Investors Bullish on Multifamily: Will It Last?

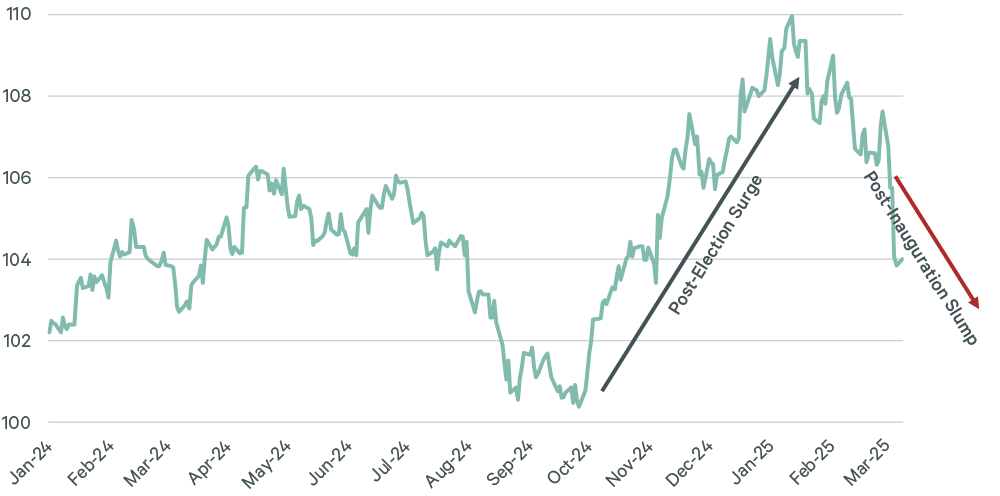

New data on investor sentiment shows optimism in the multifamily market, but given the lag between fast-moving economic developments and the Jan.-Feb. time period when the data was gathered, some of this investor enthusiasm may be blunted in light of the recent volatility. That being said, strong fundamentals and improving long-term rent growth trends have been consistent in the multifamily market, and as short-term revenue difficulties intersect with looming loan maturities, investors will be looking for opportunities to invest in distressed assets as the year progresses.

Multifamily, the Nation, and the Economy

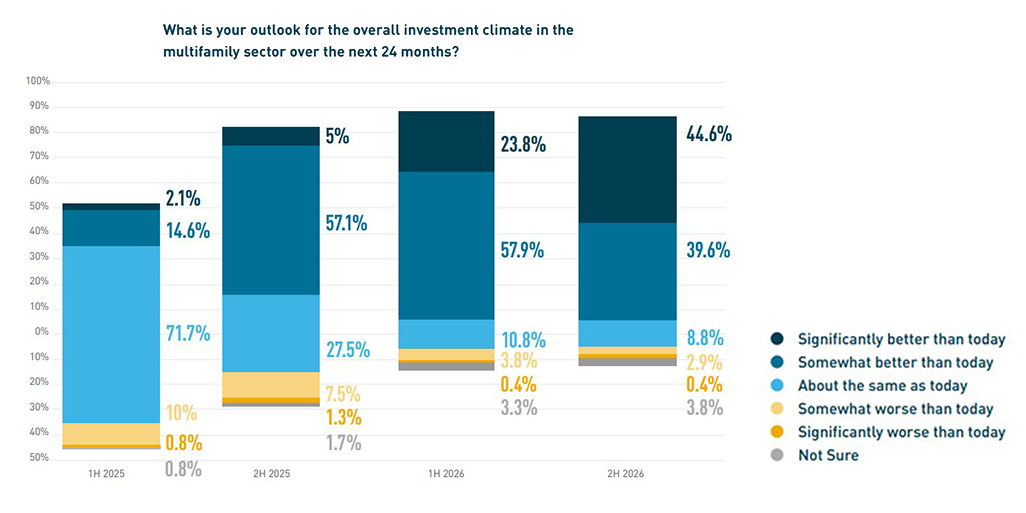

- 2025 Multifamily Investor Sentiment Survey

- Via Berkadia: “Over the next 24 months, the majority of investors expect the multifamily sector to remain as it is today, with others anticipating it’ll get better by 2H 2026.”

