Housing Demand Easily Dwarfs Economic Uncertainty

The multifamily market has been remarkably resilient in working through the historic wave of newly-built apartment supply, and comparatively, the recent dip in consumer sentiment may not be a major obstacle as rent growth is expected to to improve through 2025. Uncertainty has also hit the investment side, but recent signs of increasing investment activity suggest that investors and operators are finding ways to transact at greater volumes and with higher confidence than in 2024.

Multifamily, the Nation, and the Economy

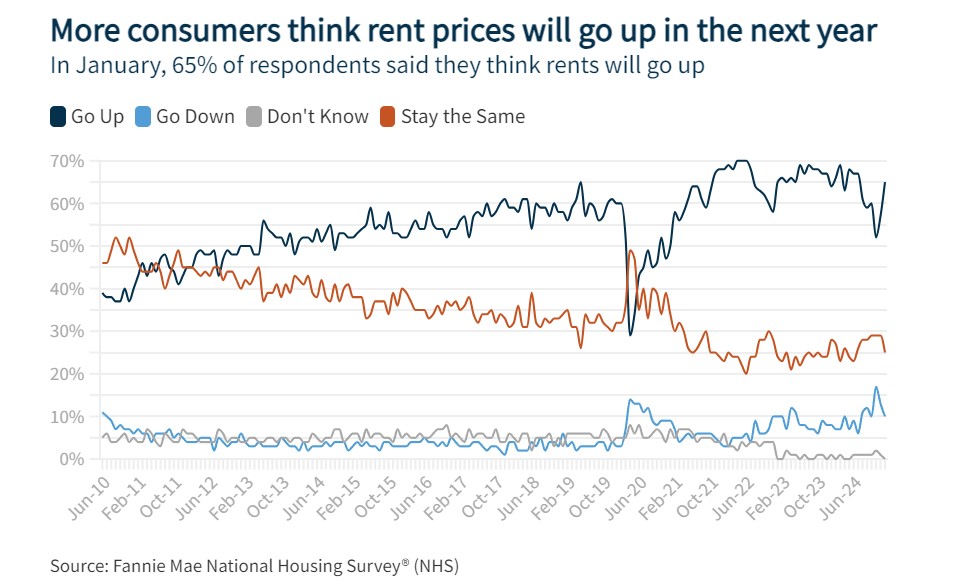

Overall Housing Sentiment Ticks Higher Despite Consumers’ Growing Affordability Concerns

Fannie Mae: “Consumers seem increasingly pessimistic that housing affordability conditions will improve across the board, as a growing share expects home prices, rent prices, and mortgage rates will all go up.”

- Jobs Report: Unemployment Ticks Down, Wages Up Slightly (Bureau of Labor Statistics)

- Job Growth No Longer Chief Predictor of Apartment Rent Growth (RealPage)

- Will Trump Tariffs Harm Home Affordability? (CoreLogic)

Multifamily and the Housing Market

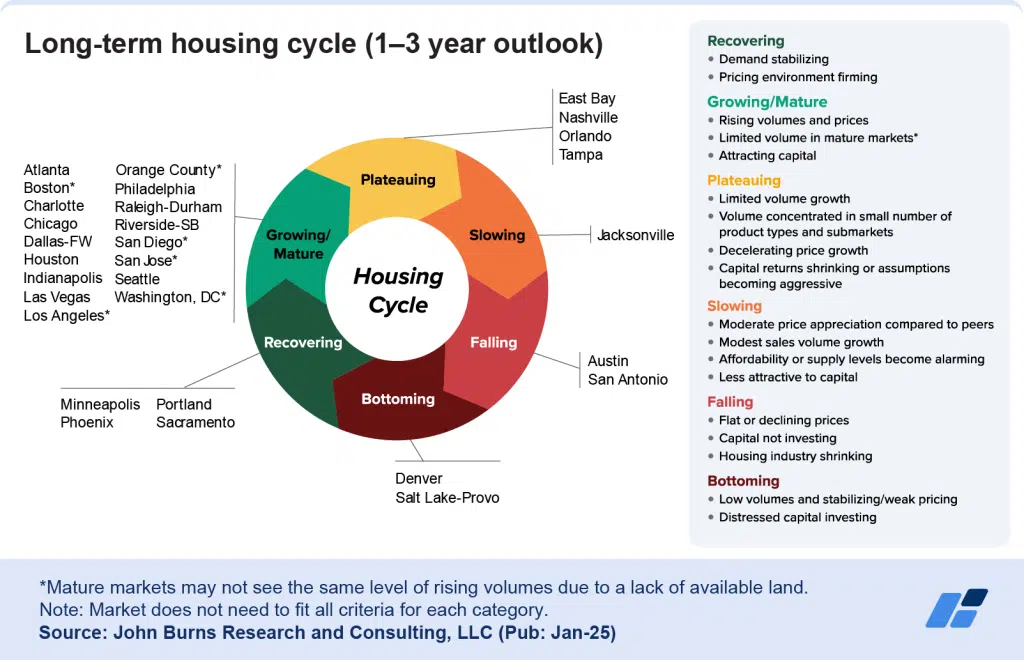

Where are we in the housing cycle? (2025 edition)

Via John Burns Research and Consulting: This article reflects the differences in housing fundamentals among the different markets in the United States, based on the differing levels of volume, pricing, and demand.

