Gray Report Newsletter: March 7, 2024

A Long Road for Rent Growth

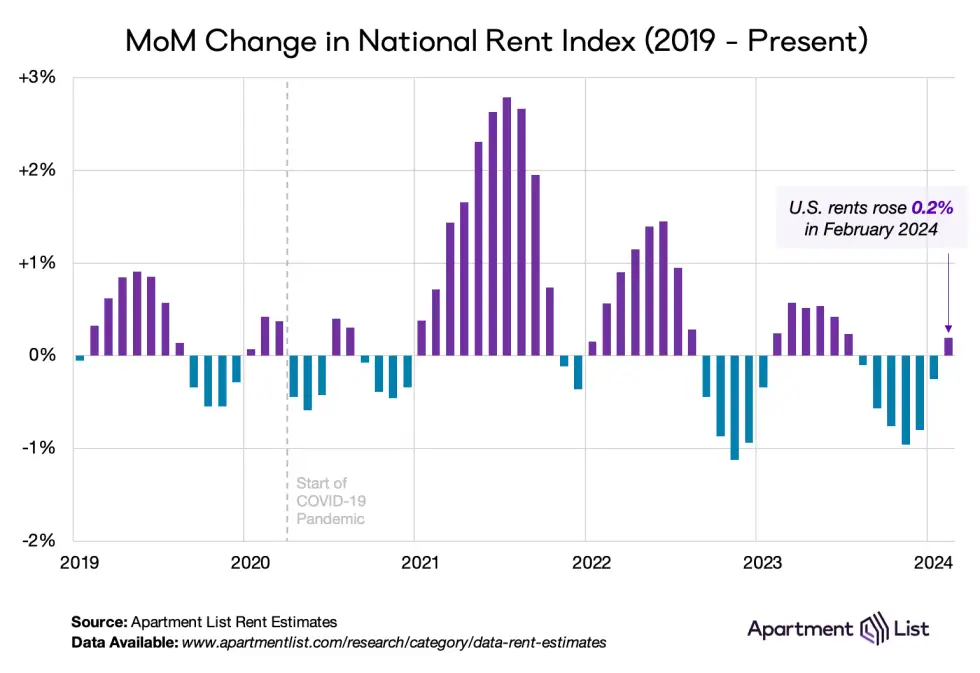

After an extended slowdown that lasted nearly 6 months, rent growth has begun to turn around. After record-breaking rent growth of 2021 and early 2022, a correction that began in late 2022 and continued through 2023 kept rent growth well below historical averages, but recent reports have shown some positive (albeit mild) signs of stronger rent growth as 2024 progresses. While the continued high volume of new apartment deliveries is a clear headwind for rent growth, a substantial upswing in apartment demand charts a path for improvement in the multifamily market.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

