(Midwest) Multifamily Stability Increasingly Attractive

The dramatic swings of the stock market have subsided, but in this still-volatile environment, the stability and positive momentum in the multifamily market stands out. As the historic wave of new apartment supply slowly subsides, midwestern markets with steady, growing economies have emerged as rent growth leaders, and this strong performance is likely to continue given current apartment supply trends. A broader economic downturn may not spare the multifamily market, but apartment assets in stable markets will be well-positioned to weather the storm.

Multifamily, the Nation, and the Economy

- Renters Account for Majority of Household Growth

- Arbor Realty Trust: “Rental households grew 1.9% in 2024, more than double the rate found in owner-occupied homes. It was the fastest pace of rental household growth since 2015, excluding the pandemic-era bounce back in 2021.”

- Pre-tariffs buying fuels US retail sales, weakness lies ahead (Yahoo Finance)

- Most Apartment Markets Still Below Pre-Pandemic Occupancy (RealPage)

- New Tariffs Highlight Commercial Real Estate’s Stability (Marcus & Millichap)

Multifamily and the Housing Market

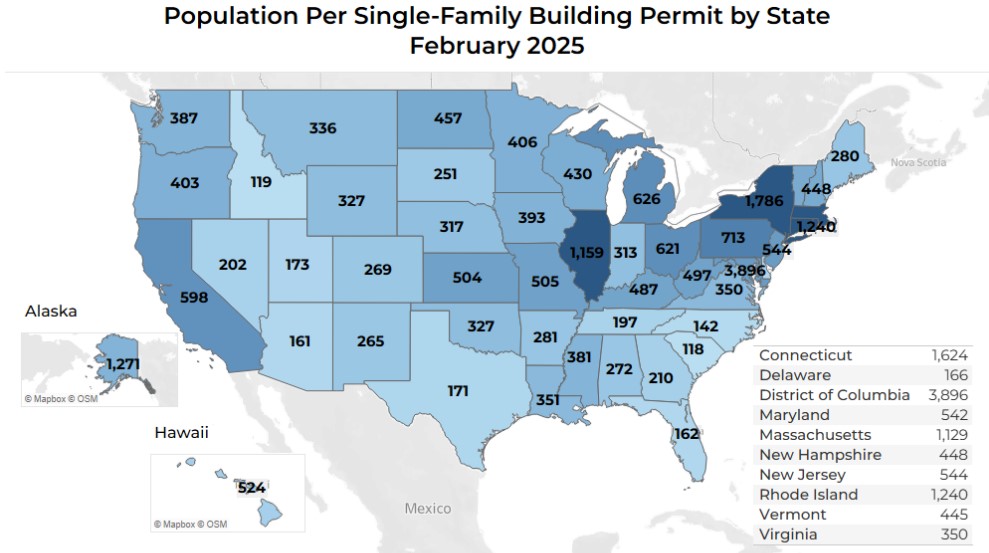

The Housing Market in February 2025

NAR: “Existing-home sales increased partly due to larger inventory, while pending home sales also saw a modest uptick. Mortgage rates have decreased for six consecutive weeks, reaching the lowest level in two months.”

- Expert Panel Expects Home Price Growth to Moderate (Fannie Mae)

- Marijuana and the Housing Market: A Budding Issue (NAR)

- April 2025 Home Price Insights: Homebuying demand remains weak (Cotality)

