Gray Report Newsletter: February 8, 2024

Multifamily Investment Picture Keeps Improving

Compared to the prevailing uncertainties of 2023, a better view of the multifamily market and its driving forces points to increased investment activity as the year progresses. Significant challenges remain for apartment operators in 2024, but greater clarity on apartment construction, interest rates, housing demand, and the economy, alongside pent-up demand from investors who were inactive this past year, are a marked contrast from 2023 and highlight the solid investment prospects of the multifamily market.

Multifamily, the Nation, and the Economy

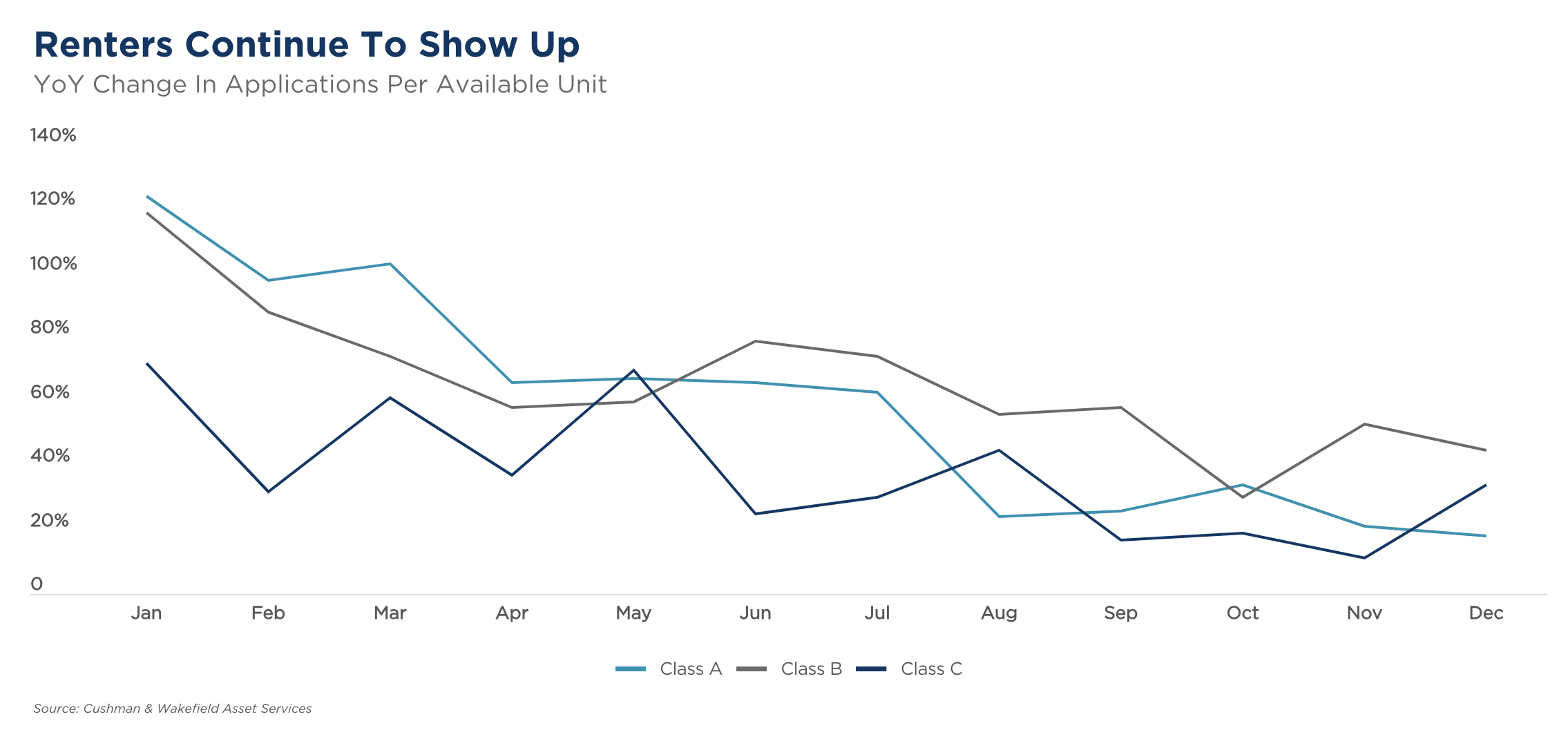

Top Multifamily Trends: “No Signs of Weakness Renters”

Via Cushman & Wakefield: From the report: “Thus far, the lights are still signaling “green,” and the share of move outs for cost reasons remains low. In 2023, more renters left units to buy a home than because the rent was unaffordable, even in one of the most unaffordable times to buy a home compared to renting.”

