Gray Report Newsletter: June 27, 2024

The indominable growth of the housing market

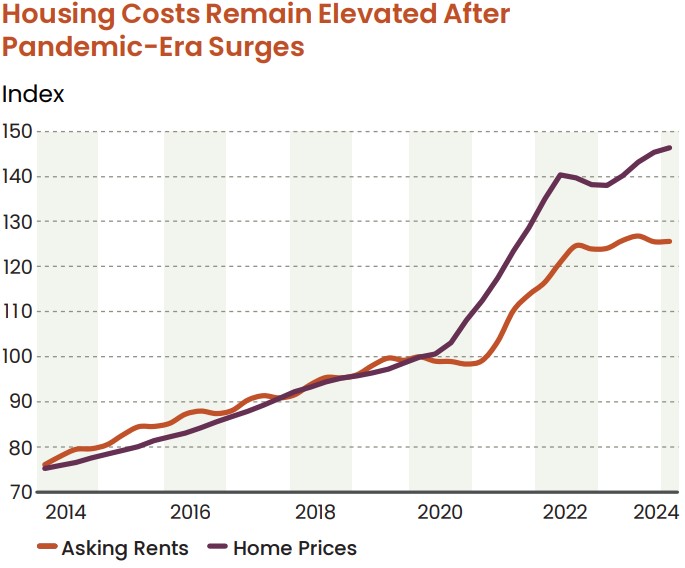

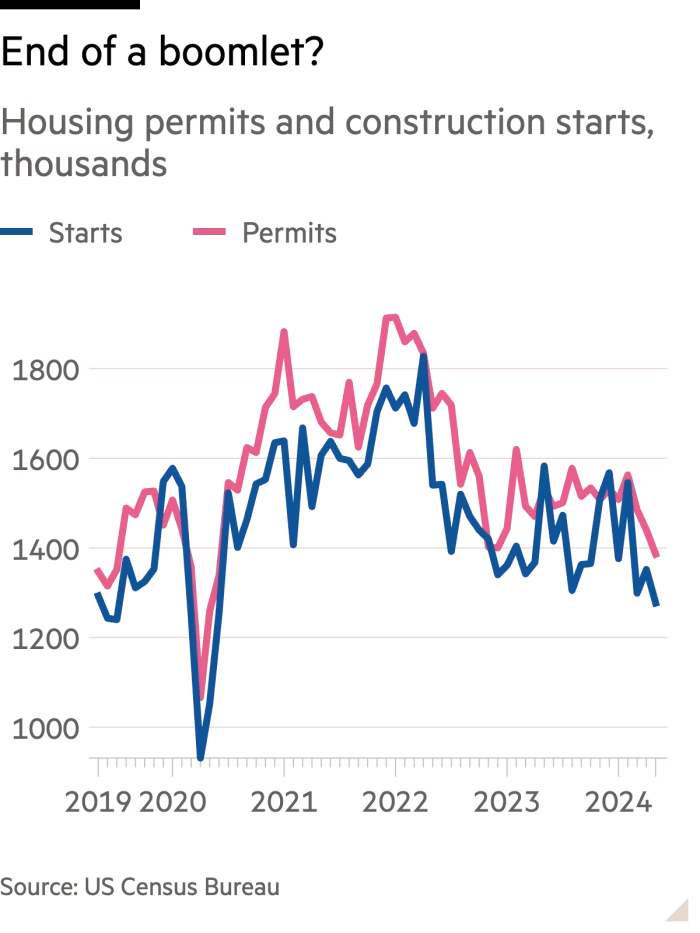

Amid persistently high interest rates and waning, but still-elevated, inflation, prices for single-family homes continue to increase, and despite the lower rent growth in the apartment market, the Harvard JCHS’s recent State of the Nation’s Housing Report finds continued affordability pressure in both the rental and for-sale areas of the housing market. While both rent growth and the growth of single-family home prices have sharply increased in the past 3 years, prices for single-family homes have increased by a far greater amount, which is a strong signal of housing demand that points to higher rent growth in the multifamily market as the wave of new apartment deliveries subsides over the next year-and-a-half.

Multifamily, the Nation, and the Economy

The State of the Nation’s Housing, 2024

Via Harvard Joint Center for Housing Studies: This comprehensive report covers both single family and multifamily housing, with particular attention to the strength and scope of the ongoing housing affordability crisis.

