Gray Report Newsletter: July 4, 2024

Does Multifamily Optimism Outweigh Economic Uncertainty?

A “trifecta of positive inflation reports” shows consistently weakening inflation, and data from both the single-family and multifamily markets points to persistent strong housing demand. Multifamily investment activity, however, is low, and there is little sign of interest rate relief for multifamily borrowers still struggling with high debt costs and sluggish rent growth. The sharpening contrast between the potential for growth and the current stagnation in the multifamily market represents a significant opportunity for investors, especially those with greater access to capital.

Multifamily, the Nation, and the Economy

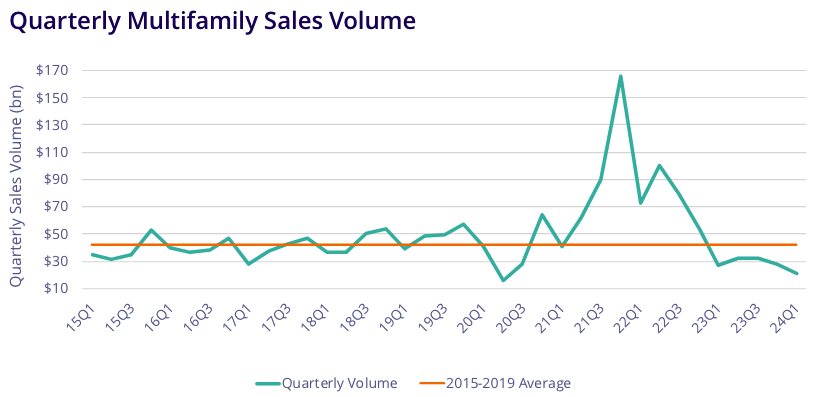

2024 Multifamily Outlook: Investment Prospects Are Improving, but Activity is Low

Via Colliers: “Today’s buyers are able to acquire assets at a reset basis, which is regularly below replacement costs. Fundamentals will begin to improve, setting the stage for more robust NOI growth if opex can be controlled.”

- Get Ahead of The Fed – Why Inflation Isn’t As High As People Think (Marcus & Millichap)

- Why The Supreme Court Ruling To Limit Federal Agency Power Is A Big Deal For Real Estate (Bisnow)

- Loan Modifications Nearly Double in 12 Months (GlobeSt)

- PCE Completes Trifecta of Promising Inflation Reports for May (Moody’s Analytics)

