Gray Report Newsletter: July 18, 2024

Biden’s Plan for 5% Rent Cap at Odds with Current Low Rent Growth Environment

The Biden administration has announced a proposal for a 5% rent cap, despite the fact that rent growth has been markedly below average for the past year-and-a-half, with this rent growth correction finally showing up in the Consumer Price Index and contributing to the milestone monthly deflation recently recorded for June. With lower inflation numbers and some suggestions of impending rate cuts from the Federal Reserve, the multifamily lending market should become more favorable; however, despite optimistic projections for the future of the apartment market, initial rate cuts from the Fed may not alleviate some multifamily borrowers’ current distress, which has grown significantly in recent months.

Multifamily, the Nation, and the Economy

Biden Administration Announces 5% Rent Cap Proposal

The White House: Biden calls for Congress to pass legislation that will bar “corporate” landlords (defined as owners of 50 or more units) from “faster depreciation [tax] write-offs” if they raise rents more than 5% per year.

- Prime Multifamily Metrics Hold Steady in Q2 (CBRE)

- Has the Fed Finally Reached a Tipping Point? (Marcus & Millichap)

- 2024 Mid-year Review: Economy and Housing in the Sweet Spot (John Burns Research and Consulting)

Multifamily and the Housing Market

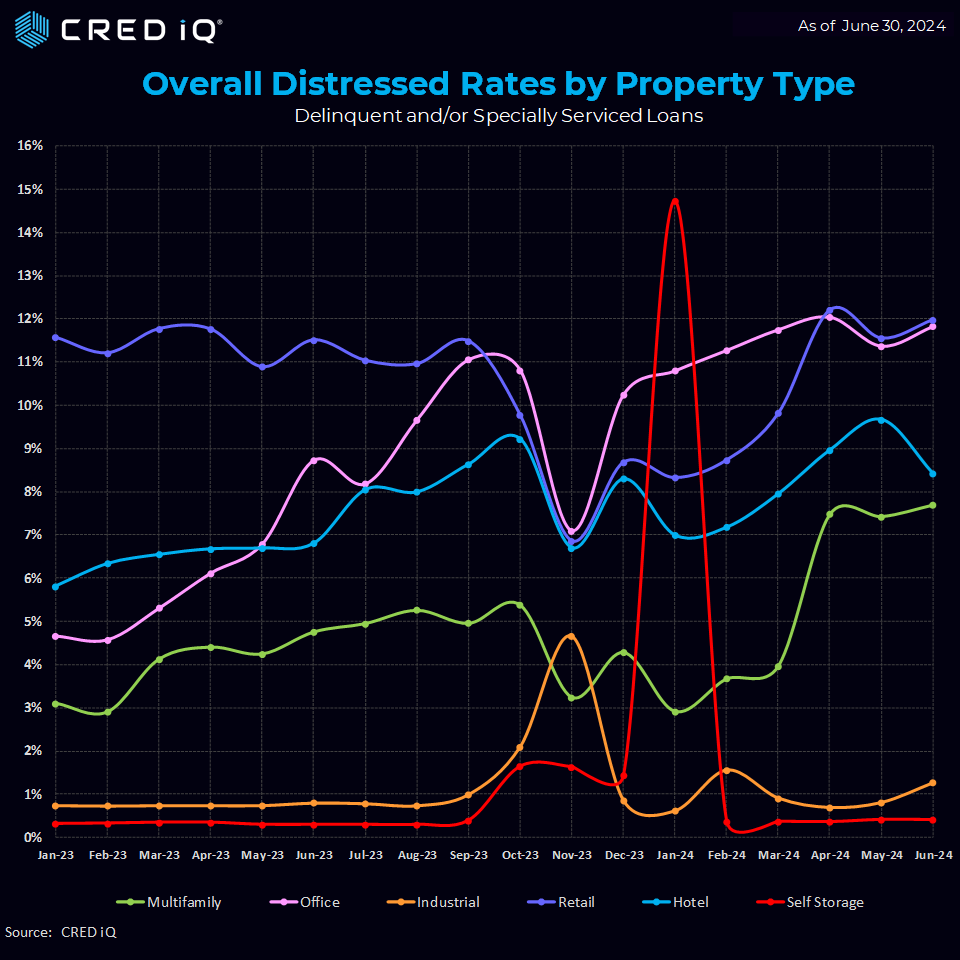

CMBS Apartment Distress Rates up 185% in last 6 Months

CRED iQ via Bisnow: “The apartment loans with CMBS financing reached an 185% increase in distress since the start of the year. The CRED iQ distress rate added 13 basis points in June to 8.62%, a nearly identical gain as posted last month. The print marks a fourth straight record high.”

- High Mortgage Rates Continue to Hold Back Builder Confidence (NAHB)

- Consumer Mortgage Understanding Study (Fannie Mae)

- The Role of Design in Addressing Housing Challenges (Harvard Joint Center for Housing Studies)

- America’s 10 Best (and Worst) Cities for First-Time Homebuyers (Realtor.com)

Multifamily Markets and Reports

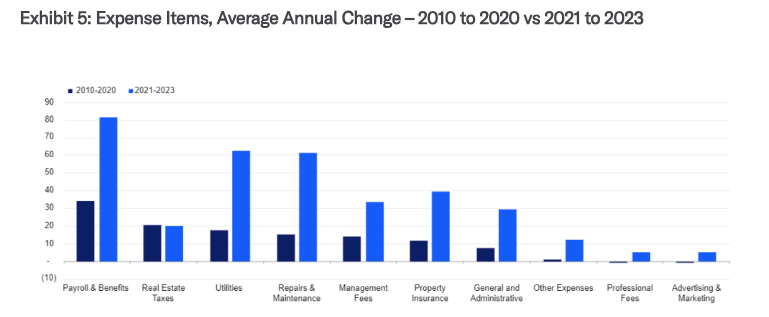

Navigating Through Major Expenses for Multifamily Properties

Via Moody’s Analytics: “An analysis of income and expense data across more than 3,500 apartment properties from the CMBS universe (with data available in 2023 & 2022) reveals that for the past year, the growth in dollar amounts has been even more drastic for Payroll & Benefits, Utilities, and Repairs & Maintenance.”

