Multifamily Groundhog Day?

Investor sentiment in the multifamily market has settled into much the same place that it was at the start of 2024, but crucial improvements in multifamily fundamentals have driven more interest in multifamily investment in 2025, despite the added weight of higher-for-longer interest rates.

Multifamily, the Nation, and the Economy

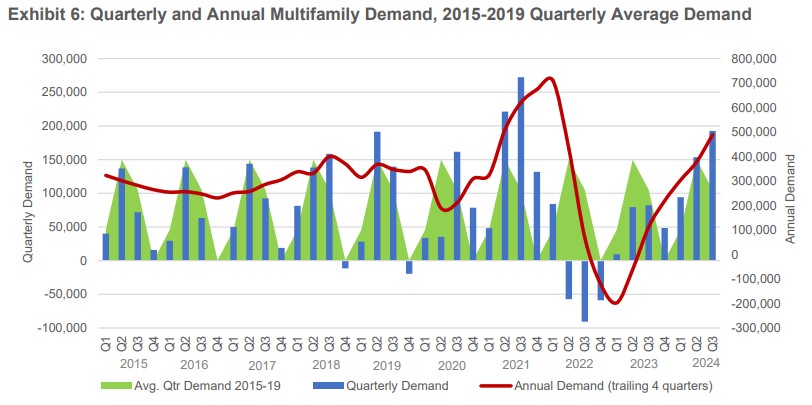

Multifamily growth “subdued but positive” in 2025

Freddie Mac: “While we expect a gradual cooling of the overall economy in comparison with 2023, solid economic fundamentals and continued demographic trends suggest demand for multifamily units will continue to remain strong.”

- Scott Turner confirmed as Trump’s HUD secretary after pledging to address housing shortages (AP)

- Q1 2025 Survey of Apartment Conditions Drops from Previous Quarter (NMHC)

- Our Chief Economist’s Takeaways from NMHC’s Annual Meeting (RealPage)

Multifamily and the Housing Market

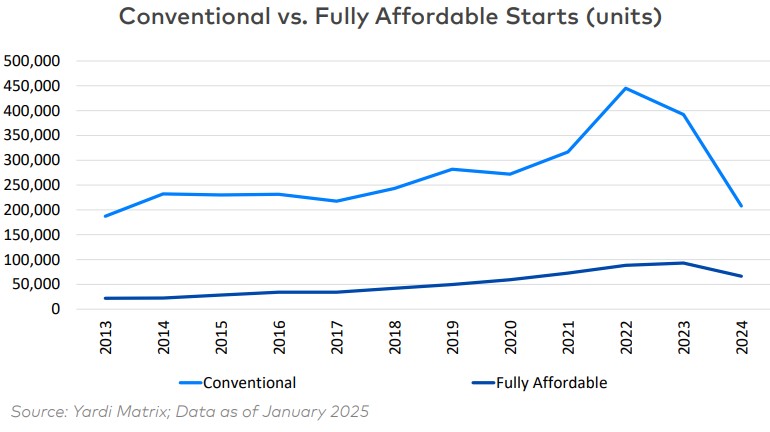

Despite Need, Affordable Multifamily Construction Slowing

Via Yardi Matrix: “What is certain is that the need for affordable housing has accelerated in recent years, and that is not likely to change as interest rates remain high and construction of for-sale housing lags historical levels.”

- Homeownership Rate for Younger Households Declines (NAHB)

- Top 5 States with the Most Expensive Property Taxes (Realtor.com)

- Home Price Growth Forecast 4.1% (CoreLogic)

