Housing Market Freeze in Q4 2024?

Price growth for single family homes is weakening, and while further declines are expected, underlying drivers of housing demand point to stronger growth in 2025. In the apartment market, rent growth in 2024 has followed a similar trajectory as 2023, but as apartment supply growth is expected to decline through 2025 and into 2026, continued growth among the renter population will bring stronger performance for apartment assets at the same time as (expected) lower interest rates should fuel more sales activity for multifamily properties. The apartment market may be cooler in late 2024, but investors are ready for a much hotter market in 2025.

Multifamily, the Nation, and the Economy

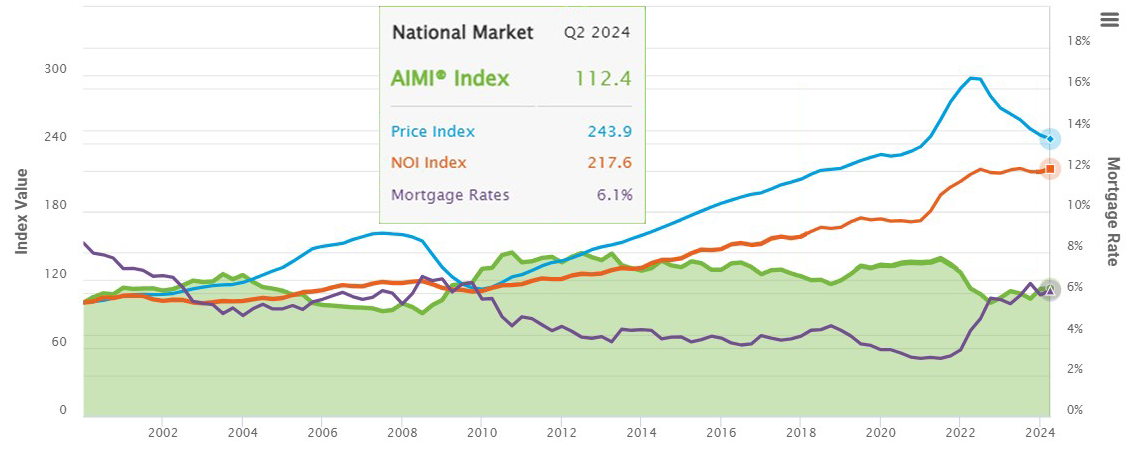

Multifamily Apartment Investment Market Index Inches Up Nationwide in Q2 2024

Via Freddie Mac: Freddie Mac’s apartment investment index “continues to show slight growth quarter over quarter, as well as year over year, as the market continues to work towards stabilization after significant volatility.”

- Rent burden may not hinge on the election result (Moody’s Analytics)

- VP Debate: How J.D. Vance and Tim Walz Differ on the Housing Crisis—and One Point of Agreement (Realtor.com)

- Energy Code Requirement Could Impact Multifamily Development, Rents (GlobeSt)

