Gray Report Newsletter: June 20, 2024

8.7% Jump for Apartment Investment Index after Sluggish 2023

Numbers showing “sharply” improved multifamily investment prospects for Q1 2024 have been released at the same time as recent analysis that has captured the extent of cooling CRE valuations in 2023, showing a stark contrast in investment market trends in spite of continued headwinds for the multifamily market and commercial real estate more broadly. Improving occupancy and a waning (but still substantial) surge of new apartment supply could help move rents in a positive direction, but regions like the Midwest and Northeast are expected to continue to outperform the Sunbelt given the massive amount of new apartment deliveries in Southern markets.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

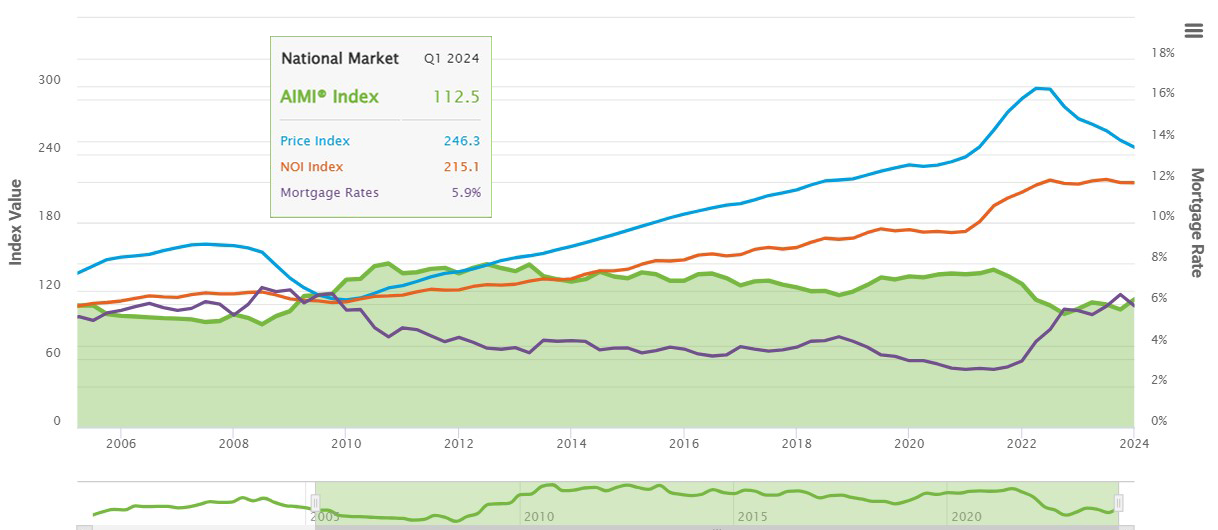

Via Freddie Mac: In one of the largest single-quarter improvements measured, the index (data linked here) “rose by 8.7% in the first quarter of 2024 as well as over the full year, with the annual index up 8.1% . . . ‘A decline in property prices and interest rates contributed to the AIMI’s strong start in the first quarter of the year.’”

- ‘The Darling Of The Party’: Investors Flock To Midwestern Multifamily As They Flee Struggling Asset Classes (Bisnow)

- Super Cheap Rates Could Come Back in This Scenario (GlobeSt)

- Why The Fed’s So Cautious About Cutting Rates (Marcus & Millichap)

Multifamily and the Housing Market

Multifamily National Report: Summer 2024 – Multifamily’s Second-Half Balancing Act

