Is Multifamily Tariff-ied?

Given the consistently strong demand numbers, the multifamily market looks forward to strengthening fundamentals in 2025, as the apartment supply wave recedes and the market comes into greater balance. Recent tariffs have done little to change these dynamics, and their negative impact on construction costs could over-accelerate the balancing of the market into a supply shortage that leads to higher rents in the years to come.

Multifamily, the Nation, and the Economy

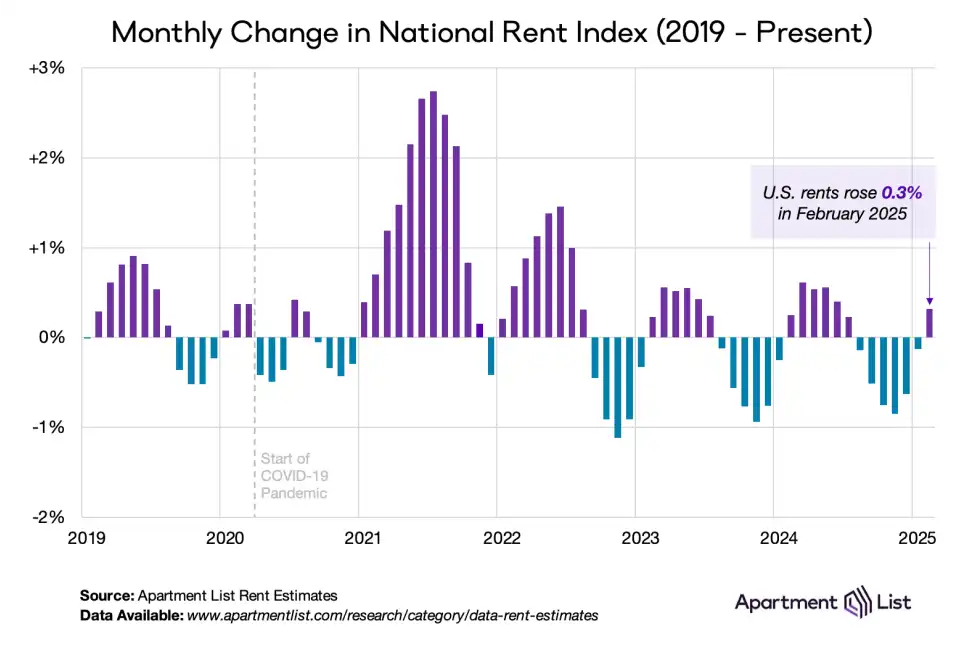

Feb. 2025 Rent Report: Gradual Progress on Rent Growth

Via Apartment List: “Our national rent index flipped back to positive month-over-month rent growth, increasing by 0.3 percent in February following six straight monthly declines. Year-over-year growth also remains negative at -0.4 percent, but is slowly inching back toward positive territory.”

- U.S. Lumber Costs Rise Sharply Amid Investigation, New Tariffs (Bisnow)

- Trump grants automakers one-month exemption from tariffs (CNBC)

- Exclusive: Honda to produce next Civic in Indiana, not Mexico, due to US tariffs, sources say (Reuters)

- Economic Worries, or Maybe Those Negative Economic Indicators May Not Be So Alarming? (GlobeSt)

Multifamily and the Housing Market

Home Price Growth Continues in 2025, Northeast, Midwest Markets on Top

CoreLogic: “Home price growth remains largely flat in the U.S. as we come out of winter. Although prices are expected to eek out gains in the coming year, there are stark differences between regions. The Northeast continues to buck overall national trends, remaining unbothered by slower job growth, elevated interest rates, and ongoing affordability concerns.”

- House Price Appreciation by State and Metro Area: Fourth Quarter 2024 (NAHB)

- Austin Knocks Nashville Off Top Spot for U.S. Remote Workers (Realtor.com)

- Is the Economy Slowing? (Marcus & Millichap)