- Forecast Points to Improved Rent Growth in 2025 (RealPage)

- Mid-Year Rental Activity Report: Minneapolis Is Top City in 1st Half of 2024, West Most Desirable Region for Renting (RentCafe)

- Residential Real Estate Market Snapshot: Midwest Only Region with Home Sales Increasing (NAR)

- US Housing Starts Increase on Pickup in Multifamily Construction (Bloomberg)

Commercial Real Estate and the Macro Economy

June 2024 Consumer Price Index Shows MoM Deflation, Lower YoY Inflation

Via Bureau of Labor Statistics: “The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent on a seasonally adjusted basis, after being unchanged in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.0 percent before seasonal adjustment.”

- Getting Closer [to an interest rate cut] (Federal Reserve Bank of Kansas City)

- AI’s Impact on Hotels (CBRE)

- These Banks Are at Higher Risk of a Depositor Run (Florida Atlantic University)

Other Real Estate News and Reports

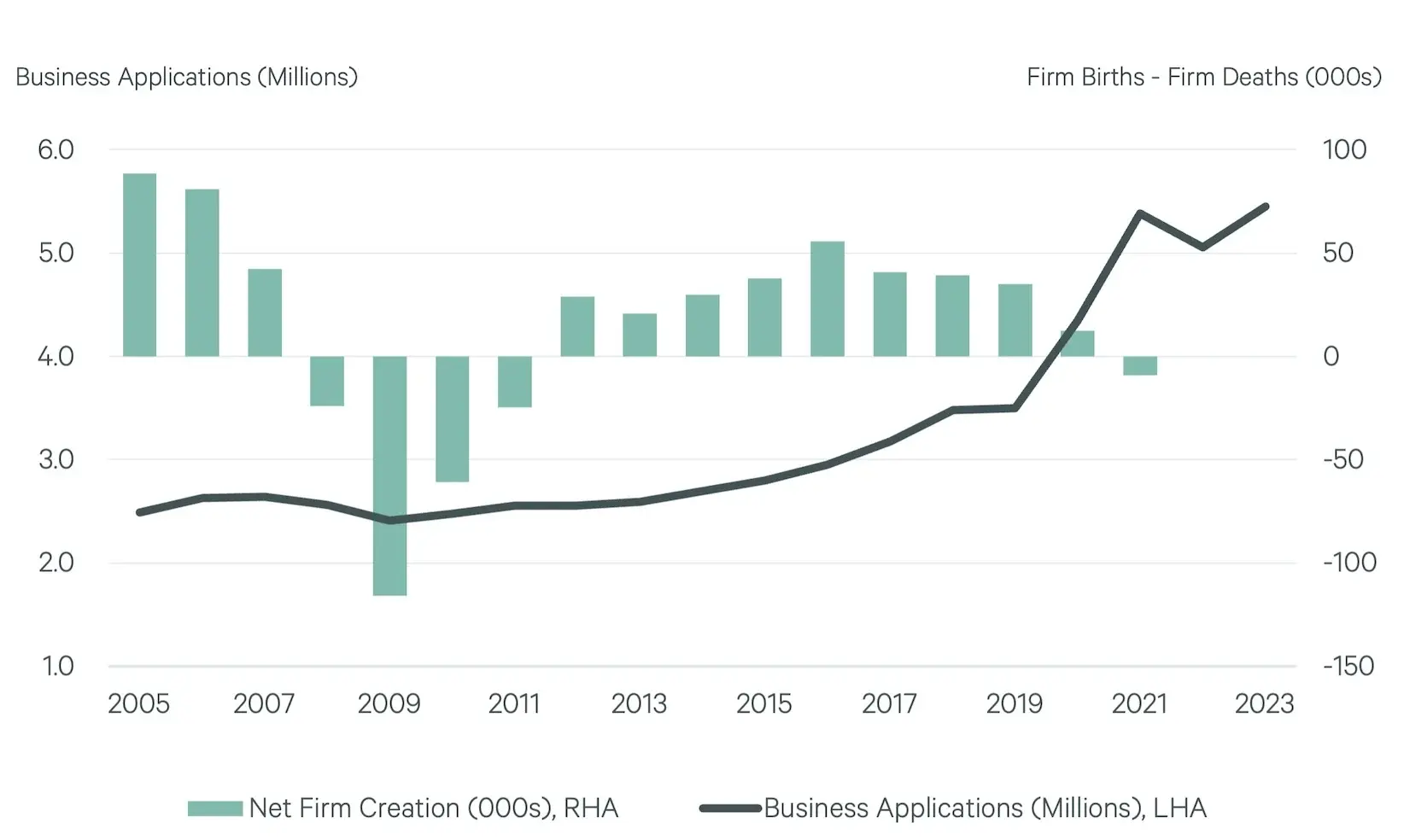

New Business Applications During the Pandemic Help Explain Today’s Tight Retail Market

Via CBRE: “This surge in consumer-facing businesses has undoubtedly contributed to tight space availability in strip and neighborhood retail centers.”

- Cross-Border CRE Capital Flows in a New Era (MSCI)

- “June saw a 4.4% rise in retail foot traffic, signaling strong consumer activity despite unchanged headline sales.” (Colliers)

- June Inflation Gives More Runway to Fed for Rate Cuts (Institutional Property Advisors)