Gray Report Newsletter: October 26, 2023

Fed Says CRE Prices Are Still Too High

Investors continuing to grapple with slow-moving CRE pricing trends are well in line with the results of the Federal Reserve’s recent survey on financial stability, which noted that commercial real estate valuations have not fallen at a rate commensurate with the increase in interest rates. While apartment buyers contend with higher prices, apartment renters have benefited from lower rent growth in 2023, with recent coverage of the housing market describing how rising mortgage rates and still-elevated home values have led to soaring costs of home ownership compared to the price of rent.

Multifamily, the Nation, and the Economy

Fed Financial Stability Survey: CRE Valuations Still Too High

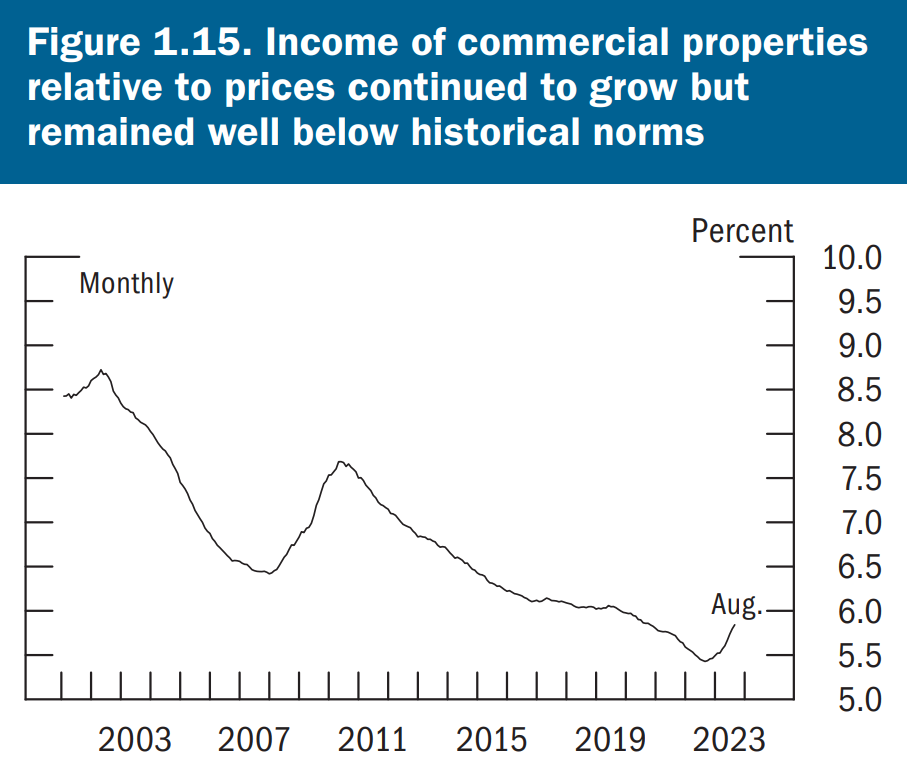

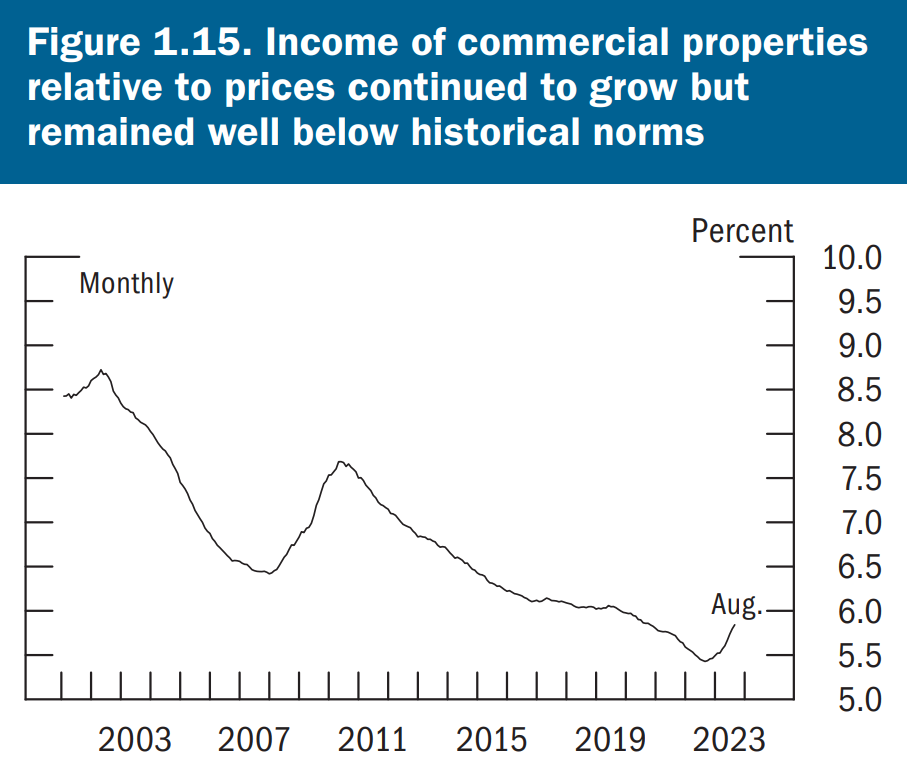

Federal Reserve Bank of the United States: “Capitalization rates at the time of property purchase, which measure the annual income of commercial properties relative to their prices, have increased modestly from recent historically low levels but have not increased as much as real Treasury yields, suggesting that prices remain high relative to rental income.”

- There’s Never Been a Worse Time to Buy Instead of Rent (The Wall Street Journal)

- Commercial real estate drop “about halfway there”: Cohen & Steers (TheRealDeal)

- How the Multifamily Industry Survived 2023 (GlobeSt)

