Housing and CRE in a New Era

Even before the milestone election, prospects for commercial real estate were expected to markedly improve, following projections of lower inflation, lower interest rates, and a labor market that has been bumpy but resilient. Donald Trump’s election has done little to change these prospects, and multifamily investors and operators will be closely following his policy agenda given the importance of housing issues in this presidential campaign.

Multifamily, the Nation, and the Economy

Has Commercial Real Estate Performance Turned the Corner?

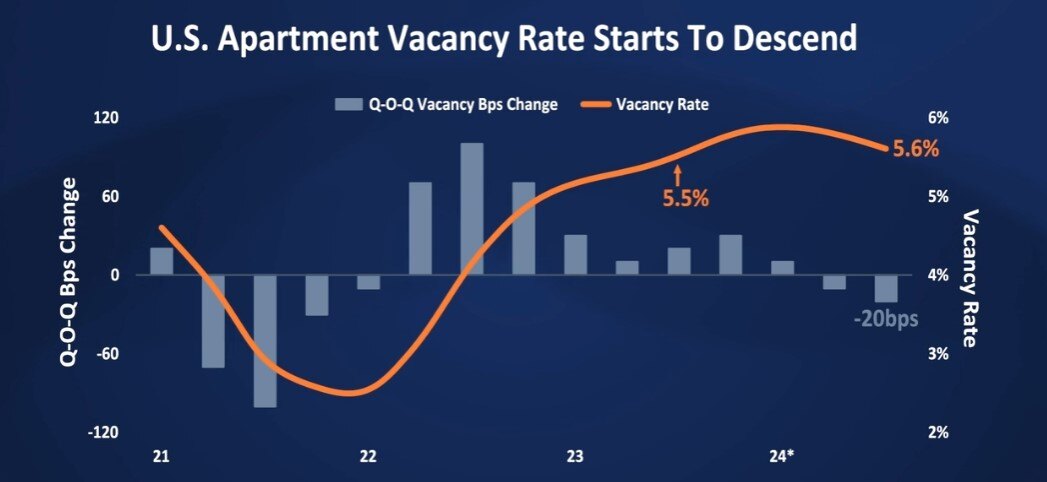

Via Marcus & Millichap: “The national vacancy rate came down by 20 bps . . . [, which,] considering the record level of apartment completions . . . is actually a little surprising and very welcome news.”

- CRE Readies For Realignment As Trump Surges Back To White House (Bisnow)

- National Multifamily Market Report, Q3 2024 (Berkadia)

- The Politics and Policies That Impact Rental Housing (John Burns Research and Consulting)

Multifamily and the Housing Market

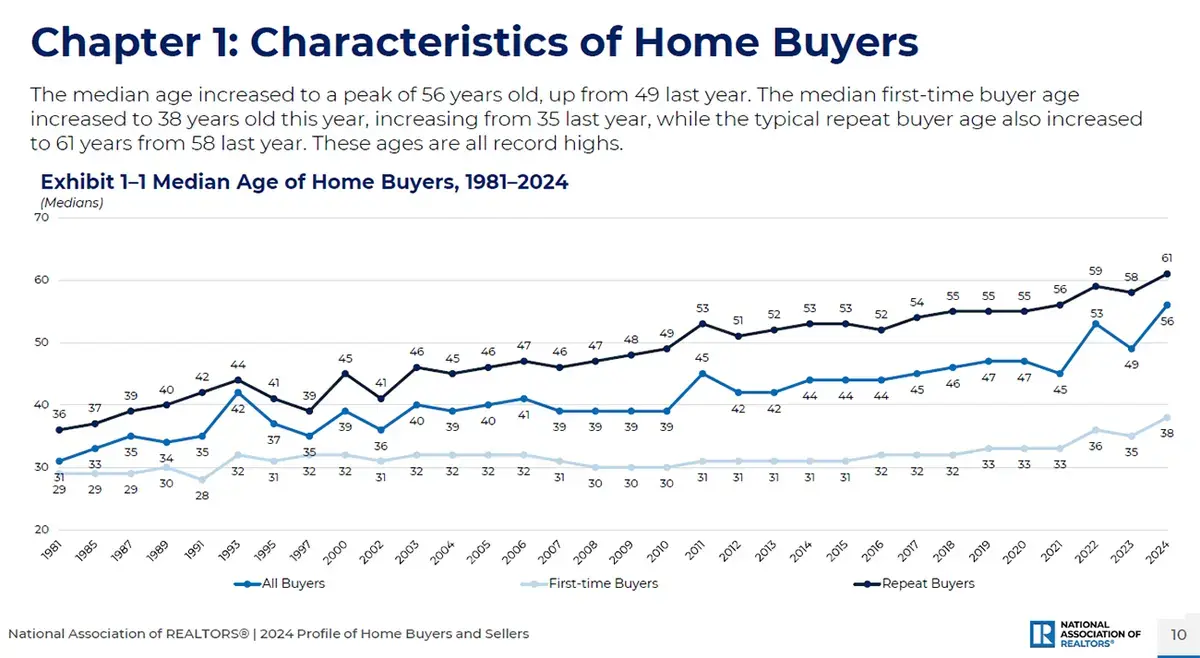

Home Buyer/Seller Preview: 1st-Time Buyers at Historic Low, Homebuyer Age Jumps

Via NAR: “The median first-time buyer age increased to 38 years old this year from 35 last year, while the typical repeat buyer age also increased to 61 years from 58 last year.”

