Economic Vibe Shift or False Hope?

Consumer sentiment is shifting as inflation expectations stabilize and more consumers expect lower interest rates in the next 12 months, but after such a long period of economic uncertainty, confidence in the economy is more difficult to find. In the multifamily market, regional differences in apartment supply continue to impact rent growth, but investment activity is poised to increase across all CRE sectors as the Fed continues the current rate cut trajectory.

Multifamily, the Nation, and the Economy

Survey of Consumer Expectations: Job, Interest Sentiment Improve, but Debt Worries Worsen

Via Federal Reserve Bank of New York: “Perceptions and expectations of credit access improved compared to a year ago; however, the average perceived probability of missing a minimum debt payment over the next three months increased to 14.2 percent from 13.6 percent in August, the highest reading of the series since April 2020.”

- Multifamily Investors Target Newer Assets for Stable Cash Flows (GlobeSt)

- Are big CRE deals suffering more than smaller ones? (CBRE)

- The “Weird” Reason Rents Are Rising in the Midwest—but Falling Down South (Realtor.com)

Multifamily and the Housing Market

Impact of Interest Rate Cuts on Real Estate Cap Rates

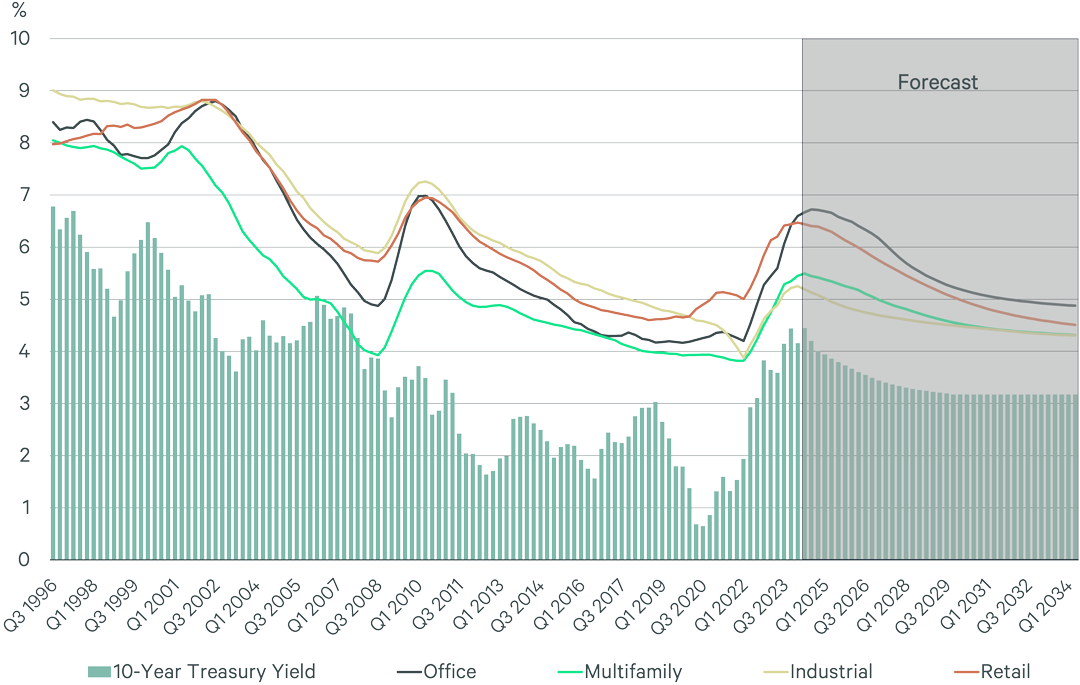

Via CBRE: CBRE “expect[s] that the 10-year Treasury yield will average below 4% for the rest of 2024 and drift down to the mid-3% range in 2025. Treasury yields at that level will put downward pressure on cap rates as the lower cost of capital supports investment activity and asset values.”

- 10 Major Housing Stories from the Latest Housing Census Data (Harvard Joint Center for Housing Studies)

- Homebuyers are pulling back from housing market again (CoStar)

- Fannie Mae CEO says she has never seen a housing market like this before (MarketWatch)

