Gray Report Newsletter: June 13, 2024

Fed Dangles a Rate Cut as CPI Cools at Zero Monthly Gain, 3.3% YoY

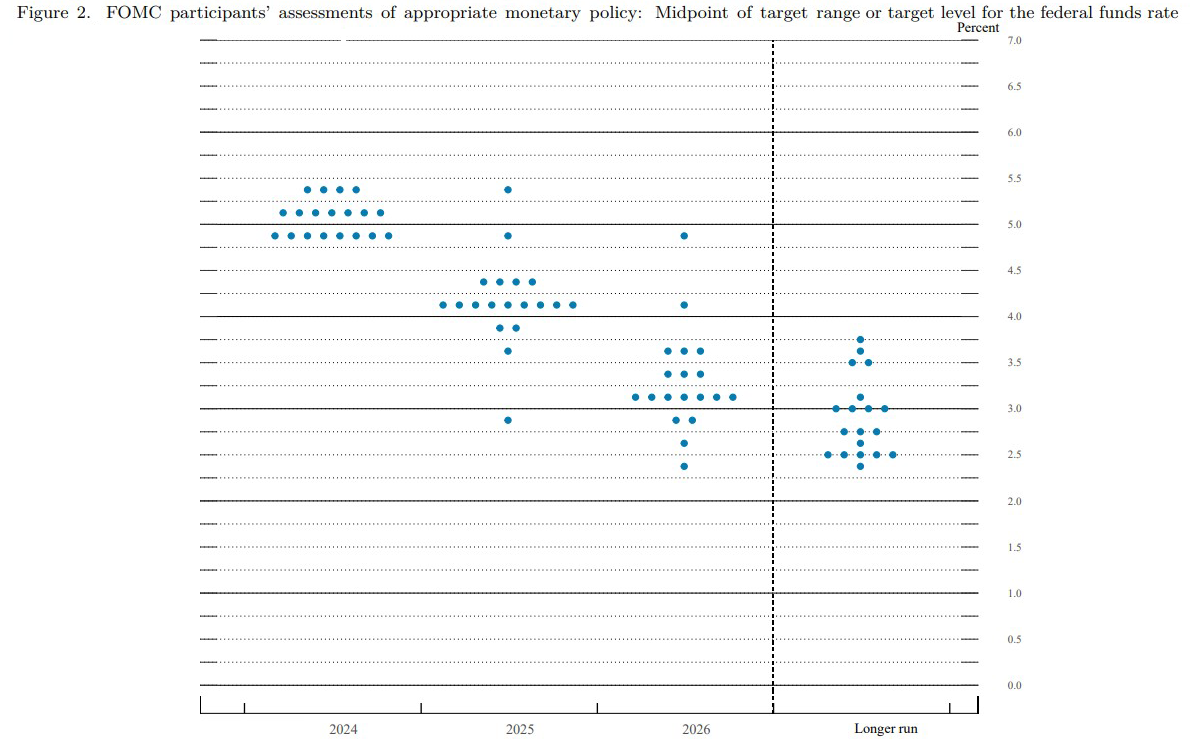

On the same day that the CPI showed yearly inflation ticking down to 3.3%, with zero price growth last month, the Federal Reserve released its updated economic projections along with commentary that raised the possibility of an interest rate cut this year, but there was little definitive indication on when that might take place. While CRE markets are showing more signs of adjustment to “higher for longer” rates, the improved inflation numbers and potential for lower rates are meaningful developments for the CRE lending market that is continuing to feel pressure from the persistent high-rate environment.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

