Gray Report Newsletter: September 12, 2024

CRE Investors Ready for the Rebound

With CPI showing continued declines in inflation this week and lower ten-year treasury yields foreshadowing an expected interest rate reduction from the Federal Reserve, investors continue to show more activity and interest in the CRE investment market, with multifamily properties specifically showing noticeable positive growth in property prices since the beginning of the year. Rents in the apartment sector will likely follow a similar trajectory as 2023, with seasonal trends pointing to slower rent growth through the end of the year, but investors are not blind to the prospects of the multifamily market and are acting on expectations of stronger performance as the surge in newly-built apartments wanes through the end of 2024 and into 2025.

Multifamily, the Nation, and the Economy

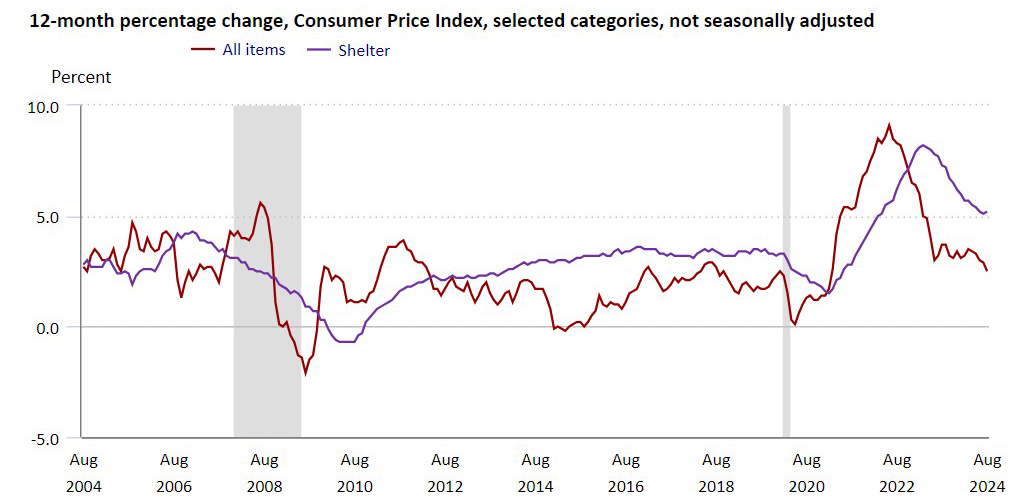

CPI: Annual Inflation Down from 2.9% to 2.5%

Via Bureau of Labor Statistics: All items inflation increased 0.2% in August, and “[o]ver the last 12 months, the all items index increased 2.5 percent before seasonal adjustment. The index for shelter rose 0.5 percent in August and was the main factor in the all items increase.”

- Major CRE Capital Markets Report: Major Investors Return to the Market (Colliers)

- U.S. Apartment Market Sees Negligible Change in August (RealPage)

- Chicagoland Matches Miami for Hottest Rental Market, Fueled by Rise of the Midwest (RentCafe)

Multifamily and the Housing Market

August 2024 National Rent Report: Peak Leasing Season Ends

Via Apartment List: “[C]umulative rent increases during the summer season have been lower than previous years. Meanwhile, seasonal declines have been more pronounced. This reflects the sluggish, supply-rich rental market that has persisted since late-2022.”

- US Home Price Insights: 4.3% Annual Increase through July (CoreLogic)

- Residential Real Estate Market Snapshot (NAR)

- Mortgage Rate Optimism Spikes, but Homebuying Pessimism Persists (Fannie Mae)

Multifamily Markets and Reports

August 2024 National Rent Report: Rents Flat, Lower for A, B-Class Properties

Yardi Matrix: “Demand continues to hold up, keeping the national occupancy rate unchanged at 94.7% in the face of rapid supply growth,” but monthly rents fell, driven by declines in the higher-end apartment segment that has been dominated by the influx of new apartment supply.

- Affordability Challenges and the Composition of Middle-Income Renters (Harvard Joint Center for Housing Studies)

- Roommate Households Are More Common Along the Coast (RealPage)

- Home Building Data: Multifamily Construction Slows as Single-Family Building Growth (NAHB)

