Extend-and-Pretend Meets Grim Reality

10-year treasury yields are higher despite the rate cut trajectory from the Fed, and while CRE prices have made some progress recently, some borrowers and lenders remain under pressure with property values still down from their peak and interest rates still elevated at this point in the rate cycle. For lenders that are taking the “extend-and-pretend” approach, placing less emphasis on valuation declines, and waiting for lower rates, the risks have not abated, and the New York Fed has taken notice in a new report.

Multifamily, the Nation, and the Economy

Extend-and-Pretend in the U.S. CRE Market

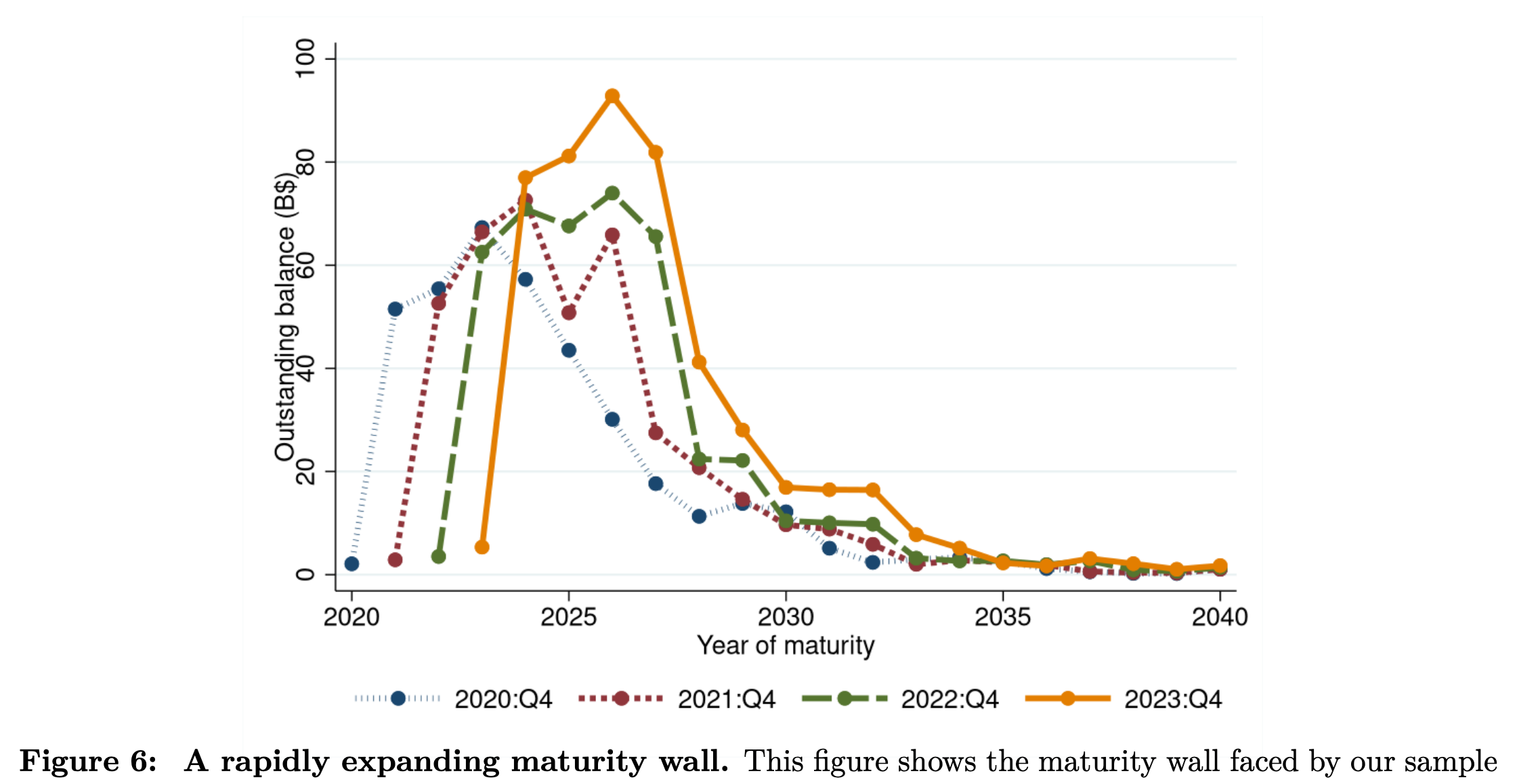

Via Federal Reserve Bank of New York: “This extend-and-pretend behavior has also led to an ever-expanding “maturity wall”, namely an increasing volume of CRE loans set to mature in the near term—which, as we later argue, represents a meaningful financial stability risk.”