- The Housing Equation: Policy, Affordability, & Supply Constraints in the U.S. (Trepp)

- Can Public Housing Play a Role in a New American Social Housing System? (Harvard Joint Center for Housing Studies)

- Home Price Forecasts: Down O.1% MoM, Up 2.3% by Next Year (CoreLogic)

Multifamily Markets and Reports

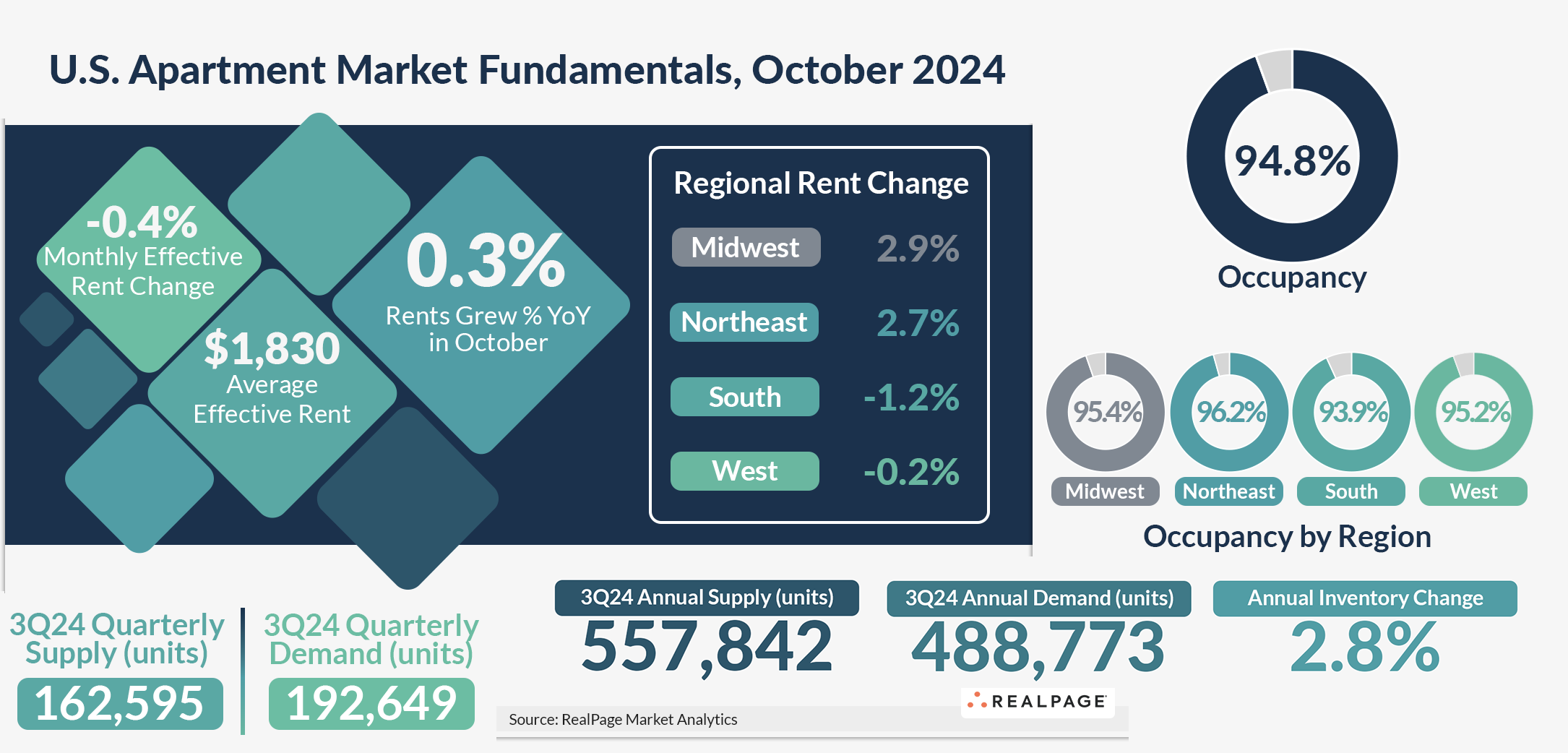

October 2024 Apartment Market: Rent Growth Ticks Down, Occupancy Stable

RealPage: “Effective rents declined 0.4% on a monthly basis, which is very similar to the monthly rent cut of 0.6% seen one year ago in October 2023.”

