Gray Report Newsletter: January 11, 2024

Private Credit and Multifamily Survival

Recent reporting on commercial real estate financing has highlighted the role of private credit in providing funding for CRE sponsors/owners and delaying the need for a capital call, and despite the expectation of interest rate reductions later in the year, it is clear that private credit will remain an important tool in 2024. Newly-published reports on multifamily performance continue to clarify the near-term challenges for apartment operators, but data showing record vacancies for office properties presents a bleaker picture and signs of persistent shifts in remote/in-person work that could lead to more sustained housing demand in the future.

Multifamily, the Nation, and the Economy

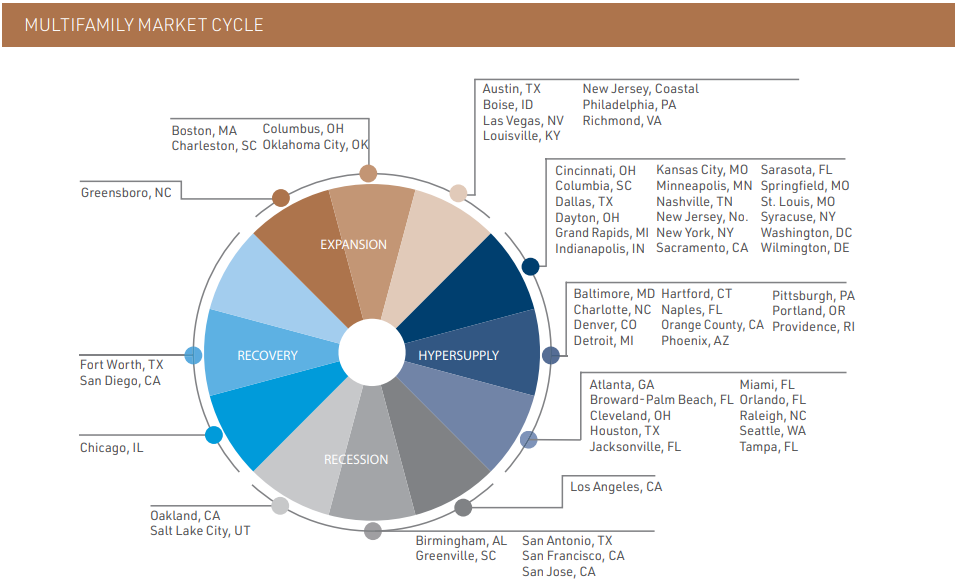

IRR Viewpoint 2024: Valuation Challenges and Investment Opportunities

Integra Realty Resources: From the (excellent) report: “Those who overleveraged or who cannot deliver exceptional management will run out of time and will represent the ‘opportunities’ the dry-powder crowd has been waiting to meet . . . The coming year will be a career-making lesson in the value of liquidity and the time-value of money.”

- Key Forecast Themes for 2024 Multifamily Include “considerable improvement in absorption” (RealPage)

- Private Lending, Subscription Lines of Credit, and CRE Returns (MSCI)

- Rental Activity Report: Atlanta Is Top Market to Watch in 2024, Midwest Most Popular Region for Renting (RentCafe)

Multifamily Markets and Reports

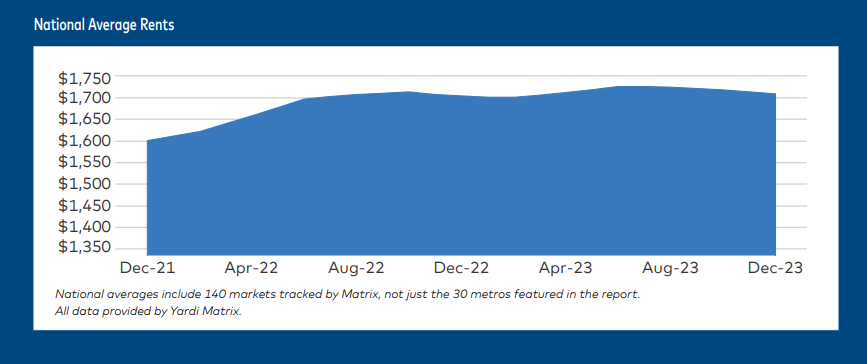

Dec. 2023 Multifamily Report: Rent Growth Continues to Flatten

Yardi Matrix: Annual rent growth for 2023 was 0.3%, and monthly rent growth was at -0.2% for December, but “overall demand remains firm, which limits the potential downside.”