Multifamily Markets and Reports

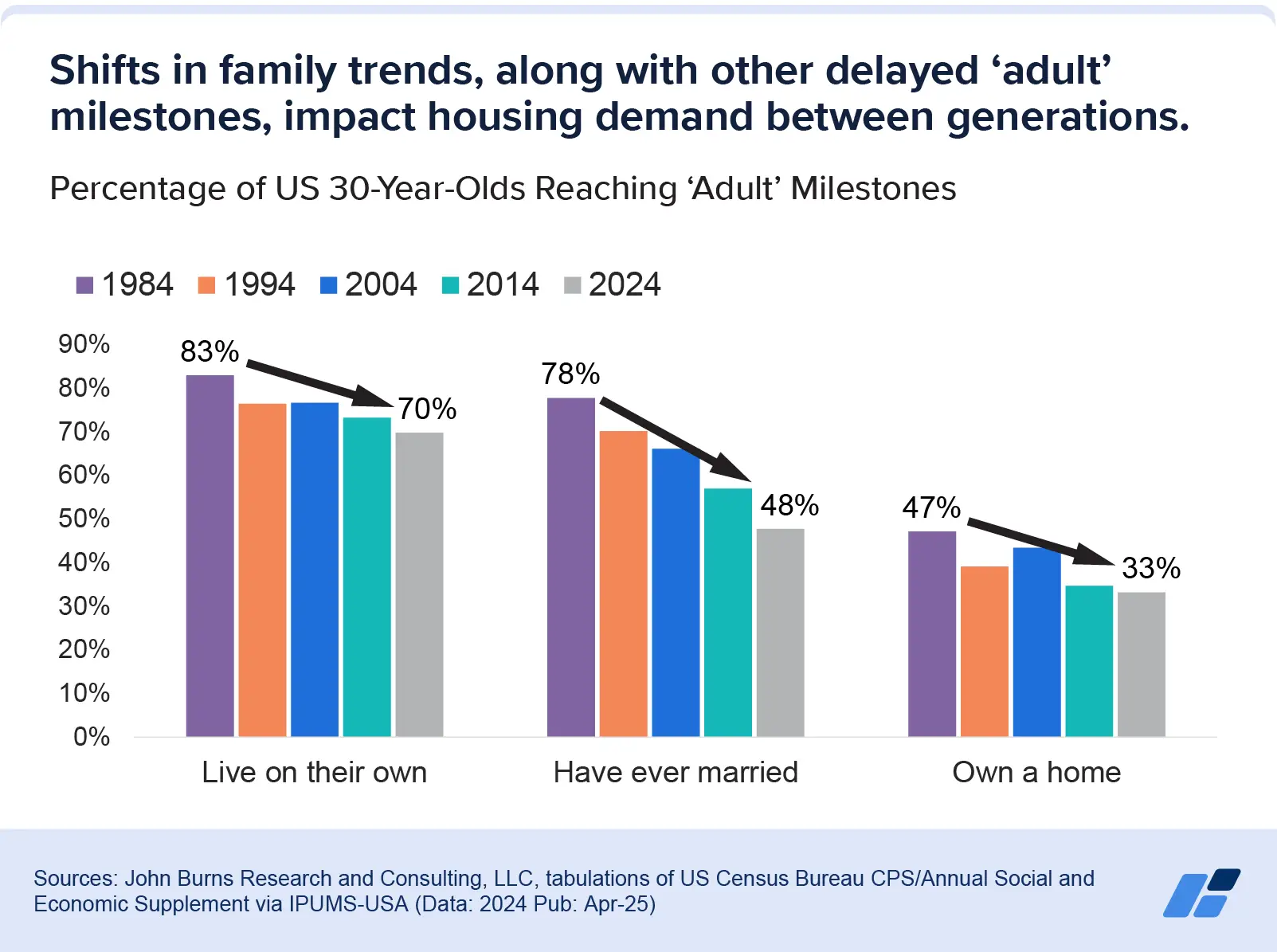

Later life milestones reshaping homeownership in the US

John Burns Research and Consulting: “Americans are waiting significantly longer to purchase homes. The typical first-time homebuyer is now 38 years old, compared to 33 in 2020 and an average of 31 between 1993 and 2018. This delayed homeownership creates increased rental demand, with 72% of US renters now age 30 or older—an all-time high.”