- All-Cash Home Sales and Prices Decline in the Third Quarter (NAHB)

- Californians vote against rent control as Prop. 33 fails (CalMatters)

- Mortgage Activity Declines in October as Mortgage Rates Increase (NAHB)

Commercial Real Estate and the Macro Economy

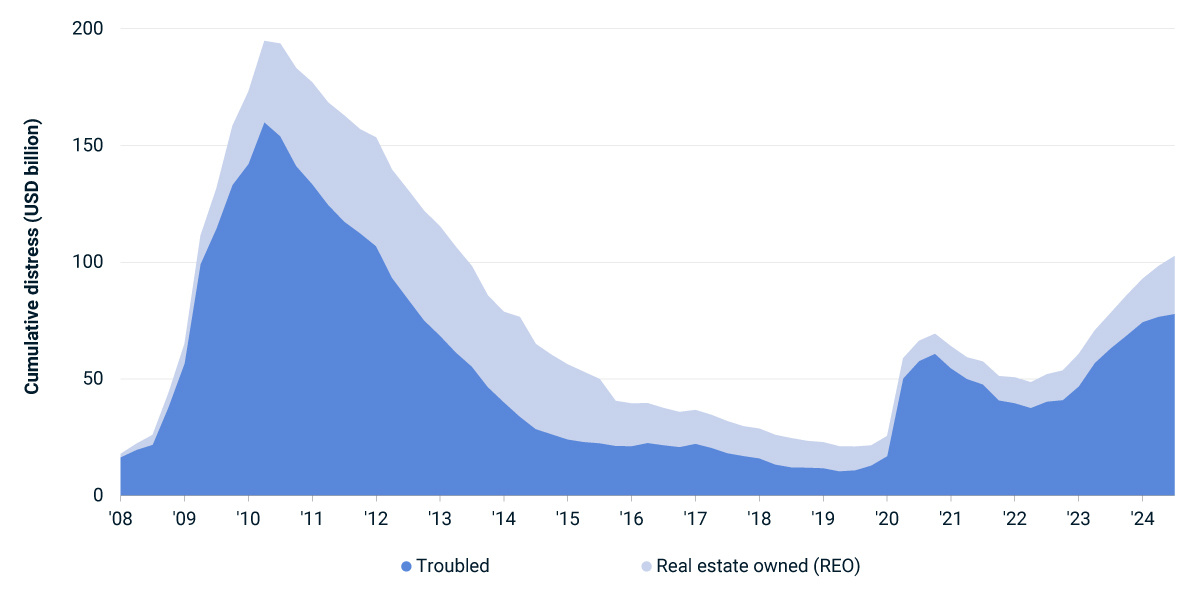

Distress in US Commercial Property Grew at a Slower Rate

Via MSCI: “Potential distress, which may precede full-blown financial trouble, stood at USD 260.9 billion at the end of the third quarter, more than double the value of the pool of distress. Unlike the balance of distress, however, the value of potential trouble declined from the prior quarter.”

- A Tale of Two Job Reports: Rate Cut Imminent? (Moody’s Analytics)

- Retail National Report: “Potential headwinds could be negated.” (Marcus & Millichap)

- Strategies for Surviving the Wall of Loan Maturities (GlobeSt)

Other Real Estate News and Reports

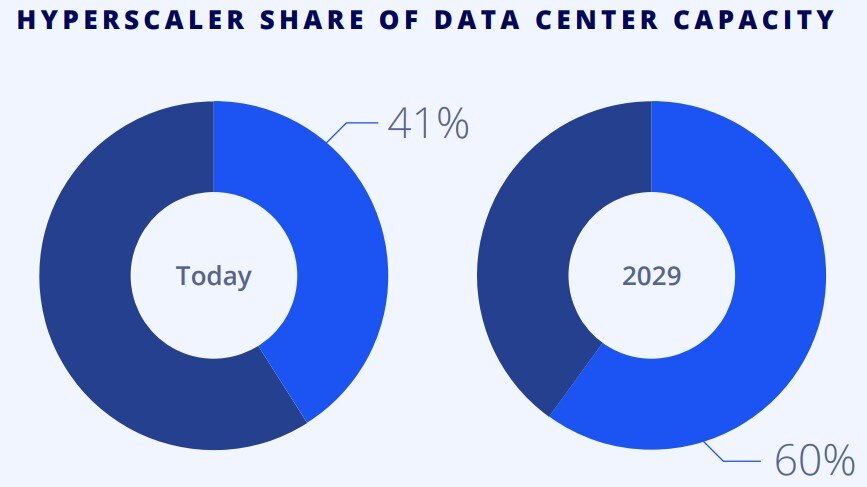

Accessing Power and Capital: The Future of Data Center Development

Via Colliers: Data centers lie at the forefront of today’s digital landscape, supporting everything from cloud computing to artificial intelligence . . . However, tapping into these opportunities goes beyond having access to significant capital.”

- Commercial real-estate bonds head for best year in a decade, says Deutsche Bank (MarketWatch)

- Banks Are Poised for a Commercial Real Estate Lending Rebound in 2025 (Commercial Observer)

- Donald Trump Will Return to the White House: What His Presidency Means for the Housing Market (Realtor.com)