- ‘Pure Chaos’: Inside The CRE Fallout From DOGE’s Slash-And-Burn Campaign (Bisnow)

- Arbor Realty Closes $1.15B Repo Line with JPMorgan (connectmoney)

- Jilted CrowdStreet investors file $1B class-action suit over unregistered broker-dealer claims (TheRealDeal)

Multifamily and the Housing Market

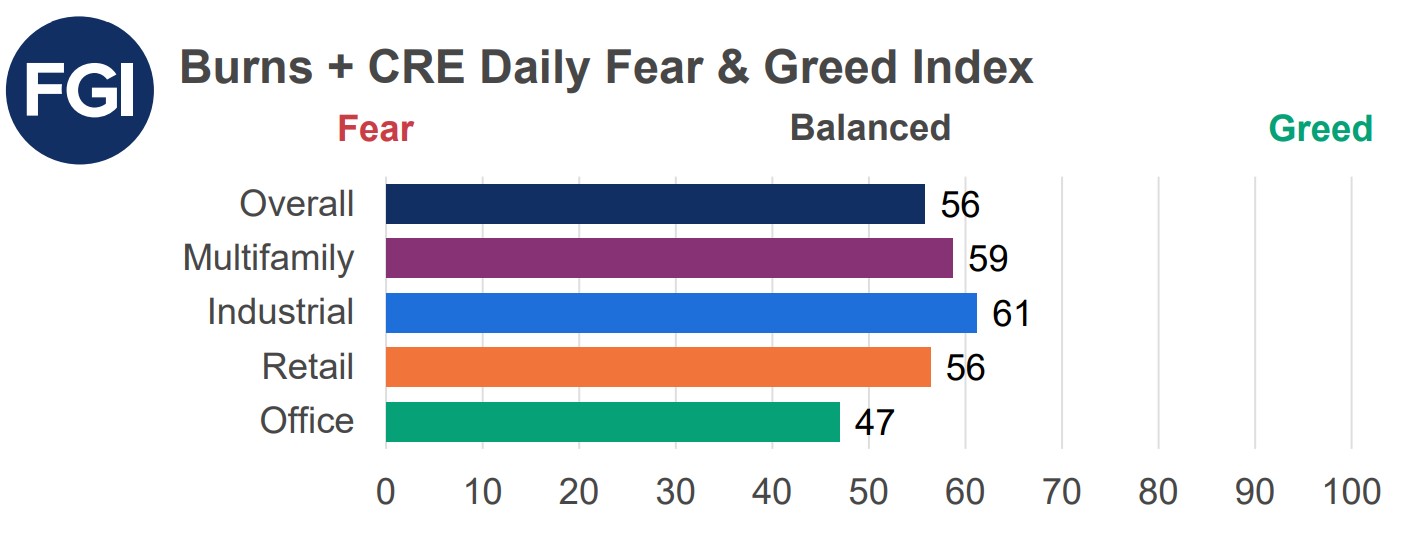

CRE Daily/John Burns Research and Consulting: “The Fear and Greed Index remained flat in 1Q25 from 4Q24. Commercial real estate investors lowered their expectations for near-term investment.”

- Trump Administration Plans To Construct Nearly 4 Million Affordable Homes On Federal Land (Yahoo Finance)

- 100+ U.S. Rent Statistics and Trends [2025] (Apartment List)

- DOGE Freezes HUD Retrofit Program Funding (GlobeSt)