Commercial Real Estate and the Macro Economy

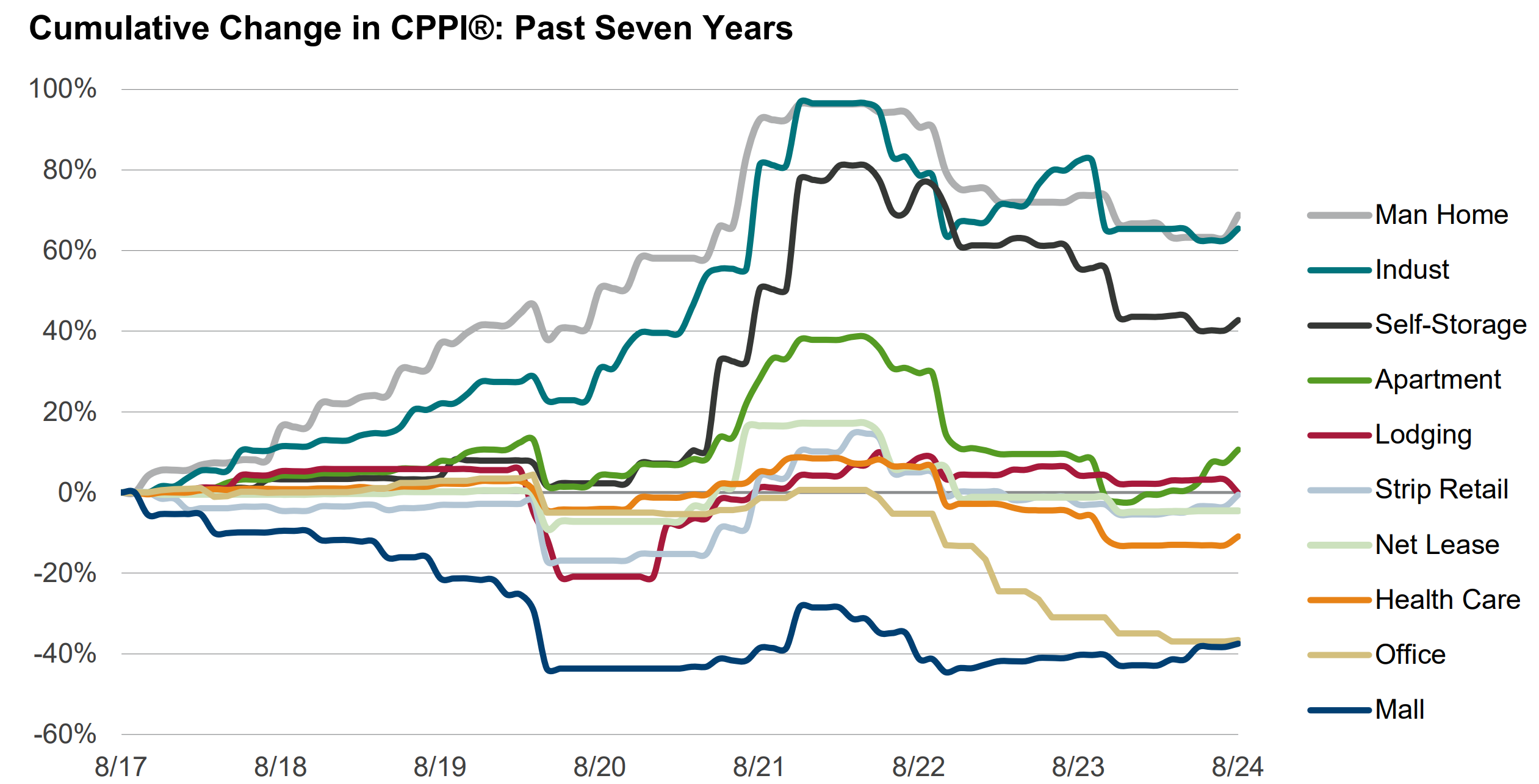

Property Price Index Shows More Growth, Up More Than 3% This Year

Via Green Street: “There’s a good chance the momentum in pricing continues. Property prices have not risen as fast as bond yields have fallen, and share prices of many listed REITs are now higher than the underlying value of their properties.”

- 2024 Mid-Year National Life Science Market Overview (Newmark)

- U.S. Hotels State of the Union September 2024 Edition (CBRE)

- U.S. Self Storage: Market Trends & Outlook (Cushman & Wakefield)

Other Real Estate News and Reports

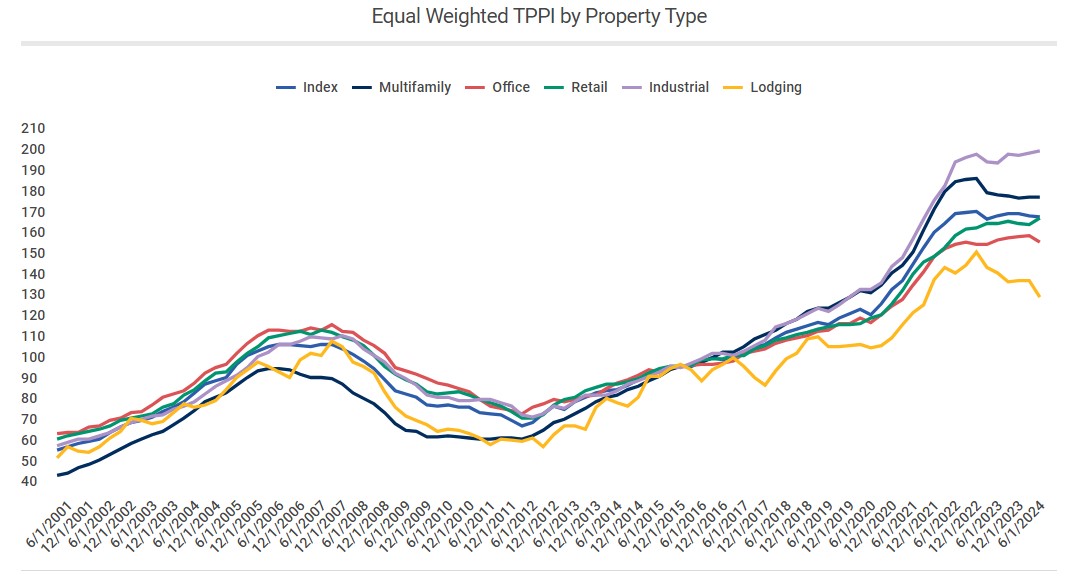

Trepp Property Price Index (TPPI) 2024 Q2

Via Trepp: “The Federal Reserve’s rate hike in March 2022 appears to have interrupted rapid price growth across all CRE sectors, though its impact has been uneven. Since early 2022, some CRE sectors have experienced significant price declines, while others have seen prices stall to varying degrees over the past two years.”

- Job Market Strengthens CRE Investment Outlook (Marcus & Millichap)

- As the Labor Market Continues to Cool, a September Rate Cut Grows Imminent (Berkadia)

- Increasing Office Visits Not A Panacea for Record High Vacancy Rates (Moody’s Analytics)