Multifamily Markets and Reports

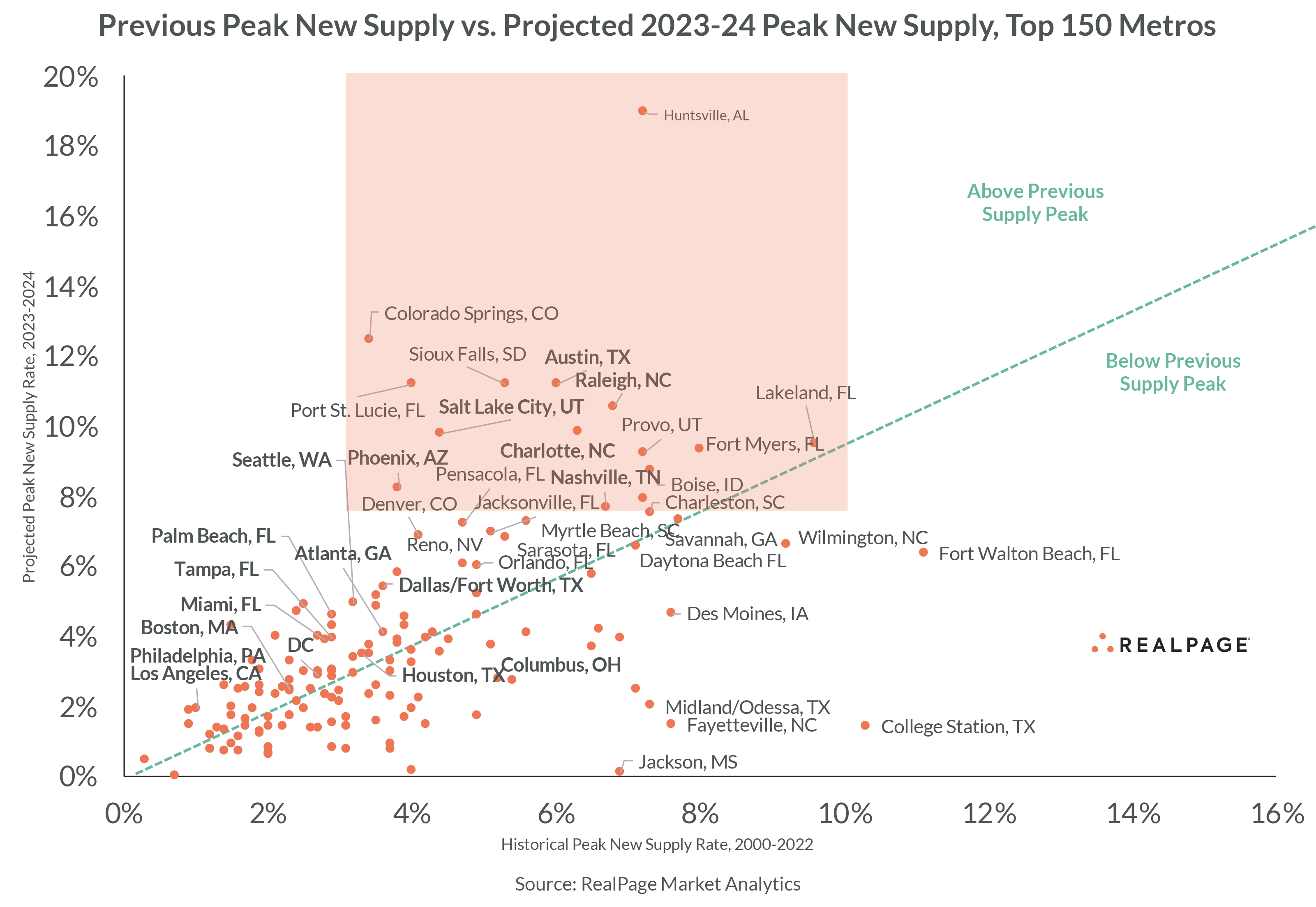

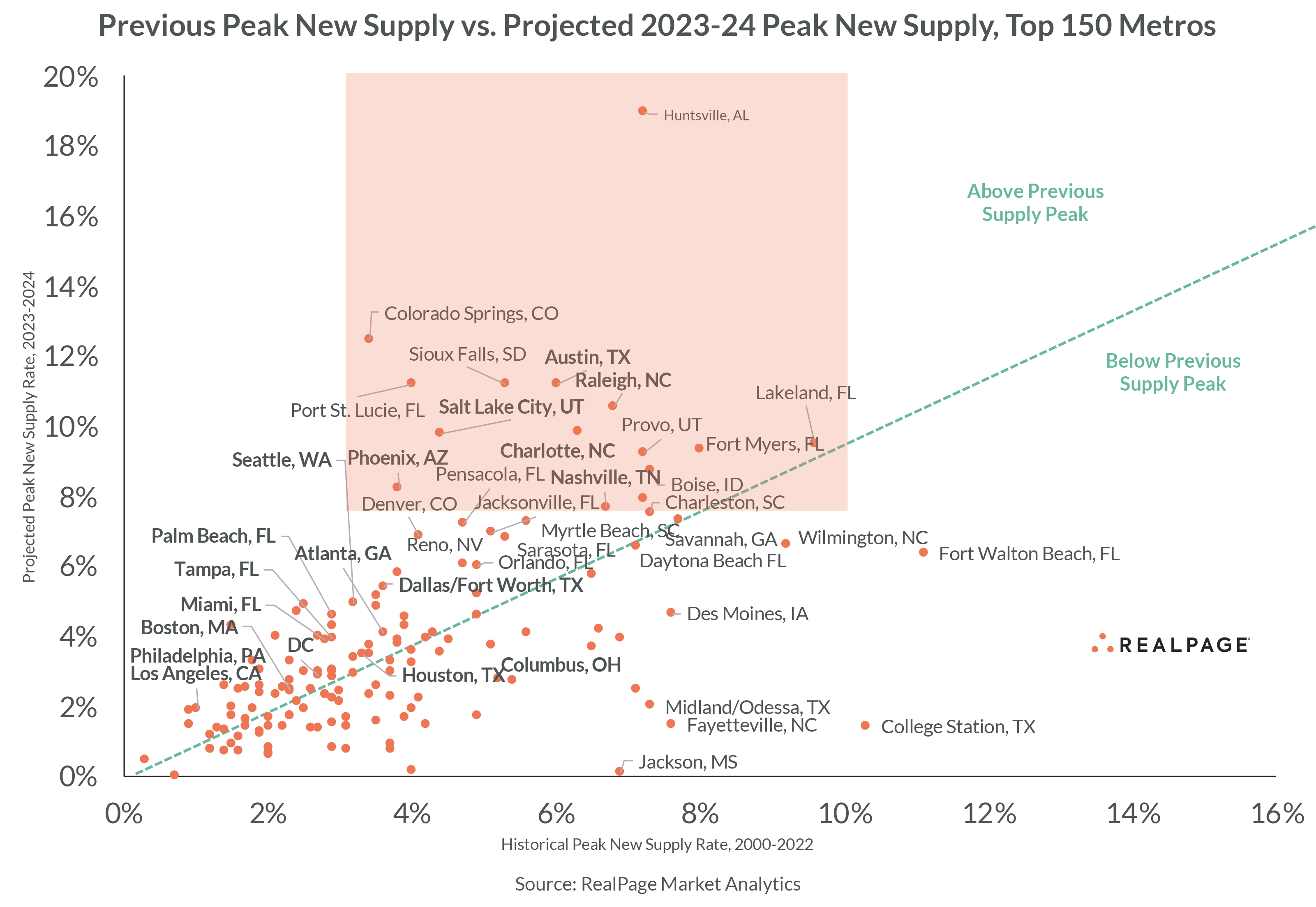

Via RealPage: Huntsville, AL has shattered its previous construction record and is projected to add nearly 20% to its current supply, but the sheer amount of markets breaking their respective records for newly-built apartments may bring similar challenges for multifamily performance that operators have faced this year.

- A Majority of U.S. Apartment Renters Feel Satisfied, Despite Stigma (RealPage)

- Rent Growth in 2024: Demand-Diluting Apartment Supply VS. Increased Renter Demand from High Homebuying Costs (GlobeSt)

- Report: Student Housing Well-Positioned for Fall 2023 Semester (Yardi Matrix)

