Gray Report Newsletter: January 18, 2024

Will the Multifamily Market Reignite?

A number of potential scenarios could restart activity in the multifamily market, with rate cuts, pent-up investor demand, loan maturities, and continued operational challenges among the possible factors that could close the buy/sell gap and motivate more apartment property sales. Multifamily asset performance faces near-term pressures from increased apartment supply as well as a potential economic downturn, but investors will be poised to act on long-term investment strategies should an opportunity emerge amid the current uncertainty.

Multifamily, the Nation, and the Economy

The Bill Is Coming Due on a Record Amount of Commercial Real Estate Debt

Via The Wall Street Journal: “Vacancy rates are increasing in some multifamily markets, making it harder for many of those landlords to raise rents or make payments on floating-rate debt . . . ‘At some point borrowers are going to have to come to grips that their lenders might be right about the values and look at it from the worst-case scenario.'”

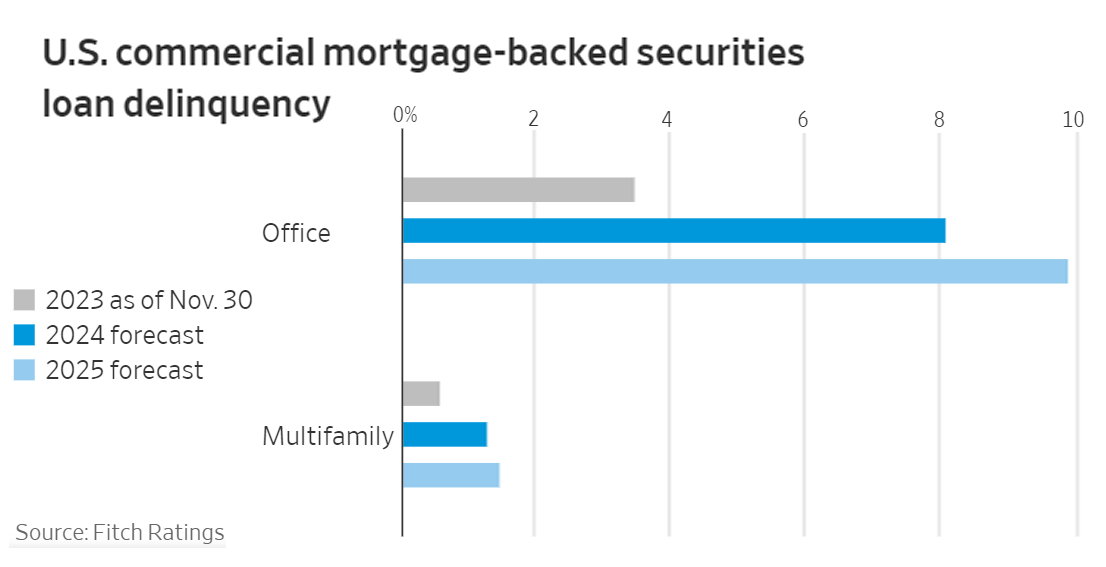

- CRE Finance Council Signals Potential for Multifamily Distress (Moody’s Analytics)

- Reasons for CRE Optimism In 2024 (Cushman & Wakefield)

- BREIT Records Worst Annual Return In Its History (Bisnow)