- This is What the End of Extend and Pretend Looks Like (GlobeSt)

- Hard or Soft Landing? The Midyear Economic Outlook (Marcus & Millichap)

- US Consumer Confidence Weakens Slightly in June (The Conference Board)

Multifamily and the Housing Market

The US housing market is awful

Financial Times: “[S]mall declines in prices will not be enough to solve the affordability problem if mortgages do not become radically cheaper. Even then, the housing market in America will remain a significant social problem that goes a long way towards explaining consumers’ dissatisfaction with an economy that is healthy in other ways.”

- Multifamily Supply Wave Recedes as Construction Stages Retreat (CoStar)

- How will declining birth rates affect housing demand? (John Burns Research and Consulting)

- The U.S. Added Nearly 600,000 Super Commuters in 2022 (Apartment List)

Multifamily Markets and Reports

Spring 2024 Off-Campus Student Housing Update

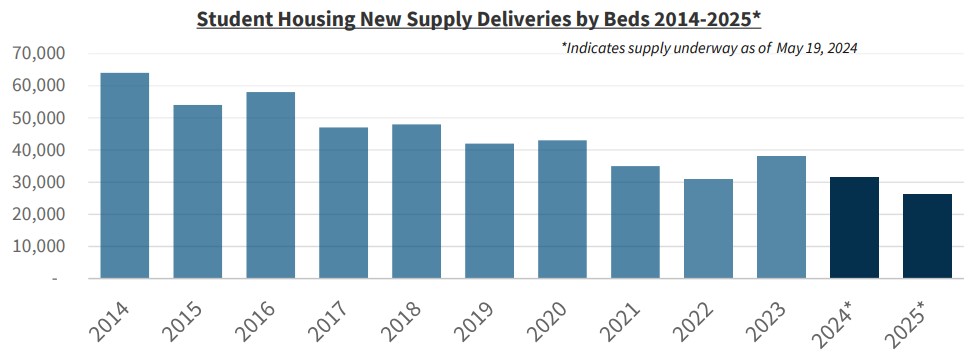

Fannie Mae: “The recently lower levels of annual supply is primarily a byproduct of the higher amounts of new supply delivered during the previous development cycle. As a result of the higher amounts delivered in the 2010s, supply quickly outpaced demand, especially as demographic trends stabilized.”

- June 2024 Rent Report Shows Accelerating Growth Close to 2% (Zumper)

- State Level Employment Situation: May 2024 (NAHB)

- U.S. Economic, Housing and Mortgage Market Outlook – June 2024 (Freddie Mac)