Multifamily and the Housing Market

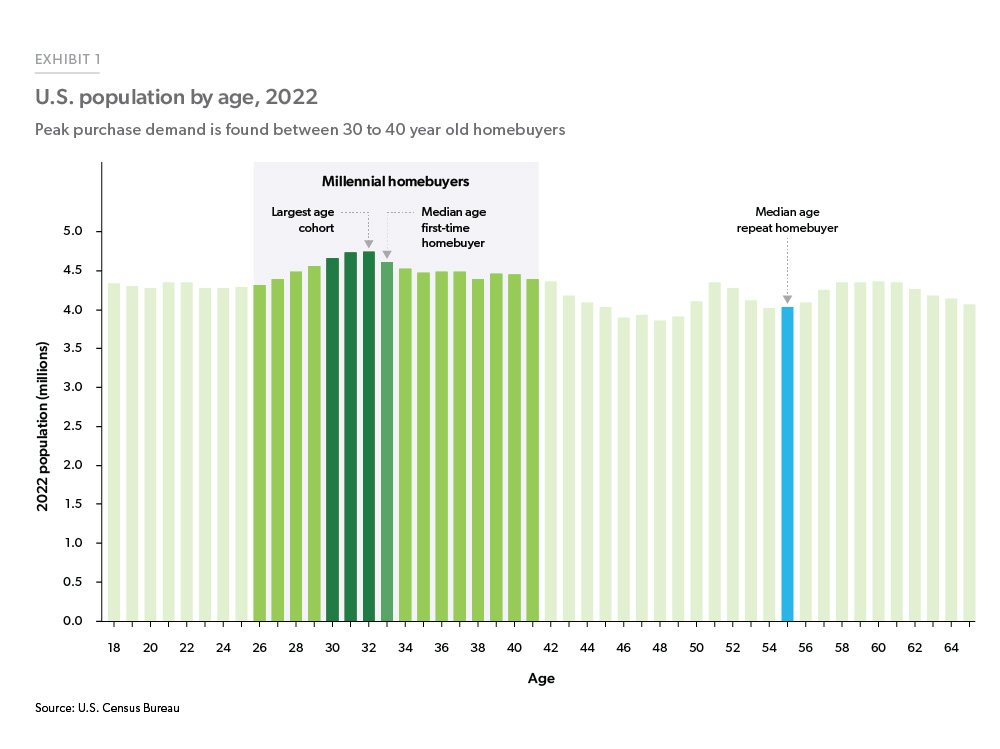

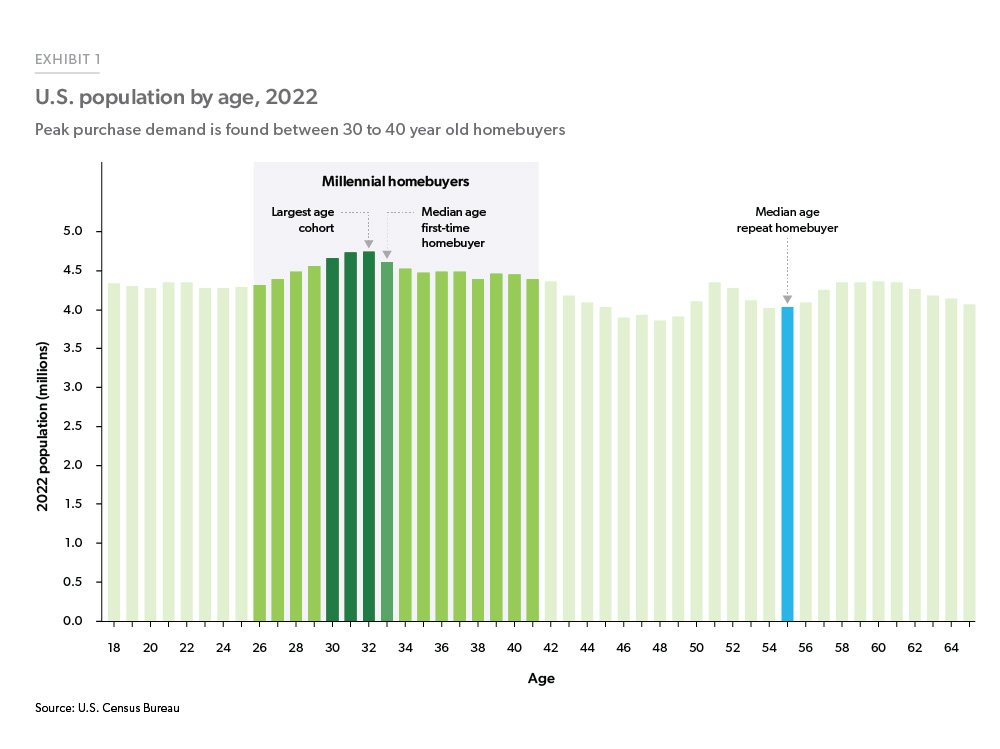

Millennial household formation—potential for 3 million additional households

Via Freddie Mac: Compared to similar age group trends for Generation X and the Baby Boomers, Millennials have 3 million fewer households, with significantly lower homeownership as well. Will more Millennials become long-term renters?

- Weakening of Residential Remodeling Activity Anticipated for 2024 (Harvard Joint Center for Housing Studies)

- As 8% Mortgage Rates Quash Home Sales, Economists Warn Of A ‘Huge Ripple Effect’ (Bisnow)

- Retail Sales Surprise to the Upside, While Existing Home Sales Hit Lowest Level Since 2010 (Fannie Mae)

Commercial Real Estate and the Macro Economy

As office CRE struggles continue, is it time to start worrying about multifamily debt?

Via Moody’s Analytics: From the report: “We think there is reason to be cautious that stagnating rent and higher interest rates could finally be catching up to the sector. We aren’t quite ready to fully sound the alarm on multifamily, but we are tentatively reaching for the handle.”