Multifamily and the Housing Market

US house prices are forecast to rise more than 4% next year

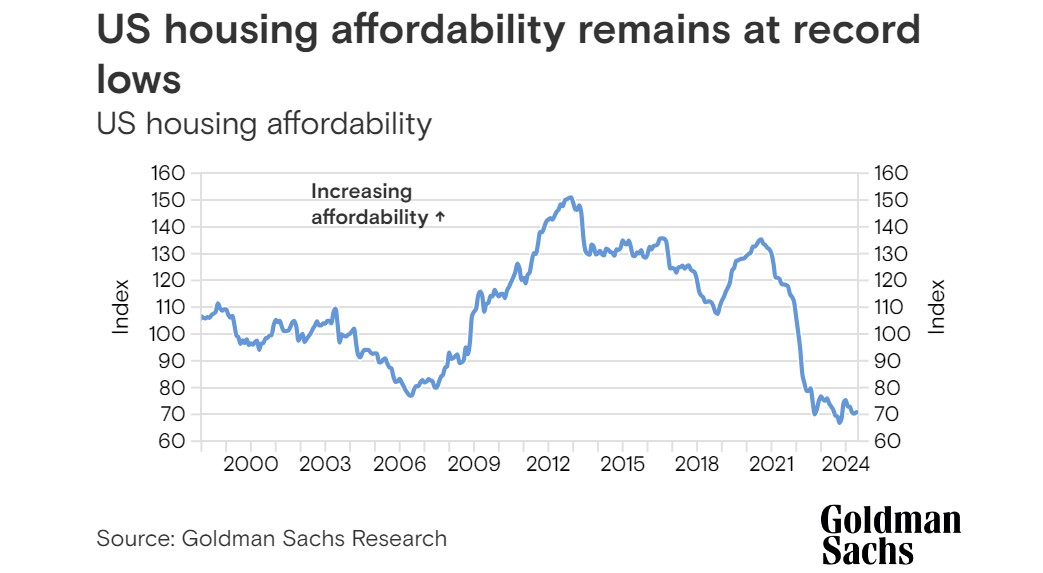

Via Goldman Sachs: “[R]ates are falling because of concerns around employment, and we don’t think those concerns will really affect the housing market without income loss . . . We believe we’re well past the peak in mortgage rates, and we think it’s going to be a slow but steady grind lower over the coming years.”

- Residential Real Estate: However, it will take several years for the housing supply to align with job growth and overall market demand. (NAR)

- Homebuying Out of Reach for Many Households Despite Lower Debt Costs (Institutional Property Advisors)

- How Nonprofits Are Using Accessory Dwelling Units as an Affordable Housing Strategy (Harvard Joint Center for Housing Studies)

- Home Price Growth Down 1% to 3.9% YoY with More Declines Expected (CoreLogic)

