Multifamily in 2025: Demand Will Dominate

After 2+ years of apartment supply dominating the multifamily market, surging demand and the receding wave of newly-built apartments will bring greater balance to the market in 2025. With fundamentals so strong, multifamily investment interest should also increase in the coming year, but recent reporting has found that investment activity remains below historical averages. Stubbornly-high ten-year treasury yields represent a persistent financing challenge, but the lending environment could improve as the Federal Reserve continues along its path of lower interest rates.

Multifamily, the Nation, and the Economy

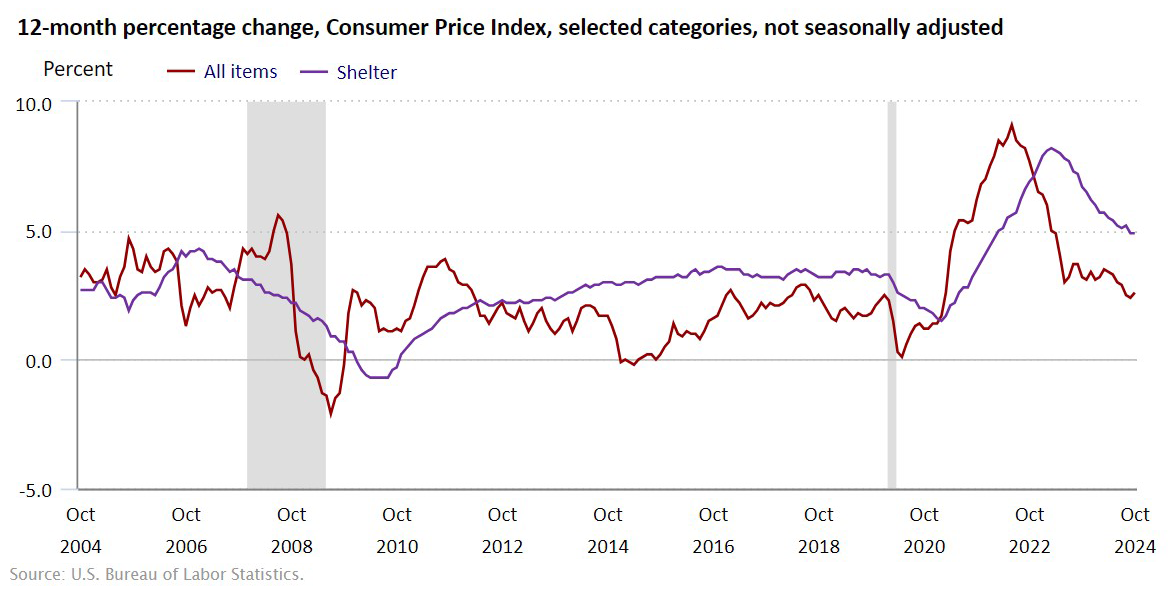

Oct. 2024 CPI: Inflation Ticks up Slightly YoY, 2.4% to 2.6%

Via Bureau of Labor Statistics: All items CPI prices “increased 0.2 percent on a seasonally adjusted basis in October . . . Over the last 12 months, the all items index increased 2.6 percent . . . The index for shelter rose 0.4 percent in October, accounting for over half of the monthly all items increase.”

- Multifamily Housing and the 2024 Election (Moody’s Analytics)

- How Trump’s Plan for Mass Deportations Could Affect Home Prices (Realtor.com)

- U.S. Multifamily Market Sees First Vacancy Decline in Two+ Years (CBRE)

- Fed Cuts Rates in Second Consecutive Meeting as Manufacturing and Services Surveys Diverge (Fannie Mae)

