Gray Report Newsletter: May 16, 2024

CPI Inflation Is Down: Rate Cut by September?

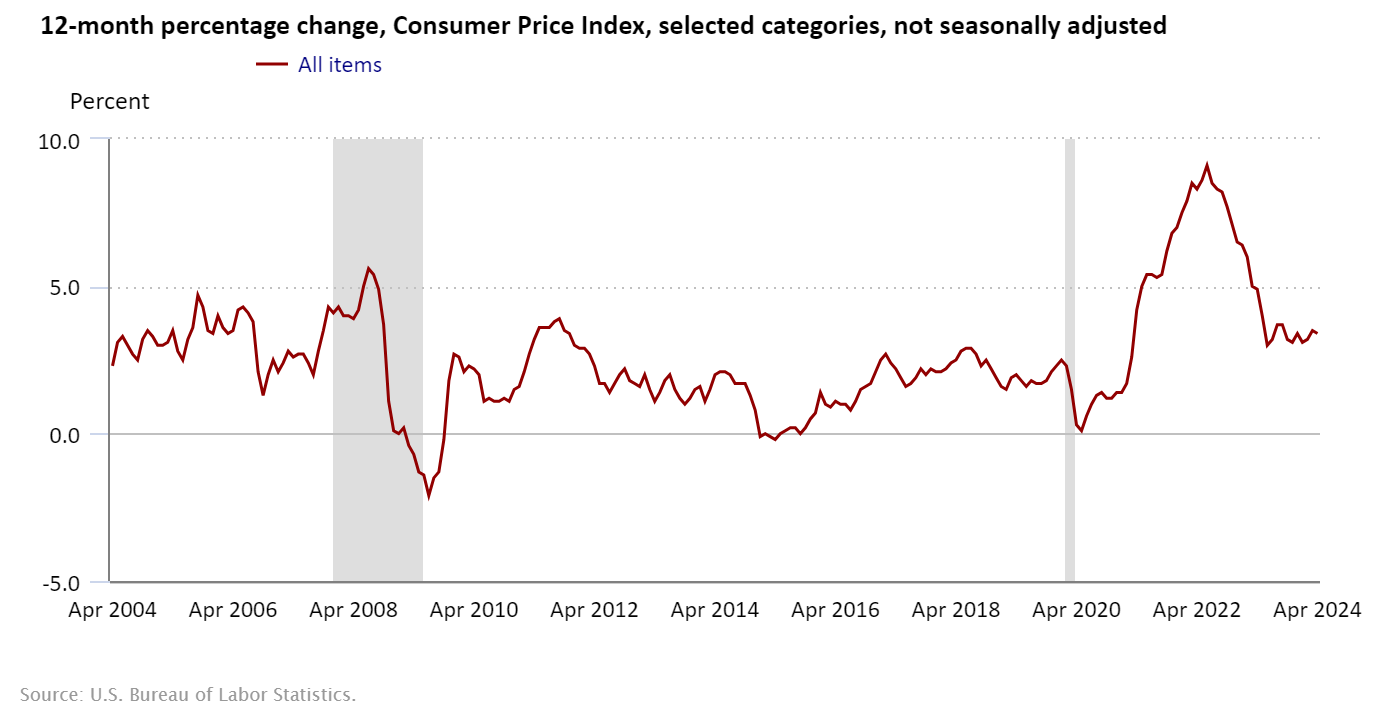

Consumer price index numbers show inflation down from 3.5% to 3.4% year-over-year in April, with monthly inflation numbers falling from 0.4% to 0.3%. It may be a bumpy road to the Federal Reserve’s inflation target, but given the moderation in the job market along with these latest numbers from the CPI, speculation that the Fed will lower interest rates in September may have some validity, but in the meantime, elevated interest rates will put pressure on multifamily borrowers as the issue of loan maturities persists as a background factor that continues to shape the motivations of apartment buyers and sellers.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

Consumer Price Index – April 2024: Inflation Declines, with Room to Drop Further

Via Bureau of Labor Statistics: Declines in all items inflation and core inflation were a welcome sign from the Consumer Price Index, even as increases in gas prices and shelter “contributed over seventy percent of the monthly increase in the index for all items.”

- Fed to cut rates in September, say nearly two-thirds of economists (Reuters)

- Multifamily Developer Confidence Wanes: Buying Opportunity? (GlobeSt)

- Distress Jumps While Extend-and-Pretend Continues (GlobeSt)

