Gray Report Newsletter: July 11, 2024

Multifamily Prices Have Bottomed. Growth Is Under Way.

Apartment prices increased a full 4.9% last month, according to recent data from Green Street’s Property Price Index, which follows a 2% increase from the previous month and is the strongest positive trend since late 2021. Apartment demand remains strong amid a generational peak in new apartment supply. Weakening (however gradually) inflation, alongside indications from the Federal Reserve that interest rate cuts are a growing possibility, could finally lead to a more active multifamily investment market, but currently, sales activity is relatively low.

Multifamily, the Nation, and the Economy

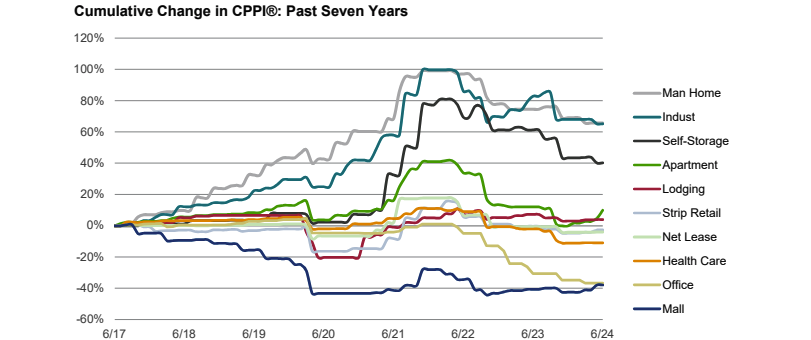

Multifamily Price Growth Leads as Commercial Property Prices Trend Upward

Via Green Street: Apartment prices were the only property type with price growth this past month, with the 4.9% monthly increase in apartment prices carrying the overall property price index to 0.7%.

- Clearing the way for rate cuts? US economy no longer overheated, Fed’s Powell tells Congress (Reuters)

- Rent Control’s Impact on Multifamily (GlobeSt)

- Multifamily Construction Data Shows Growing Share of Low-Medium Density Buildings (NAHB)

Multifamily and the Housing Market

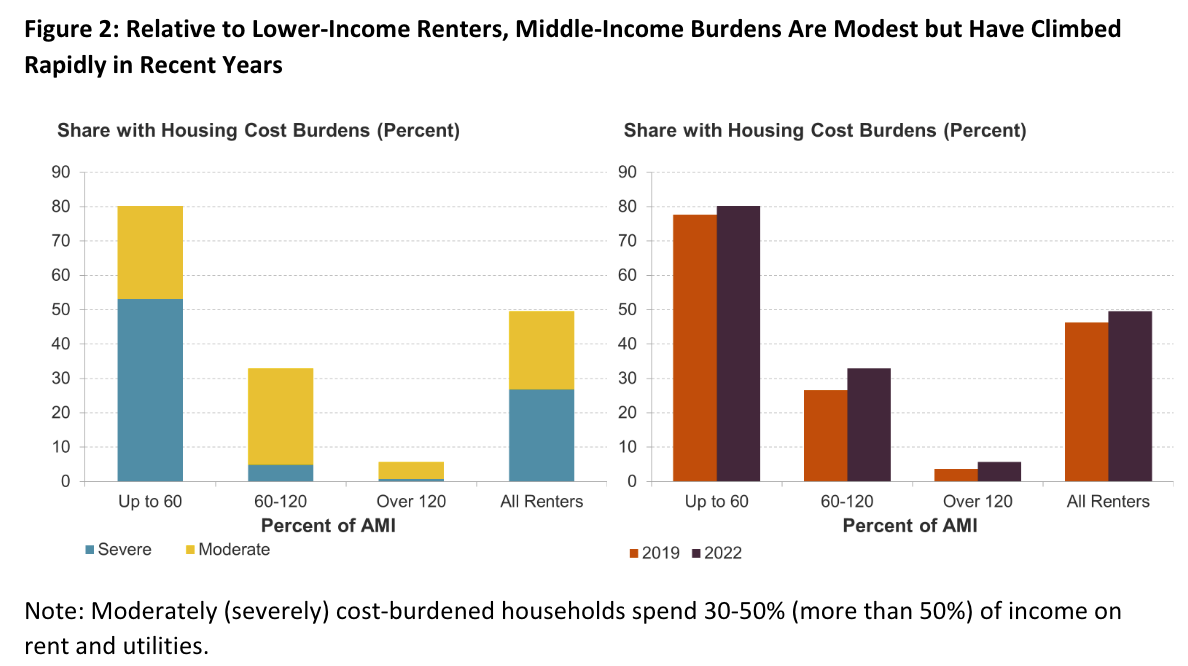

Middle-Income Housing Programs Emerge as Affordability Challenges Climb the Income Ladder

Harvard Joint Center for Housing Studies: “For starters, these programs are relatively new, with most of them coming into existence since 2019. The programs are geographically diverse, present in states across the county, and encompass a range of market conditions, housing costs, and political environments, including statewide programs in California, Georgia, and Minnesota.”