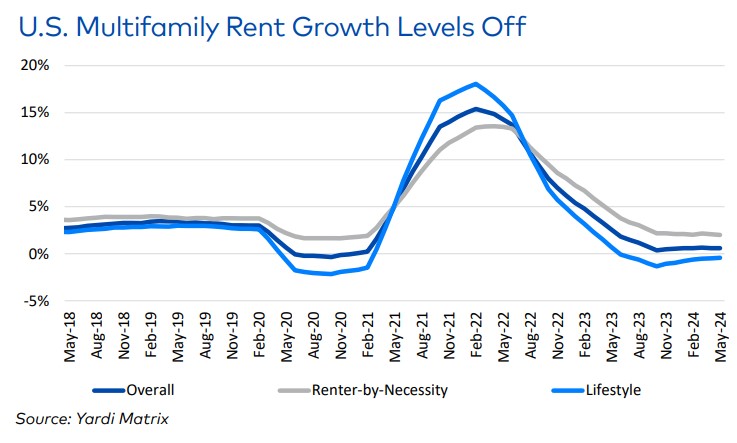

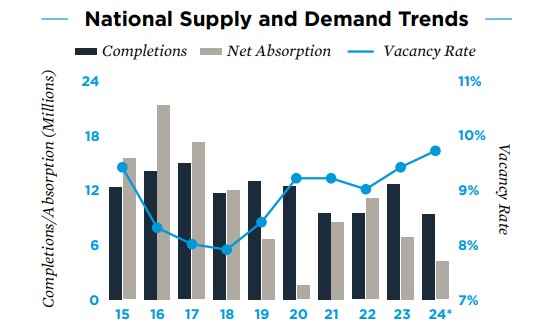

Yardi Matrix: “Performance continues to benefit from the strong economy and robust demand, while facing headwinds that include a large number of deliveries in some markets and higher-for-longer interest rates,” with the moderate supply growth and strong economic prospects bolstering the regional outperformance of the Northeast and Midwest.

- US Single-Family Rent Index – June 2024: -0.5% MoM, Up 3% YoY (CoreLogic)

- The Connections between Rental Deserts, Segregation, and Restrictive Zoning (Harvard Joint Center for Housing Studies)

- Competition in the housing market is cooling off. Here’s why (CNBC)