- The Dry Powder Can’t Get Here Soon Enough (GlobeSt)

- “Optimism is back” and “Values could be bottoming” – Takeaways from the NMHC Conference (RealPage)

- Regional Banks Still Have the CRE Blues (GlobeSt)

Multifamily and the Housing Market

Groundhog Day: Will There Be A Long Winter for CRE?

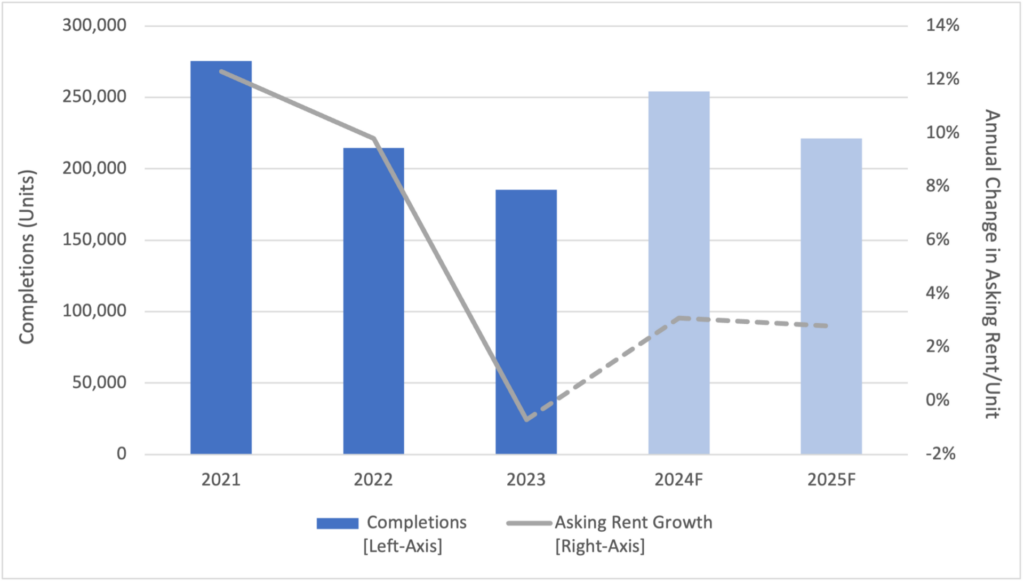

Moody’s Analytics: “We expect the multifamily sector’s rent growth to increase by the low- to mid-2% range in 2024 as robust multifamily (and single-family) completions spill over from the previous year, subduing the rebound in rents, especially at the higher-end of the multifamily market.”

- Housing Sentiment Improving, Mortgage Rate Optimism Hits Survey High (Fannie Mae)

- Gains for Student Housing Construction (NAHB)

- Study: The Best Housing Market to Buy Based on Past Pricing Trends [it’s Columbus, OH] (Florida Atlantic University)