Multifamily Markets and Reports

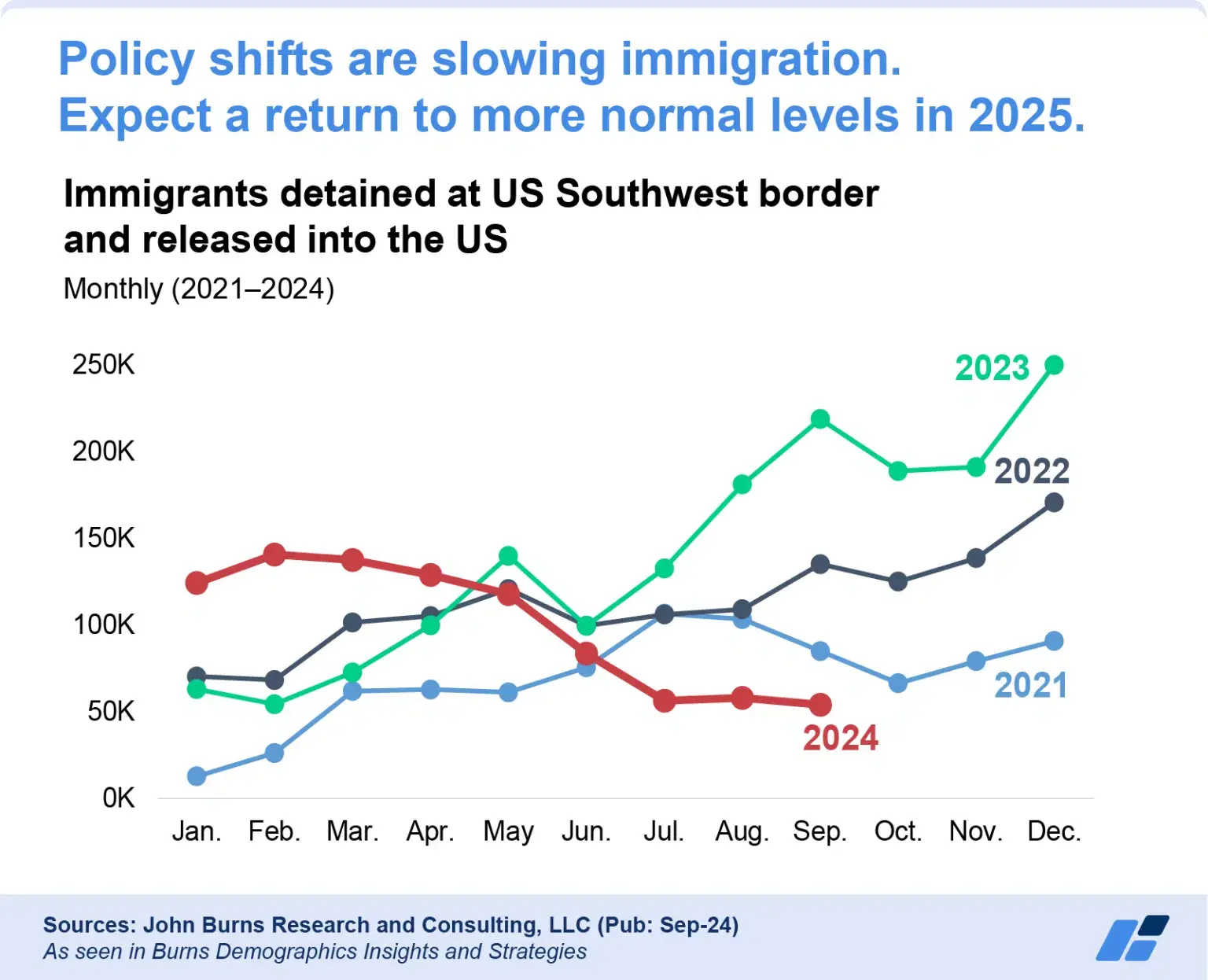

Slowing immigration set to give a smaller boost to housing

John Burns Research and Consulting: “Most new immigrants rent homes. Of the 700K extra new households from higher-than-normal immigration during 2022–2024P, we estimate 600K were renters. Putting the magnitude of these extra new households into perspective, 600K additional renter households over this 3-year period amount to 133% of the new multifamily housing units completed in an average year.”

- Markets with Apartment Demand at All-Time Highs (RealPage)

- Could Legalizing Mid-Rise Single-Stair Housing Expand and Improve Housing Supply? (JCHS)

- Rental Activity Report: Detroit Takes the Crown, South Is Renters’ Preferred Region (RentCafe)