- Which U.S. Metros Sit in the Crosshairs of Remote Work Migration? (CoreLogic)

- December 2023 Student Housing Pre-Lease Rate Tops 40% (RealPage)

- 2024 National Apartment Forecast Report (Berkadia)

Multifamily and the Housing Market

Home Purchase Sentiment: Consumer Optimism About Mortgage Rates Jumps Significantly

Via Fannie Mae: “In December, a survey-high 31% of consumers indicated that they expect mortgage rates to go down, while 31% expect them to go up, and 36% expect rates to remain the same.”

- County Median Home Prices and Monthly Mortgage Payment (NAR)

- The Top 50 Master Planned Communities Sold Over 34,000 New Homes in 2023 (John Burns Research and Consulting)

- Dec. Apartment Report: Rents Down 0.8% for the Year, Down 0.2% for the Month (Redfin)

Commercial Real Estate and the Macro Economy

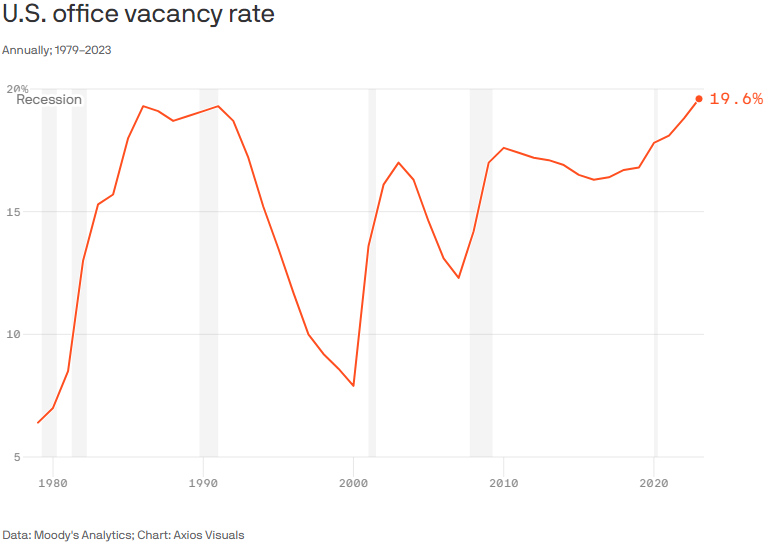

Charted: Office vacancies hit a new record high

Via Axios: “Office vacancies hit a record high in the fourth quarter of last year, surpassing previous peaks last reached in 1991 and 1986 . . . The transition marks an enormous societal shift as Americans adjust to a whole new way of working and living — big changes are underfoot in cities and suburbs around the country.”

- Market Pulse: Strong Economic Data Throws Cold Water on Rate Cut Rally (Trepp)

- Investment Sales Continue Their Decline (GlobeSt)

- 3 Reasons CRE Activity Should Revive (Marcus & Millichap)

Other Real Estate News and Reports

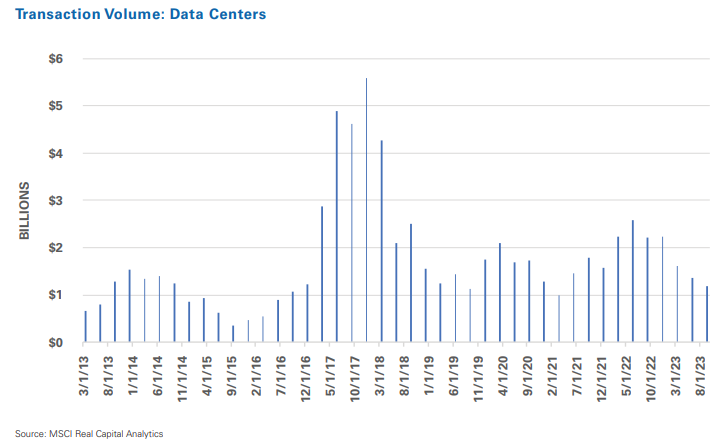

2023 U.S. Data Center Market Overview & Market Clusters

Via Newmark: “$26B in dry powder remains with data center allocation potential, but most activity is focused on new development and value add opportunities, given the amount of demand and attractive unlevered development yields. Returns can vary greatly by market, but U.S. profit margins are generally >50%.”

- The Year-End 2023: CRE at a Crossroads for Loan Maturities and Interest Rates (Trepp)

- News Real Estate’s Finance Class Sees Hope And Distress For 2024 At CREFC Conference (Bisnow)

- Another Disconnect Between the Markets and the Fed (Moody’s Analytics)