- Housing Sentiment Rebounds, Returns to Likely Plateau (Fannie Mae)

- County Median Home Prices and Monthly Mortgage Payment, Q1 2024 (NAR)

- Rate cuts won’t fix housing affordability, economist says (Yahoo Finance)

- Seattle OKs incentives for developers turning offices into housing (Seattle Times)

Multifamily Markets and Reports

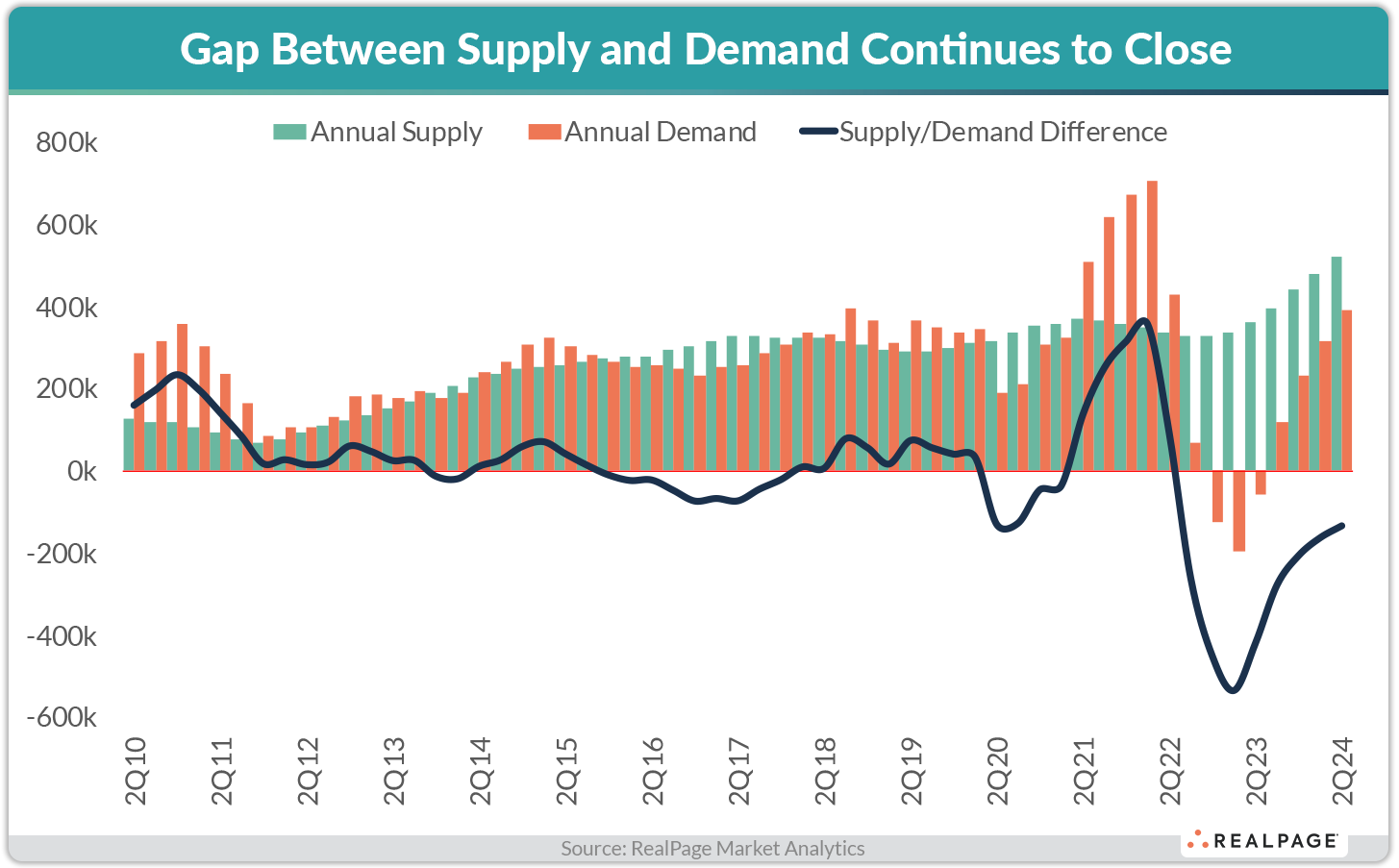

U.S. Apartment Demand Surges in 2nd Quarter

Via RealPage: “While supply continues to garner the lion’s share of apartment industry-focused headlines, there’s an equally remarkable demand surge brewing across the country. In fact, the impressive demand reading in year-ending 2nd quarter 2024 may be difficult to overstate.”

- Student Housing Rent Growth Softens as Pre-Leasing Chugs On in June (RealPage)

- The American Elevator Explains Why Housing Costs Have Skyrocketed (New York Times)

- Will Rent Growth in BTR/Single-Family Rentals Outpace Apartment Rent Growth Over Time? (John Burns Research and Consulting)

Commercial Real Estate and the Macro Economy

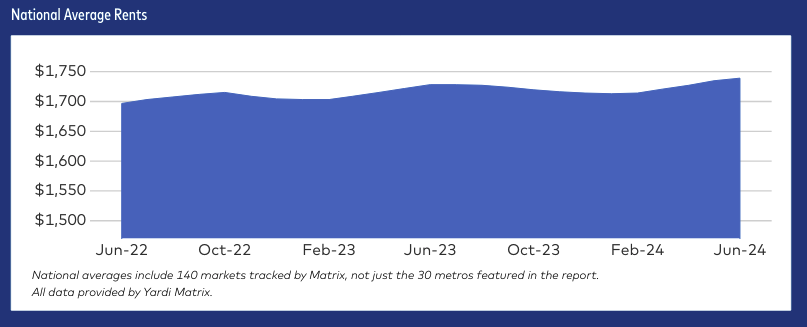