- Oct. 2023 CRE Market Insights: Rebounding Demand in the Multifamily Sector (NAR)

- If Big Data Puts the Squeeze on Renters, Why Have Rents Gone Down? (The Wall Street Journal)

- CMBS Third-Quarter Workouts Incur Big Losses (Commercial Observer)

Other Real Estate News and Reports

National Office Market, Oct. 2023: Success in Suburban Offices

Via Yardi Matrix: While the broader slowdown in the office market continues, “companies that move their office to the suburbs are increasingly looking towards vibrant mixed-use developments that mimic city centers.”

- Urban vs. Suburban Offices: Metrics, Distress, and the Road Ahead (Trepp)

- 10 High-Impact Moves to Reduce Total Cost of Occupancy (CBRE)

- Effective Medical Office Asset Management amid Economic Headwinds (Cushman & Wakefield)

Gray Report Newsletter: October 26, 2023

Fed Says CRE Prices Are Still Too High

Investors continuing to grapple with slow-moving CRE pricing trends are well in line with the results of the Federal Reserve’s recent survey on financial stability, which noted that commercial real estate valuations have not fallen at a rate commensurate with the increase in interest rates. While apartment buyers contend with higher prices, apartment renters have benefited from lower rent growth in 2023, with recent coverage of the housing market describing how rising mortgage rates and still-elevated home values have led to soaring costs of home ownership compared to the price of rent.

Multifamily, the Nation, and the Economy

Fed Financial Stability Survey: CRE Valuations Still Too High

Federal Reserve Bank of the United States: “Capitalization rates at the time of property purchase, which measure the annual income of commercial properties relative to their prices, have increased modestly from recent historically low levels but have not increased as much as real Treasury yields, suggesting that prices remain high relative to rental income.”

- There’s Never Been a Worse Time to Buy Instead of Rent (The Wall Street Journal)

- Commercial real estate drop “about halfway there”: Cohen & Steers (TheRealDeal)

- How the Multifamily Industry Survived 2023 (GlobeSt)

Multifamily Markets and Reports

Via RealPage: Huntsville, AL has shattered its previous construction record and is projected to add nearly 20% to its current supply, but the sheer amount of markets breaking their respective records for newly-built apartments may bring similar challenges for multifamily performance that operators have faced this year.

- A Majority of U.S. Apartment Renters Feel Satisfied, Despite Stigma (RealPage)

- Rent Growth in 2024: Demand-Diluting Apartment Supply VS. Increased Renter Demand from High Homebuying Costs (GlobeSt)

- Report: Student Housing Well-Positioned for Fall 2023 Semester (Yardi Matrix)

Multifamily and the Housing Market

Millennial household formation—potential for 3 million additional households

Via Freddie Mac: Compared to similar age group trends for Generation X and the Baby Boomers, Millennials have 3 million fewer households, with significantly lower homeownership as well. Will more Millennials become long-term renters?

- Weakening of Residential Remodeling Activity Anticipated for 2024 (Harvard Joint Center for Housing Studies)

- As 8% Mortgage Rates Quash Home Sales, Economists Warn Of A ‘Huge Ripple Effect’ (Bisnow)

- Retail Sales Surprise to the Upside, While Existing Home Sales Hit Lowest Level Since 2010 (Fannie Mae)

