Gray Report Newsletter: July 25, 2024

Can Fed Rate Cuts Fix High Housing Costs?

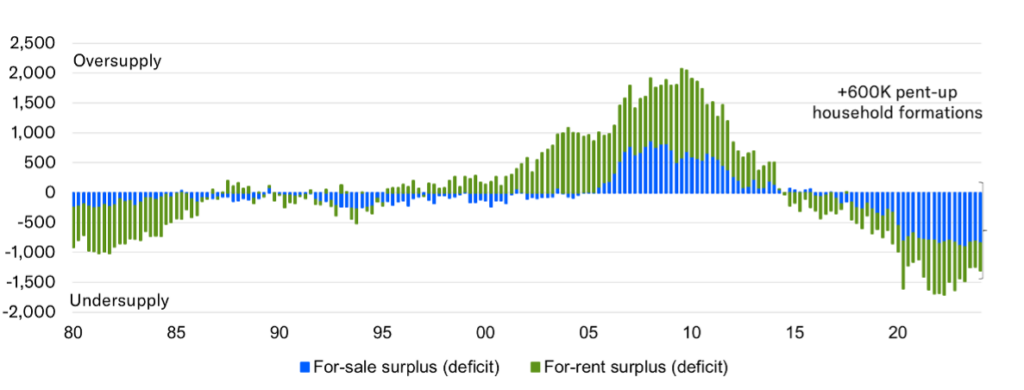

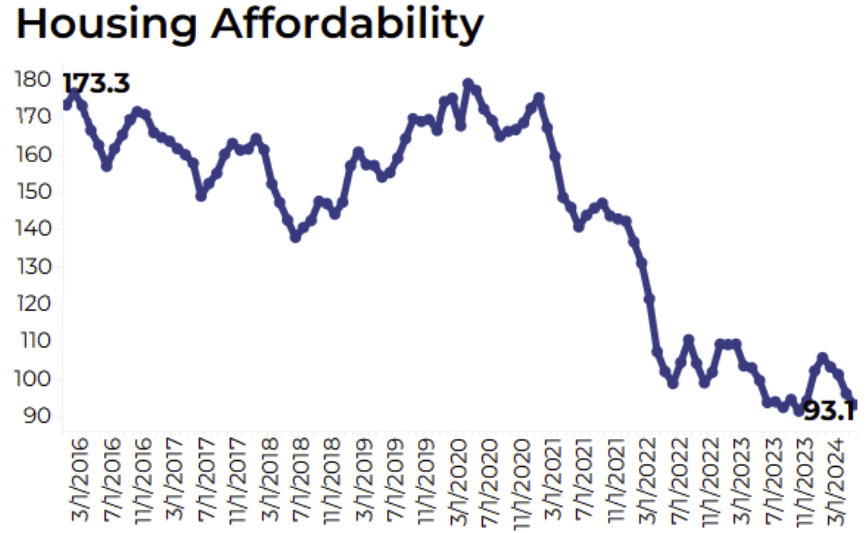

Single family homes prices are as high as they’ve ever been, but home sales are low. High interest rates have suppressed both multifamily and single family building, and lack of housing supply has led to declining affordability and a sustained housing deficit. There is significant pent up demand in the housing market. In both single-family and multifamily markets, this extended period of unusually low sales activity has led to building pressure as this pressing need for homes contends with housing costs that are too high for demands to be met.

Multifamily, the Nation, and the Economy

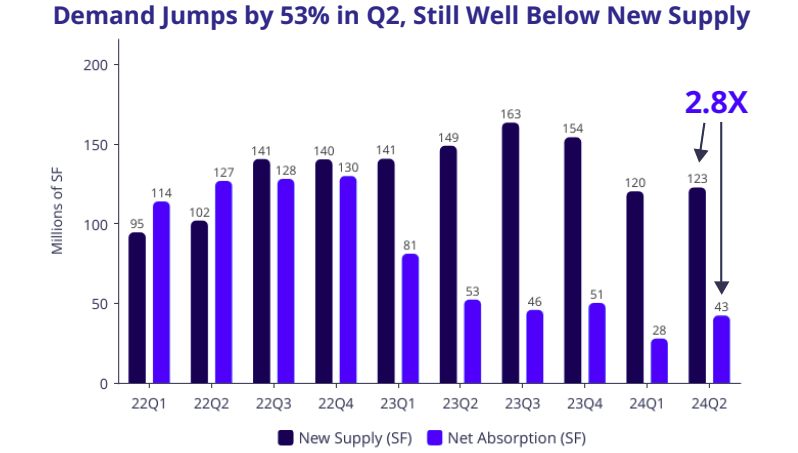

Elevated Completions Continue to Weigh on Multifamily Rent Growth, but Housing Demand Remains Strong

Via Moody’s Analytics: Despite a house shortage estimated to be “at least 1.9 million homes,” due to elevated apartment deliveries, “Moody’s CRE recently pared back its forecast for asking rent growth to the low- to mid- 1% range in 2024.”