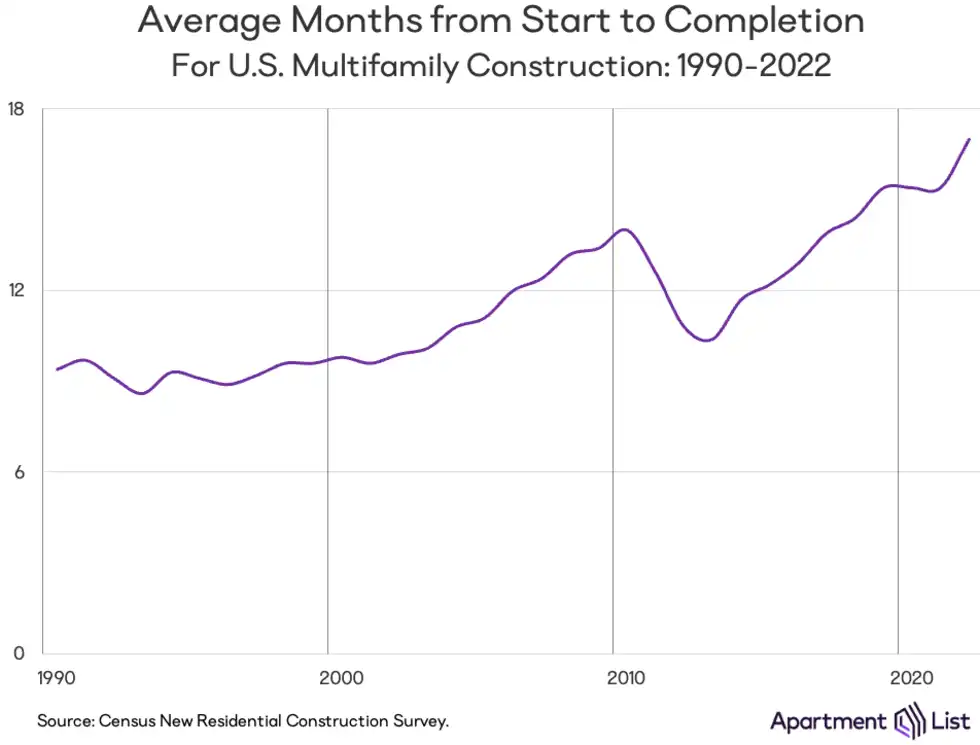

What will the pullback in multifamily construction permitting mean for the rental market?

Via Apartment List: The dip in multifamily supply may not be as sharp as anticipated: “If 2024 does end with 525 thousand units permitted, as the year-to-date trend suggests, that level would be 26 percent below the 2022 peak, but it would still be 9 percent higher than the 2015 to 2019 average and higher than any year from 1987 to 2022.”

- Inner Ring Submarkets Lead Multifamily Rent Growth (CBRE)

- FOMC Statement: June 12, 2024 (Federal Reserve Bank of the United States)

- The Constitutional Case Against Exclusionary Zoning (The Atlantic)

Multifamily and the Housing Market

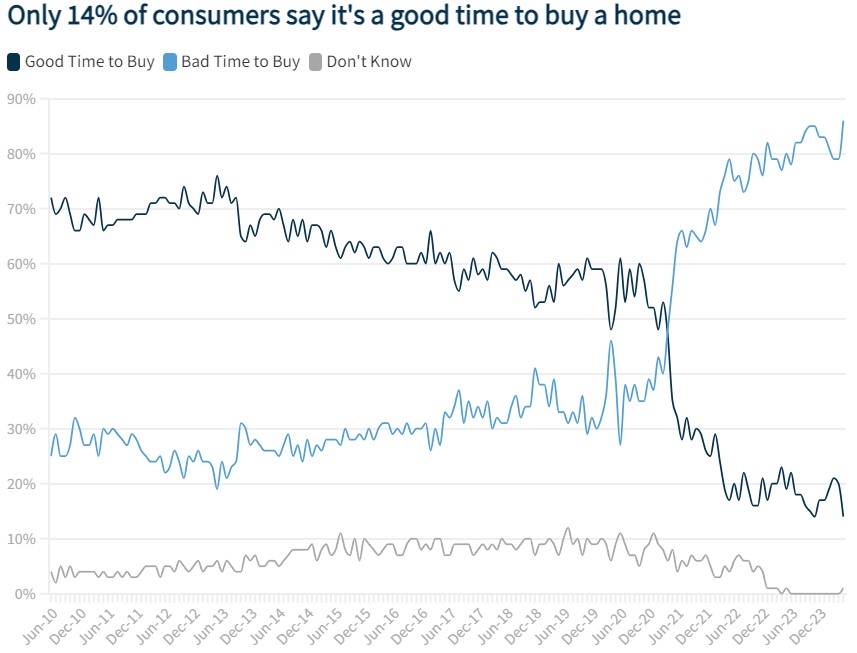

Homebuying Sentiment Hits New Survey Low

Fannie Mae: “This month, only 14% of consumers indicated that it’s a good time to buy a home, down from 20% last month, while the share believing it’s a good time to sell fell from 67% to 64%. Meanwhile, consumers continue to believe affordability will remain tight for the foreseeable future, as respondents believe that, on net, home prices and mortgage rates will go up over the next year.”

- High Housing Costs Are Consuming Household Incomes (Harvard Joint Center for Housing Studies)

- Here’s How Many Home Sales Were ‘Lost’ by the Mortgage Rate Lock-In Effect (Realtor.com)

- Amazon Commits Another $1.4B To Affordable Housing Fund (Bisnow)

Multifamily Markets and Reports

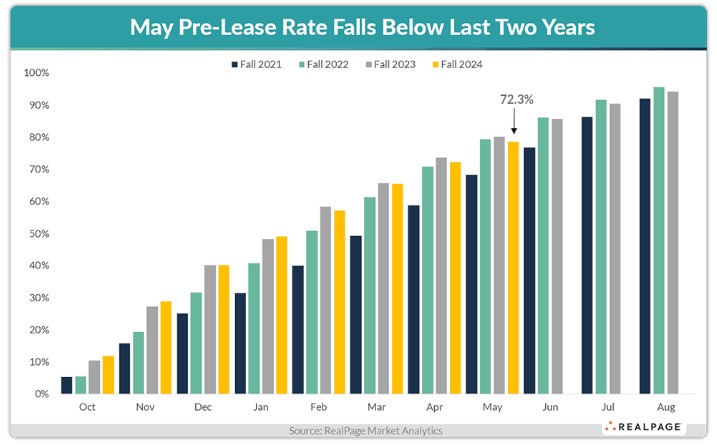

Still Historically Strong, Student Housing Pre-Leasing and Rent Growth Fall Below Year-Ago Records

RealPage: “As of May, 78.6% of beds at the core 175 universities tracked by RealPage have been claimed for Fall 2024, compared to a rate of 80.3% one year ago . . . May’s pre-lease rate also falls below the May 2022 pre-lease rate for Fall 2023 of 79.5%.”