Commercial Real Estate and the Macro Economy

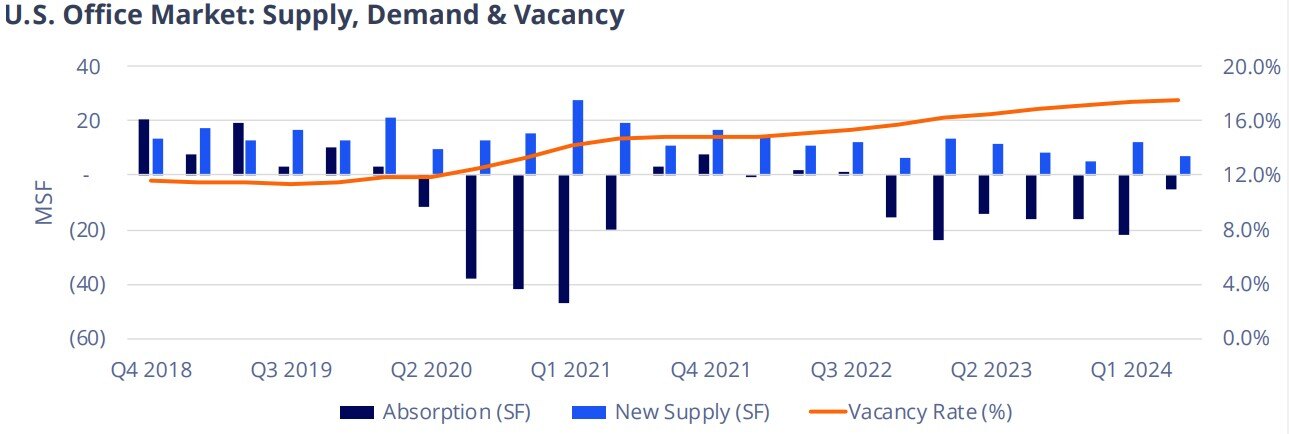

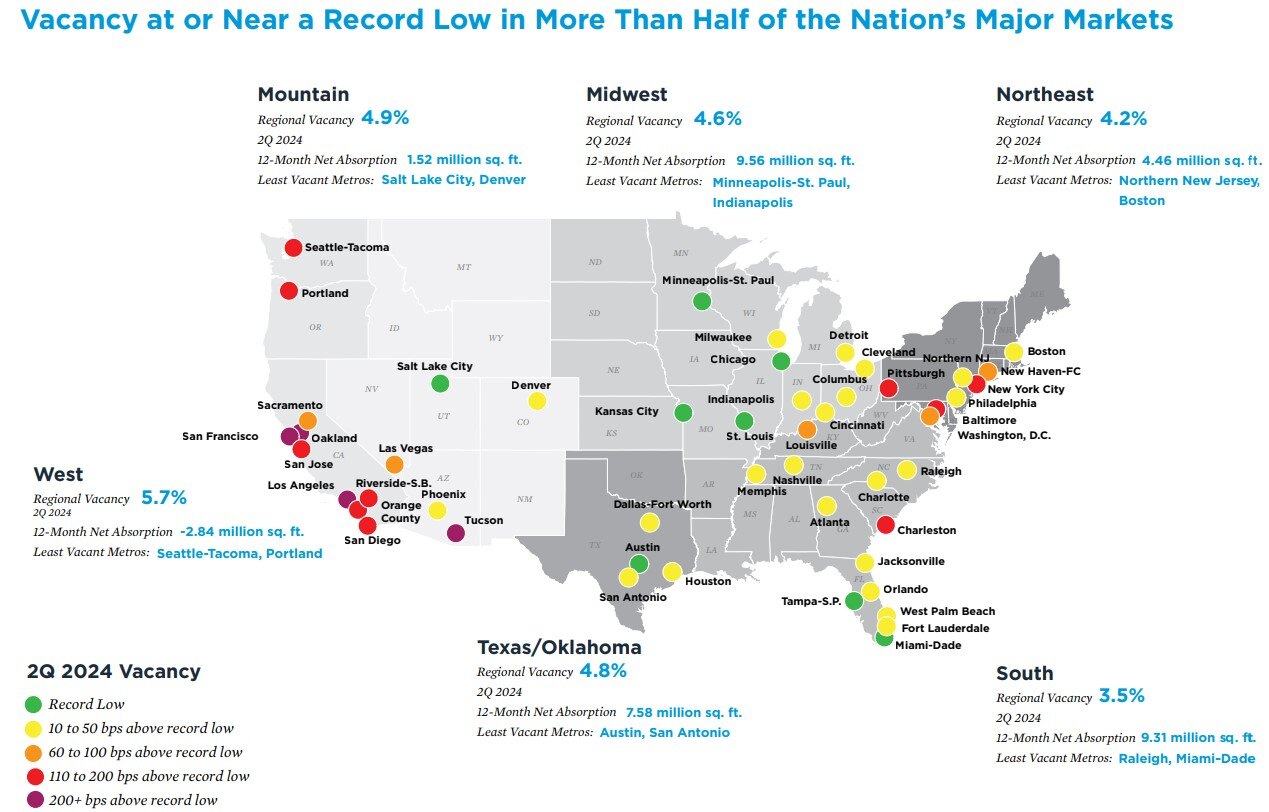

U.S. Office Markets: Performance and Prospects | September 2024

Via Colliers: “As of midyear 2024, the office market’s growth in the United States varies across different markets. More than 20 cities are nearing an official “recovery” phase, with notable growth in Florida and South Carolina, characterized by increased rents and frequent new developments.”

- Office Submarkets Bucking the Trend Through Mid-Year (Moody’s Analytics)

- How data center ownership rules are changing (JLL)

- The Federal Reserve may have pretty much just hit its 2% inflation target (CNBC)

Other Real Estate News and Reports

Retail Strength Linked to Shift to Lower Interest Rate Trajectory

Via Institutional Property Advisors: ‘While household budget tightening and labor market softness remain potential headwinds that could impact the sector, the Federal Open Market Committee’s overnight lending rate cut in September likely launched a lowering cycle that will extend through next year and possibly offset the impacts of these factors.”

- Unpacking the Institutional CRE Investment Landscape (GlobeSt)

- The What and the When Matter for the Losses of Real-Estate Lenders (MSCI)

- Fed’s Pivot Sucks Wind From The Sails Of Dry Powder Bargain Hunters (Bisnow)