The Multifamily Market Is Bigger Than REITS

Investor capital flowing out of major real estate investment trusts like Blackstone’s BREIT and Starwood’s SREIT may cause some anxiety about the state of the multifamily market, but there is very little indication that these issues in the REIT space will have a meaningful impact on apartment asset prices. The issues affecting these REITs are the same ones driving the commercial real estate market as a whole: Interest rates have dampened investor demand and caused property values to moderate. Looking forward to 2023, multifamily fundamentals remain strong and Midwestern markets continue to attract positive attention from investors looking for stable, strong performance in the coming year.

The Wall Street Journal: “Investors Yank Money From Commercial-Property Funds, Pressuring Real-Estate Values”

Financial Times: “How the gates closed on Blackstone’s runaway real estate vehicle”

Blackstone’s BREIT, “their flagship real-estate fund,” is facing a problem of investors pulling too much money out of the fund: “Blackstone’s $69 billion fund, known as the Blackstone Real Estate Income Trust Inc., or BREIT, has a quarterly redemption limit of 5% of the fund’s net assets. Last week, Blackstone said redemption requests exceeded the cap, meaning some investors won’t be allowed to cash out before next year.”

As a Financial Times article explains, Blackstone’s BREIT is structured in a more open-ended way than some other funds,

“Unlike its traditional funds designed for institutional investors like pensions, that came with 10-year lives, BREIT was designed as a ‘perpetual’ fund with no expiration. Interested investors could buy in at the fund’s net asset value and Blackstone would charge a 1.25 per cent annual management fee and a 12.5 per cent performance fee on its annual profits above a 5 per cent hurdle.”

“It pitched BREIT as offering wealthy individuals the same ability as large institutions to diversify away from public markets and receive healthy dividends. However, to do so, they would have to accept giving up some liquidity rights. The fund allows for 2 per cent of total assets to be redeemed by clients each month, with a maximum of 5 per cent allowed in a calendar quarter.”

Financial Times also notes that the majority BREIT’s money was invested “in logistics and multifamily US real estate,” and the total value of the portfolio, including leverage, “stands at $125bn in gross assets.”

There’s a lot of aspects about this situation that get a little complicated, but this is not exactly a “bank run” moment for REITs like Blackstone’s BREIT and Starwood’s SREIT, another large REIT in a similar situation.

“Still, if the number of investors asking for their money back keeps growing, it would likely become a problem for the real-estate market. That is because funds that need to raise cash to pay back their investors often have no other choice but to sell buildings.”

A patient investor looking for an opportunity in this environment could see this as a buying opportunity. A lot of properties that are on the market now or are going to be on the market are already having to face the reality that current interest rates mean that prices might need to come down in order to find a buyer. I wonder how much Blackstone and Starwood will be willing to come down if they have a pressing need to sell.

Yardi Matrix: “Year to End Strong for Multifamily” – https://www.yardimatrix.com/publications/download/file/3084-MatrixBulletin-MultifamilyForecast-November2022