Multifamily Markets and Reports

Multifamily Forecast: 3% Rent Growth, 30BPS Cap Rate Expansion

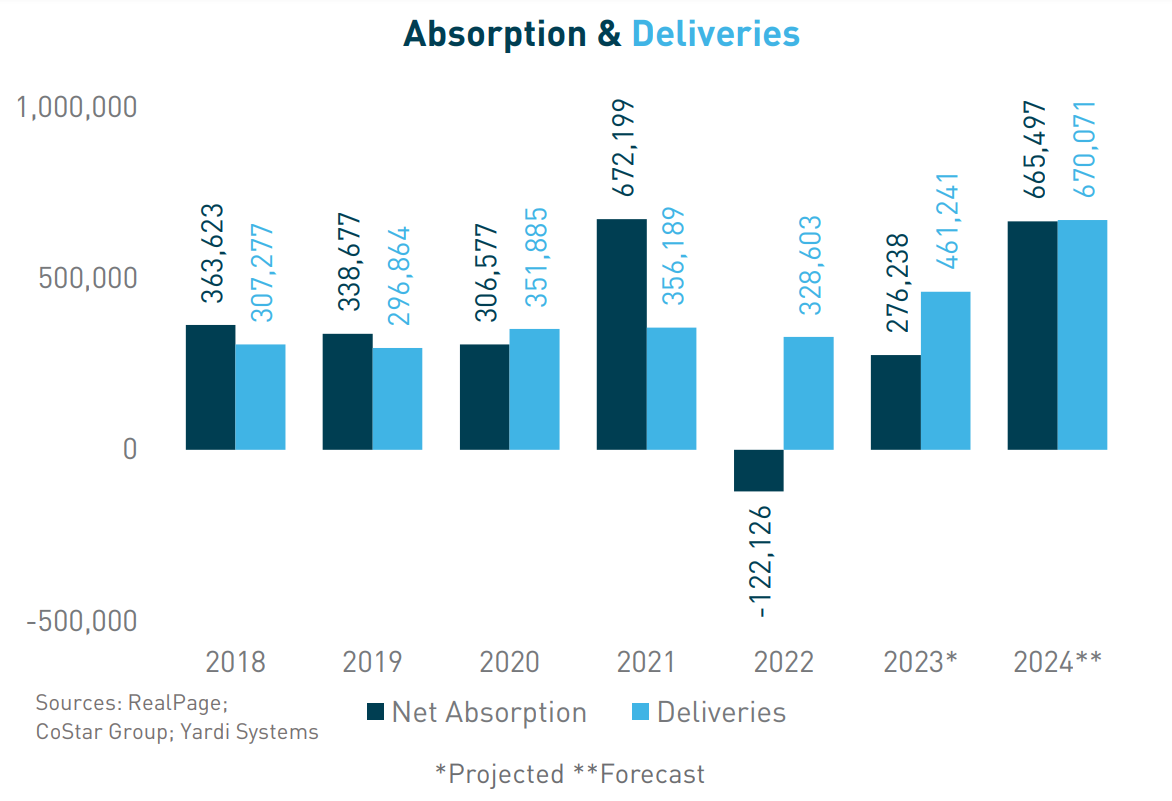

Berkadia: Among the projections in this forecast report is a substantial amount of demand, nearly enough demand to match the historic amount of new apartment supply expected to enter the market this year.

- 2023 Apartment Market By the Numbers (RealPage)

- 2024 U.S. housing market poised for the largest influx of multifamily housing supply since the Nixon era (Fast Company)

- Renter-Age Population Grew Fastest in These Markets (RealPage)