Multifamily and the Housing Market

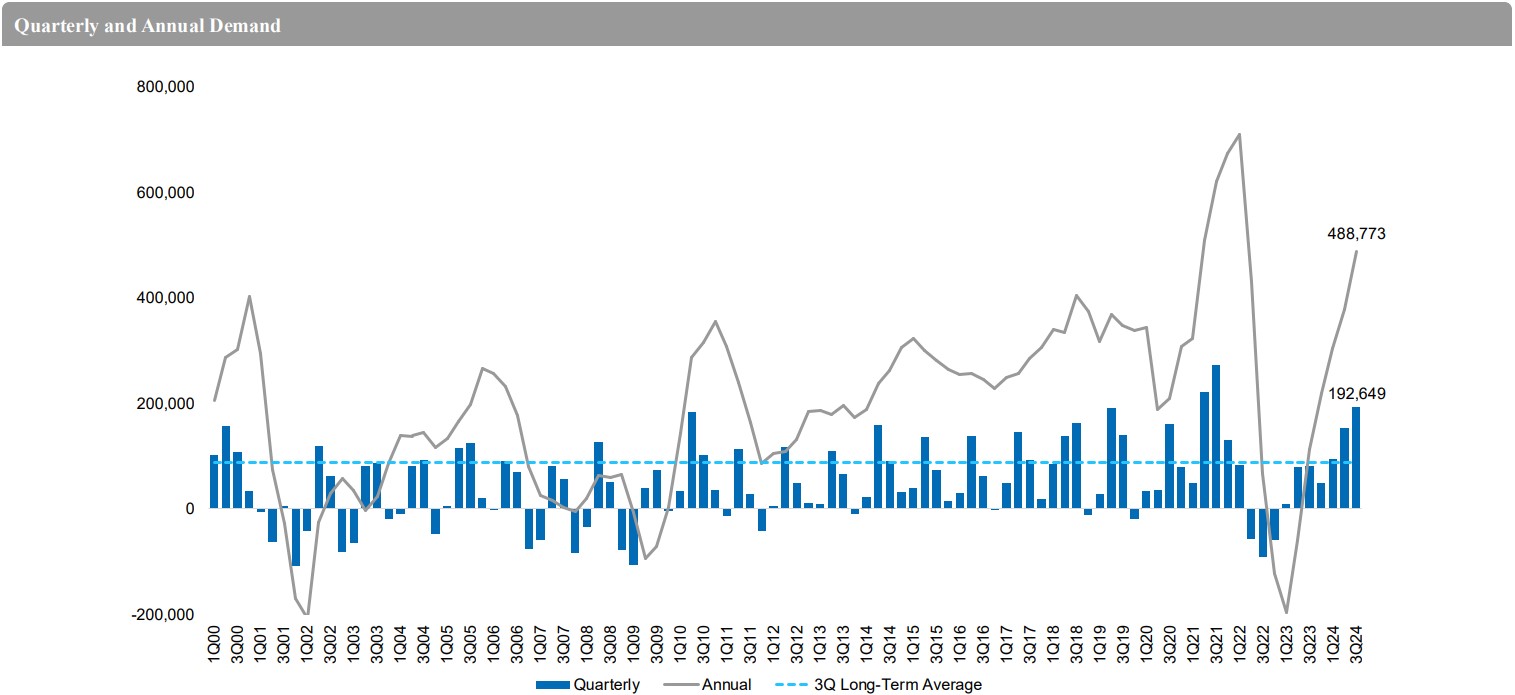

Q3 Multifamily Capital Markets Report: Investors Subdued, Fundamentals Improve

Via Newmark: While multifamily sales activity increased by 9.8% YoY, apartment demand has surged even in the midst of massive wave of newly-delivered apartments, exceeding supply in 48 of 50 markets.

- Residential Real Estate Market Snapshot:: Home Sales Continue to Stagnate (NAR)

- Consumers Feeling Better About Housing Market Despite High Home Prices (Fannie Mae)

- The Decline in Relative Housing Affordability and the Impact on Homebuyer Search Behavior (Freddie Mac)