- Increasingly Debt-Strapped Consumers Concerned About Rising Housing-Related Costs (Fannie Mae)

- Insurance Costs Suppress Multifamily Values Most in Certain Sun Belt Markets (CBRE)

- U.S. Economic, Housing and Mortgage Market Outlook – July 2024 | Spotlight: Consumer Delinquencies (Freddie Mac)

- Multifamily Distress Could Head for “Real Estate Armageddon (GlobeSt)

Multifamily and the Housing Market

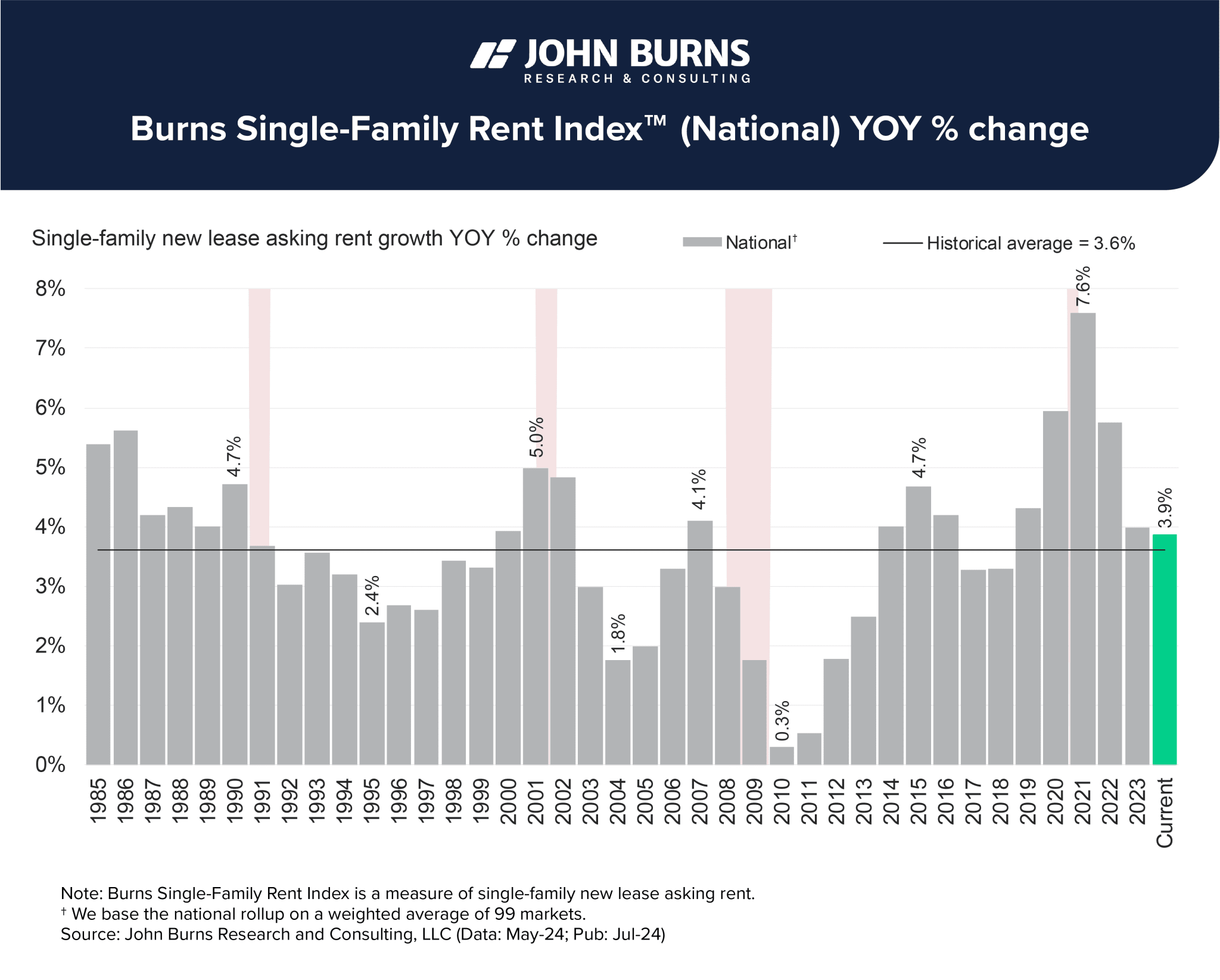

Single Family Rent Growth Remains Elevated in Contrast with Apartment Market

John Burns Research and Consulting: “SFR new lease asking rent growth rose +3.9% YOY nationally as of May 2024, surpassing the historical average of +3.6% YOY. National SFR new lease asking rent growth has historically stayed positive even in recessionary periods.”

