Gray Report Newsletter: September 5, 2024

CRE Investors Ready for the Rebound

While the stock market dipped lower following weaker jobs data, CRE investors are moving quickly in anticipation of a recovery in the markets and higher sales activity amidst a more favorable debt environment. One singular rate cut won’t make a dramatic difference for more borrowers, but CRE investors are forward-looking, and they see a rebound on the way after more than a year of lower activity and cooling valuations. For multifamily specifically, high absorption rates and strong demand drivers were cited in the most recent earnings reports from major apartment REITs, and while rent growth in 2024 is looking very similar to 2023, continued signs of the enormity of underlying housing demand have made apartment investors increasingly confident in the multifamily market’s performance moving into 2025 and beyond.

Multifamily, the Nation, and the Economy

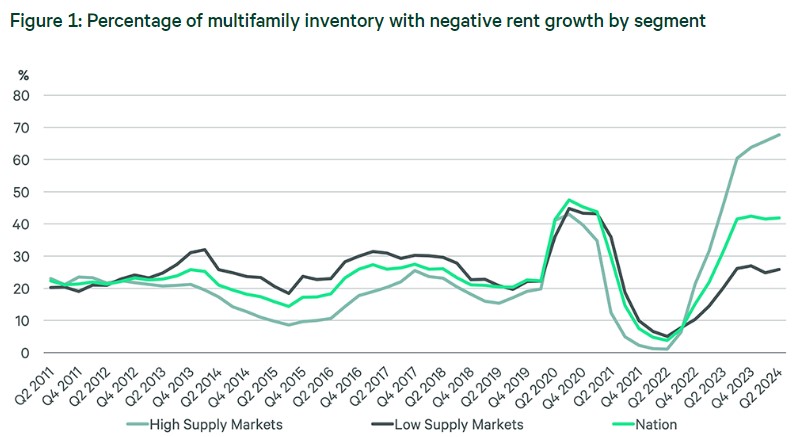

High-Supply Multifamily Markets Begin to Recover

Via CBRE: “Many multifamily markets that have seen the most growth in new supply, and consequently the most negative effective rent growth, may be recovering soon. Occupancy rates have stabilized across these markets as renter demand has absorbed much of this new supply.”

- Excellent Article on “The Labyrinthine Rules That Created a Housing Crisis” (The Atlantic)

- Wells Fargo Chief Economist: CRE Can Rebound On A Single Rate Cut, But Lending Will Be Slower To Move (Bisnow)

- Gray Capital Acquires $112M of Multifamily Assets in 2024 with the Acquisition of Solana at the Crossing (Yahoo Finance)

Multifamily and the Housing Market

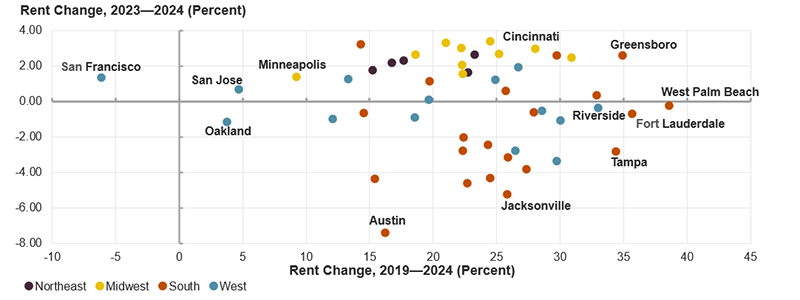

Rental Markets Are Cooling, but Rents Still Far Exceed Pre-Pandemic Levels

Via Harvard Joint Center for Housing Studies: “Even with recent declines, rents have increased most in the Southern region by 22.9 percent. But with continued rent growth over the past year, the Midwest and Northeast are catching up, with rents rising 22.1 percent and 21.4 percent respectively since 2019.”