- Builder Confidence Levels Indicate Slow Start for Spring Housing Season (NAHB)

- Renters Disproportionately Seek Disaster Assistance for Uninsured Vehicle Damages (Harvard Joint Center for Housing Studies)

- Big banks push for simpler mortgage rules as housing market slows (Yahoo Finance)

Commercial Real Estate and the Macro Economy

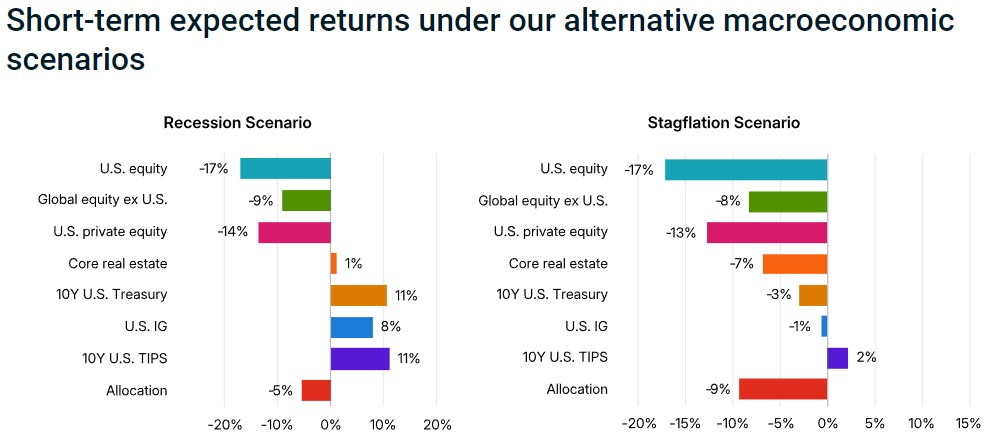

Managing Long-Term Portfolios Through Short-Term Volatility

Via MSCI: “In the stagflation scenario, inflation-linked bonds offer the most attractive return, while equity and real-estate assets sell off most sharply. U.S. equities — with stretched valuations — decline more than global-ex-U.S. equities.”

- Low-Correlation Markets Can Help Optimize Portfolio Returns (CBRE)

- Financial Market Whiplash vs CRE Investment Durability (Marcus & Millichap)

- The U.S. dollar’s role as the de facto global reserve currency is looking increasingly uncertain (MarketWatch)

Other Real Estate News and Reports

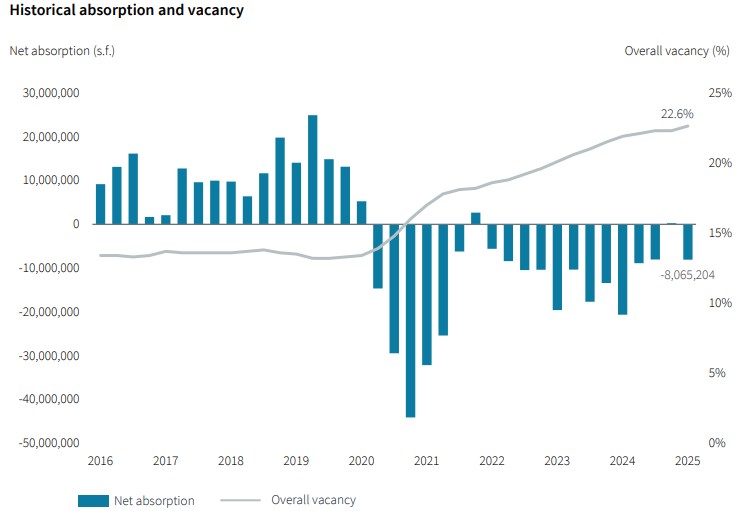

U.S. Office Market Dynamics, Q1 2025

Via JLL: “Occupancy losses were elevated in Q1 by federal lease terminations, federal contractor sublease additions, and buildings removed for conversion which had space leased prior to removal.”

- Bank Branches Are Disappearing. Many Landlords Are Happy To See Them Go (Bisnow)

- ‘From Anxious to Petrified’: Consumer Sentiment Plunges Further (The Wall Street Journal)

- Office real estate market faces tariff-related uncertainty (Marketplace)