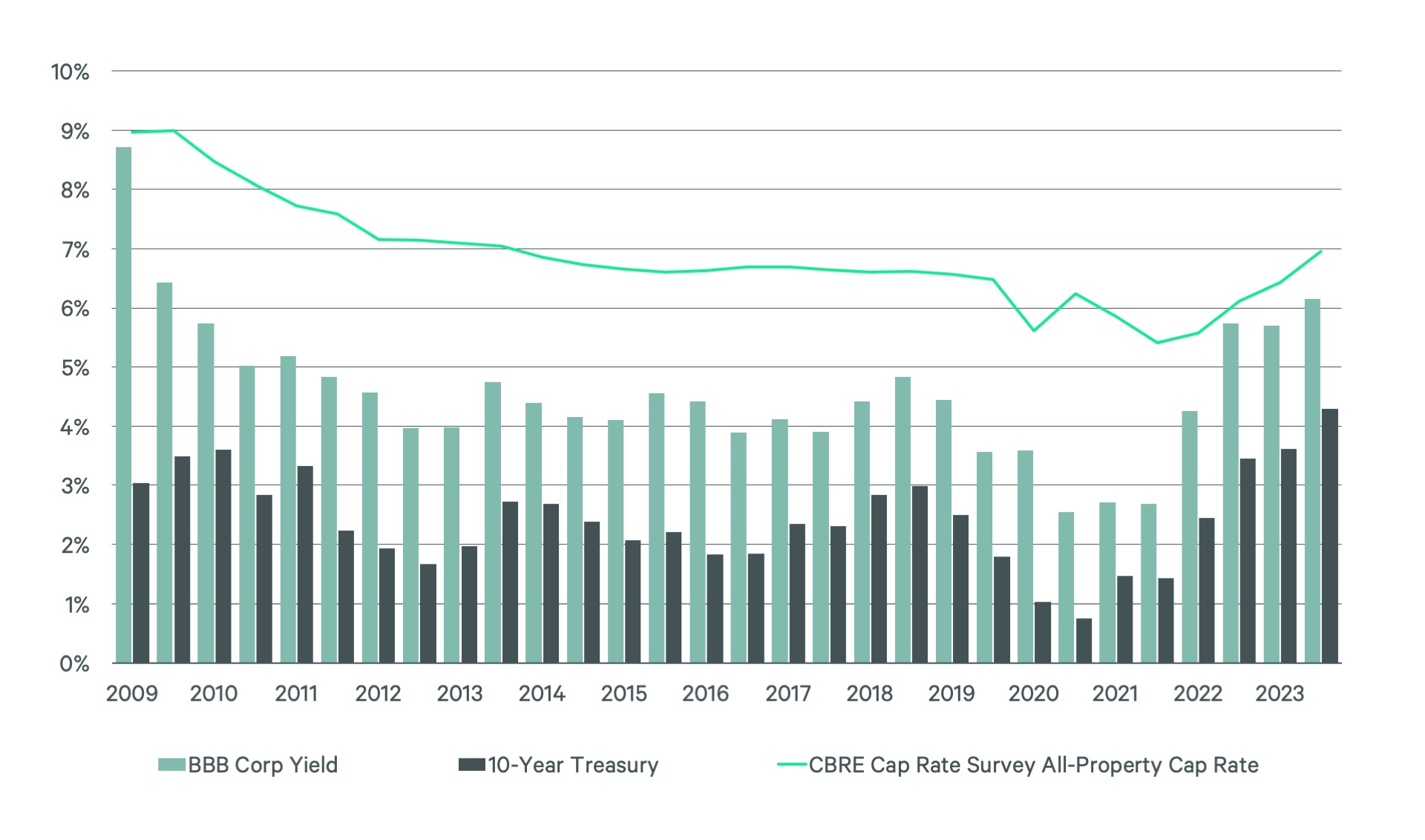

Cap Rate Survey: Most Respondents Believe That Cap Rates Have Peaked

Via CBRE: “Fewer survey respondents believe cap rates will increase in H1 2024 than did so in H1 2023. This likely reflects investor expectations of a more accommodative Federal Reserve policy and bond yields decline from October 2023 highs.”

- CRE Cap Rate and Valuation Survey (Newmark)

- CRE’s Best Bosses of 2024 [Featuring Gray Capital’s Spencer Gray] (GlobeSt)

- Jerome Powell Says Fed on Track to Cut Rates This Year (The Wall Street Journal)

