Multifamily Investments to Surge in 2025?

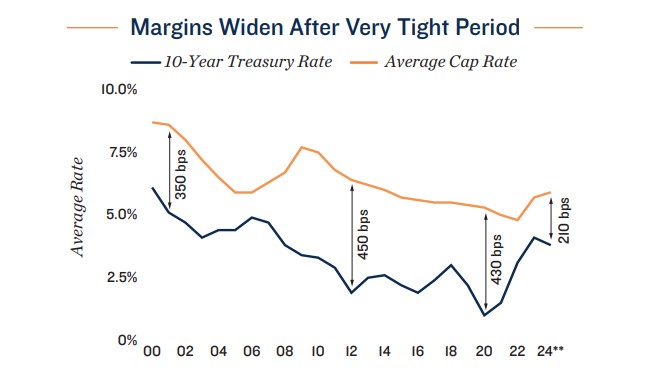

Conditions may not be perfect for multifamily investors right now, but the lending environment and supply/demand fundamentals are lining up for a significant improvements in 2025. With markets currently expecting two more rate cuts before the end of the year, cap rate-interest rate spreads may widen enough to bring more investment activity after a lengthy period in which sales volumes were half the pre-pandemic levels. Lengthy CRE transaction times mean that price discovery will not be instantaneous for the multifamily market, but there is a chance that, in areas with fewer properties currently on the market, pent up demand from investors could lead to some pricing volatility in the short-term.

Multifamily, the Nation, and the Economy

Q3 2024 Multifamily Report: Expanding Renter Pool Limits Impact from Surge of New Apartments

Via Marcus & Millichap: “The net absorption of nearly 260,000 apartments across the opening two quarters of this year exceeded the prior 12-month total by almost 35,000 units.”

- The Times They Are a-changin’ as More Markets Clear Their Hurdle Rate (CBRE)

- Fed Cuts Interest Rates Amid Sluggish Existing Sales but a Rebound in Starts Activity (Fannie Mae)

- America Needs More Affordable Housing, Not Just Class A Inventory (Moody’s Analytics)

Multifamily and the Housing Market

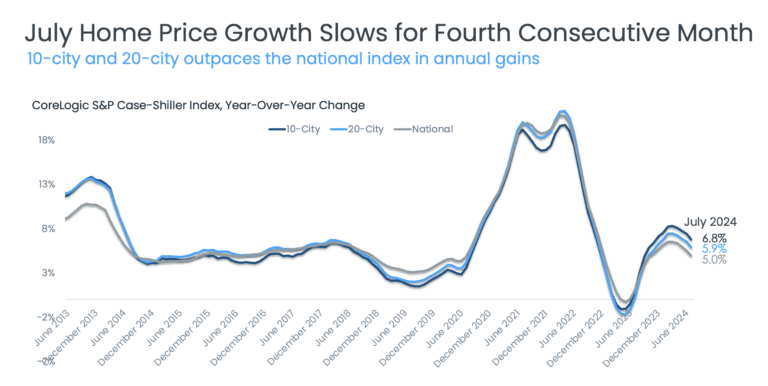

Via CoreLogic: “Although reluctant buyers stalled 2024 home sales activity to levels not seen since the Great Financial Crisis, expectations that the Federal Reserve will continue to cut rates influenced mortgage rates to decline and started to infuse some life back into the housing market.”

- Midwest Markets Report Notably Tight Apartment Occupancy (RealPage)

- DOJ Lawsuit Against RealPage Forcing Change In How Landlords Price Rents (Bisnow)

- Algorithmic Rent Pricing in the Headlines (Institutional Property Advisors)

Multifamily Markets and Reports

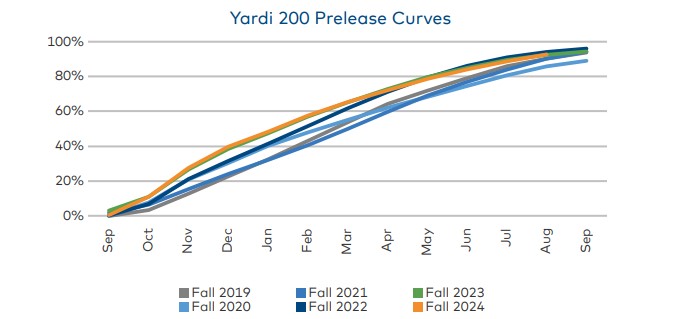

September 2024 Student Housing Report: Preleasing, Rent Growth Inch Toward Finish

Yardi Matrix: “Surveyed preleasing for the Yardi 200 reached 92.9% in August 2024, 20 basis points ahead of August 2023, as many markets welcomed student tenants back during the month. Rent growth slipped to 4%, as properties strove to fill up late in the leasing season, but has averaged 5.8% since October 2023.”