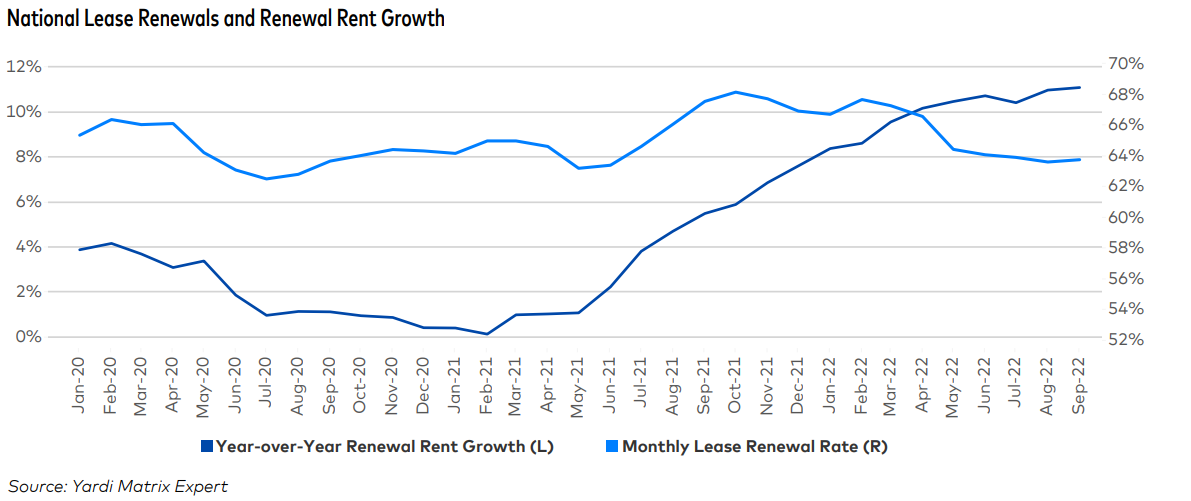

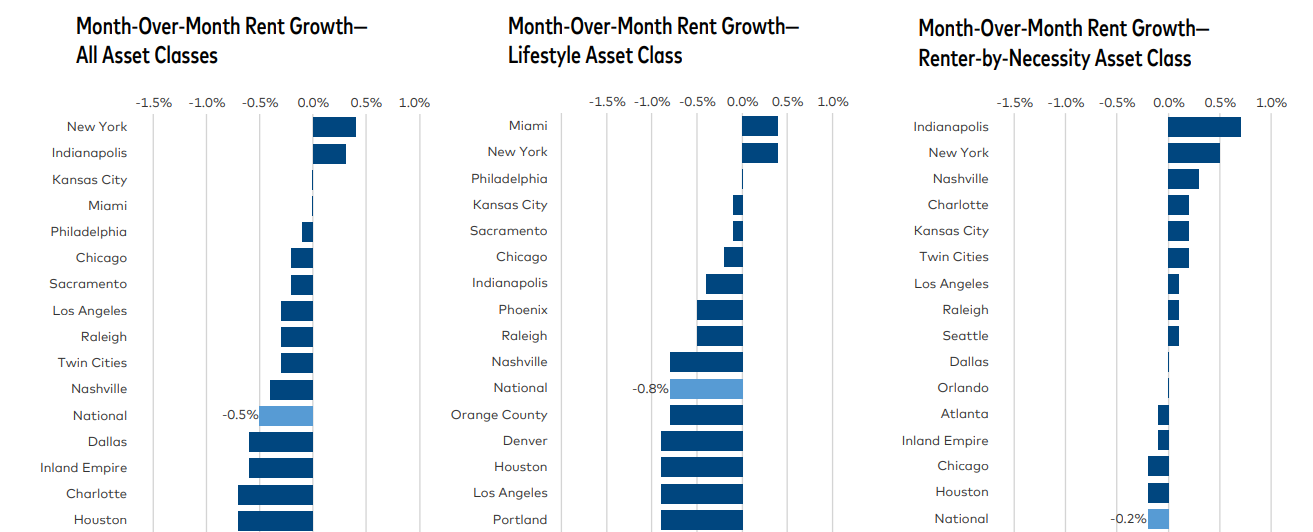

This article is an important reminder that the fundamentals of multifamily are not in a dire situation and are in fact quite strong. Rent growth for 2022 will end up very elevated, especially in Midwestern markets like Indianapolis. The near-term growth looks dicey, but we’ve had an incredibly strong year in the multifamily market in 2022.

The BREIT situation is fundamentally different from the state of the multifamily market, both on the investment side and the housing demand side.

Yes, we are seeing reduced investor demand and expanding cap rates due to interest rate pressures, but in the non-REIT space, this is a solvable problem and not a harbinger of an imploding market.

One of the drawbacks to a REIT is that it is more subject to the whims and volatility of something like a stock market due to the ease with which investments in these vehicles can be bought and sold.

That, to me, is the key trouble: If these funds were more restrictive, they might be able to weather a temporary increase in interest rates, but now, these REITs are having to deal with a kind of bank-run psychology as more investors look to get their money out.

Now, one question is, will a troubled group of REITs, like Blackstone’s BREIT or Starwood’s SREIT, be forced to sell off enough of their assets that it meaningfully impacts multifamily property values and causes prices to drop.

If BREIT has $169bn in gross assets, and according to a recent Colliers report, multifamily sales volume was around 74.1 billion last quarter, I mean, it could? This is really wading into enough potential domino effects that the future is muddy, but I doubt that the Blackstone and Starwood and any of these other REITs will be forced to sell enough property that it will start a feedback loop of crashing prices. It could have an effect though!

Another very important aspect to consider, and it’s something that we’ve mentioned in our discussions about lower rent growth nationally, is that different regions are performing very differently. Yardi Matrix notes this specifically, explaining that the Midwest and Southeast are overperforming in the current market and helping to balance out some of the more severe rent cuts in other areas.

For investors who have the right time horizon and the right market in mind, there may not be a huge threat associated with recent developments. And for those currently invested in apartment assets that are stable, strong performers, there might even be a buying opportunity and less of a forced sell-off.