Multifamily and the Housing Market

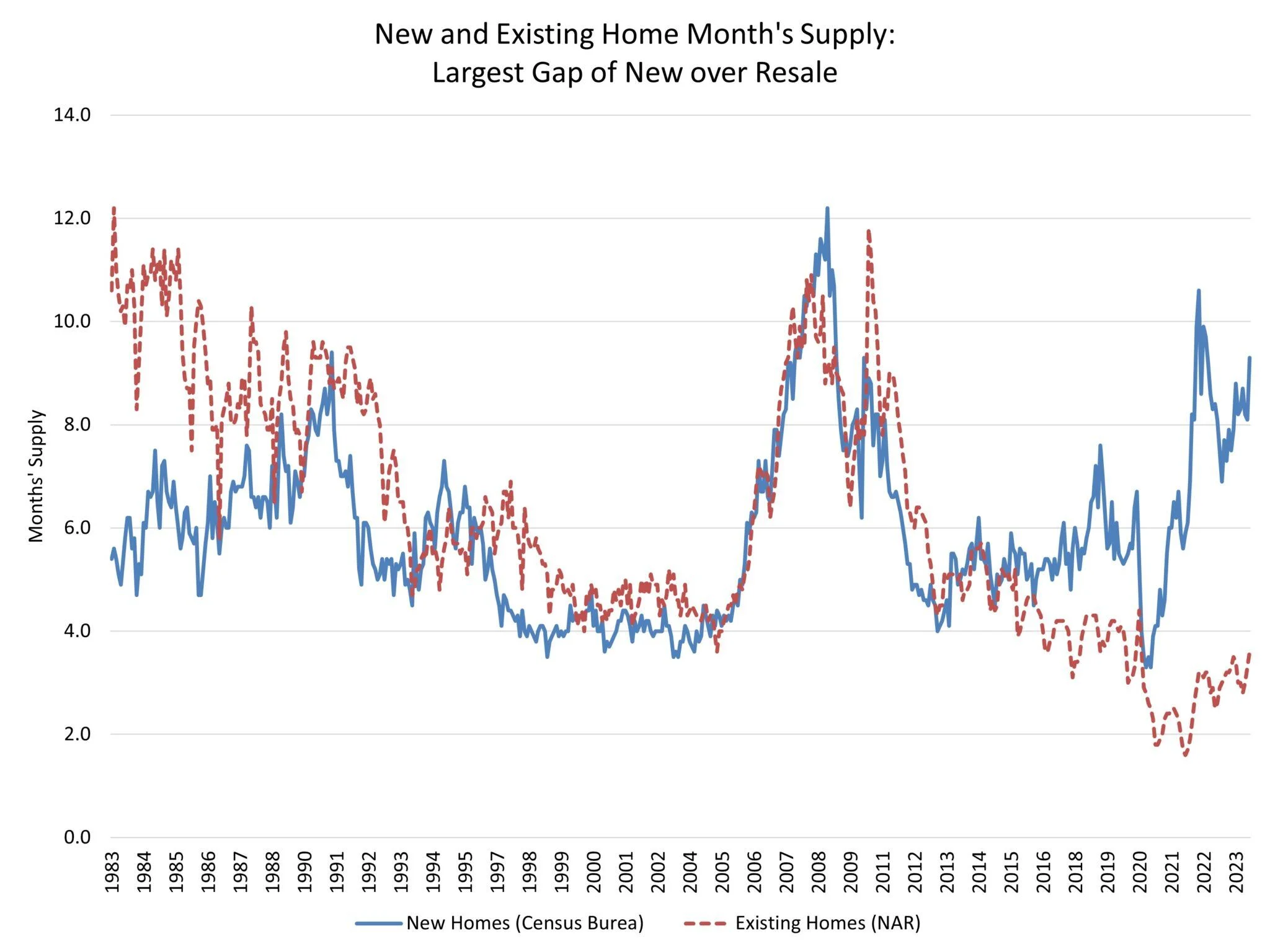

Considering Housing Inventory: Why Both New and Existing Supply Matters

Via NAHB: “The data thus show that current market conditions are unusual, with a large gap between new and existing single-family months’ supply . . . [but] lower mortgage rates will . . . put downward pressure on the months’ supply metric by increasing sales rates.”

- Starts and Permits Drop for Both Multifamily and Single-Family (RealPage)

- Study: Detroit Overtakes Atlanta as Most Overvalued Housing Market (Florida Atlantic University)

- Multifamily Rent Forecast Update: Summer Leasing Start Returns to Normal (Yardi Matrix)