- Record house prices depress US home sales in June (Reuters)

- Remodeling Spending to Tick Up through Mid-2025 (Harvard Joint Center for Housing Studies)

- Adjustable-Rate Mortgages Gain Popularity Amid Surging Rates (CoreLogic)

- Student Housing Preleasing Reaches 85%, Rent Growth Slows (Yardi Matrix)

Multifamily Markets and Reports

Residential Real Estate Snapshot: Low Affordability, Low Sales Activity

Via NAR: With dramatically low single family home sales driven in part by high mortgage rates and declining affordability, “only the Midwest saw a [YoY] increase in home sales while all other regions experienced declines.”

- Pace of Rent Declines Is Slowing (GlobeSt)

- How often does rent growth top the 5% mentioned in the White House’s rent cap proposal? (Apartment List)

- Student Housing Rent Growth Softens as Pre-Leasing Chugs On in June (RealPage)

- How Much Apartment Space Does $1,500 Get You in 200 U.S. Cities? (RentCafe)

Commercial Real Estate and the Macro Economy

Q2 Industrial Market Statistics: New Supply Outstrips Demand

Via Colliers: “Year over year, vacancy has increased the most in the West region — by 278 basis points, while it’s up the least in the Midwest — by 74 basis points. Vacancy was highest in the South region, at 7.8%.”

- July 2024 Office Report: Loans Mature Into Shaky Office Market (Yardi Matrix)

- U.S. Gateway Office Market Construction | Q2 2024 (Colliers)

- The Forces Pushing the Fed to Cut Rates Soon (Marcus & Millichap)

Other Real Estate News and Reports

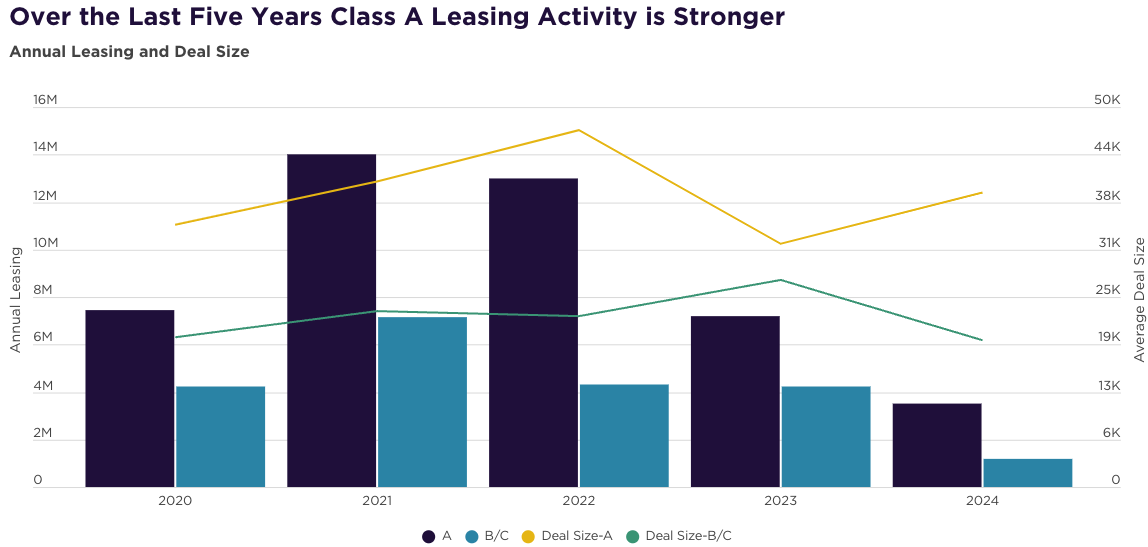

The Flight to Quality in Life Sciences

Via Cushman & Wakefield: “With an average gross taking rent of $80.85 per square foot (psf) over the last five years, Class A has received a 48% price premium vs. Class B and C space. While Class B and C offers tenants a significant pricing discount, the operational limitations they impose can offset the cost benefit.”

- Bank CRE Loan Performance in Q1 2024 Signals Rising Risks (Trepp)

- Bubble Fears Emerge About Trillion-Dollar AI Bet Fueling One Of Real Estate’s Hottest Sectors (Bisnow)

- The D.C. Office Market Is in Trouble—No Matter Who Wins the Election (The Wall Street Journal)