Multifamily Markets and Reports

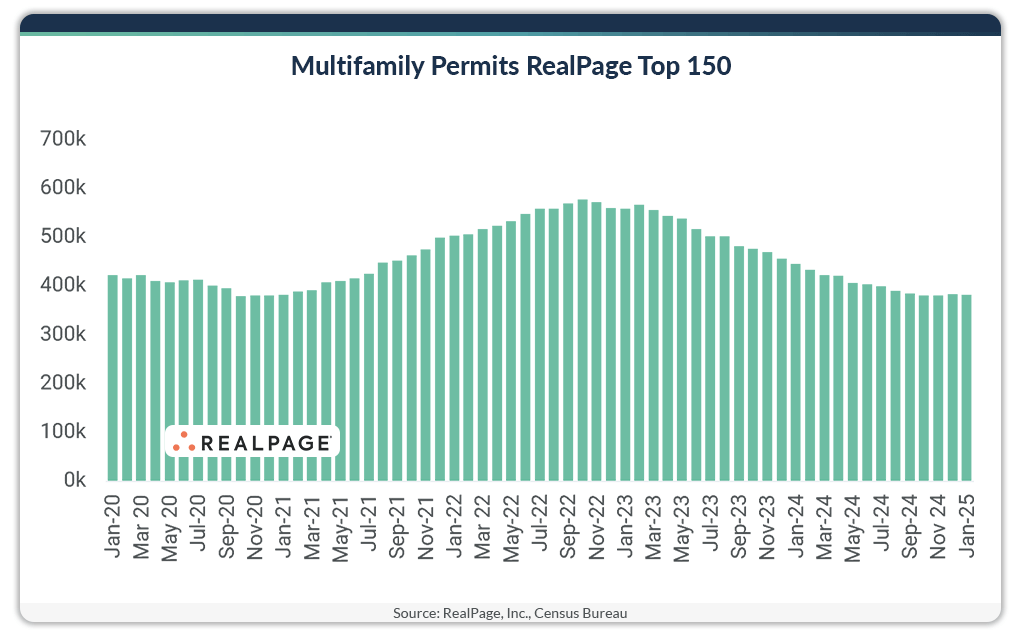

Multifamily Permitting Falling Fast in Top Markets

RealPage: “The number of multifamily units permitted for construction in RealPage’s top 150 markets continues to shrink and has been below 400,000 units for the past six months, after peaking at more than 577,000 units in late-2022.”

- NMHC and NAA Letter to President Trump on Regulatory Reform (NMHC)

- Multifamily REIT Veris plans to sell up to $500M in assets (Multifamily Dive)

- Rental Activity Report: Washington, D.C. Tops List Again as Southern Cities Attract More Interest (RentCafe)

Commercial Real Estate and the Macro Economy

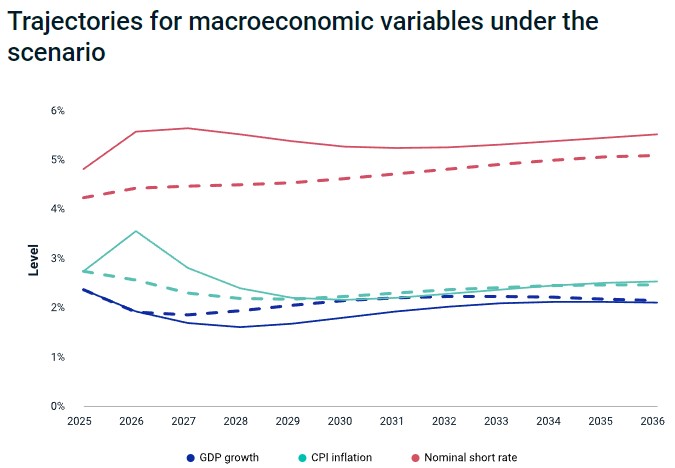

Scenario Analysis: Tariffs and a Strong US dollar

Via MSCI: “In our scenario, we assume tariffs and retaliatory measures lead to a short-term inflation spike of about 1 percentage point above the baseline, but that this shock dissipates relatively quickly. In contrast, economic growth faces a more persistent slowdown, with long-term growth settling around 20 basis points below the baseline.”

- Colliers Supply Chain Solutions | State of the Industry Report March 2025 (Colliers)

- 2025 U.S. Office Investment Forecast (Institutional Property Advisors)

- Treasury Suspends Rule Requiring Disclosure Of LLCs’ True Owners (Bisnow)

Other Real Estate News and Reports

Q4 2024 Office Investment & Leasing: Glimmer of Recovery?

Via Colliers: “After facing one of the harshest volume declines, the asset class is now a leader in year-over-year sales gains. Distress is working its way through the system, bringing properties to market, at times, at substantial discounts to previous sales prices. Distress will remain at a steady pace for some time to come.”

- Can We Bridge the Widening Property Insurance Gap? (CoreLogic)

- Here’s how tariffs will hit the U.S. housing market (CNBC)

- Report: Suppliers Stock Up Inventory Ahead of Tariffs (FAU)