- Apartment stocks topping most other REITs sectors as tough housing market spurs demand for rentals (ABC News)

- Multifamily Feels Pressure on Loans and Increased Inventory (GlobeSt)

- Slower Gains for Consumer Credit (NAHB)

Commercial Real Estate and the Macro Economy

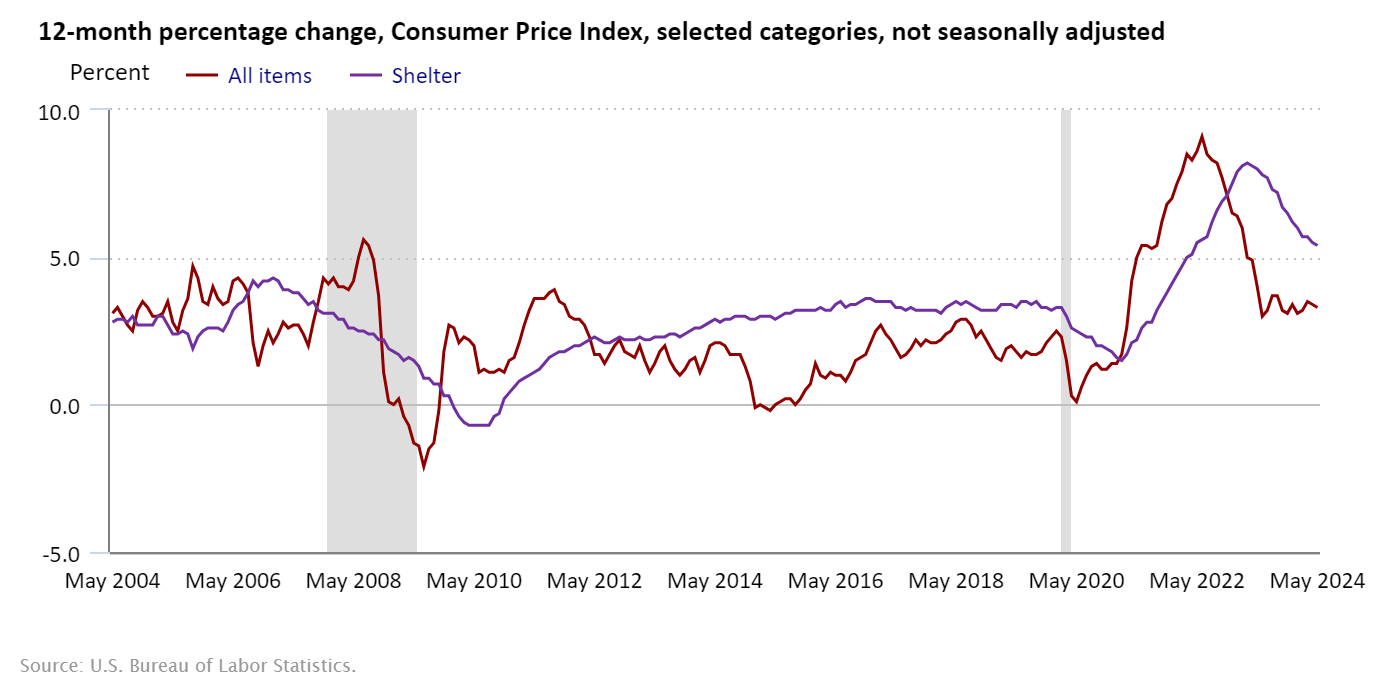

May 2024 CPI: Prices at 3.3% YoY, MoM Change is 0%

Via United States Bureau of Labor Statistics: “More than offsetting a decline in gasoline, the index for shelter rose in May, up 0.4 percent for the fourth consecutive month. The index for food increased 0.1 percent in May. The food away from home index rose 0.4 percent over the month, while the food at home index was unchanged.”

- U.S. Macro Outlook: An Uncomfortable Soft Landing (Cushman & Wakefield)

- Consumer Spending Slows Down, Just Not at These Retailers (Moody’s Analytics)

- Building Codes Cost. But What is Resiliency Actually Worth? (CoreLogic)

Other Real Estate News and Reports

Federal Reserve Bank Summary of Economic Projections

Via Federal Reserve Bank of the United States: These economic projections accompany the Federal Reserve’s release of a statement on employment, inflation, and interest rates as the Federal Reserve “decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent.”

- Moody’s Could Downgrade 6 U.S. Banks Over CRE Exposure (Bisnow)

- Fed recap: Chair Powell explains why the central bank isn’t ready yet to cut rates (CNBC)

- Mid-Year Report: Office on the Brink (Trepp)