Multifamily Markets and Reports

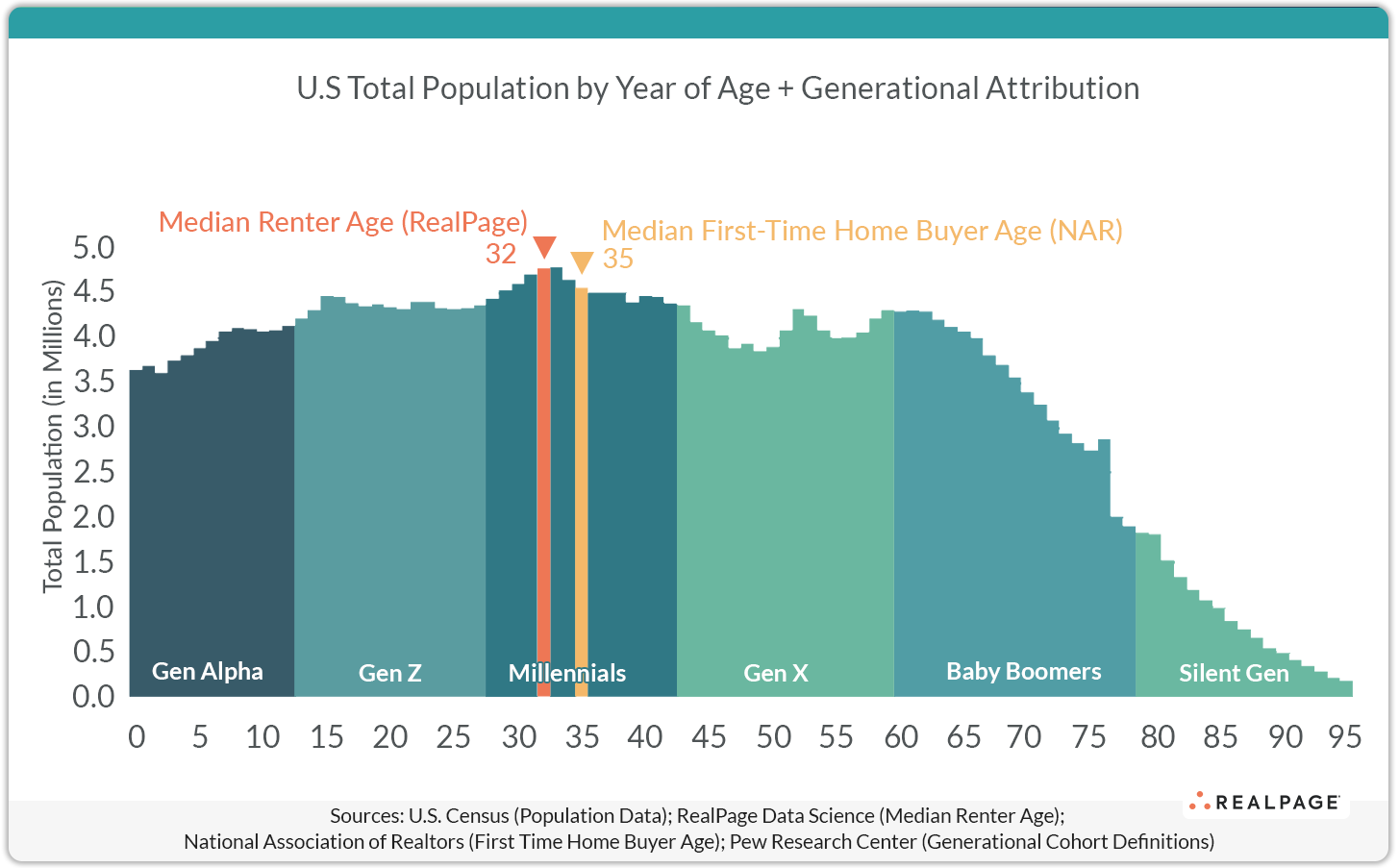

U.S. Demographics Support Continued Housing Demand

RealPage: “Demographics of U.S. apartment renters demonstrate continued support for housing demand, based on several layers of data analyzed by RealPage . . . The median age of apartment renters in the U.S. is 32, according to RealPage. The median age for first-time home buyers in the U.S. is 35, according to National Association of Realtors.”

- Asking Rents for New Apartments Drop 6% to Lowest Level Since 2022, as Finished Buildings Soar (Redfin)

- National Migration Trends: South the Only Region with Positive In-Migration (Colliers)

- Chicagoland Matches Miami for Hottest Rental Market, Fueled by Rise of the Midwest (RentCafe)

