Gray Report Newsletter: May 9, 2024

Apartment Demand Growth Amid Record Supply

As a historic wave of newly-built apartments continues beyond the one-year mark, elevated absorption numbers and data showing the first positive growth in occupancy in 2+ years are noteworthy signs of resilience in the apartment market. In the broader economy, lower jobs numbers and declining consumer credit suggest a pullback in consumer spending and (hopefully) lower inflation, but while consumers may balk at ever-pricier Big Macs or Frappuccinos, apartment housing is still in high demand.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

Apartment Occupancy Ticks Up for the First Time Since Early 2022

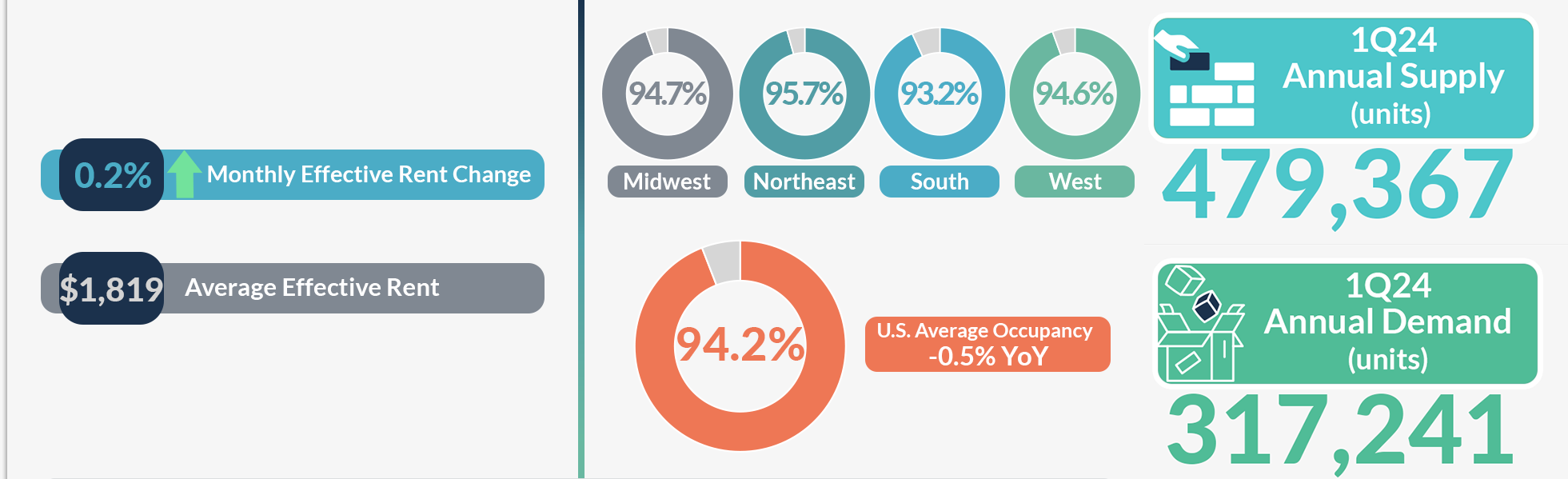

Via RealPage: “New data from RealPage indicates the industry might be at an inflection point in which occupancy could be stabilizing: For the first time since February 2022, the national average for apartment occupancy ticked up month-over-month to stand at 94.2% in April 2024.”

- New Bipartisan Housing Caucus Aims To Tackle The Nation’s Housing Crisis (Bisnow)

- Weaker US jobs data soothes Fed worries of renewed overheating (Reuters)

- Interest Rate Cap Costs Are Surging Again (GlobeSt)