Multifamily Markets and Reports

Most U.S. Apartment Markets Recording Occupancy Improvement

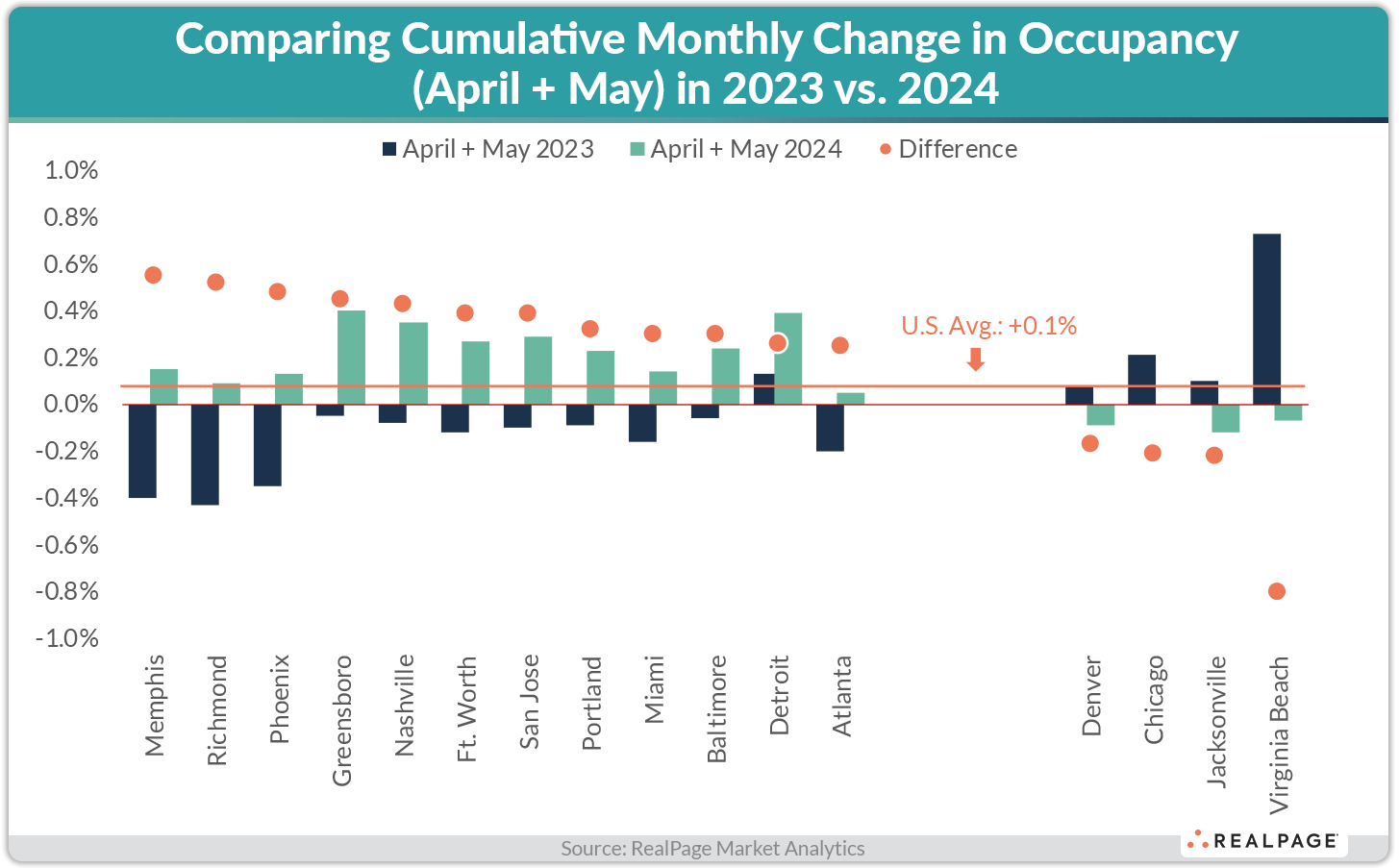

RealPage: “The nation overall saw April and May combine for a 0.1% increase in occupancy, according to data from RealPage Market Analytics. The same time last year, occupancy rates ticked down by a rounding error of -0.02%.”

- Chicago, Silicon Valley Challenge Miami as Hottest Rental Markets (RentCafe)

- Very Little Premium for Class A Units in These Apartment Markets (RealPage)

- Cooling rent growth demonstrates the impact of new supply (Apartment List)

Commercial Real Estate and the Macro Economy

Valuation and Sales Price Comparison 2023: Declines between Valuations and Sale Prices

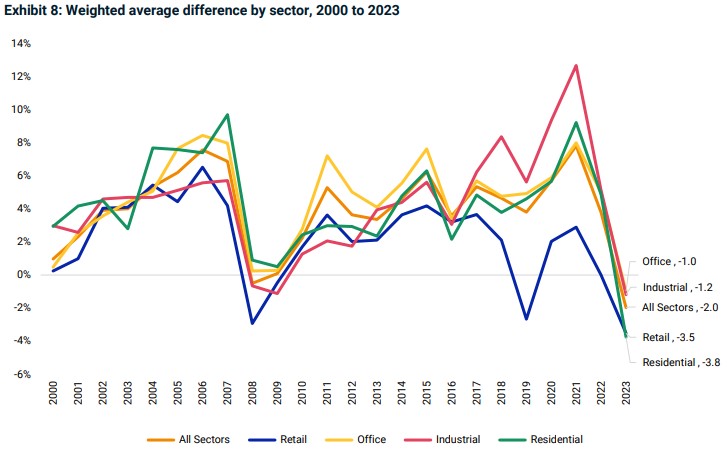

Via MSCI: “The weighted-average difference (WAD), which measures the amount a property’s sales price is above or below its valuation, posted a notable drop . . . [and a]t country level, the U.S. recorded the most negative WAD of -6.8%, indicating the lower average sale price compared to the previous valuation estimate.”

- Office National Report, 2Q 2024: Fragmented Performance and Changing Approaches to Office Use (Marcus & Millichap)

- U.S. Hospitality Brand Performance Comparison Report | Q1 2024 (Colliers)

- Buyers Snap Up Aging and Empty Office Buildings for Deep Discounts (The New York Times)

Other Real Estate News and Reports

Via Institutional Property Advisors: “During the trailing 12 months ended in March, transaction velocity was down by nearly 40 percent year-over-year. The bulk of trades that took place, however, were in the $1 to $10 million price tranche as private buyers stayed active.”

- Legal Sector Leasing & Associate Survey Insights (Cushman & Wakefield)

- How Real-Estate Debt Funds Have Fared in the Downturn (MSCI)

- U.S. Retailer Industry Foot Traffic Analysis | May 2024 (Colliers)