(How Much) Will Multifamily Thrive in 2025?

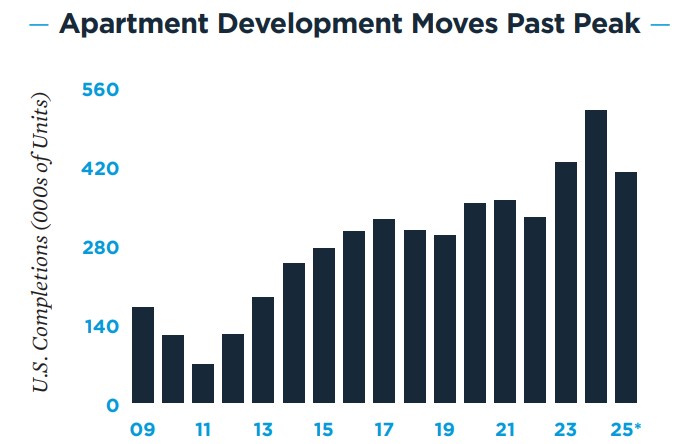

Normalizing supply trends should follow the lower construction activity in the apartment market, and while regional differences could exacerbate and interest rate trajectories have been persistently uncertain, high housing demand will continue to drive multifamily performance in 2025.

Multifamily, the Nation, and the Economy

A Sharp Pullback in U.S. Apartment Deliveries Is on the Way

Institutional Property Advisors: “Active development has moved past peak . . . [, but s]elect Sun Belt locations remain very active . . . Starts should stay under the norm for a bit longer.”

- Luxury Apartment Demand Drives Up Rents for Affordable Units (GlobeSt)

- 2024 year-end review: innovation and resilience shine in housing and the economy (John Burns Research and Consulting)

Multifamily and the Housing Market

Via Realtor.com: “While the surge in new multifamily supply offers renters more options, the large renter population will dampen any significant impact on rental prices. The median asking rent in 2025 is expected to be only slightly lower than in 2024 (-0.1%).”

- Unpacking 2024 Housing Market Trends (CoreLogic)

- What will it take to get the stalled housing market moving in 2025? (Marketplace)

Multifamily Markets and Reports

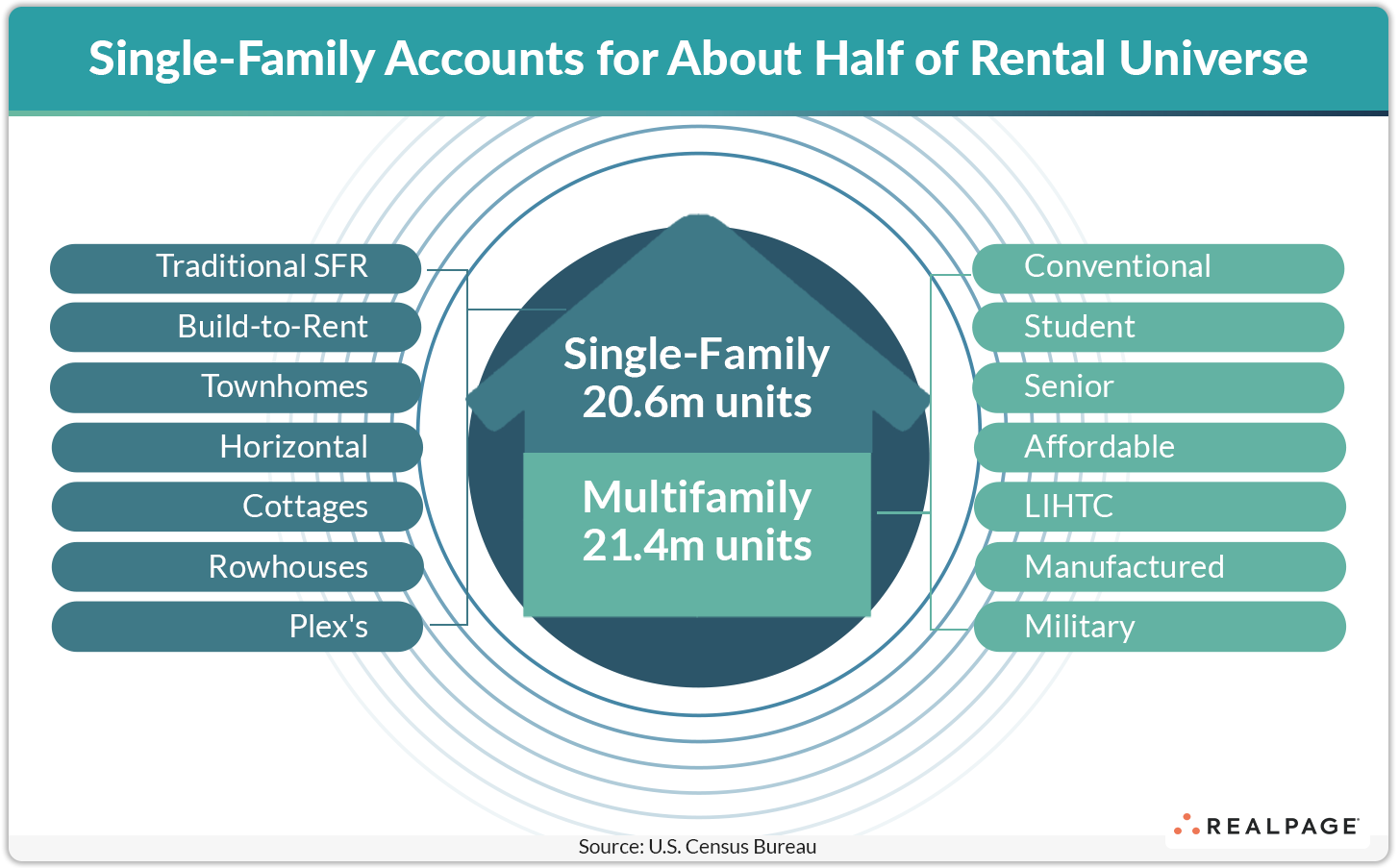

Drivers of the Build-to-Rent Sector

Via RealPage: “While conventional multifamily accounts for about half of the rental universe, about 21 million units fall under the single-family rental umbrella. Single-family rentals include the traditional single-family rental (“for rent by owner”), townhomes and BTR – as defined by the Census Bureau.”

