Is a Wave of Distress Building?

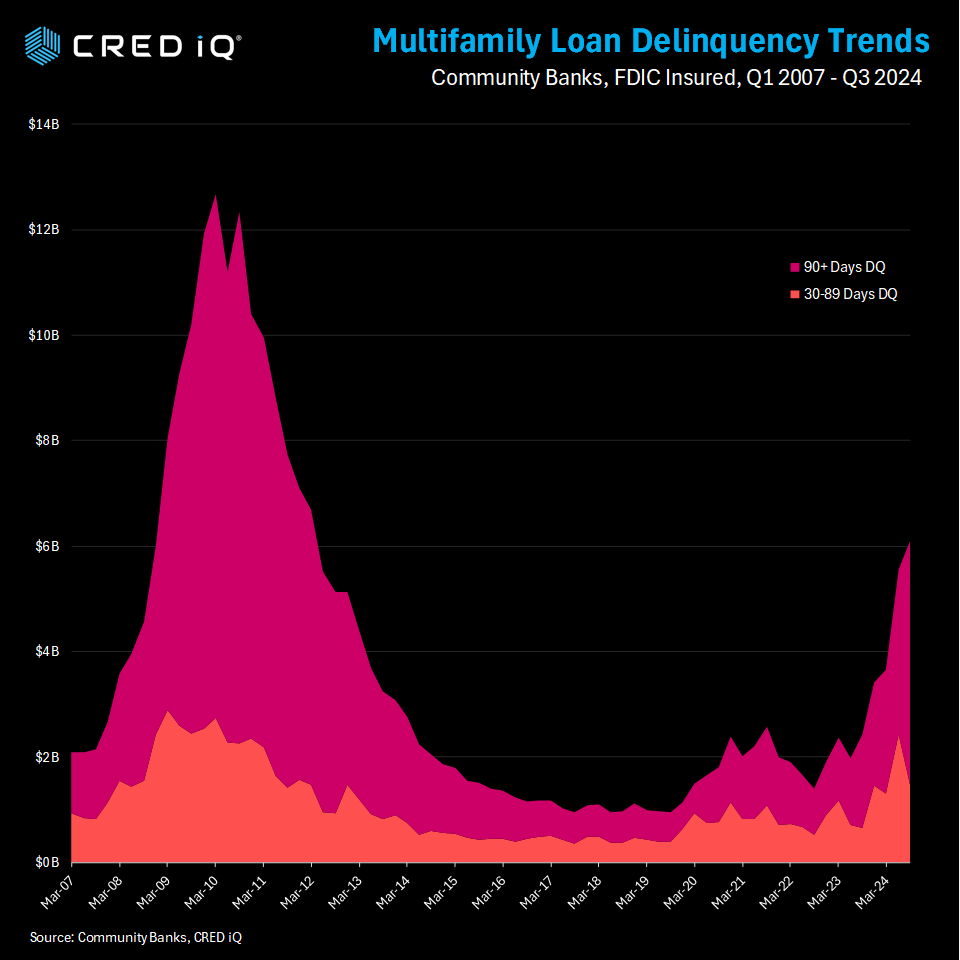

Data on multifamily loan delinquencies and special servicing shows a slow buildup throughout 2024 that could lead to greater distress in 2025, which is particularly relevant given the challenges expected for multifamily operations with apartment supply still elevated and economic uncertainty putting downward pressure on rent growth. better prospects moving forward which could create investment opportunities as the year progresses.

Multifamily, the Nation, and the Economy

- Multifamily Distress Volumes Hit 12-Year High

- Via CRED iQ: “CRED iQ’s data suggests 2025 could be a bumpy ride. With $500 billion in CRE loans maturing this year (a stat echoed across industry reports), multifamily faces a refinancing cliff. If rates ease—say, a 25-basis-point cut by mid-2025—some pressure might lift. But oversupply won’t vanish quickly.”

- FHFA Director Bill Pulte Reverses Biden Administration’s Renters Bill of Rights (Bisnow)

- Tariffs’ Impact on Commercial Real Estate (Colliers)

- Practical CRE: Adapting to the Maturity Wave (Moody’s Analytics)