Multifamily Markets and Reports

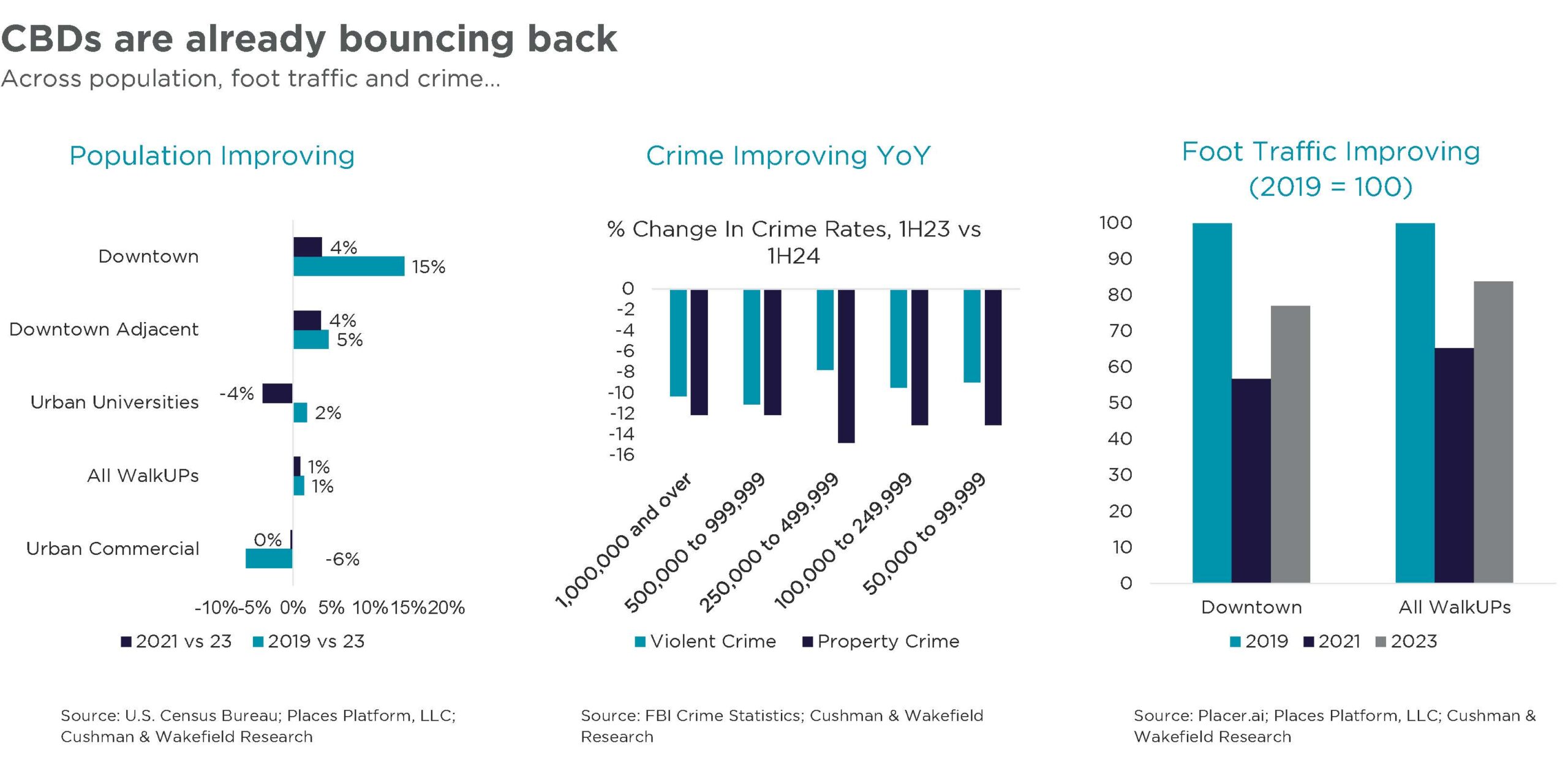

Exploring the Post-Pandemic Resurgence of Downtown Multifamily Living

Via Cushman & Wakefield: “With improving fundamentals and many of these CBD apartments priced at relatively low levels—often below replacement costs—now appears to be an opportune time to invest in urban cores.”

- High Rates, High Vacancies: Why Freddie Mac Still Projects Multifamily Loan Origination Growth (Trepp)

- Record-Breaking 71K Apartments Set to Emerge From Office Conversions (RentCafe)

- The (Student) Housing Crisis (Moody’s Analytics)

Commercial Real Estate and the Macro Economy

Will CRE Investors Adapt to Higher Rates?

Via Marcus & Millichap: “While investors probably won’t benefit from ultra-low interest rates in 2025, it appears they plan to capitalize on other opportunities.”

