Homebuilding and the Housing Shortage from the Multifamily Perspective

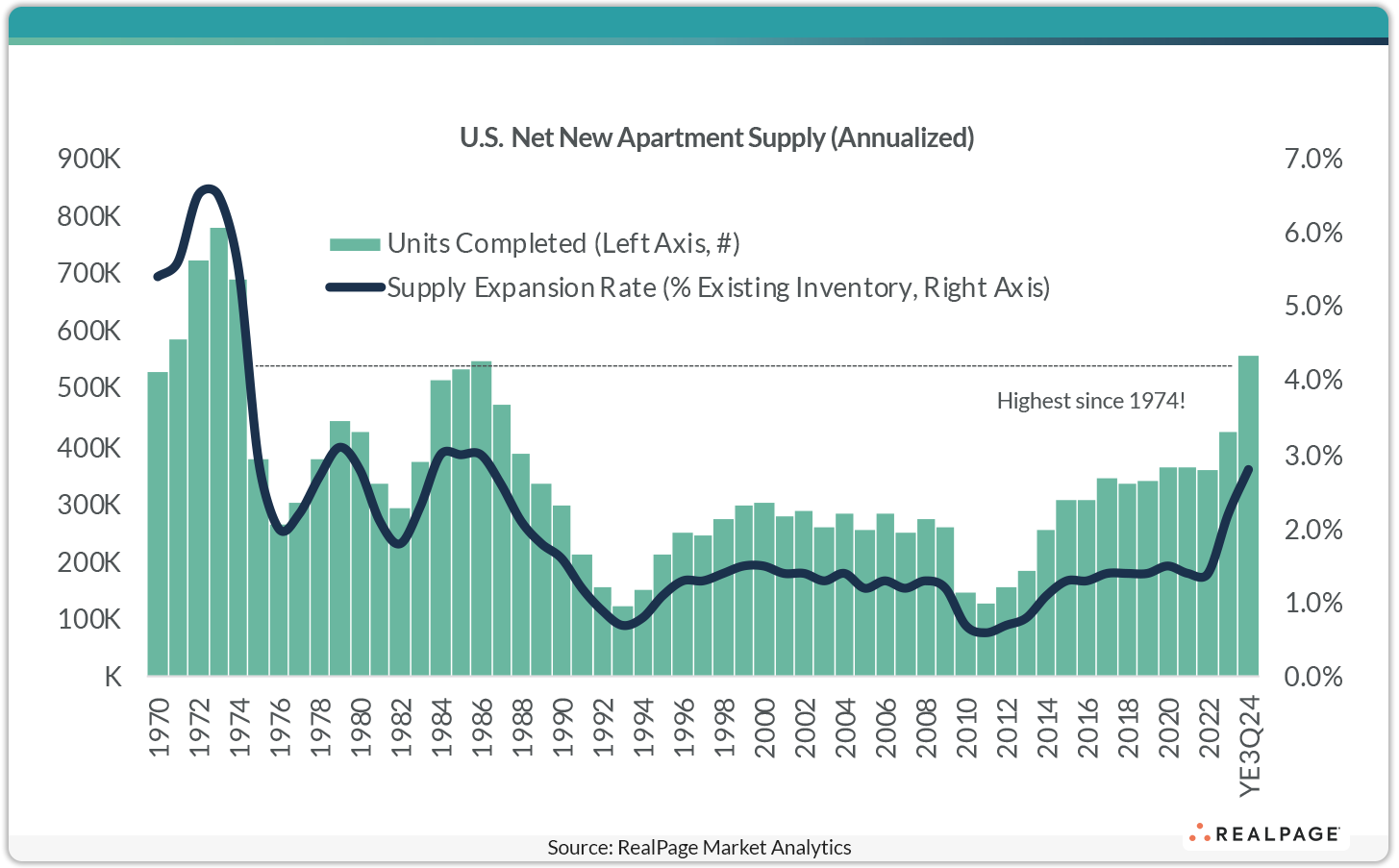

Source – RealPage: “Some Perspective on the 50-Year Peak in Apartment Supply Volumes”

A look at apartment supply for the year starting in Q3 2023 till Q3 2024. A view from the top, as it were, before apartment supply falls in the months to come. The numbers from the census bureau have YoY new supply at 647K for the same period, which is higher than the 557K number from RealPage. CoStar’s number is 683K, and that’s factoring in demolitions, but my point is that these numbers for apartment supply vary slightly from source to source, and it’s worth looking at multiple sources and figuring out if they’re all moving in the same direction. I’ve contacted our source at RealPage about how they get their apartment supply numbers, and I’ll be sure to update if/when I hear back.

This short post from Kim O’Brien lists some of the far-off cultural and historical happenings of 1974, which was the last time that apartment supply was this high. Watergate. Happy Days. Hank Aaron. The Godfather, Part II. It’s good color. (I’ll add some music highlights: Queen, Van Halen, and The Ramones played their first concerts in 1974, the proto-punk visionaries The Modern Lovers disbanded that year, two years before their seminal self-titled debut album).

- So you get an idea of that time, and you also get a really wonderful graph that gets straight to the point on apartment supply in the 1970s through today, tracking both the raw number of new apartment supply added in each year as well as how this new apartment supply compares to the existing supply.

- For example: Current new apartment supply for the 12 months ending in Q3 2024 was 557K. Compared to existing supply, it’s a little under 3% of supply.

- In 1974, that supply number was higher, a little under 700K. Even more extreme, those new apartments added about 5% to existing supply.

Following the apartment supply numbers in this graph, there’s a good 12-year period from 1976 to 1988 where we were adding 2-3% to existing apartment supply every year.

Then, we had a 34-year period, from 1988-2022, where apartment supply was only growing by 1-2% each year.

So, clearly, it’s not unprecedented to be adding 2-3% to apartment supply. Measuring from the start of that earlier high-supply period around 1968, there’s a good 20-year period in which, more often than not, apartment supply was expanding at roughly twice the rate that it was expanding in the years preceding the pandemic.

But that was the 70s and 80s. It took over 30 years to see apartment supply grow at those high rates, and crucially, this current apartment supply wave is going to be much shorter in duration.

This apartment supply wave is expected to recede relatively quickly. CoStar estimates that deliveries fall from an expected 645K for 2024 to 346K in 2025, that’s a HUGE drop, and that new supply forecast is actually lower than the pre-pandemic numbers. We had two big years for apartment builders. 600K new apartments in 2023, 645K in 2024. Then we’re falling back down to below-normal levels.

CoStar’s forecast may be underestimating new apartment supply in the next few years, but permits and starts data unambiguously point to a dramatic drop.

We’re at a moment where housing costs are super high. We had what, 2 measly years where we added 3% to existing supply?! In the 70s, when the Fonz was banging on the jukebox, we were banging out apartments, year after year. We still need more housing in 2024, but in the multifamily market, we won’t be building enough apartments any time soon. Multifamily investors: This means higher rent growth. This means better investment prospects.

In 2025, renters will have enjoyed a 2-year period of low rent growth, but that could change very quickly. Housing demand, and apartment demand specifically, is NOT going away. As demand stays high and new supply starts ticking down, rent growth could easily accelerate.