- 10 Things to Know About the Mortgage and Housing Market Right Now (CoreLogic)

- The Nation’s Stock of Second Homes (NAHB)

- Pedestrian (On-Campus) Properties Still Command Premium in Student Housing (RealPage)

Multifamily Markets and Reports

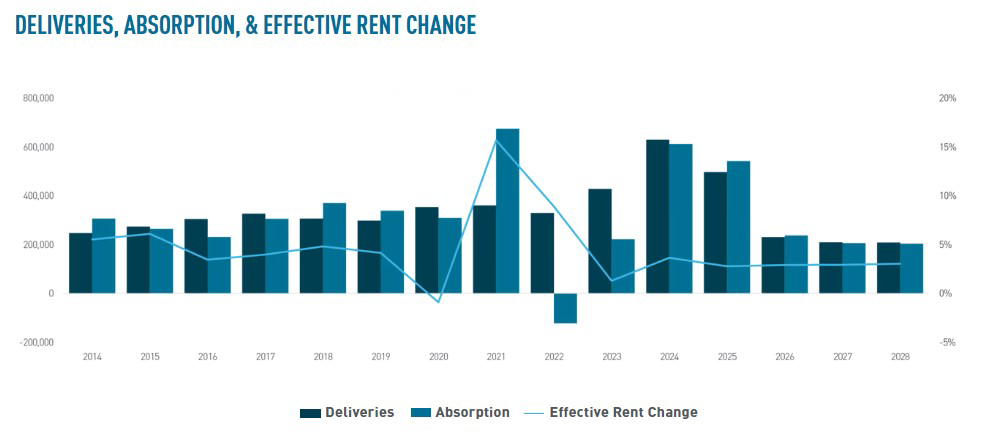

Berkadia: “Pent-up housing demand and limited single-family inventory for sale benefitted the U.S. apartment market to start 2024. Leasing activity nearly kept pace with the inflow of apartment inventory as occupancy averaged 94.2% in the second quarter of 2024, the same rate at the close of 2023.”

- Single Family Housing Influencing CRE Outlook (Marcus & Millichap)

- Major Themes in 2nd Quarter Earnings Calls from Multifamily REITs (RealPage)

- Construction Labor Market is Cooling (NAHB)

Commercial Real Estate and the Macro Economy

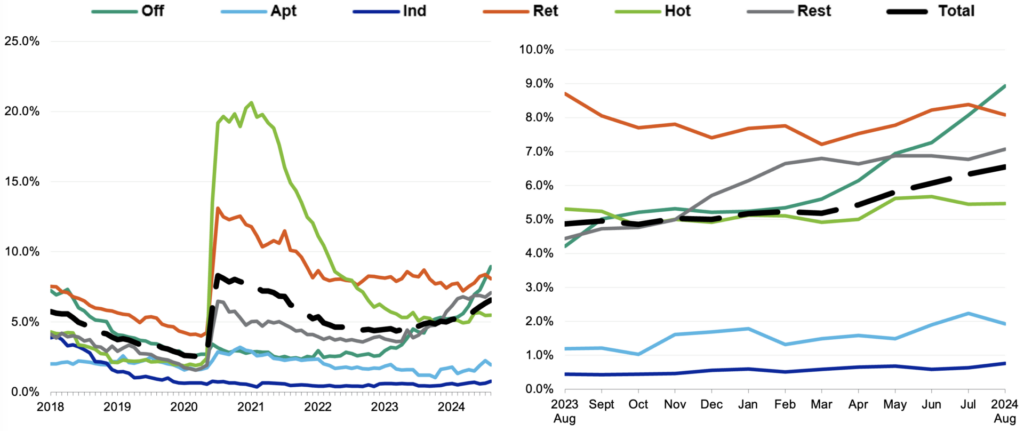

Delinquency Rates Approaching Pandemic Highs

Via Moody’s Analytics: “Conduit loan delinquencies ticked up for the tenth consecutive month to reach 6.5%. The rate is now 1.9% above their post-pandemic low of 4.6% in May of 2022 and 4% above their pre-pandemic low of 2.5% in March 2020.”