Multifamily Markets and Reports

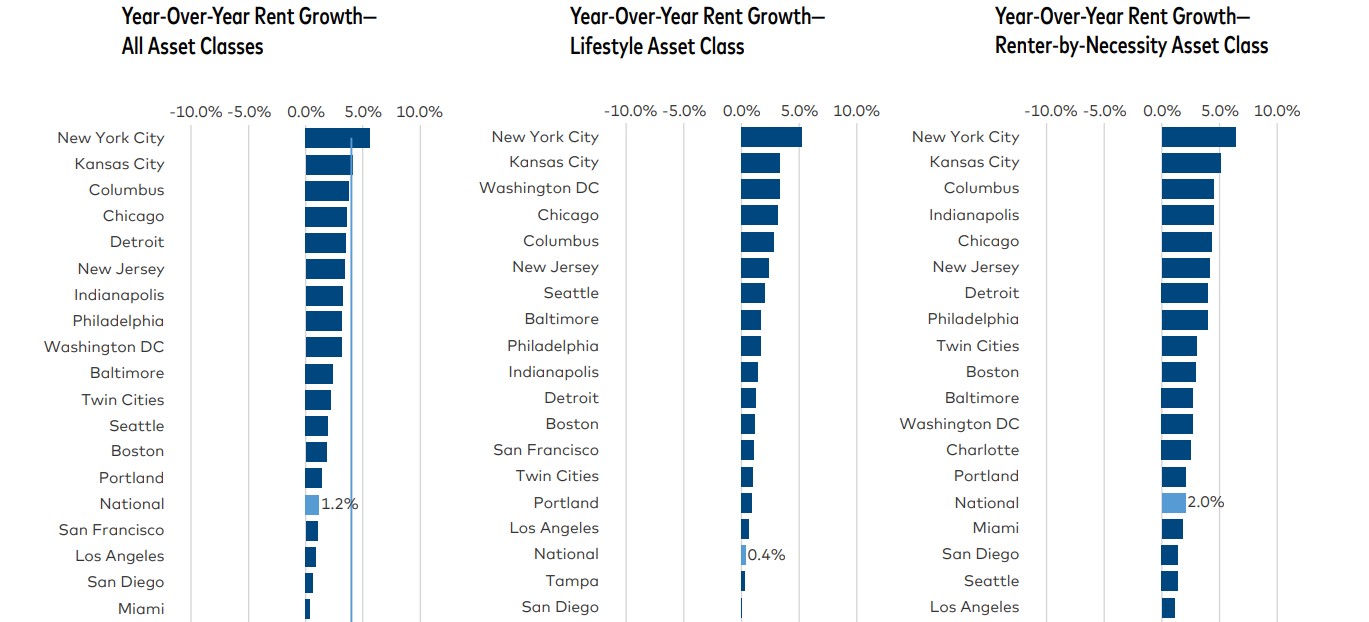

Feb. 2025 National Multifamily Report: “Multifamily Market Set to be Tested”

Yardi Matrix: “Will demand remain robust? If so, fewer deliveries would allow high-supply markets to absorb new units and enable rents to grow again. However, early indications are that demand is weakening as absorption drivers are slowing.”

- Riding the Waves of Megatrends: Look to the Boomers, of Course! (Cushman & Wakefield)

- New Chapter Unlocked: These Are the Best College Towns for 2025 (RentCafe)

- Washington, D.C. Multifamily Market Positioned Well To Withstand DOGE Flux (Marcus & Millichap)

Commercial Real Estate and the Macro Economy

On Again, Off Again: Tariffs & Commercial Real Estate

Via CBRE: “Industrial and retail property fundamentals will see the most immediate impacts from tariffs if consumer spending power is reduced and the flow of goods shifts. The office market recovery should continue, barring an economic downturn.”

- Global investment sentiment “has remained upbeat despite a likely slower-than-expected pace of interest rate cuts” (CBRE)

- U.S. Retail Monthly Foot Traffic & Sales Analysis | February 2025 (Colliers)

- 2025 Outlook Retail Sector Well-Anchored Against Potential Turbulence (Marcus & Millichap)

Other Real Estate News and Reports

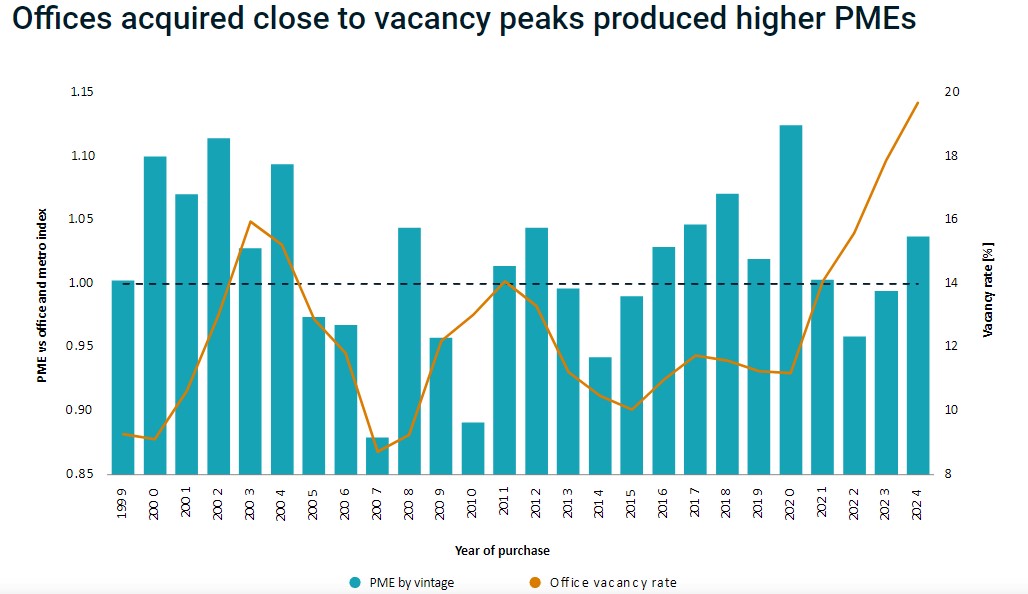

Via MSCI: “While the office-property market continues to evolve amid structural challenges, PME analysis shows that a wait-and-see approach has typically not been the route to outperforming the broader real-estate market. Instead, returns-enhancing opportunities are more likely to be found in pursuing development at the outset and timing exits well.”

- Self Storage National Report – March 2025 (Yardi Matrix)

- H2 2024 Global Real Estate Capital Flows (CBRE)

- Trepp Property Price Index (TPPI) 2024 Q4: Some Relief for Commercial Real Estate Prices as Rate Cuts Ease Pressures (Trepp)