Multifamily and the Housing Market

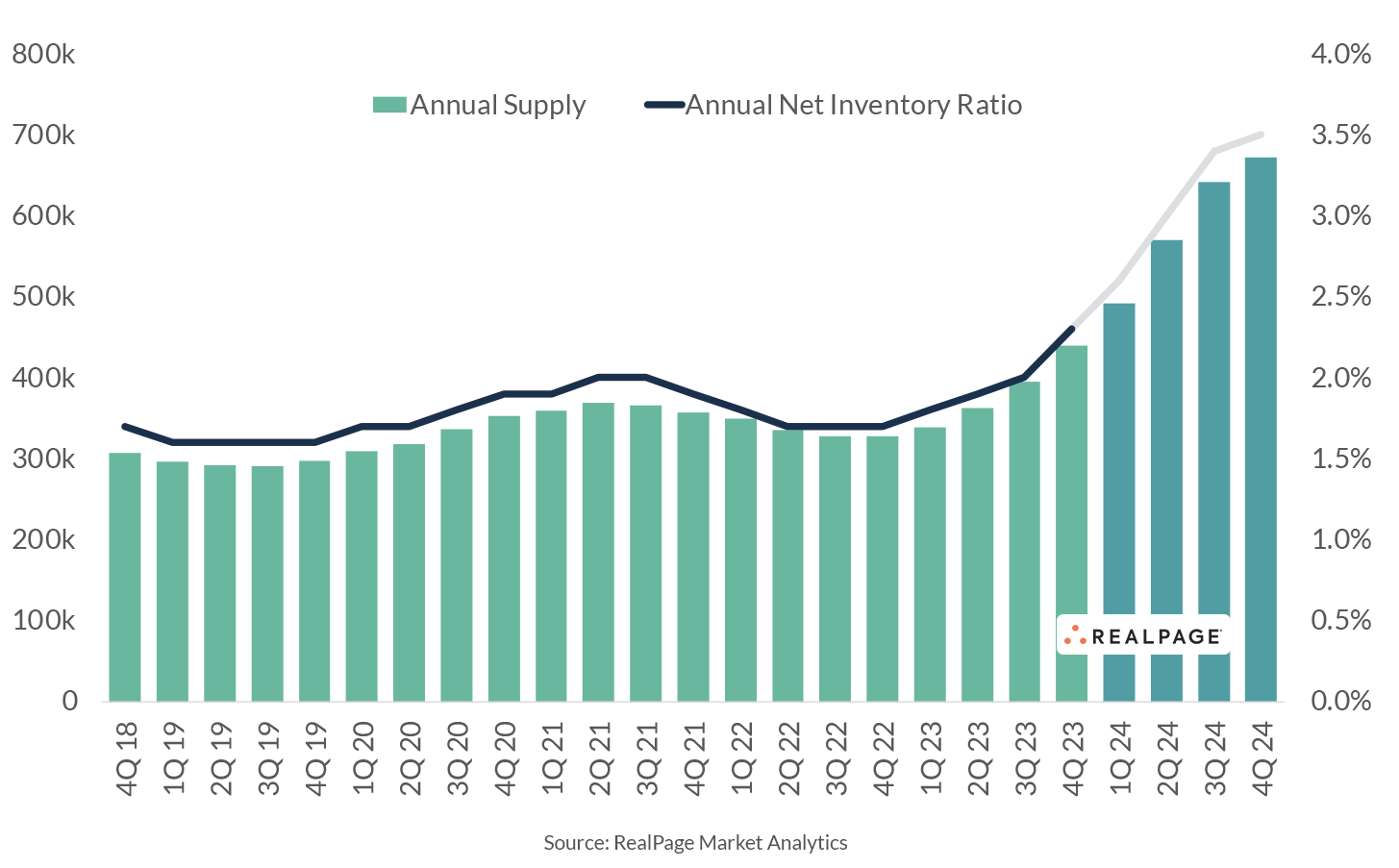

2024 Apartment Supply Scheduled to Outweigh 2023

RealPage: “2023 logged a big increase in deliveries, with nearly 440,000 apartment units completed throughout the year, a 36-year high for the market. For 2024, scheduled completions in the U.S. total another 670,000 or so apartments, which blows past that record volume by about 50%.”

- Home Price Index: Growth remained positive in Q4 but continued to decelerate (Fannie Mae)

- Hottest Markets for 2024: Buffalo, Indianapolis, Cincinnati, Columbus (Zillow)

- Hoping To Buy a Home in 2024? Here’s Where Prices Have Been Rising—and Falling—the Most (Realtor.com)

Migration and Housing Reports

Via Atlas Van Lines: “Hawaii was once again a sought-after destination this year, with 77% of the shipments being inbound,” followed by Maine, North Carolina, Montana, and New Hampshire.

- National Movers Study: 2023 (United Van Lines)

- Top Growth States of 2023 (U-Haul)

- Long-Distance Movers Targeting Less Competitive, Less Expensive Housing Markets (Zillow)

Commercial Real Estate and the Macro Economy

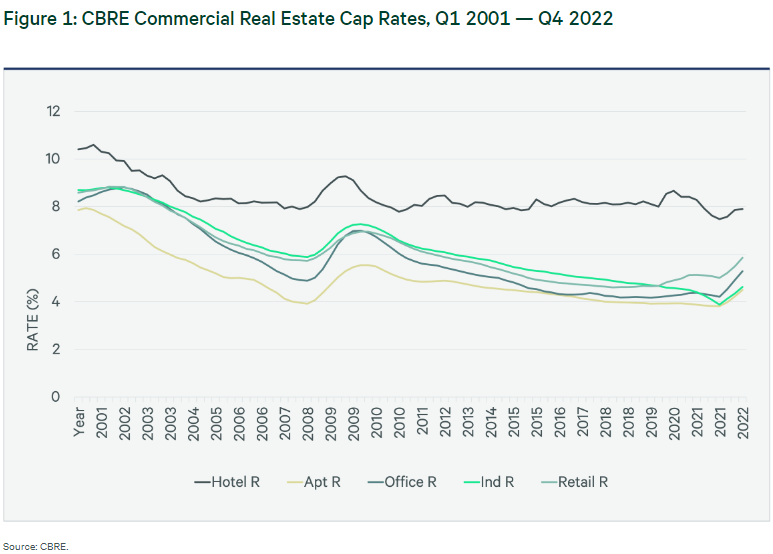

Connections & Disconnections of Commercial Property Cap Rates

Via CBRE: “The statistical evidence presented herein aligns with the proposition [that] . . . all real estate performance is driven by the same forces . . . and not the conventional wisdom that idiosyncratic fundamental forces result in property type performance measures that show very different patterns over time.”

- Research Video: Supply Chain Inflation Risk (Marcus & Millichap)

- The Math Behind the Hybrid Workplace (CBRE)

- Global Real Estate Outlook, 2024 (JLL)