Multifamily and the Housing Market

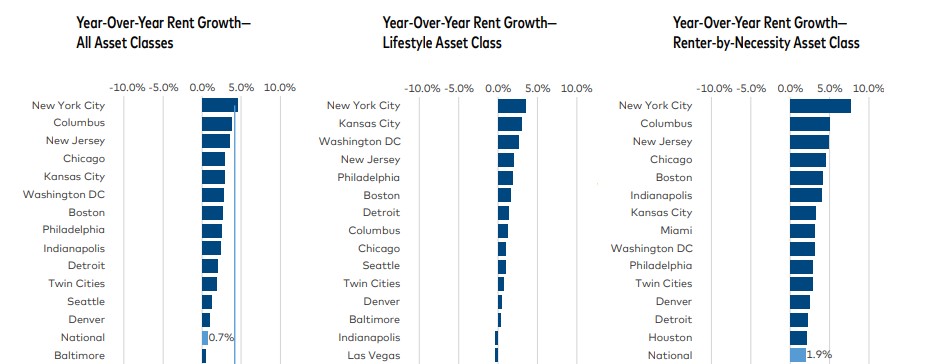

April 2024 Multifamily Report: Steady Absorption Boosts Multifamily Rents

Yardi Matrix: “Demand for multifamily properties remained strong in the first quarter of 2024, with the market absorbing units at a 300,000-per-year rate . . . Nationally, 72,800 units, or 0.5% of apartment stock, were absorbed in the first quarter.”

- Fixer-upper listings hinder home sales (John Burns Research and Consulting)

- Home Prices Up 5.3% Year-over-Year in March 2024 (CoreLogic)

- At 2022 Rates, 10 Million More Households Could Afford a New Home (NAHB)

Multifamily Markets and Reports

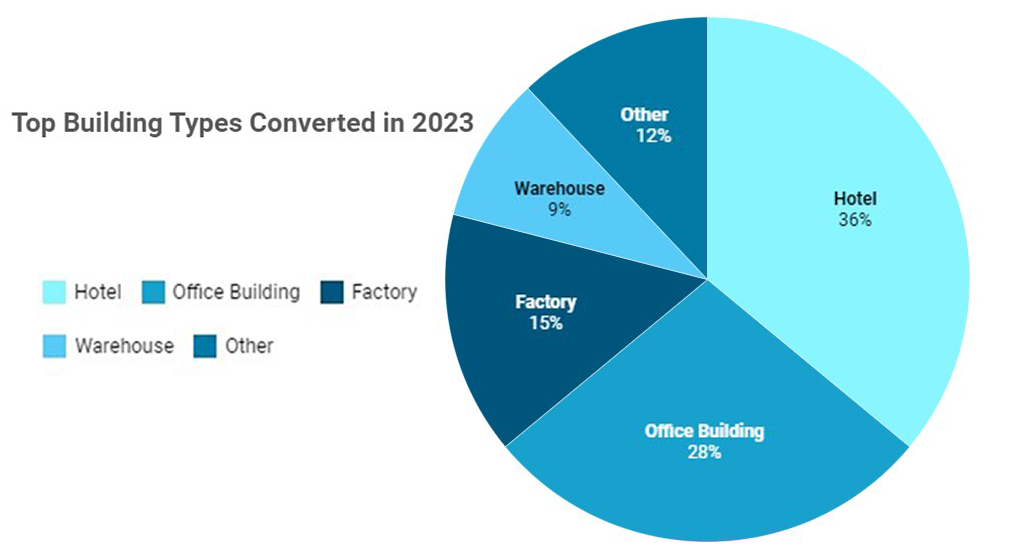

Adaptive Reuse Surges Again With 151K Upcoming Units; Hotel Conversions Overtake Offices in 2023

RentCafe: “While office conversions remain popular, 2023 saw a shift towards repurposed hotels, particularly in Manhattan, which now dominates the adaptive reuse landscape . . . A growing Atlanta suburb leads in office conversions, closely followed by two Midwest hubs—Milwaukee and Indianapolis.”