Multifamily and the Housing Market

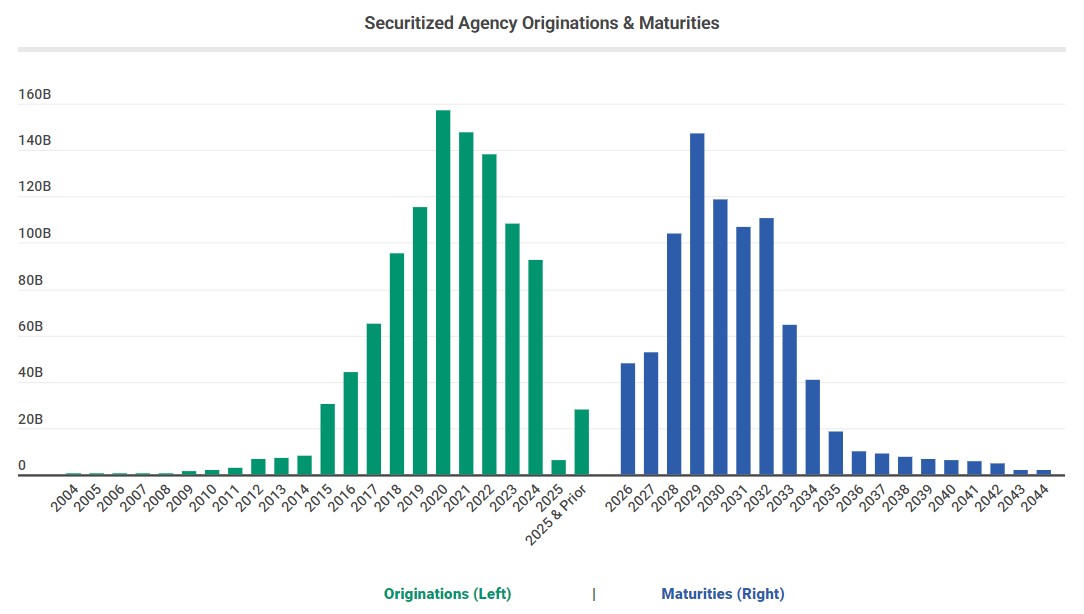

Will Fannie Mae and Freddie Mac Exit Conservatorship This Year?

Trepp: “Given this large volume of recent originations, large waves of maturities over the next several years will sustain the market for refinancing activity. Consequently, the important role the GSEs play in CRE financing markets is expected to expand further, serving as both a borrower option and a key source of commercial paper.”

- New Plan Emerges for Privatizing Fannie and Freddie (GlobeSt)

- Machine learning algorithm that predicts properties’ values benefits housing market, says study (Phys.org)

- Overview: The Housing Market in February 2025 (NAR)