Commercial Real Estate and the Macro Economy

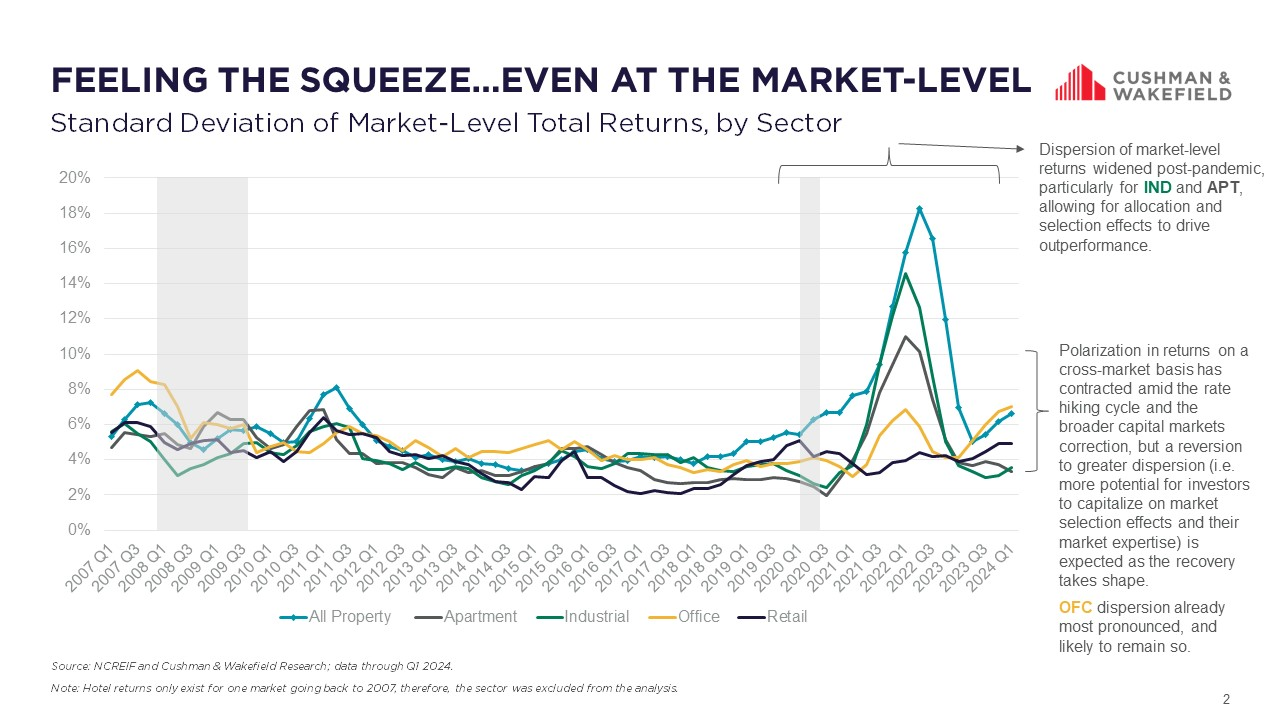

Converging CRE Performance and Finding Alpha

Via Cushman & Wakefield: “Despite the Fed’s patient and data-dependent approach, the acceleration seen in Q1’s inflation data has reversed course and the critical cooling trend desired by the Fed is once again more evident.”

- Global Data Center Trends 2024: We need more power. (CBRE)

- National Self Storage Report, June ’24: Sluggish housing market dampens performance (Yard Matrix)

- When It Rains, It Ports: Supply Chain Disruptors to Influence Industrial Market Activity in H2 2024 (Newmark)

Other Real Estate News and Reports

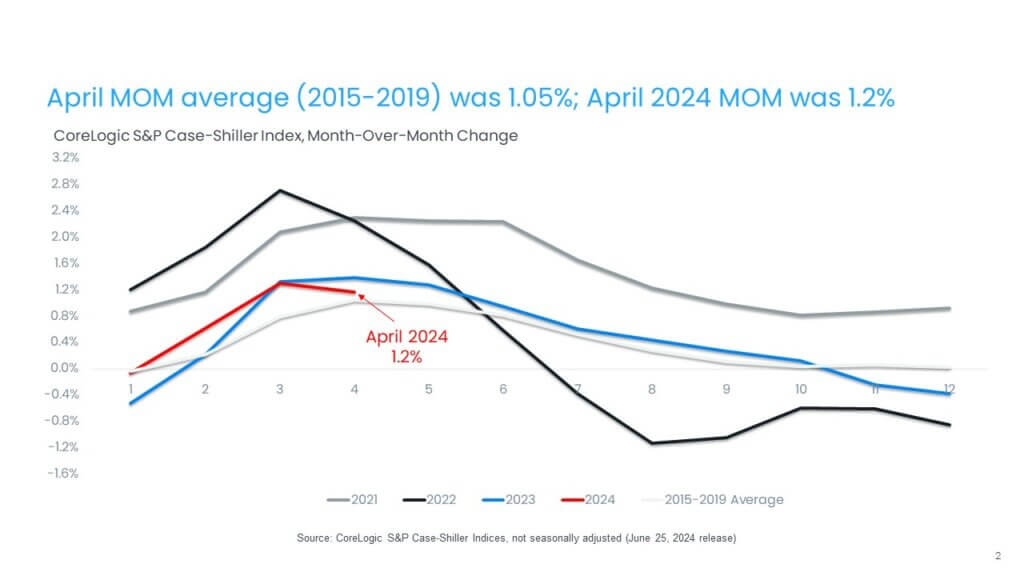

Home Prices Increasing More Slowly, but Still Increasing at Above-Average Rates

Via CoreLogic: “In April, the CoreLogic S&P Case-Shiller Index slowed to a 6.3% year-over-year gain after peaking at 6.5% during the previous two months. It was still the 10th straight month of annual appreciation.”

- National Office Report, June ’24: Office Distress Slowly Plays Out (Yardi Matrix)

- Healthcare Services Report | Q2 2024: Behavioral Health and Real Estate (Colliers)

- 8% Of U.S. Office Buildings Are Taking Basically All The Tenant Activity (Bisnow)