Multifamily and the Housing Market

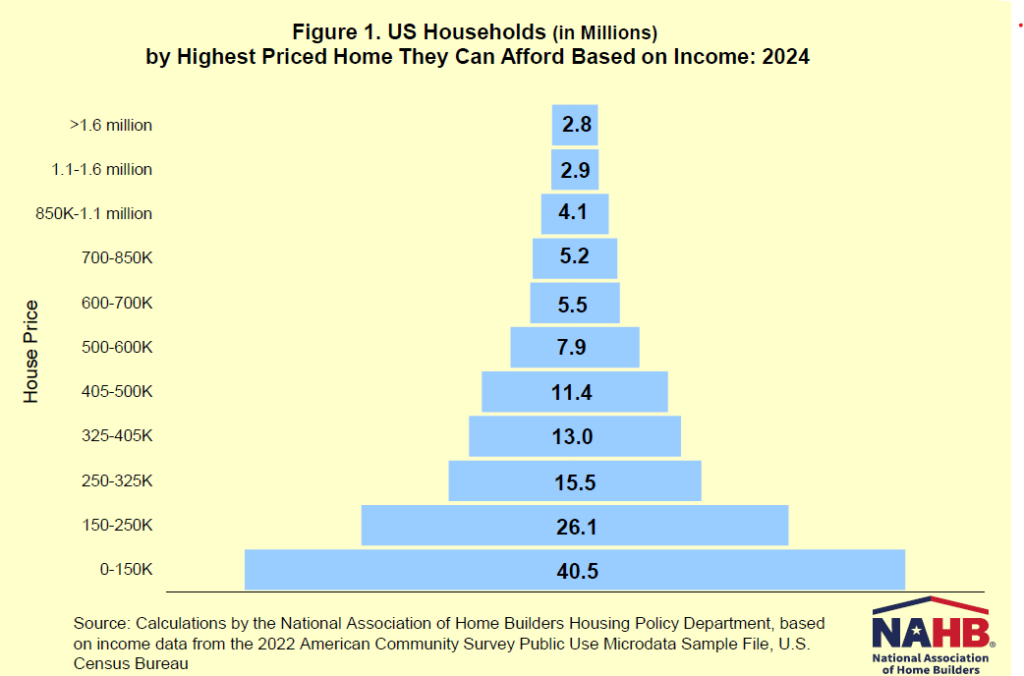

Affordability Pyramid Shows 66.6 Million Households Cannot Buy a $250,000 Home

NAHB: “103.5 million households are not able to afford a median priced new home and an additional 106,031 households would be priced out if the price goes up by $1,000.”

- A Deep Dive into Demographics and Housing (John Burns Research and Consulting)

- Crackdown on Hedge Fund Homebuyers Won’t Lower Housing Prices, Economist Argues (Realtor.com)

- Can Housing Foreclosures Remain Low as Consumer Debt Rises? (CoreLogic)

Multifamily Markets and Reports

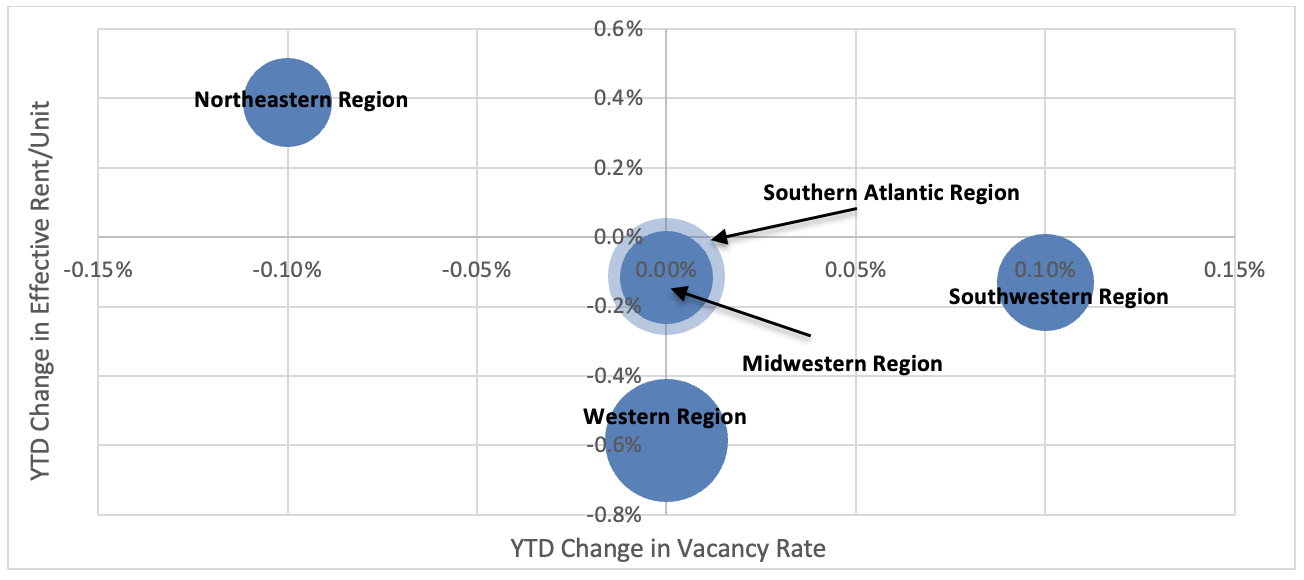

Regional Multifamily Performance in Q1 2024: Northeast Takes a Commanding Lead

Moody’s Analytics: “The Northeastern and Southern Atlantic Region each had two of the top five metros while the Western and Southwestern Region each had two of the bottom five metros.”

