Gray Report Newsletter: September 28, 2023

Loan Maturities Update: Is Distress Around the Corner?

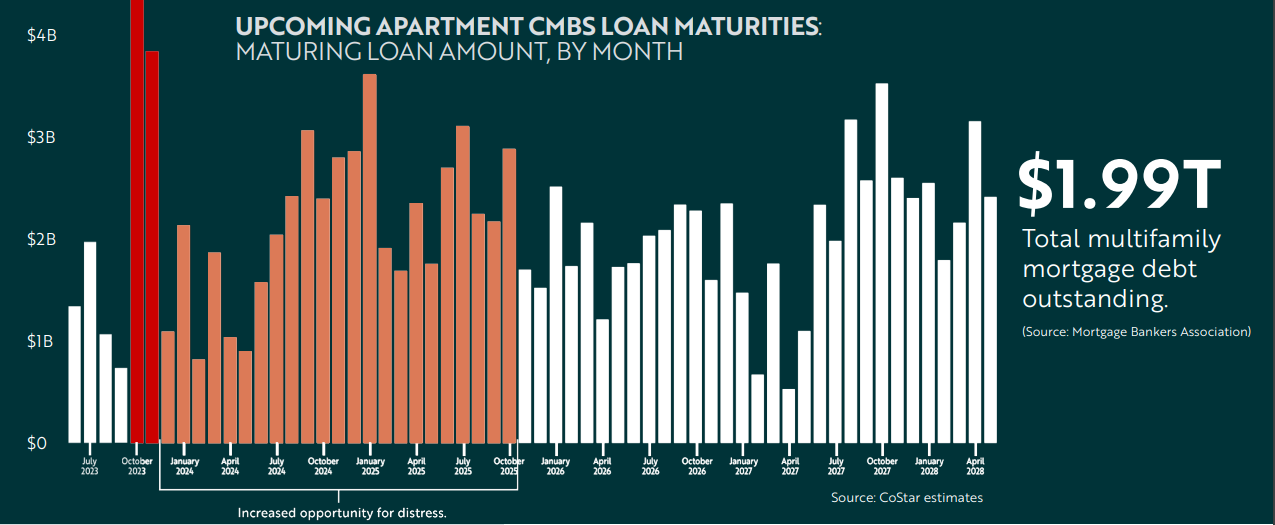

Reports of persistently-high expenses for commercial real estate operators, extended periods of higher interest rates, and lower rent growth have compounded the potential for distress linked to the wave of multifamily loan maturities due in Q4 of this year. Solid, long-term fundamentals and robust housing demand continue to make multifamily an attractive investment, but for floating-rate borrowers whose loans are coming due, these short-term challenges could motivate sales at prices low enough to break the multifamily sales market out of its current stagnation.

Multifamily, the Nation, and the Economy

Update: Wave of Multifamily Loan Maturities Imminent

Via Gray Capital: Upcoming loan maturities have the potential to create significant investment opportunities in the multifamily property market. Read our newest report and learn how these maturities intersect with higher expenses and other factors that could motivate multifamily borrowers and sellers to close the buyer/seller gap and generate greater sales activity.

- National Rent Report, September 2023 (Apartment List)

- Following 2022 Peaks, Urban Core Apartments Lose Pricing Power (RealPage)

- The World’s Billionaires Are Betting Big On U.S. Multifamily (Bisnow)

Multifamily Markets and Reports

Older Multifamily Properties Achieve Above-Average Rent Growth

Via CBRE: “Investors may want to take a closer look at older multifamily properties based on a CBRE Research finding that those built before 2010 have averaged 4.6% annual rent growth over the past decade compared with 3.4% for post-2010 assets.”

- Florida’s Apartment Renter Evolution (Institutional Property Advisors)

- Student Housing National Report, September 2023 (Yardi Matrix)

- How Rising Interest Is Affecting Floating Rate Refis (GlobeSt)

Multifamily and the Housing Market

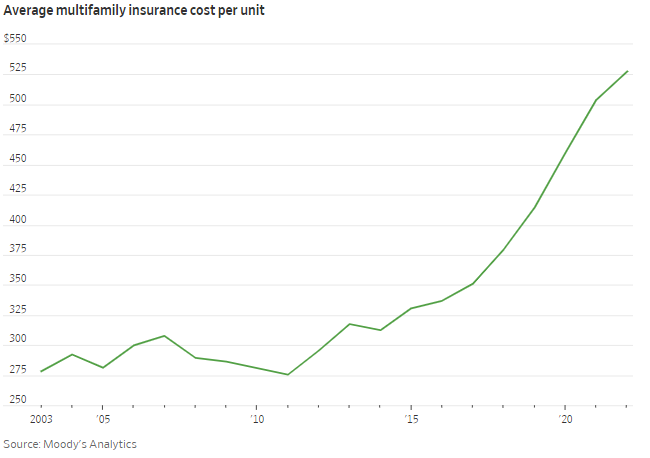

Commercial Real Estate’s Next Big Headache: Spiraling Insurance Costs

Via The Wall Street Journal: “While insurance premiums are rising virtually everywhere and for all building types, some cities have been particularly hard hit, especially for multifamily buildings.”