June 2024 National Multifamily Report: Expense Growth Painful Where Rent Increases Cool

Via Yardi Matrix: “Overall, expenses per multifamily unit nationally rose by 8.0% year-over-year to $8,890 in 2023, after increasing by 8.2% in 2022 . . . more than double the

3.4% average growth rate of the previous four years.”

- Feds Stepping Up Scrutiny As Falling Property Values Expose Fraud (Bisnow)

- June Hiring Poses Implications For Health Care and Retail Real Estate (Institutional Property Advisors)

- How Changing Behavior Is Reshaping CRE (Marcus & Millichap)

Other Real Estate News and Reports

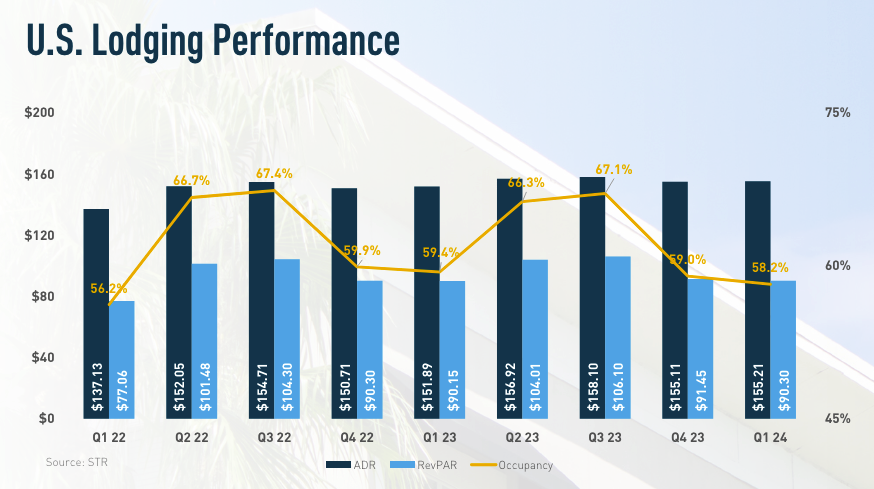

National Hotel Industry Report, Q1 2024

Via Berkadia: While occupancy numbers have differed little from recent years, ADR and RevPAR have stagnated, with RevPAR trending slightly down relative to recent years.

- How Property Type and Location Affected US Lenders’ Losses (MSCI)

- U.S. Hotels State of the Union July 2024 Edition (CBRE)

- Special Servicing Rate Inches Up Again in June 2024, Driven by Increases in Mixed-Use & Office (Trepp)