- Chicago Claims Most Balanced Supply/Demand Relationship Nationwide (RealPage)

- Rent Growth Continues in Under-the-Radar Secondary Markets (Yardi Matrix)

- The Federal Reserve’s Housing Market Dilemma in One Chart (Fast Company)

Commercial Real Estate and the Macro Economy

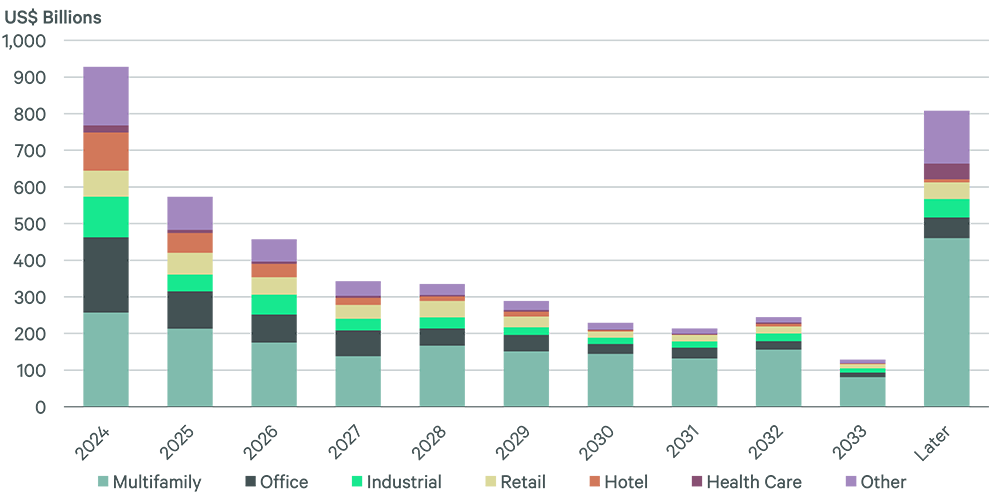

Some Distress Will Emerge Amid Wall of Loan Maturities

Via CBRE: “Loan defaults will be concentrated in office, which suffers from high vacancy and lower demand, and in multifamily, where many investors who financed acquisitions at ultra-low interest rates face significantly higher debt servicing costs as loans mature.”

- Potential Risks That CRE Investors Should Monitor (Marcus & Millichap)

- Special Servicing Rate Takes Massive Leap in April 2024, Largest Monthly Uptick Since COVID (Trepp)

- Where Capital Is Headed in 2024 in the CRE Market (Cushman & Wakefield)

Other Real Estate News and Reports

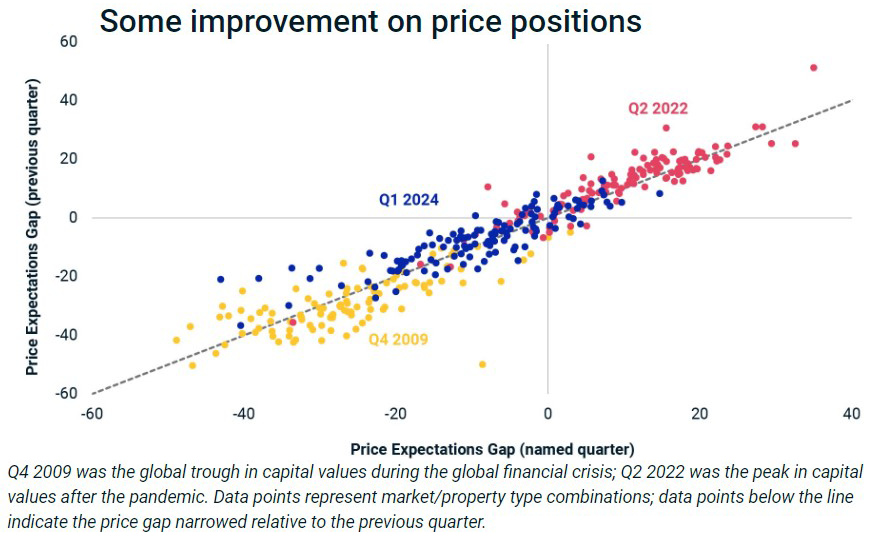

Real Assets in Focus: Are We Nearly There Yet?

Via MSCI: While CRE “buyers expect to pay much less than sellers are willing to accept[,] . . . there are a growing number of market segments for which the gap has narrowed relative to the previous quarter, and a handful are even now in positive territory, which could be an encouraging signal.”

- Retailers are finding success in secondary and tertiary market expansions (CBRE)

- Finding Opportunity in Midwest Industrial Markets (Cushman & Wakefield)

- Goldman Sachs Closes $7B Real Estate Debt Fund To Fill Lending Gap (Bisnow)

- What the Affordability Gap Means for CRE Investors (Marcus & Millichap)