- Earnings calls for multifamily REITs: “1st quarter results met or outpaced expectations” (RealPage)

- Housing Sentiment Again Shows Signs of Plateauing for Homebuyers (Fannie Mae)

- Home Buyers’ Ideal Community: “convenience, walkability, and a suburban feel” (NAHB)

- Rising Insurance Costs Impacting Affordable Housing Development and Preservation Effort (Berkadia)

Commercial Real Estate and the Macro Economy

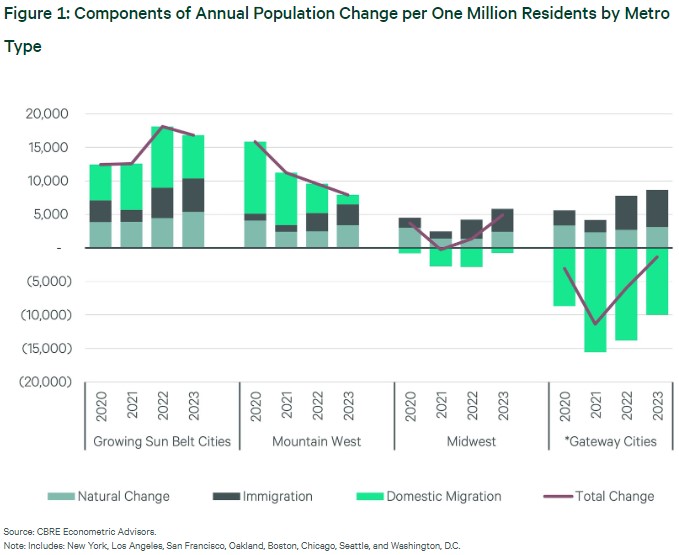

Census data highlights shifts in population migration, housing patterns

Via CBRE: “New data from the Census Bureau highlights . . . domestic population movement is reverting to pre-COVID trends . . . [as] high-cost, densely populated Gateway Cities (e.g., New York, Los Angeles) have largely shaken off their pandemic travails and are on the cusp of returning to population growth.”

- April 2024 Self Storage Report: “Street rate performance worsened in March, despite hope that the busier spring leasing season would bring improvements.” (Yardi Matrix)

- What the Affordability Gap Means for Investors (Marcus & Millichap)

- CRE Mortgage Maturities & Debt Outstanding – Q4 2023 Update: “[M]ortgages increased by $232.8 billion year-over-year, or 4.1%” (Trepp)

Other Real Estate News and Reports

April 2024 CRE Report: CRE debt increased in Q1 2024, Small Banks with $2T, Large Banks with $876B

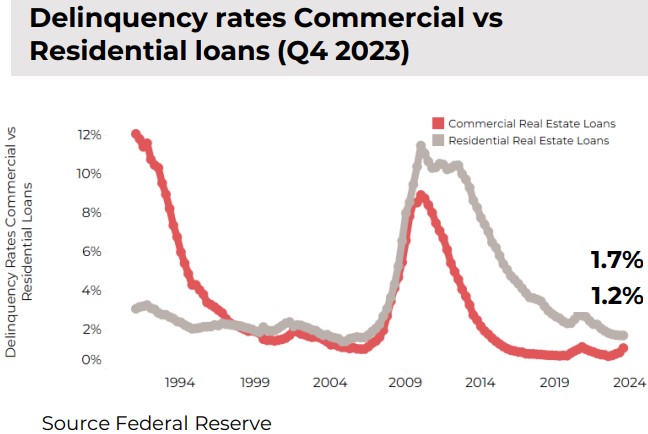

Via NAR: “[W]hile the delinquency rate for residential loans is decreasing, there is an upward trend in delinquent commercial real estate loans since the last quarter of the previous year. Specifically, the CRE delinquency rate was 0.69% in Q4 2022, and currently, it stands at 1.17%.”

- Mall Giant Simon Sells Stake in Authentic Brands, Its Partner in Rescuing Retailers, for $1.45 Billion (CoStar)

- CRE Guidance from Accounting Regulatory Body (Public Company Accounting Oversight Board)

- April 2024 Industrial Report: “At a time when firms are looking to reduce costs, increases in input prices could lead to reduction in real estate costs” (Yardi Matrix)