Commercial Real Estate and the Macro Economy

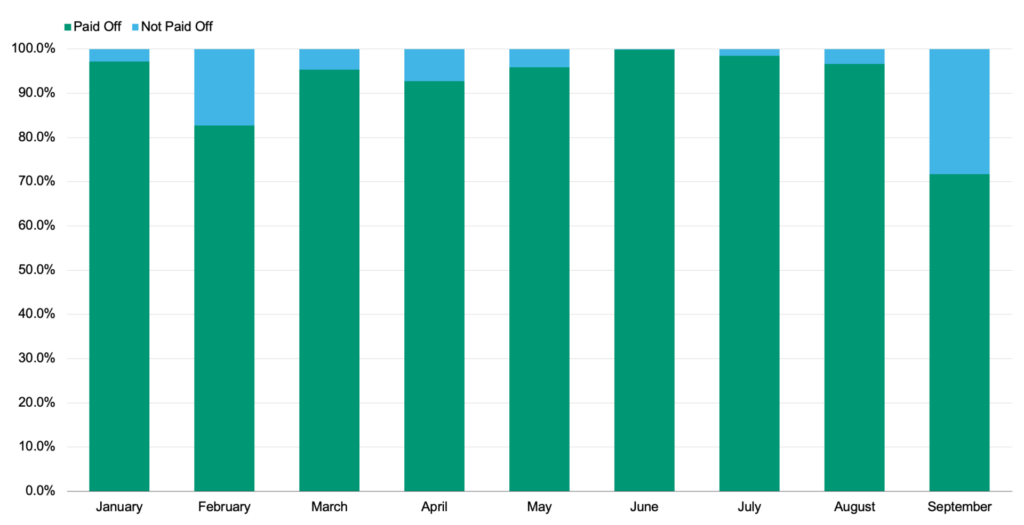

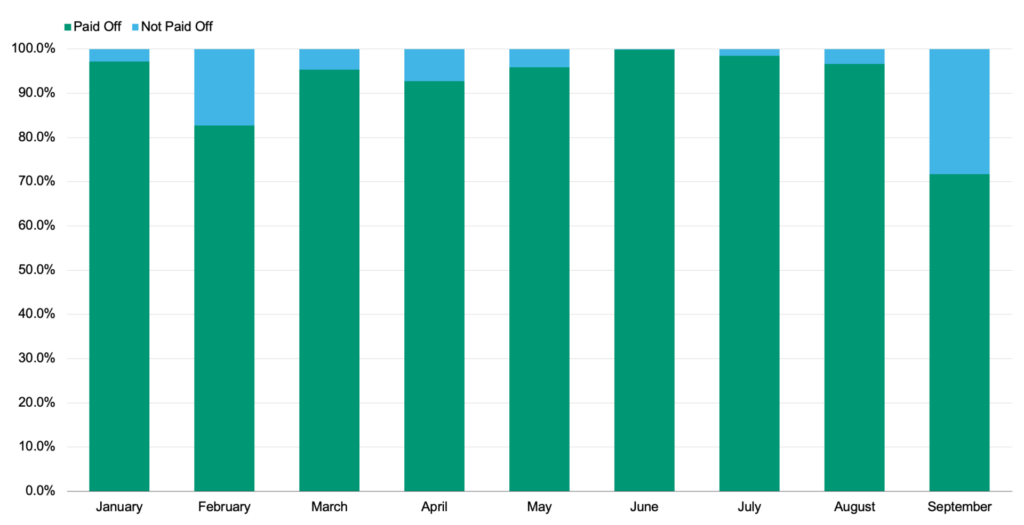

As office CRE struggles continue, is it time to start worrying about multifamily debt?

Via Moody’s Analytics: From the report: “We think there is reason to be cautious that stagnating rent and higher interest rates could finally be catching up to the sector. We aren’t quite ready to fully sound the alarm on multifamily, but we are tentatively reaching for the handle.”

- Oct. 2023 CRE Market Insights: Rebounding Demand in the Multifamily Sector (NAR)

- If Big Data Puts the Squeeze on Renters, Why Have Rents Gone Down? (The Wall Street Journal)

- CMBS Third-Quarter Workouts Incur Big Losses (Commercial Observer)

Other Real Estate News and Reports

National Office Market, Oct. 2023: Success in Suburban Offices

Via Yardi Matrix: While the broader slowdown in the office market continues, “companies that move their office to the suburbs are increasingly looking towards vibrant mixed-use developments that mimic city centers.”

- Urban vs. Suburban Offices: Metrics, Distress, and the Road Ahead (Trepp)

- 10 High-Impact Moves to Reduce Total Cost of Occupancy (CBRE)

- Effective Medical Office Asset Management amid Economic Headwinds (Cushman & Wakefield)