- CMBS Surveillance: Four Multifamily Loans to Watch as Delinquency Rates Are on the Rise (Trepp)

- Underwater Multifamily Borrowers See Chance For Off-Ramp With Fed Rate Cuts (Bisnow)

- Consumer Confidence Weakened as Consumers Worry About Jobs (The Conference Board)

Commercial Real Estate and the Macro Economy

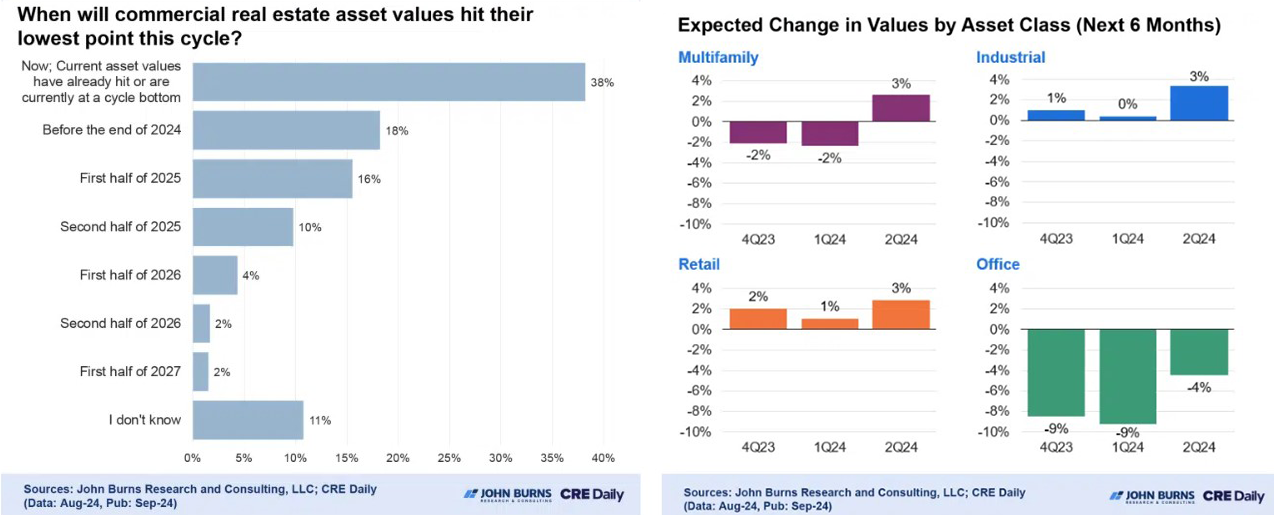

Investors say the worst is over for commercial real estate

Via John Burns Research and Consulting: “Despite recent challenges in commercial real estate (CRE), most investors expect growth in the near future. Over half (56%) expect CRE asset values to bottom out in 2024, while 38% think values have already reached their lowest point.”

- An Inside Look at the Top 25 U.S. Industrial & Logistics Markets (Colliers)

- Why real estate investors are watching the dollar (JLL)

- FAU Expert: Unrealized Losses Drop as Banks Offload Securities (Florida Atlantic University)

Other Real Estate News and Reports

U.S. Economic, Housing and Mortgage Market Outlook – September 2024

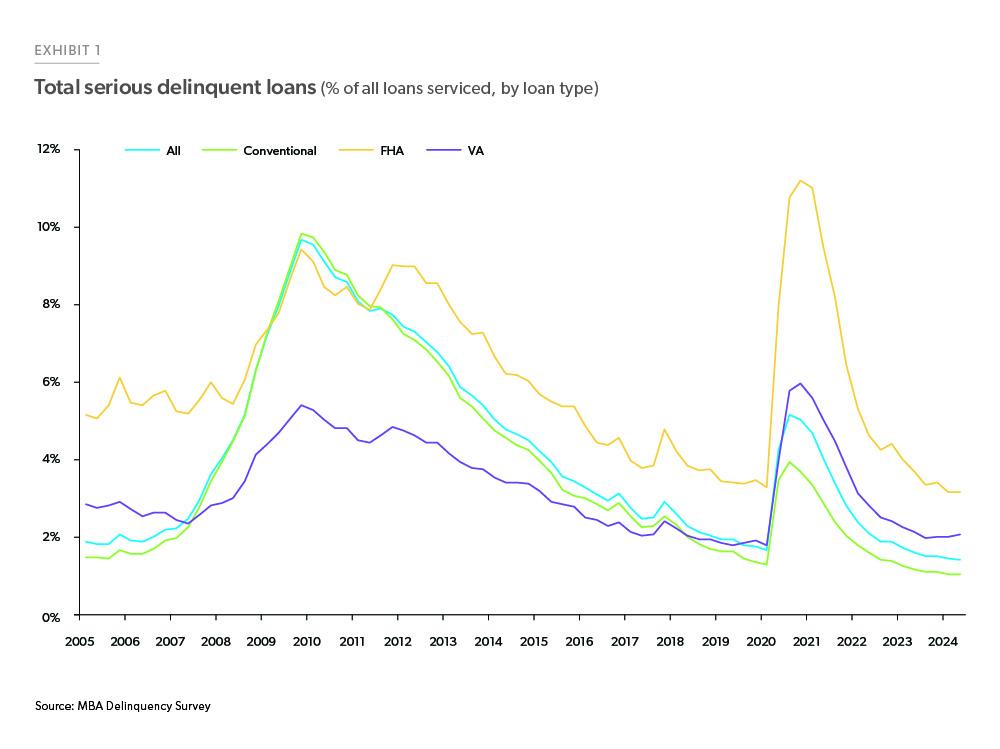

Via Freddie Mac: ” While early-stage delinquencies have been rising modestly, serious delinquency rates continue to fall, indicating that homeowners are able to deal with short-term distress and avoid serious delinquencies and foreclosures.”

- REPORT: More Than 8 in 10 CEOs Think Hybrid Work Will Be Dead Within 3 Years (Bisnow)

- September 2024 National Office Report: The Life Science Supply Problem (Yardi Matrix)

- The Rate Cut Won’t Save These Real-Estate Owners (The Wall Street Journal)