- 2025 Housing Market Outlook: “house prices to rise by 3% overall in 2025” (J.P. Morgan)

- Builders’ Top Challenges for 2025: Interest Rates and Building Materials Prices (NAHB)

- Affordable Housing Within America’s Housing Affordability Landscape; Notable Demand Despite Substantial Growth (Moody’s Analytics)

Multifamily Markets and Reports

Jan. 2025 National Multifamily Report: “Multifamily Rents Off to Positive Start in 2025”

Via Yardi Matrix: “Despite the strong absorption, the robust supply pipeline has caused the occupancy rate to decrease in many markets. Nationally, the occupancy rate for stabilized properties fell to 94.5% in December, according to Matrix, its lowest level since the first quarter of 2014.”

- Jan. 2025 Rental Report: Apartment Supply Slows, as Rent Growth Approaches Positive Growth

- Will Multifamily Thrive in ’25? (Multi-Housing News)

- High Rates, High Vacancies: Why Freddie Mac Still Projects Multifamily Loan Origination Growth (Trepp)

Commercial Real Estate and the Macro Economy

Capital Markets Snapshot: Momentum Builds

Via Colliers: “Investors are coming back to the multifamily market with a vengeance. Volume increased by a healthy 22% in 2024, leading all asset classes. Consistent monthly activity indicates the market has turned a corner.”

- Q4 2024 Office Market Report: “early signs of stability” (Colliers)

- Will Tariffs Impact Commercial Real Estate? (Marcus & Millichap)

- Interest Rate Cuts Expand Consumer Credit Growth in Q4 2024 (NAHB)

Other Real Estate News and Reports

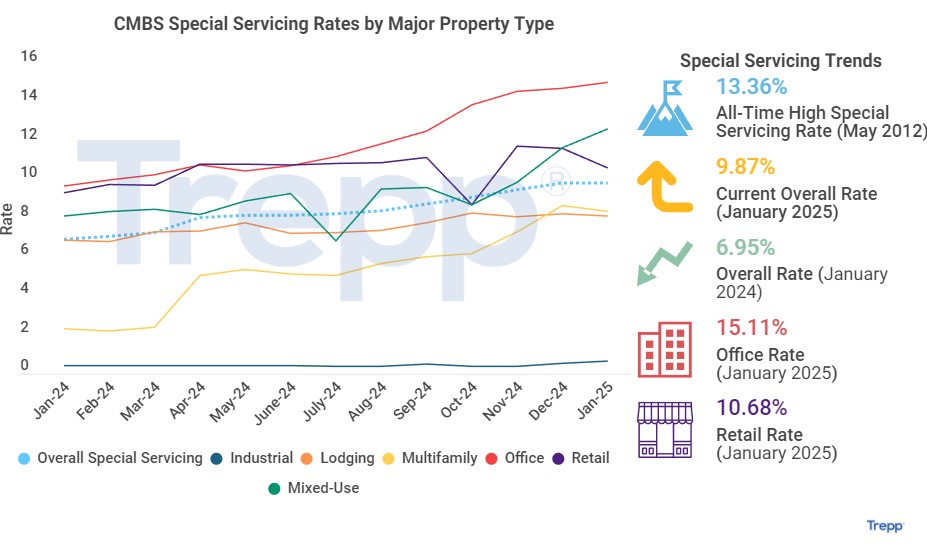

Special Servicing Rate Retreats Slightly in January 2025 for the First Time Since December 2023

Via Trepp: “The Trepp CMBS Special Servicing Rate pulled back 2 basis points to 9.87% in January 2025. This was the first decline in the monthly rate since December 2023. The main driver of the rate’s decrease was the increased overall balance of all CMBS loans outstanding. Compared to last month, the balance of loans in special servicing rose by $843.0 million, but the balance of all outstanding CMBS loans also increased by $9.5 billion.”

- Trump’s Tariffs Could Slash S&P 500 Fair Value by 5%, Warns Goldman Sachs (GlobeSt)

- Jan. 2025 Commercial Markets Report: “the multifamily sector continued to experience strong growth” (NAR)

- Startup Focused On ‘Democratizing Real Estate’ Ordered To Hand Over 119 Properties To Lender (Bisnow)