- Self Storage to Balance Optimism, Caution in 2025 (Yardi Matrix)

- Life Sciences Funding in View (Cushman & Wakefield)

- What Healthcare Tenants Want From Their Retail Landlords (GlobeSt)

Other Real Estate News and Reports

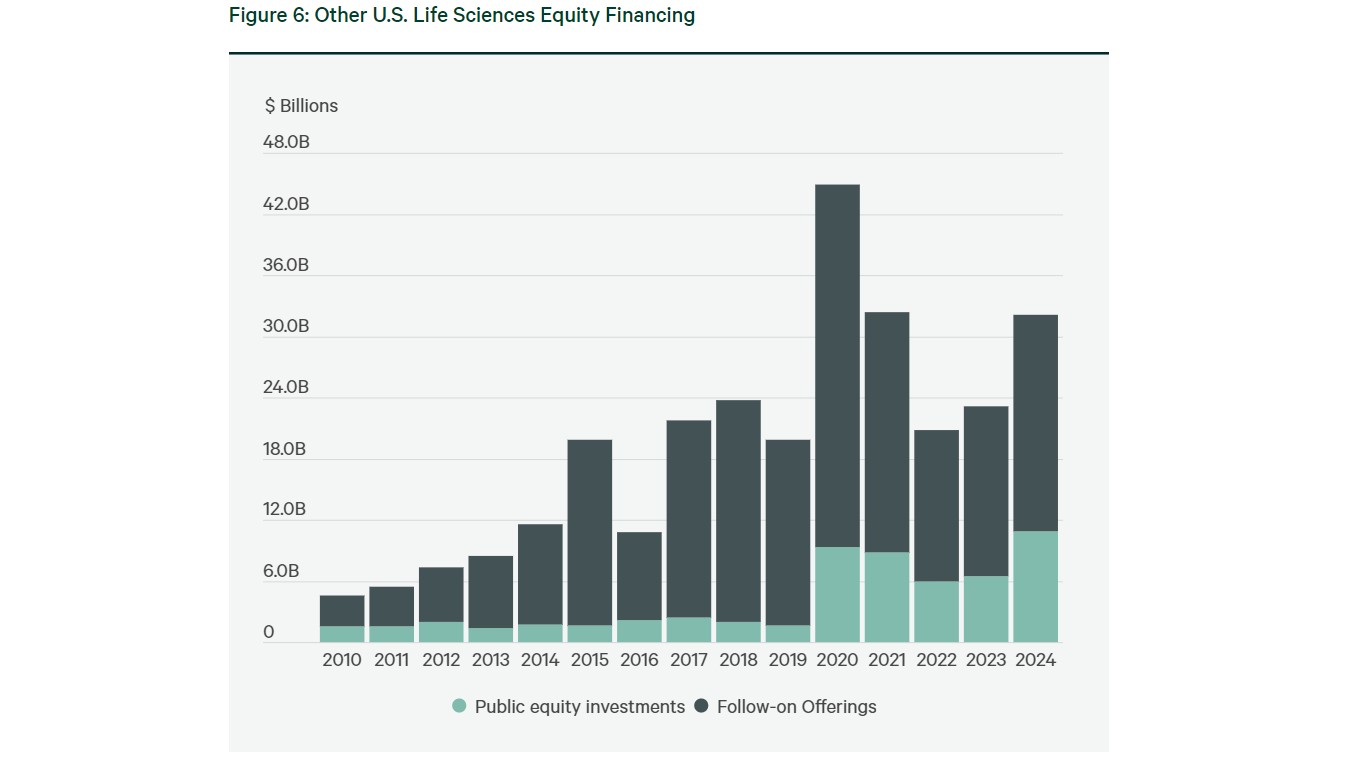

Five Positive Forces Unfolding in Life Sciences

Via CBRE: “Continued resilience of the U.S. economy this year will help drive life sciences revenues that support demand for lab/R&D space. This economic resilience is underpinned by strong consumer spending despite relatively high inflation and interest rates. Part of this has been driven by record household wealth over the past two years due to surging equity markets and home values.”

- The Future of the Office (McKinsey)

- Affordability-challenged buyers turn to easier financing options (John Burns Research and Consulting)

- Office Attendance Hits Postpandemic High (Bisnow)