Multifamily Markets and Reports

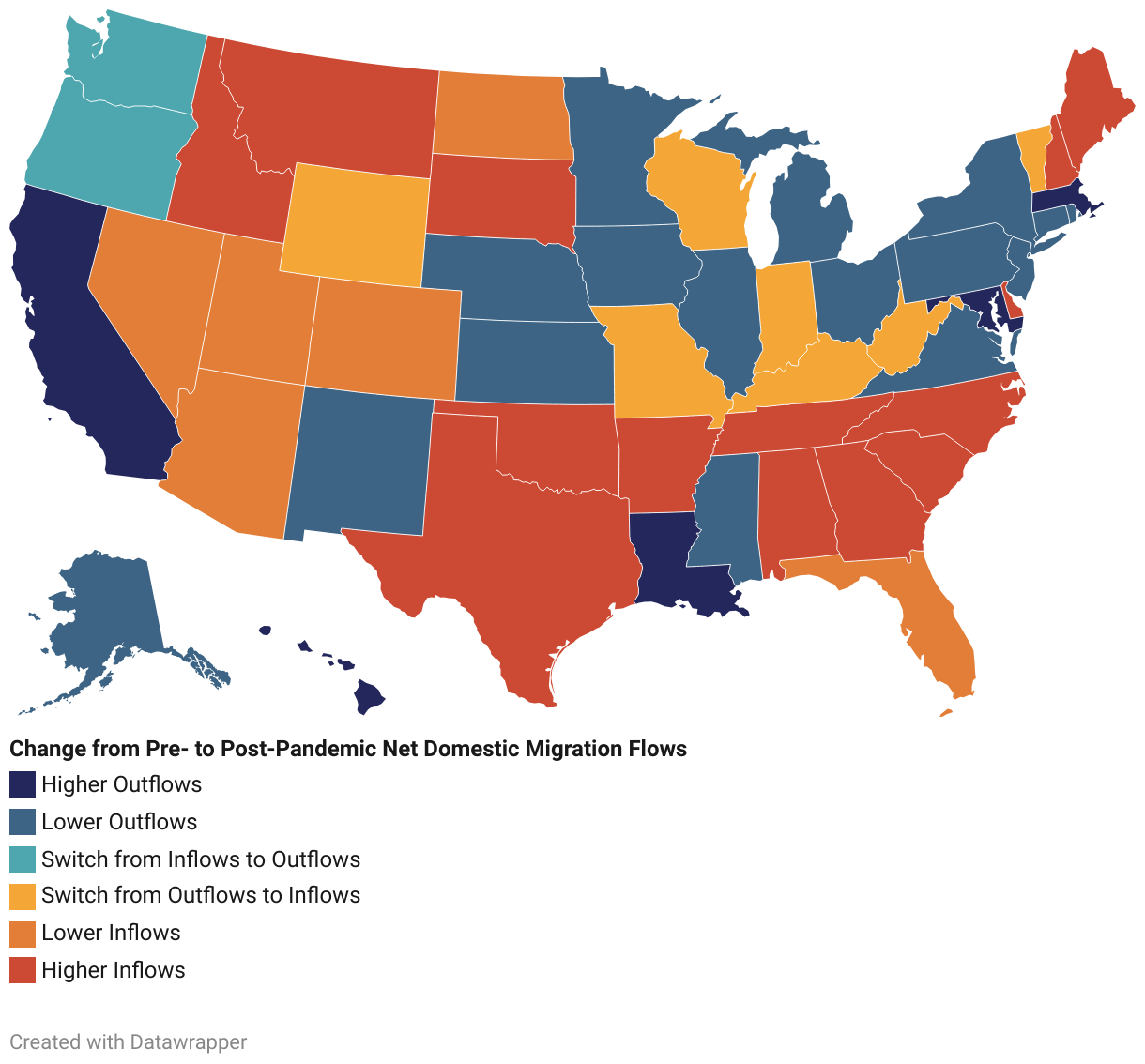

Five Ways Residential Mobility Has Changed in the Pandemic Era

Harvard Joint Center for Housing Studies: “[N]otable [migration] shifts took place in many states in the Midwest and Northeast, where outflows were either lower than they had been before the pandemic, or net outflows had switched to net inflows. This may be evidence of a coming shift in migration towards ‘Snow Belt’ states.”

- Work-from-Anywhere Trend Pushes Rents Ahead of U.S. Norm in Florida Beach Towns (RealPage)

- The Forces Driving Long-Term Rental Housing Demand (Marcus & Millichap)

- Land Banking and the Housing Market (John Burns Research and Consulting)

Commercial Real Estate and the Macro Economy

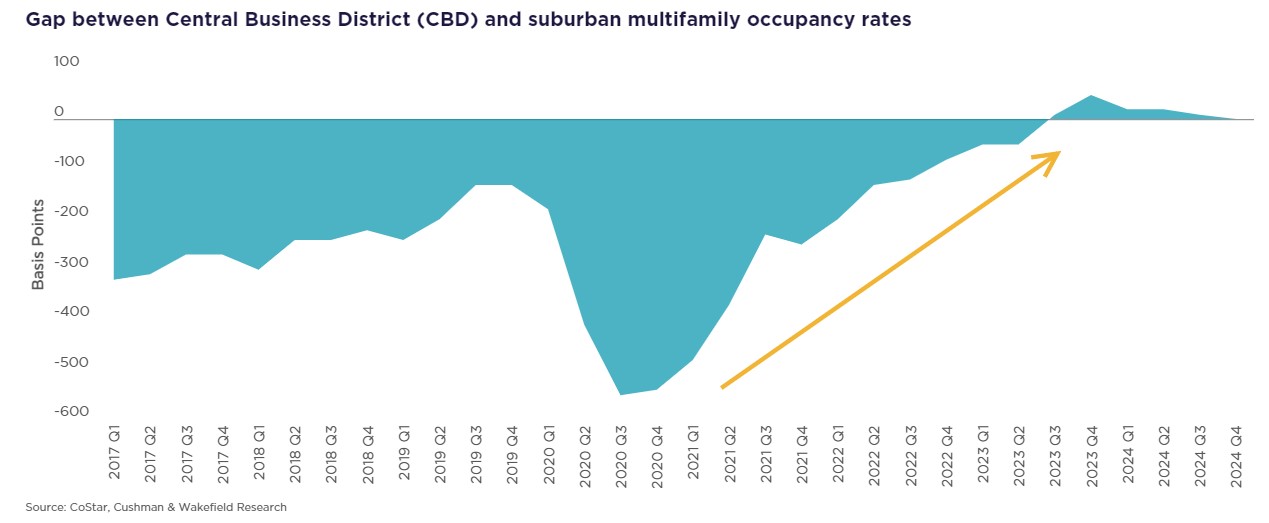

Via Cushman & Wakefield: “In the immediate wake of the pandemic, CBD multifamily occupancy cratered by over 375 basis points (bps). People, especially young renters-by-choice, moved out of cities[, but t]he exodus was temporary. Multifamily occupancy levels returned to and exceeded pre-pandemic norms by the end of 2021.”