- Demand Surges for AI-Specialty Tech Talent (CBRE)

- Office Loan Maturity Monitor: U.G.L.Y.: Underperformance Grows vs Last Year (Moody’s Analytics)

- U.S. Hospitality Brand Performance Comparison Report | Q2 2024 (Colliers)

Other Real Estate News and Reports

CRE and Economic Market Conditions

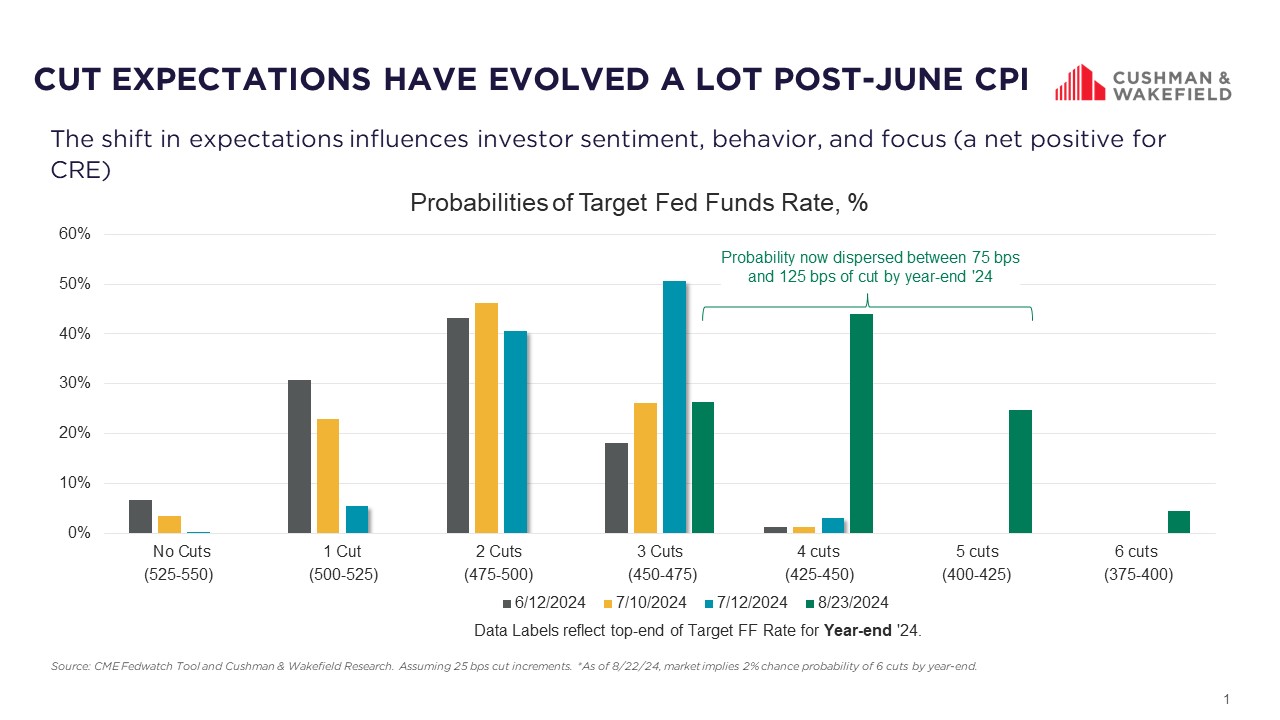

Via Cushman & Wakefield: “The first Fed cut reflects a meaningful turning point within the CRE capital markets recovery. While the full macroeconomic outlook will, as always, remain uncertain, the commencement of the cutting cycle will help provide investors and lenders with a sense of direction and vision for the path ahead.”

- August 2024 Commercial Real Estate Market Insights (NAR)

- Once Hot Life Science Real Estate Is Now Being Offered as Office Space (The Wall Street Journal)

- When Property Investors Want Out, These Bargain Hunters Rush In (The New York Times)