- Home Prices Hit an All-Time High, but Appreciation not Enticing Seller Activity (Marcus & Millichap)

- Top legislative priorities for multifamily pros (Multifamily Dive)

- Rent Now, Buy Never? The Cities Where Paying Cheap Rent Makes More Sense Than Buying a Home (Realtor.com)

Commercial Real Estate and the Macro Economy

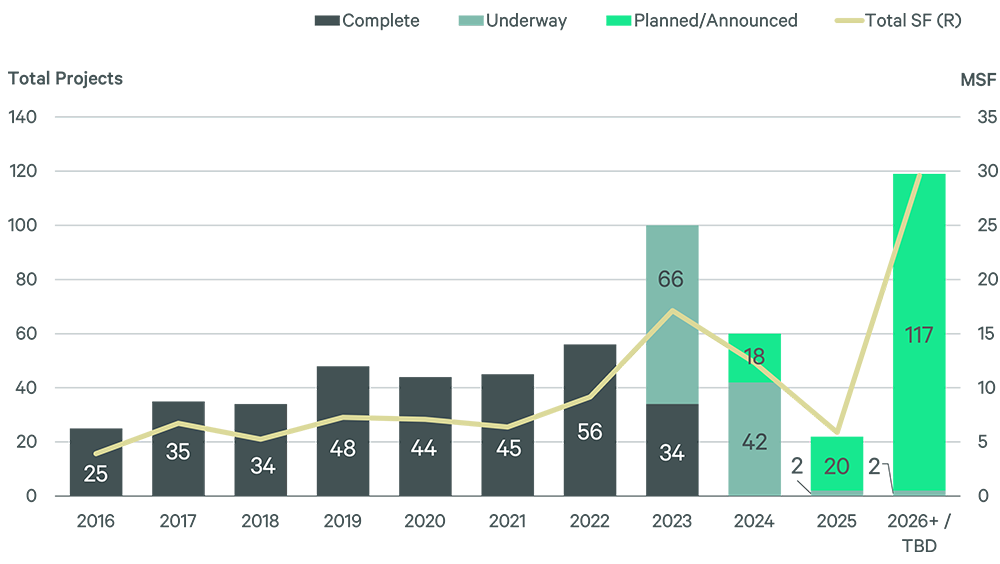

Rise in Office Conversions May Help to Reinvigorate Cities

Via CBRE: “Approximately 100 office-conversion projects—nearly half of them to multifamily—are expected to be completed in major U.S. cities this year, compared with the annual average of 41 between 2016 and 2022.”

- National Office Report, September 2023 (Yardi Matrix)

- Here’s Why Simon Property Is Defying Critics With New Billion-Dollar Bet On Retailer Aéropostale (Bisnow)

- More workers returning to NYC office buildings than previously reported: study (New York Post)

Other Real Estate News and Reports

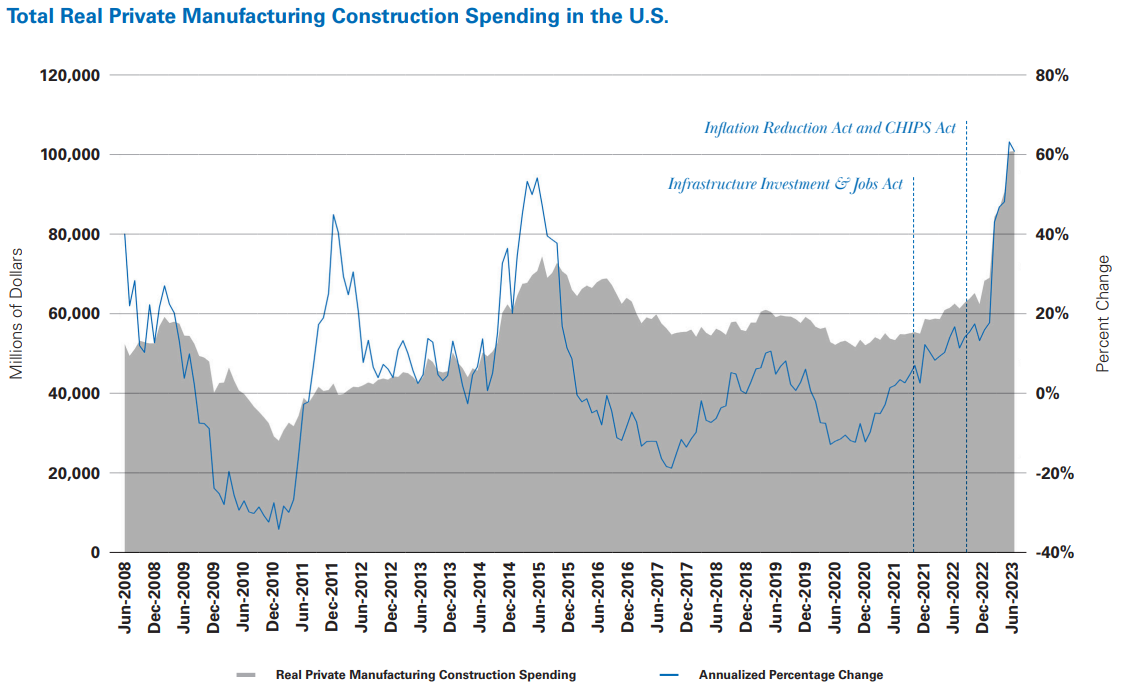

Manufacturing Momentum: Advanced Manufacturing Ascendancy in North America

Via Newmark: “Monumental growth in North American manufacturing is underway, with numerous implications for the industrial and logistics market.”

- U.S. Retailer Industry Foot Traffic Analysis | August 2023 (Colliers)

- US CoreLogic S&P Case-Shiller Index Switches Gears in July, Increases 1% Year Over Year (CoreLogic)

- Economic, Housing and Mortgage Market Outlook – September 2023 (Freddie Mac)