- America’s Renters Are Moving Less Than Ever (Redfin)

- Top 10 Most Popular States Americans Moved to in 2024 (Realtor.com)

Commercial Real Estate and the Macro Economy

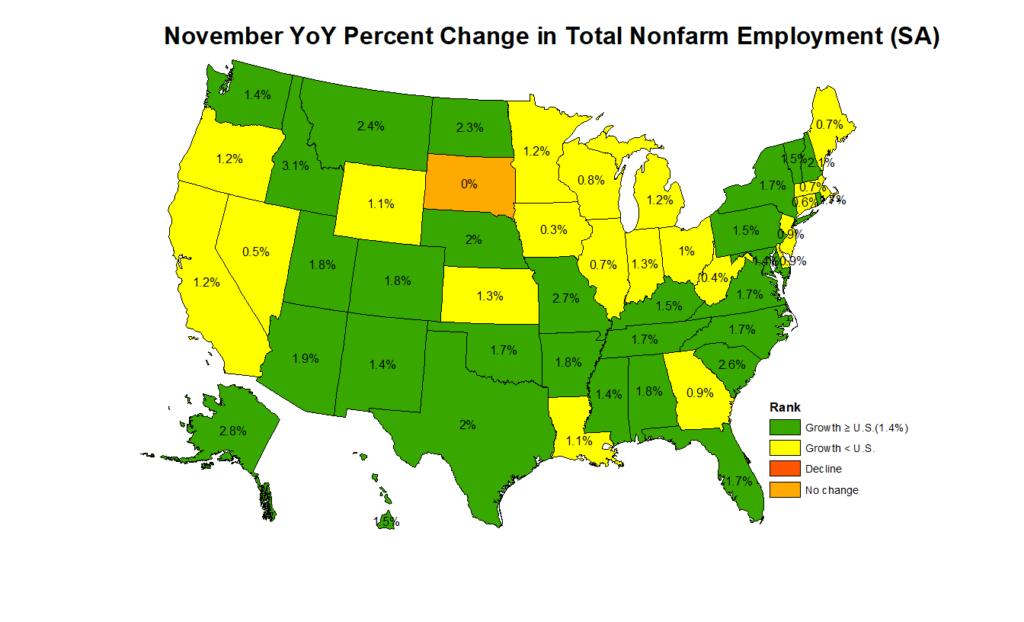

State-Level Employment Situation

Via NAHB: “On a month-over-month basis, employment data was most favorable in Florida, which added 61,500 jobs, rebounding from the hurricanes that hit the sunshine state in October. Washington came in second (+30,900), followed by North Carolina (+15,000).”

- From wet to dry: How AI is shaking up laboratory design (JLL)

- ‘The Math Isn’t Going To Lie’: Lab Real Estate’s Woes To Continue In 2025 (Bisnow)

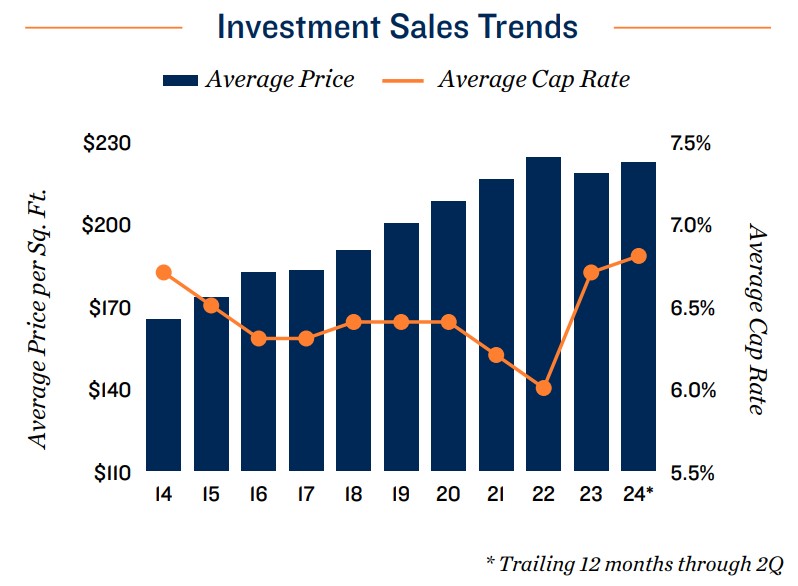

Other Real Estate News and Reports

Retail National Report: “Potential headwinds could be negated”

Via Marcus & Millichap: “The retail sector entered the second half of 2024 as the only major commercial real estate property type with a vacancy rate below its year-end 2019 recording. Consumer resiliency empowered standout tenant demand across the segment. Core retail sales reached a record mark in August, with spending up in real terms even after factoring in core CPI inflation.”

- Retail Rents Rise in Prime Business and Mixed-Use Districts (GlobeSt)

- The Outlook for Commercial Real Estate (Even Office) in 2025 Is Positive (Commercial Observer)