Lower Interest Rates “Paving Way for Invigorated CRE Investment”

Institutional Property Advisors: “Interest Rates Trend Lower, Paving Way for Invigorated Commercial Property Investment”

This research brief roughly summarizes a lot of what’s being expected and projected in the CRE market: Expecting: A rate cut. Projecting: Lower borrowing costs. Etc. Could it be a 25 basis point or 50 basis point rate cut? Will Ten-Year Treasury yields stay under 4%?

To repeat the subtitle, lower rates will bring “Invigorated Commercial Property Investment,” a hopeful statement that also acknowledges how much the commercial real estate investment market has been in need of life and activity and how little buying and selling has been going on.

But this short brief contributes more than a rehash of typical conversations about what might happen with the Federal Reserve and the Federal Funds rate.

“Since early May, commercial mortgage rates have fallen approximately 50 basis points to the 6.25 percent-to-6.75 percent range. Multifamily rates have declined to the 5.25 percent-to-5.75 percent band, down approximately 95 basis points in that span for conventional agency financing. For comparison, the average cap rate across all commercial properties traded over the 12-month period ended in June was 6.7 percent. For multifamily properties, the measure was lower, at 5.8 percent. As lenders’ spreads move closer in line with cap rates, investment sales activity is likely to heat up.”

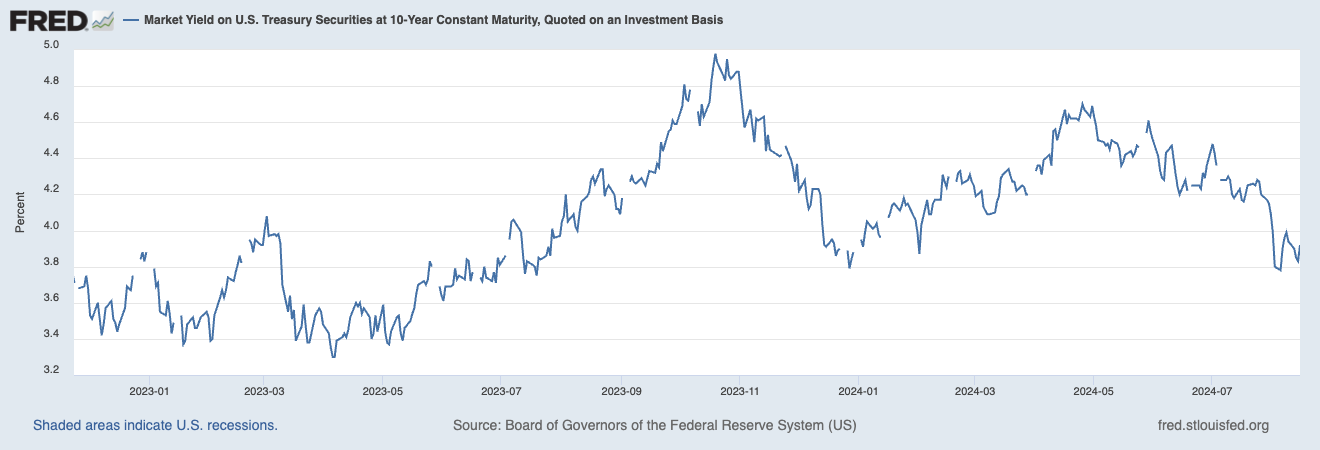

This is tracking a longer-term movement in rates than the shake-up we’ve seen in the past couple of weeks, a downward trend of steadily lower rates that roughly tracks the ten-year treasury. Which is to say that, on some level, markets have seen this rate cut coming since May. Or, alternatively, people have been more interested in buying Ten Year T-notes since May, which has driven down the yield from 4.6 to 3.8%.

So, yes, the rapid August drop in the TYT has been dramatic, going from 4.2 to 3.8% in the steepest drop, but the longer-term trend between May through the end of July, 4.7 to 4.2%, has been of greater magnitude.