- HUD Changes to DSCR and LTV to Encourage Expanding Housing Supply (U.S. Department of Housing and Urban Development)

- New Residential Construction in 5 Graphs (Moody’s Analytics)

- Both Presidential Candidates Want To Solve The Housing Crisis. Do They Have The Power? (Bisnow)

Multifamily and the Housing Market

A Detailed Overview of the Build-to-Rent Market

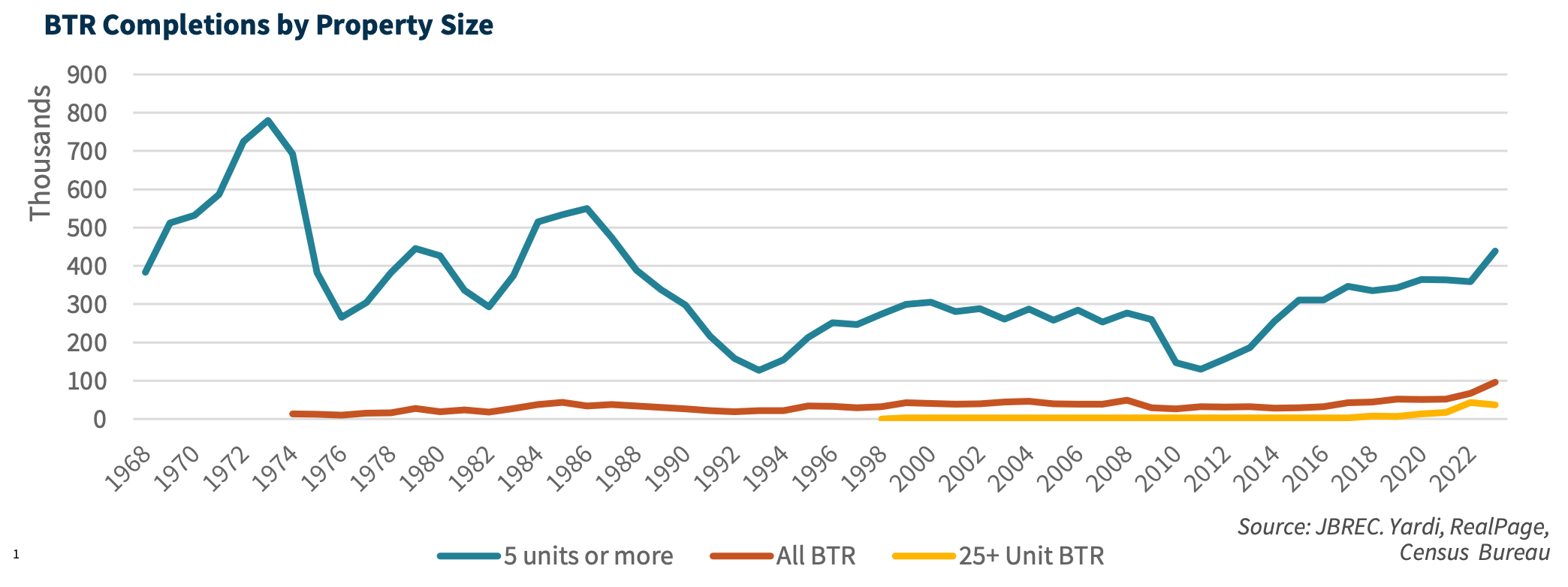

Via Fannie Mae: “BTR is still a nascent asset class in the housing sector, but it is growing, and we believe it could become a larger alternative to homeownership over the longer term. The pandemic led to a large rise in demand for BTR, which the industry responded to by generating a sudden influx of new units, as well as creating a new asset class by including some existing housing product types.”