- What’s in and what’s out five years after COVID-19 lockdowns began: commercial real estate edition (Moody’s Analytics)

- Capital Watch: Increased Investment Expected Despite Bond Market Volatility (CBRE)

- Volume of Residential Construction Loans Falls in Q4 2024 (NAHB)

Other Real Estate News and Reports

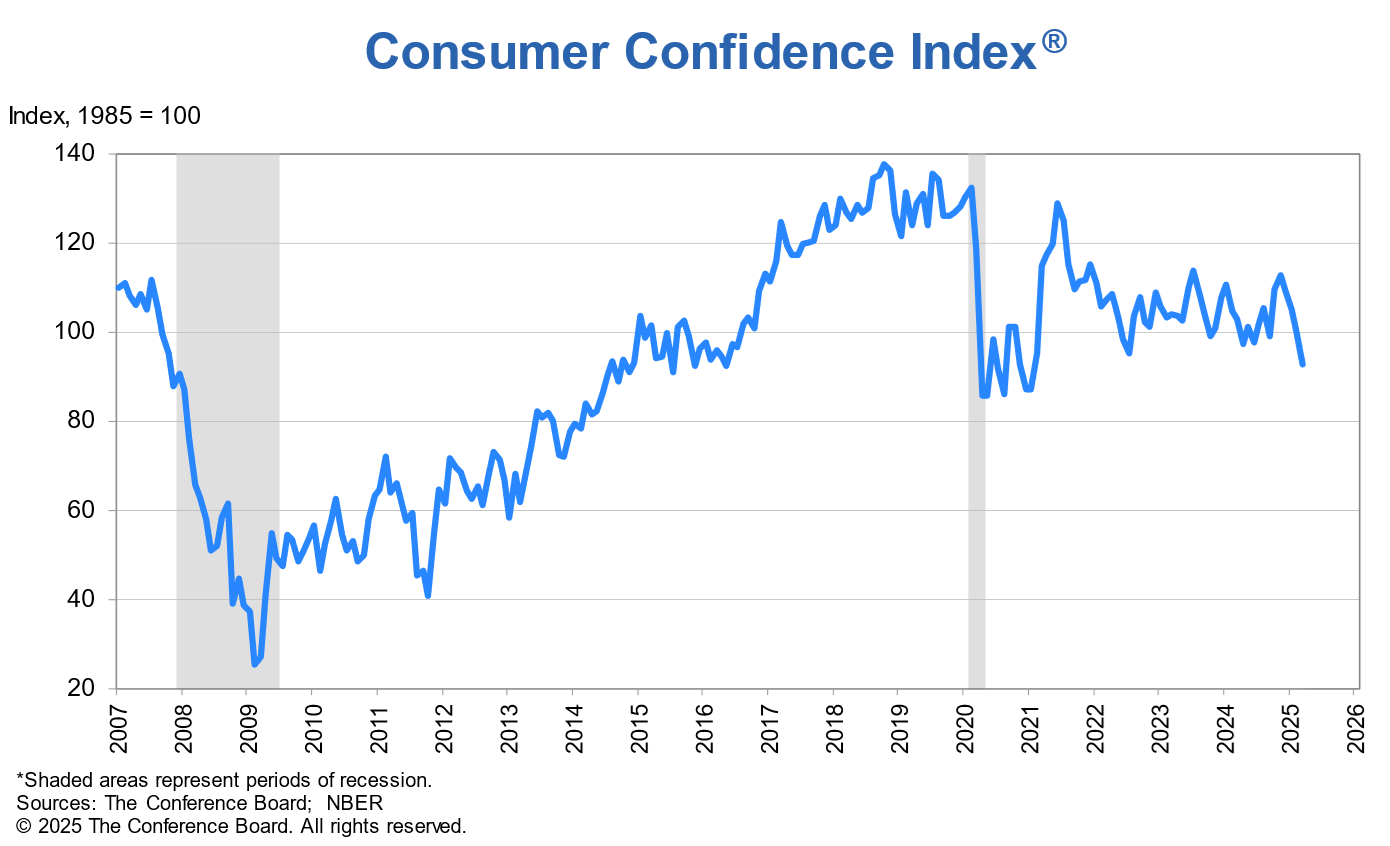

US Consumer Confidence tumbled again in March

Via The Conference Board: “Views of current business conditions weakened to close to neutral. Consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects falling to a 12-year low.”

- Winning Office: Where U.S. Office Space is Thriving and Why (Newmark)

- Trump Administration Slashes Number of Federal Buildings for Sale in New List (The Wall Street Journal)

- Realtors just revised their rules for home listings. You won’t like what they decided. (Business Insider)