Gray Report Newsletter: September 14, 2023

CPI: Inflation Up 3.7% YoY, Multifamily Implications

The Consumer Price Index’s recent numbers for August showed a substantial monthly increase of 0.6% that was driven largely by rising gas prices, but when excluding food and energy prices, price growth continued to decelerate as shelter costs and moderating rent growth brought core inflation to a mere 0.2% year-over-year. While the topline inflation numbers may help justify the recent interest rate increase from the Federal Reserve, a more compelling signal of economic activity can be seen in the robust housing demand that has led to rebounding single family home prices in spite of the high mortgage rate environment, which is a strong indication of robust multifamily demand moving forward.

Multifamily, the Nation, and the Economy

Rents Continue to Dip, While Home Prices Rebound to All-Time Highs

Via Apartment List: “While single-family construction stalled, multi-family construction has remained strong even in the face of high interest rates. Rents peaked in 2022 at around the same time as home prices, and while the following dip was not as sharp as in the for-sale market, it has proven stickier.”

- Consumer Price Index Summary, August 2023 (Bureau of Labor Statistics)

- Top Four Strategies REITs Are Implementing Post-COVID (RealPage)

- National Multifamily Report, August 2023 (Yardi Matrix)

Multifamily Markets and Reports

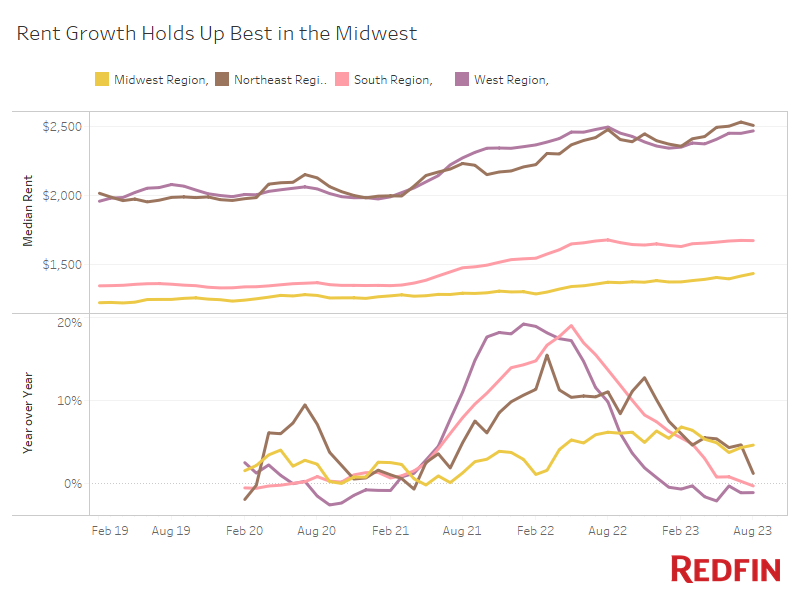

Rent Tracker: Midwest Outperforms as National Rents Hover Near Zero YoY Rent Growth

Via Redfin: “In the West, the median asking rent fell 1.1% year over year to $2,469 in August. And in the South, it fell 0.3% to $1,673—the first (albeit small) decline since 2020. By comparison, asking rents climbed 4.6% year over year to a record $1,434 in the Midwest and rose 1.2% to $2,509 in the Northeast.”

- With Existing Inventories Historically Low, Homebuyers Turn to the New Home Market (Harvard Joint Center for Housing Studies)

- Four Multifamily Strategies to Navigate the Current Environment (GlobeSt)

- 1 in 10 Home Sellers Are Moving Because They’re Being Called Back to the Office: Survey (Redfin)

Multifamily and the Housing Market

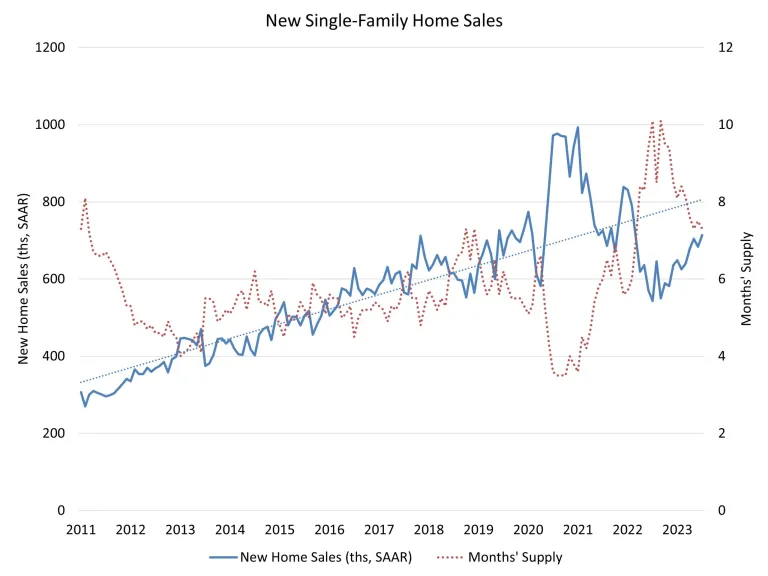

New Home Sales Increase in July

Via NAHB: “New home sales were solid in July because of an ongoing housing deficit in the U.S. and a lack of resales stemming from many home owners electing to stay put to preserve their low mortgage rates. However, despite this monthly uptick, new home sales will likely weaken in August as higher interest rates price out prospective buyers.”

- National Housing Sentiment Survey, August 2023 (Fannie Mae)

- Appraisal Process Report (NAR)

- High Mortgage Rates May Be Here To Stay—at Least Through 2023 (Realtor.com)

Commercial Real Estate and the Macro Economy

Pandemic Population Boom in Rural Hotspots Sparks Resentment

Via Bloomberg: “The number of people living in non-metro areas outgrew the urban population for the first time in three decades in 2021, and the rural population expanded again last year.”

- Can AI revolutionize office space design? (JLL)

- Federal Staffing Mandates Come for Nursing Homes (Moody’s Analytics)

- Two Forces Driving the CRE Outlook (Marcus & Millichap)

Other Real Estate News and Reports

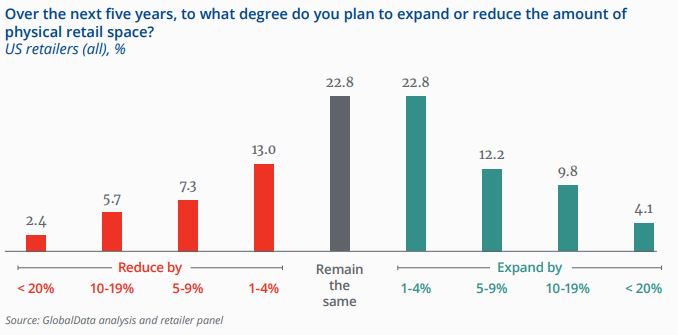

Via Colliers: “Retail is undergoing a significant transformation, with the need to rapidly adapt to evolving store formats and integrate online and offline channels.”

- Office Outlook Report: An Office Sector Tipping Point: Climbing Vacancy and Debt Maturities Raise Risks (Marcus & Millichap)

- IRS Audits Planned For CRE Partnerships With Over $10B In Assets (Bisnow)

- Annual U.S. Home Price Growth Rebounds in July (CoreLogic)