- Build-to-Rent Residential Market Overview (CBRE)

- US Single-Family Rent Index – October 2024 (CoreLogic)

- Purpose-Built SFR Communities Catch the Eye of BTR Operators (GlobeSt)

Multifamily Markets and Reports

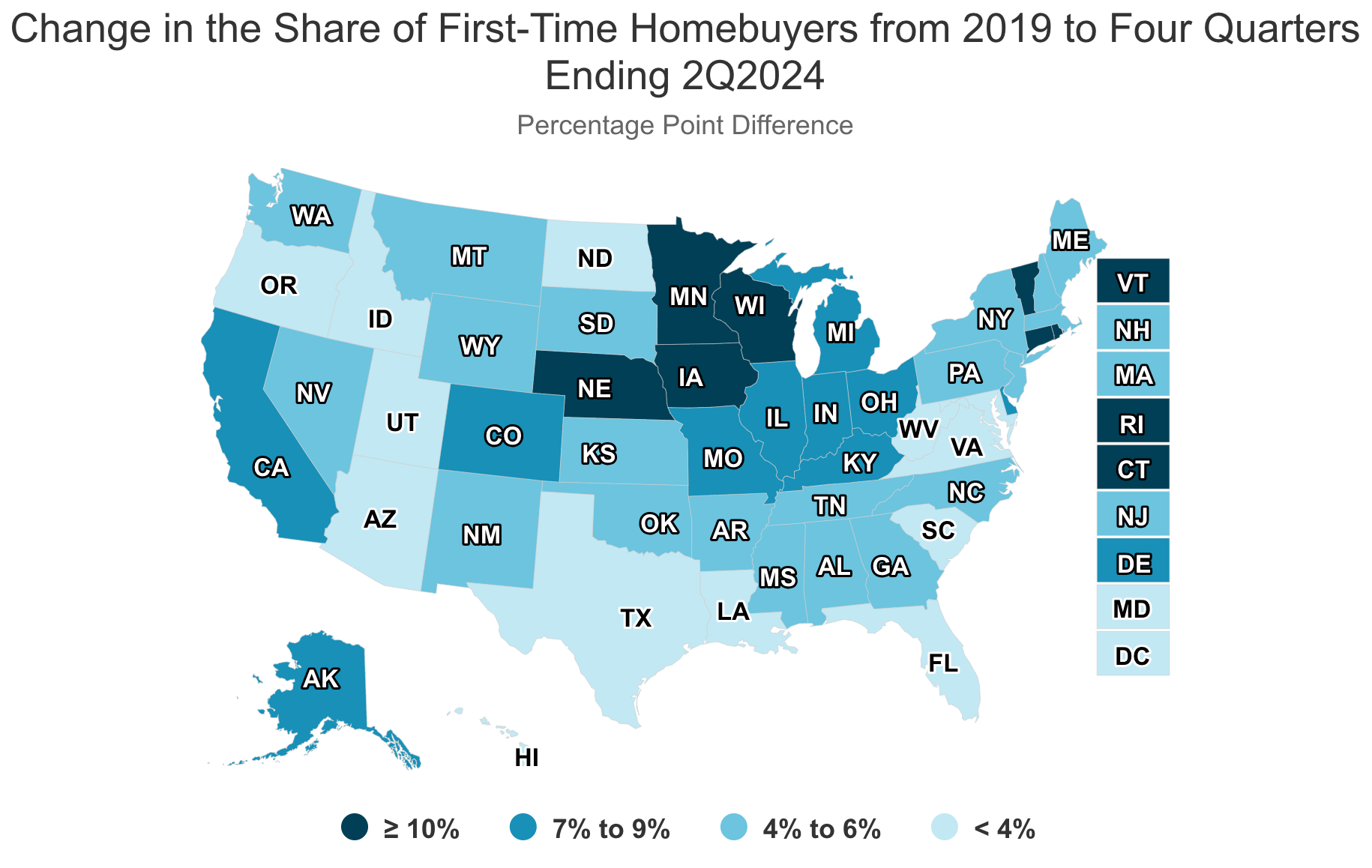

Strong Demand from First-Time Homebuyers, but Headwinds Remain

Freddie Mac: “Millennials are now of prime homebuying age, and Gen Z’s oldest members are entering the workforce. These two cohorts will become the driving force in the housing market in the coming years and add to the pool of first-time buyers.”

- Housing Cost Burdens Across Congressional Districts (NAHB)

- A Blueprint for Intergenerational Living (Harvard Joint Center for Housing Studies)

- The Fed cut interest rates, but mortgage rates aren’t falling (John Burns Research and Consulting)

Commercial Real Estate and the Macro Economy

What REIT Share Prices Say About Where Commercial Real Estate Values Are Headed

Via CBRE: “Today, expected falling interest rates and continued economic growth means that the public markets are pricing-in future cap rate compression. As such, REIT-implied cap rates are trending back below private market valuations.”

