out there, but you may have to look outside of the biggest cities to find them.

Property Management Adapts with New Procedures and Technologies

The multifamily industry has been remarkably responsive to the COVID-19 pandemic. The now-ubiquitous mask-wearing / social distancing signage is just the beginning of the changes that landlords and property managers have implemented in the face of these unprecedented circumstances, and their efforts have been particularly effective in maintaining the health and safety of their tenants and themselves. Many of these changes will likely become permanent features of multifamily property management.

Apartment hunts that used to take place physically can now be done online, with virtual tours and web conferencing actually reducing the time it takes for people to find the apartments that they need. Well-maintained HVAC systems have become increasingly important, with more attention paid to proper air circulation and filtration to reduce the potential for the virus to spread throughout the building. High-traffic areas are routinely cleaned and sanitized. Remote and electronic rent payments have become easier and more accessible. The multifamily industry has adapted with robust procedures and new technologies that are both effective and financially viable solutions.

Multifamily Resilience and Government (In)Action

The drum beat of doomsayers has tolled fairly consistently throughout the pandemic. Even as the CARES Act was passed and people began receiving much-needed support from the government, there was already a steady source of anxiety-laden prognostications about the coming collapse of the apartment industry. The stimulus check is a one-time event. Unemployment benefits are set to run out in July. Renters are self-reporting that are going to have trouble paying their rent. Doom is right around the corner.

Except that wasn’t the case. The much-reported death of the multifamily real estate market has yet to exist in any other place than the imaginations of these would-be prophets, (and, unfortunately, in New York City and San Francisco). It would be foolish to say that the apartment industry is an iron-clad, future-proof source of investment success, but at this point, ignoring the predictions of rent collapse is understandable, and backed by months of stable rent performance.

Multifamily investment involves risk, just like any other investment, but those who choose to remain on the fence are ignoring the clear opportunities that could deliver them strong returns long after the pandemic has subsided.

For more insights into multifamily investment, sign up for our free weekly Gray Report newsletter, and for those interested in joining our exclusive investment club, follow the link below to apply.