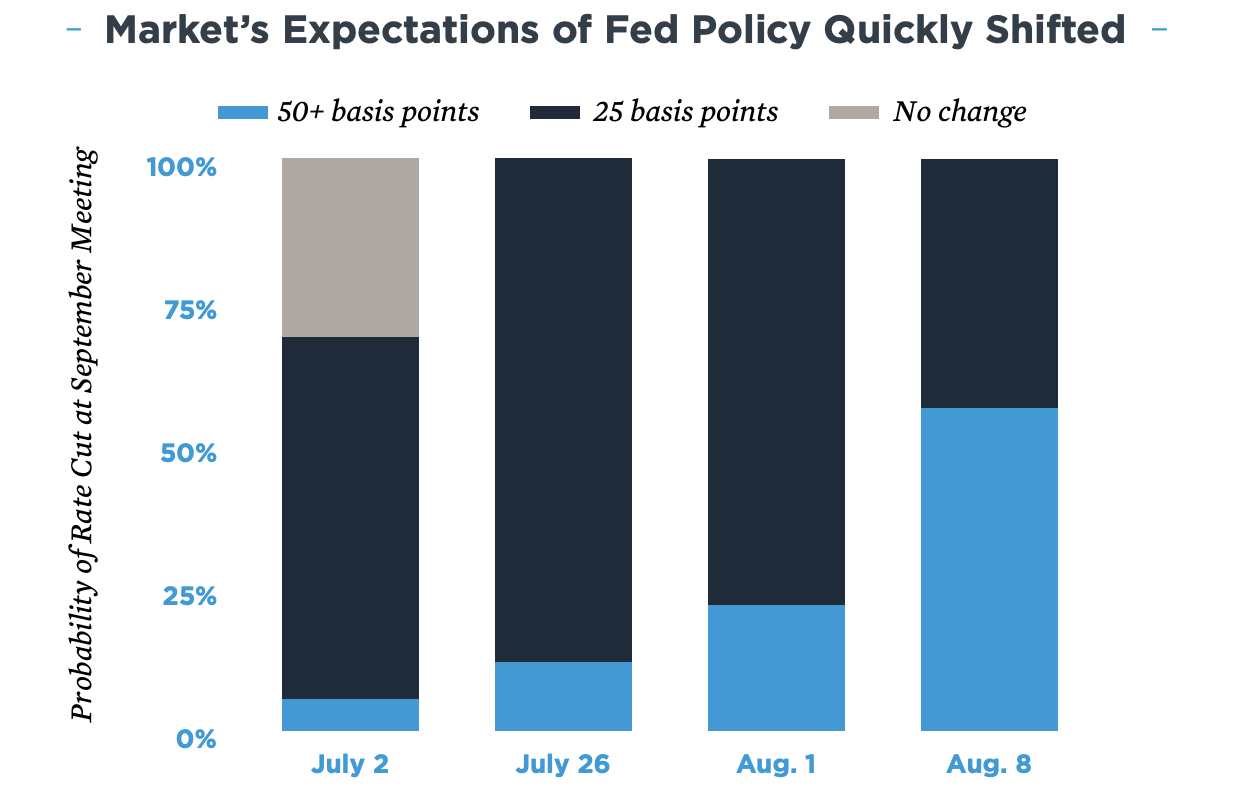

Interestingly, recent interest rate expectations have gone under a major shift, which began before whatever jobs-report-japan-carry-trade-volatility emerged in August. According to FedWatch numbers, which tracks “the likelihood that the Fed will change the Federal target rate at upcoming FOMC meetings,” in early July, those expecting no rate cuts in 2024 were at 30%, but that 30% vanished by July 26. By Aug 8, the dominant expectation was for a 50 BPS rate cut, but in early July, only 5% were expecting a 50 BPS cut.

What this means, in my imperfect view, is that by and large, market watchers responded to low inflation numbers. Luckily we have fluff news stories about cheap McDonalds combo meals to really get the public on board, but we also have a sophisticated data-gathering apparatus that has been telling us specifically how much inflation has gone down. Granted, recession expectations were also a factor influencing people’s higher expectation for a rate cut, but that didn’t seem to kick off in earnest until the recent stock market correction a couple weeks ago. My point is that there is more than fear that can motivate these interest rate expectations, but in my heart of hearts, I don’t think the Federal Reserve would cut rates without tasting a little bit of the fear in the air. (Like how a snake tastes the air with its tongue!)

But then, what does this mean for the commercial real estate market (and the apartment market as well)? It sounds a little redundant to say, but I do think the upshot is a reinvigorated commercial real estate market. Higher sales volumes, more investment, and, maybe, just maybe higher valuations for commercial properties that would accompany this higher activity.

I gathered up a tidy list of items to cover this week, but a late find, a working paper from the National Bureau of Economic Research, has an idea that has been stuck in my head more than the others:

It’s a little heady, but basically, the authors look to quantify the cost of higher mortgage rates for homeowners, not as much in terms of the higher interest payments compared to when rates are low, (which, they did calculate as a total of $215 billion in the year between q3 2022 and q3 2023) but more in the more difficult terms of missed opportunities and lost mobility that happened when, instead of buying and selling homes, people decided to stay in their houses because they locked in great interest rates:

“Rate lock also has economic costs in the form of the deadweight loss caused by forgone moves, relative to a counterfactual where mortgages are assumable. We can value these costs by considering the demand for moving as a function of the present value of mortgage payments. These costs amount to $20bn in the last year, an average of $296 per household with a mortgage.”

$20 billion is a little shy of 10% of the actual extra money that homebuyers did spend on higher interest rates, but this “deadweight loss” is a little more insidious. $215 billion in extra interest payments is at least real and gets to circulate in the economy. That $20 billion is money that could have been and value that could have been created, but never got to be.

How does this concept would transfer into the world of commercial real estate? The working paper emphasizes mobility and moving houses, which is not quite so relevant when it comes to investment properties, but there is definitely a kind of deadweight loss in the CRE market, billions of dollars of value that never came to be but would have been.

The question is, how much of this deadweight loss would contribute to pent up demand? The loss of opportunity associated with high interest rates does not 100% turn into pent up demand, but a lot of it does. We’re at the edge of a turning point in the CRE market, and ignoring the sales and the deals that would have been means ignoring billions of dollars that would have been. What’s going to happen when all of those people who wanted to buy and sell suddenly can? When there’s more sales activity, do prices usually go up or down?