Multifamily Markets and Reports

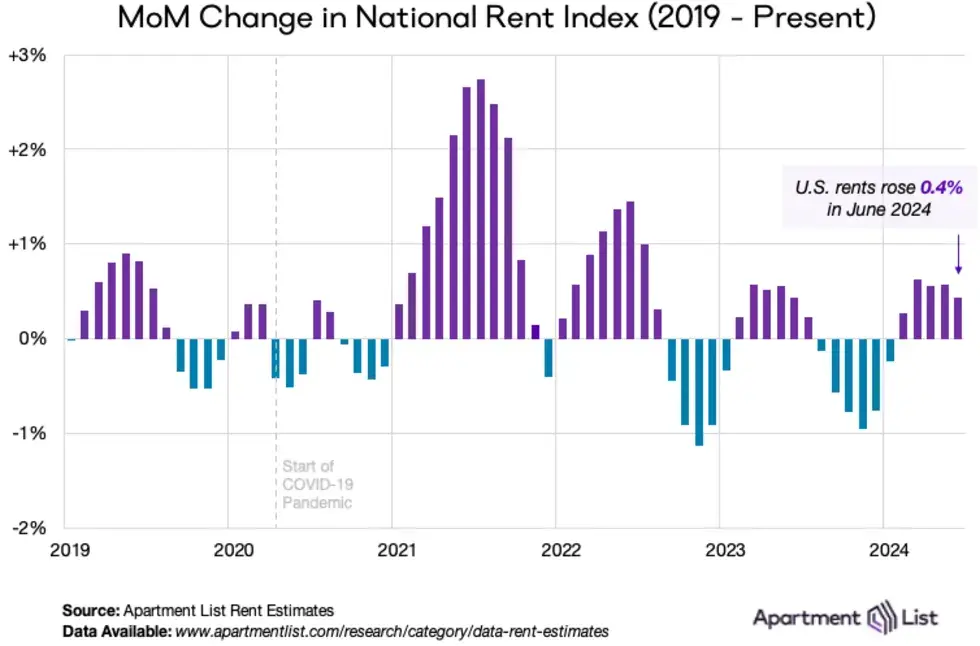

June 2024 National Rent Growth

Apartment List: “This is typically the time of year when rent growth is accelerating amid the busy moving season, so sluggish growth this month indicates that the market is headed for another slow summer.”

- Best Cities for Renters to Live in 2024: Charleston Tops the Charts for Second Year in a Row (RentCafe)

- Why Invest in the Midwest? (Cushman & Wakefield)

- June 2024 CRE Insights: Apartment Demand on the Rise as Industrial and Retail Falter (NAR)

Commercial Real Estate and the Macro Economy

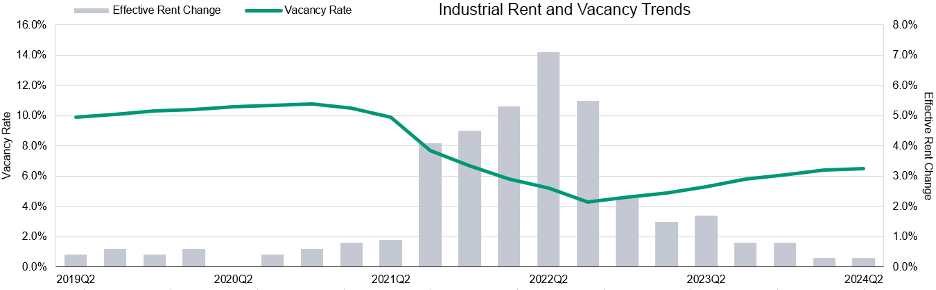

Q2 2024 Preliminary Trend Announcement: Apartment Demand Catching Up as Industrial Cools Down

Via Moody’s Analytics: “As demand fell more rapidly than supply, [industrial] vacancies have been on the rise for several quarters. Since Q2 of last year, the rate has increased by 120 bps to 6.5% nationally. Despite this, the current vacancy rate is significantly lower than the sector’s pre-pandemic average.”

- A Return to the Office? U.S. Office Attendance Policies Midyear 2024 (CBRE)

- CMBS Loan Loss Report: Volume of Loan Losses Decreases in June 2024 (Trepp)

- A Real-Estate Fund Industry Is Bleeding Billions After Starwood Capped Withdrawals (The Wall Street Journal)

Other Real Estate News and Reports

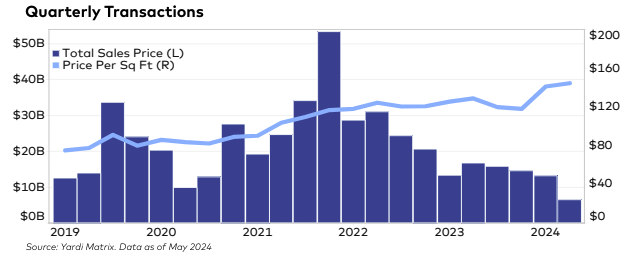

June 2024 National Industrial Report: Sale Prices Increase Despite Headwinds

Via Yardi Matrix: “The historic wave of new supply that has sent vacancy rates upward is petering out, with just 69.2 million square feet starting construction so far this year.”

- Retail National Report2Q 2024: Strong Fundamentals and Resilient Consumers (Institutional Property Advisors)

- CRE prices “bounced back in May after a sustained decline, potentially signaling the start of a bottoming market” (CoStar)

- Empty Offices Risk Wiping Out $250 Billion in Commercial Property Value (Bloomberg)