CRE Demand WILL Surge in 2025

Commercial real estate investment activity has not changed much since last month’s interest rate reduction from the Federal Reserve (nor has it had much time to adjust), but sales volumes will almost certainly improve in 2025, given the strong investment prospects for CRE assets at the start of a rate cutting cycle. For multifamily apartments, unambiguous signs of strong demand point to improved performance in the medium-to-long-term, but in the shorter term, elevated levels of apartment supply and typical seasonal demand trends could mean that rent growth continues to trend lower until Spring of next year.

Multifamily, the Nation, and the Economy

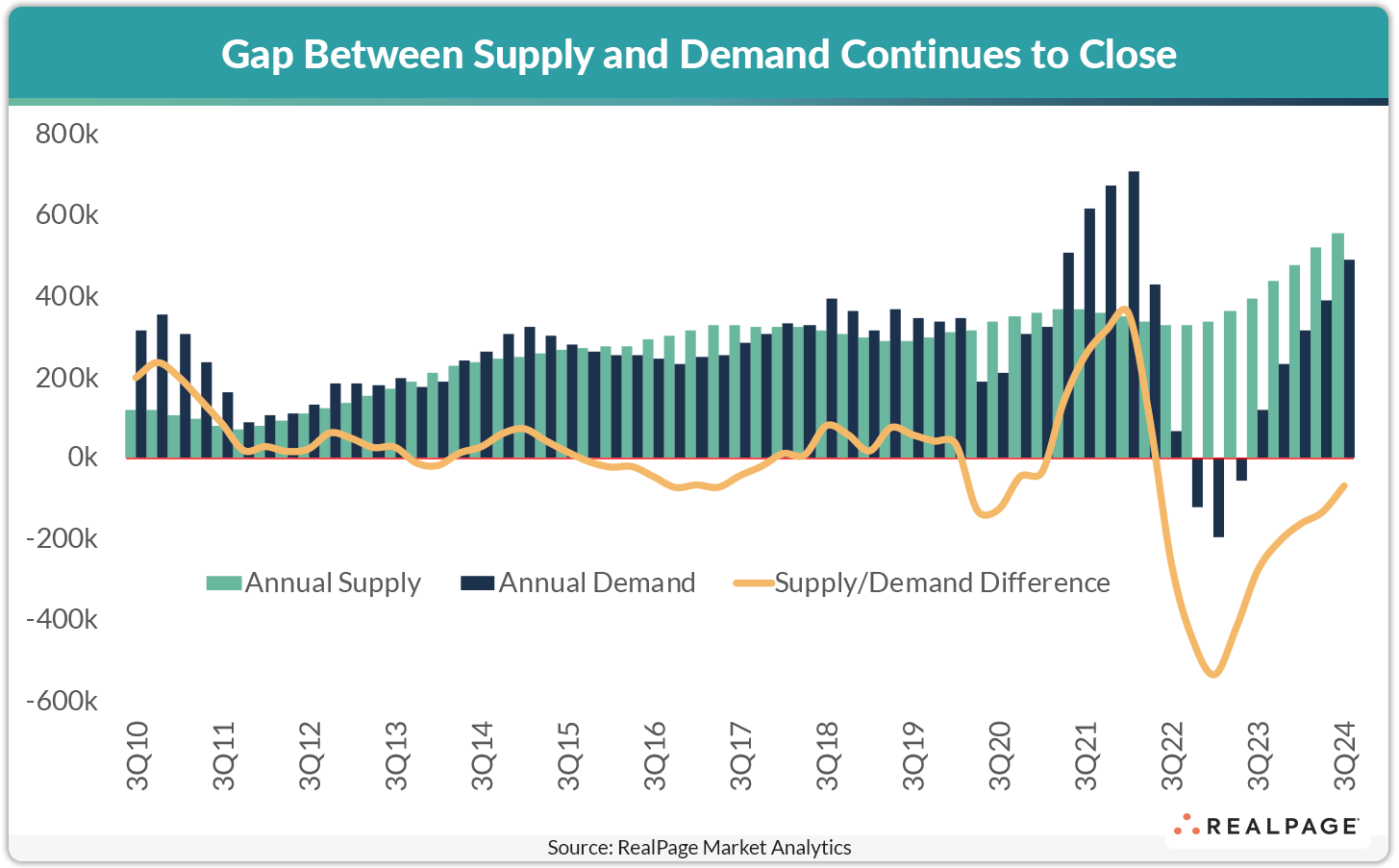

Strong Apartment Demand Persists in 3rd Quarter as Supply Hits 50-Year High

Via RealPage: “On an annual basis, supply reached 557,842 units, a rate unseen since 1974. While robust demand still fell below concurrent rates of new supply, the delta between the two was at the lowest point in two years” and is closing not from reduced supply but from increased demand.