Commercial Real Estate and the Macro Economy

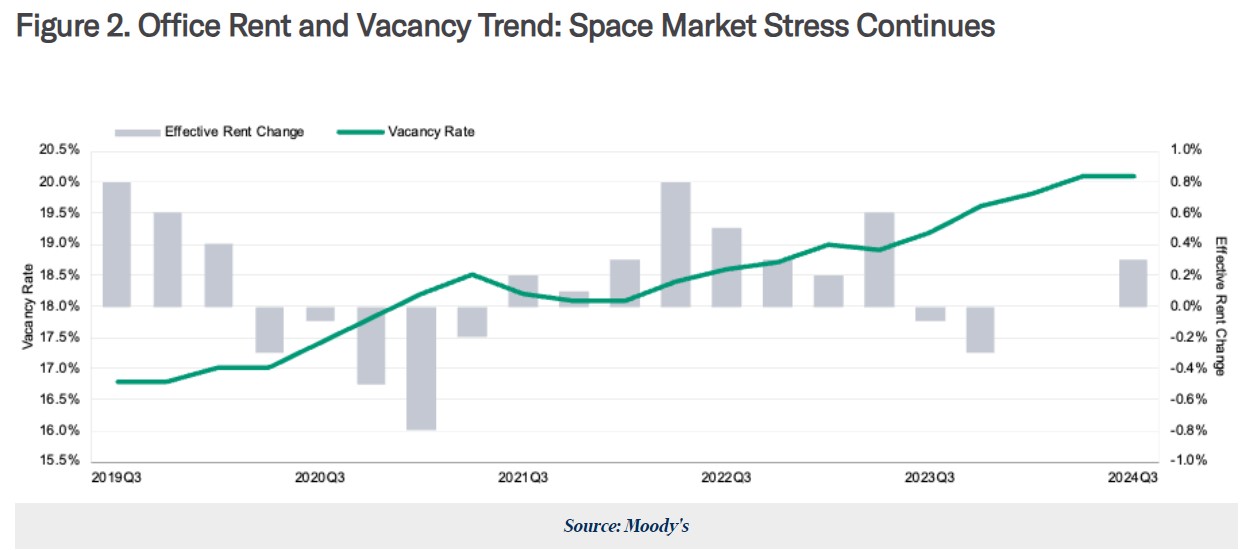

Q3 2024 CRE Trends: Multifamily Steady, Office Stress, Industrial Sector Cools

Via Moody’s Analytics: “The 50-bps rate cut from September’s FOMC meeting was a significant move towards economic recovery . . . Moreover, lower inflation rates, full employment, and steady wage growth should continue to foster healthy household formation and strengthen renters’ financial buffers, thereby supporting sustainable consumer spending and housing demand.”

- Reimagining Cities: Disrupting the Urban Doom Loop (Cushman & Wakefield)

- Office Loans Maturing in a Disrupted Property Market (MSCI)

- 2024 Global Midyear Hotels Outlook: Performance Lower than Forecasted (CBRE)

Other Real Estate News and Reports

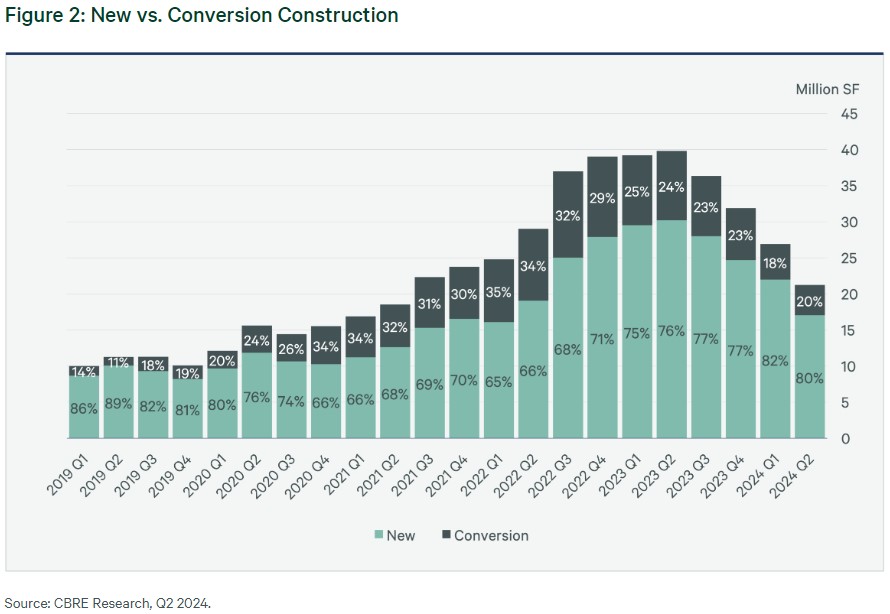

Life Sciences Construction Trends: Changing Dynamics Amid Uncertain Times

Via CBRE: “After the mad dash for lab/R&D space that began in late 2020, the amount of lab/R&D space under construction in the top 13 U.S. life sciences markets peaked at nearly 40 million sq. ft. in Q2 2023.”

- Rebound for Construction Job Openings (NAHB)

- CRE Investors’ Top Question About Interest Rates (Marcus & Millichap)

- CMBS Delinquency Rate Jumps in September 2024, Driven by Retail Sector (Trepp)

- Adam Neumann Dives Back Into Coworking With WeWork Competitor (Bisnow)