Multifamily and the Housing Market

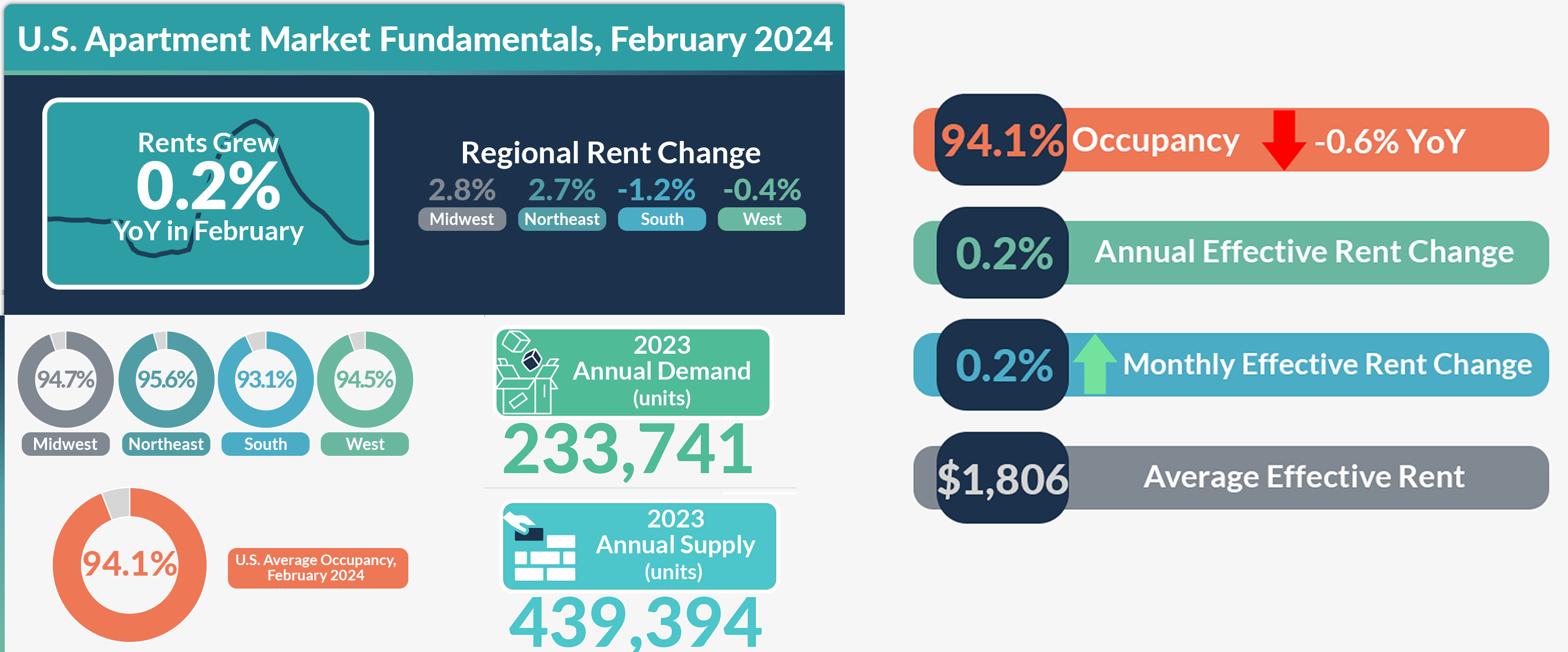

Apartment Rent Growth Remains Aloof in February as Occupancy Stabilizes

RealPage: “While February 2024 saw rents increase 0.2% month-over-month, rent growth momentum remains aloof. Still, the February increase of 0.2% was the largest monthly increase dating back to June 2023 which suggests that seasonal movement in rents – though muted – appears to be following historical trends.”

- 3 Migration Shifts Shaping Housing Markets in 2024 (John Burns Research and Consulting)

- Single-Family Production Shows Signs of Stirring Across the Nation (NAHB)

- ‘This Is A Big Deal’: LIHTC Could See Most Significant Reform In Decades (Bisnow)

Multifamily Markets and Reports

February 2024 Rent Report: Apartment Market Turns a Corner

Apartment List: “The rental market turned a corner in February; after six consecutive months of rent declines, prices ticked up 0.2 percent this month[, but] on a year-over-year basis, rent growth remains in negative territory at -1 percent, where it has sat for the last several months.”

- Study: Here Are the Best and Worst Markets for Renters (Florida Atlantic University)

- National Rent Report, February 2024 (Zumper)

- An Assessment of the Revived U.S. Retail Market (Holland & Knight)

Commercial Real Estate and the Macro Economy

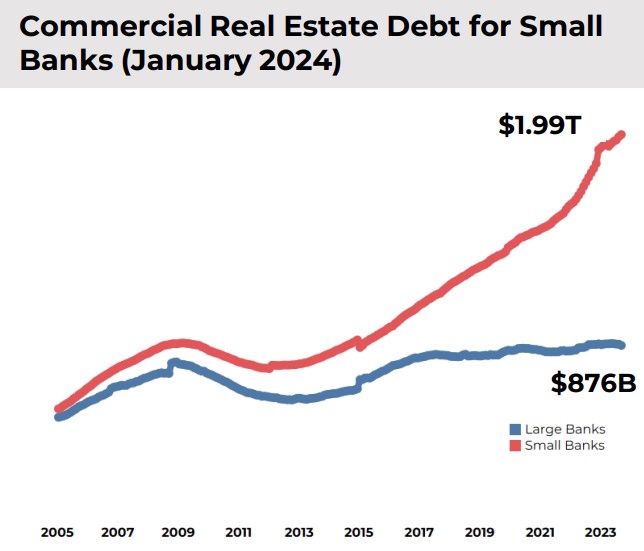

CRE Market Report, February 2024

Via NAR: “Despite reports of more stringent lending standards, commercial real estate debt continues to grow this year. Specifically, within small, domestically chartered commercial banks, the volume of CRE loans rose to $1.99 trillion.”