Multifamily Markets and Reports

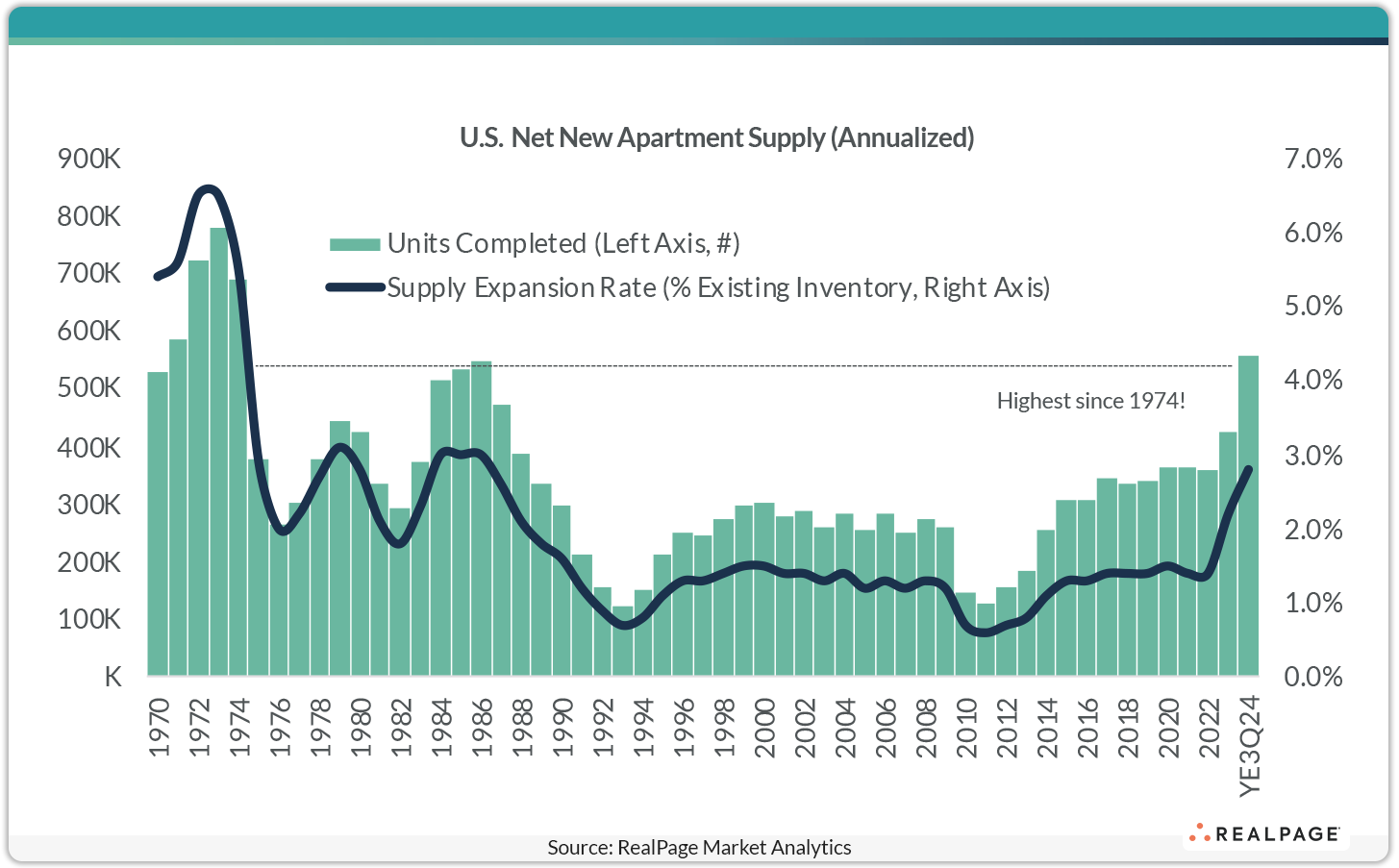

Some Perspective on the 50-Year Peak in Apartment Supply Volumes

RealPage: A lot of time has passed since apartment supply was at the levels seen today, but the current surge in apartment construction will have added 2-3% to existing supply, annually, for the 3 years between 2023 through the end of 2025. The previous peak in apartment supply, however, added 4-6% annually to apartment supply over a longer period.

- Oct. 2024 National Multifamily Report: Multifamily Rents Drop; Election Heralds Change(Yardi Matrix)

- Multifamily Portfolio Trends: Strength and Growing Demand in the Rental Pool alongside Seasonal Cooling (Cushman & Wakefield)

- What Will a Second Trump Presidency Mean for U.S. Housing? (CoreLogic)

- Rental Manufactured Home Communities Are Here (John Burns Research and Consulting)

Commercial Real Estate and the Macro Economy

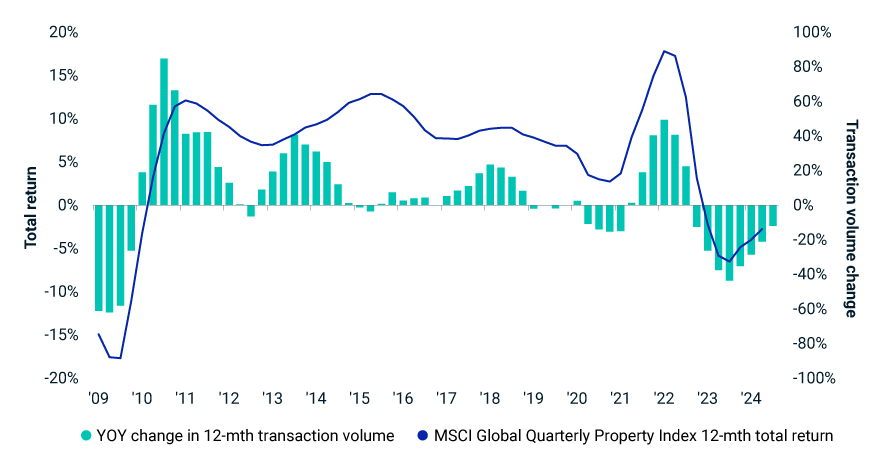

Real Estate in Focus: Light Is There but the Tunnel Is Long

Via MSCI: “Investors are likely to be feeling more optimistic than they were at the start of 2024, but the market is not yet fully out of the woods . . . marked by the interplay of structural shifts and economic pressures, as well as an unsettled geopolitical picture and the risk of the reemergence of inflation.”

- Strong Office Conversion Pipeline Will Boost Business-Centric Downtowns (CBRE)

- U.S. Office Market Outlook Report | Q3 2024 (Colliers)

- 3Q24 U.S. Retail Market: Conditions & Trends (Newmark)

- A Rate Cut from the Fed: What Will the Terminal Rate Be? (NAHB)

Other Real Estate News and Reports

Oct. 2024 CRE Insights: Multifamily Strong, Industrial Losing Momentum

Via NAR: “With additional rate cuts on the horizon, there is growing optimism for more favorable market conditions in the months ahead across the CRE sector.”

- U.S. Industrial Market Outlook Report | Q3 2024 (Colliers)

- The Forces Driving Retail and Industrial CRE (Marcus & Millichap)

- 2025 U.S. Healthcare Real Estate Outlook: Demand Coming from All Sides (CBRE)

- United States Retail Outlook Q3 2024: Interest in 2nd-Gen. Spaces (JLL)