- As Hurricanes Strike, Insurance Costs Soar for Commercial Real Estate (The New York Times)

- Sep. 2024 Report: Strong Economy, Demand Boost Multifamily Optimism (Yardi Matrix)

- Kamala Harris’s YIMBY (“Yes In My Backyard”) Approach to Housing (Washington Post)

Multifamily and the Housing Market

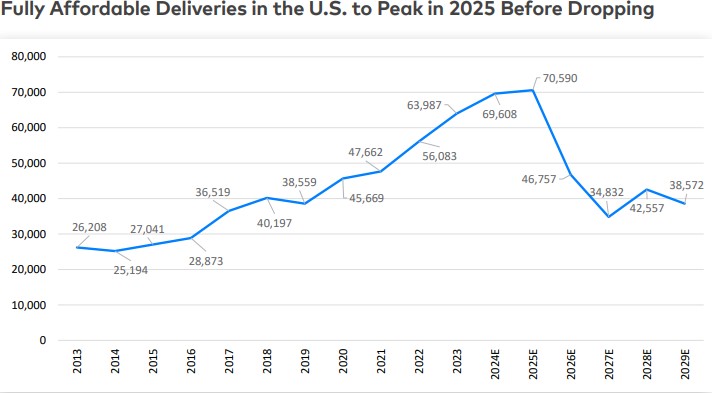

Via Yardi Matrix: This excellent report from Yardi Matrix “forecasts deliveries of fully affordable housing to reach 69,600 units in 2024 and then hit a multi-year peak in 2025 at 70,500 units before dropping in future years.”

- See Where the Housing Market Could Change the Most as Mortgage Rates Drop (Realtor.com)

- Home Purchase Sentiment Data Shows Improving Confidence (Fannie Mae)

- Where the regional housing market is shifting—and where it isn’t (Fast Company)

Multifamily Markets and Reports

Sep. ’24 National Rent Report: Market Enters the Slow Season

Apartment List: “[W]hile rental demand has bounced back a bit this year, recent signs of labor market softness could dampen demand going forward. With this in mind, we expect that new supply will continue to outstrip demand into 2025.”

- Newly Built Apartments Are Starting to Fill Up Faster, But At a Slower Pace Than Last Year (Redfin)

- NYC’s Airbnb crackdown has sparked an underground market for home shares — and these startups are looking to cash in (New York Post)

- Improving the Rental Housing Experience (Freddie Mac)

Commercial Real Estate and the Macro Economy

CRE Investment Prospects Stronger at Start of Rate Cut Cycle

Via CBRE: “Looking at NCREIF Property Index (NPI) all-property total returns, commercial property has consistently performed well for one, two and three years following the start of a new rate-cutting cycle,” with the ’89 savings and loan crisis and the ’07 great financial crisis as notable exceptions.

- Retail Sector’s Strength Coincides With Monetary Policy Shift That Could Prove Vital to Consumer Spending (Marcus & Millichap)

- Job Growth Hits a Six-Month High, Likely Guiding the Fed Toward a Gradual Path (Institutional Property Advisors)

- 2024 Second Quarter State-Level GDP Data (NAHB)

Other Real Estate News and Reports

CRE Markets Overview: Multifamily and Retail Strength; Industrial and Office with More Challenges

Via NAR: Office “remains in negative territory,” multifamily has “thrived” with twice the absorption as last year, “[r]etail space remains at historically tight levels,” and “[t]he industrial sector continued to lose momentum.”

- Special Servicing Rate Surges as Office Posts Another Large Increase (Trepp)

- Spanish Investor Launches $3B Partnership To Build Thousands Of U.S. Homes (Bisnow)

- No Quick Fix for CRE Refinancing Woes as Market Resets (GlobeSt)