- CRE Capital Markets Report (Colliers)

- Hospitality Market Investment Forecast (Marcus & Millichap)

- After a Turbulent 2023 for the CRE Market, Is It Now Safe To Move About the Cabin? (Moody’s Analytics)

Other Real Estate News and Reports

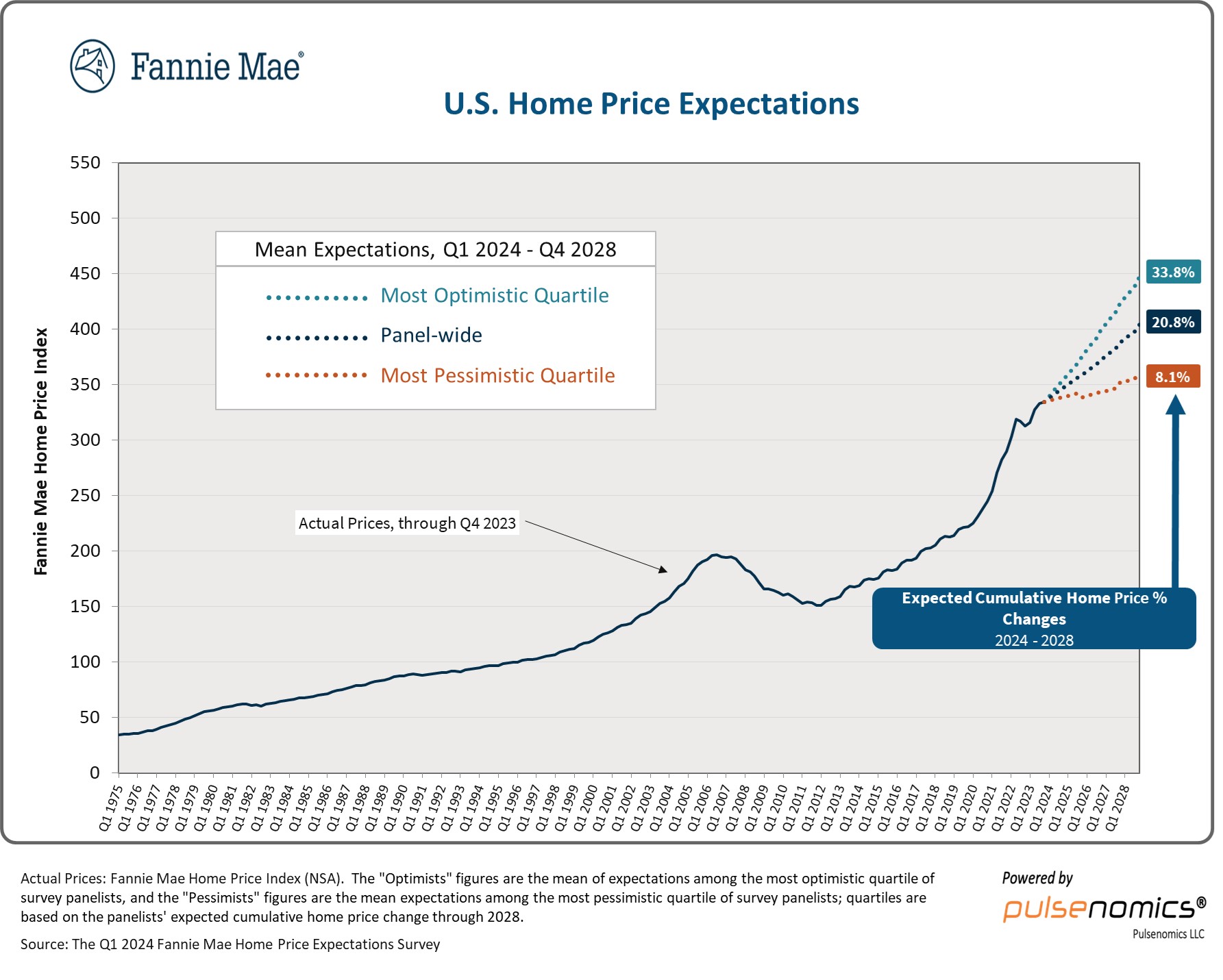

Home Price Expectations Survey (HPES)

Via Fannie Mae: Survey respondents expect continued price growth in the single family home market, with constrained housing supply as the largest driver of price growth, followed by lower mortgage rates.

- CMBS Delinquency Rate Inches up in February 2024, Driven by Office Sector (Trepp)

- Chicago mayor announces $1 billion revamp of vacant downtown buildings amid commercial real estate crisis (Fortune)

- Banks With Heavy Commercial Property Exposure See Bonds Get Hit (Bloomberg)