- What if cities finally legalized adult dorms? (Vox)

- Office Market Statistics | Q3 2024 (Colliers)

- More to Revival of Listed US Real Estate Than Rate Cuts [but a lot is from rate cuts] (MSCI)

Other Real Estate News and Reports

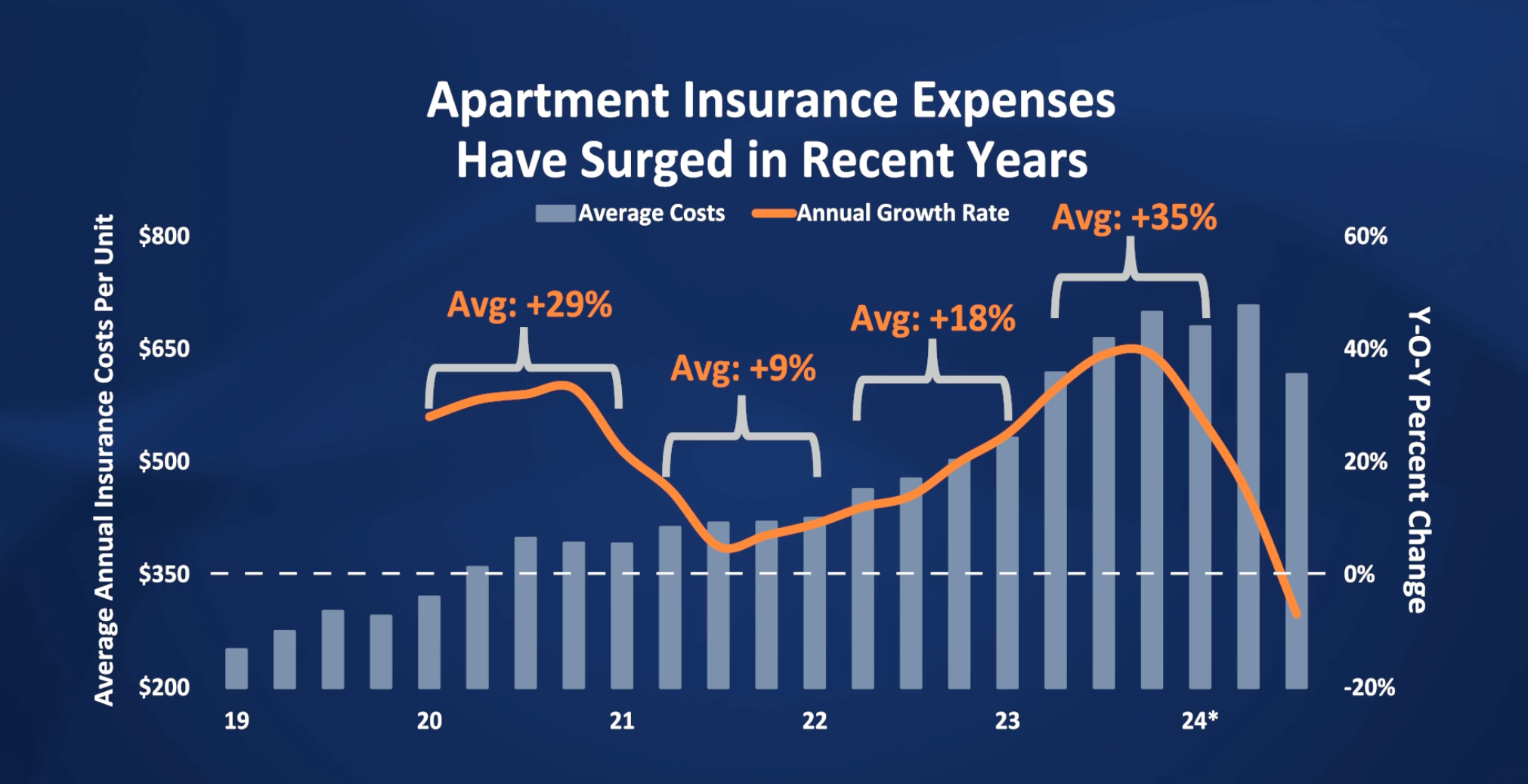

Why CRE Insurance Costs Are Poised to Surge

Via Marcus & Millichap: “[I]f you look at the five-year span from the third quarter of 2019 to the third quarter of 2024, insurance rates have doubled, but the rate increases haven’t been evenly distributed. Some metros have gone up more than others.”

- As Hurricanes Strike, Insurance Costs Soar for Commercial Real Estate (New York Times)

- U.S. Retailer Industry Foot Traffic Analysis | September 2024 (Colliers)

- From Coast to Coast: Which Are the Most Livable Places in the U.S. in 2024? (RentCafe)