Multifamily Markets and Reports

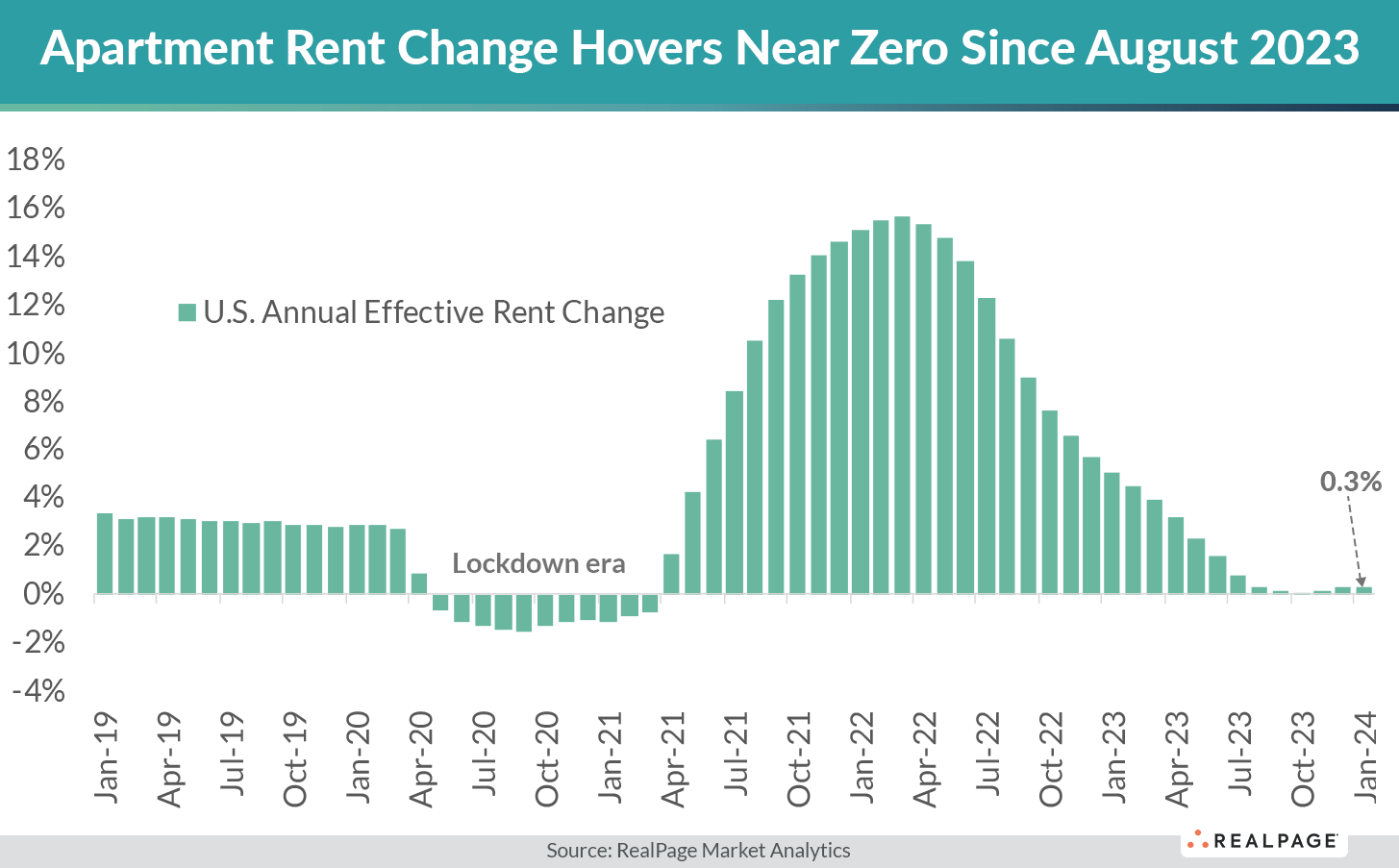

Apartment Rent Growth Remains Near Stagnant

RealPage: “[J]ust 13 of the nation’s 50 largest metro areas saw same-store rents expand by more than 2% in the year-ending January 2024. These markets are overwhelmingly clustered in Midwestern U.S. such as Cincinnati, Chicago, Milwaukee, Indianapolis, Cleveland and Kansas City.”

- New Apartment Supply Exceeds Strong Demand (CBRE)

- Cleveland, Milwaukee, Columbus and Chicago Are Rent Growth Leaders (Zumper)

- The Housing Market’s ‘Affordability Picture’ May Finally Be Coming Into Focus (Realtor.com)

Commercial Real Estate and the Macro Economy

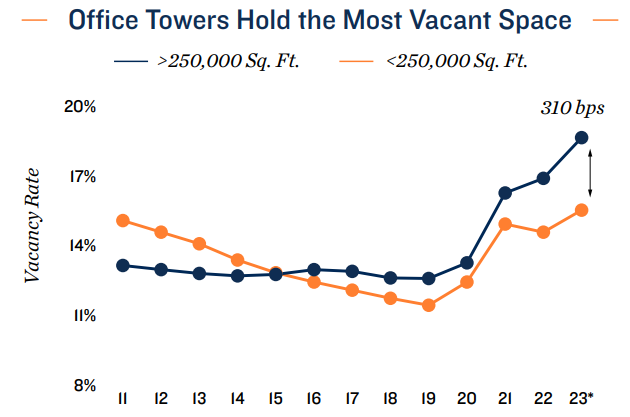

2024 U.S. Office Investment Forecast

Via Marcus & Millichap: “Pandemic-era work disruptions will persist in 2024. The office sector will consequently contend with a reduction in space needs. Office utilization data and a growing understanding of hybrid work needs will allow firms to better adjust existing office leases, translating to muted space demand this year.”

- 2024 Insurance Commercial Real Estate Trends to Watch (JLL)

- Economic Watch: Robust Job Growth Keeps Fed Cautious (CBRE)

- How Definitions Shape the Rural Housing Landscape (Harvard Joint Center for Housing Studies)

Other Real Estate News and Reports

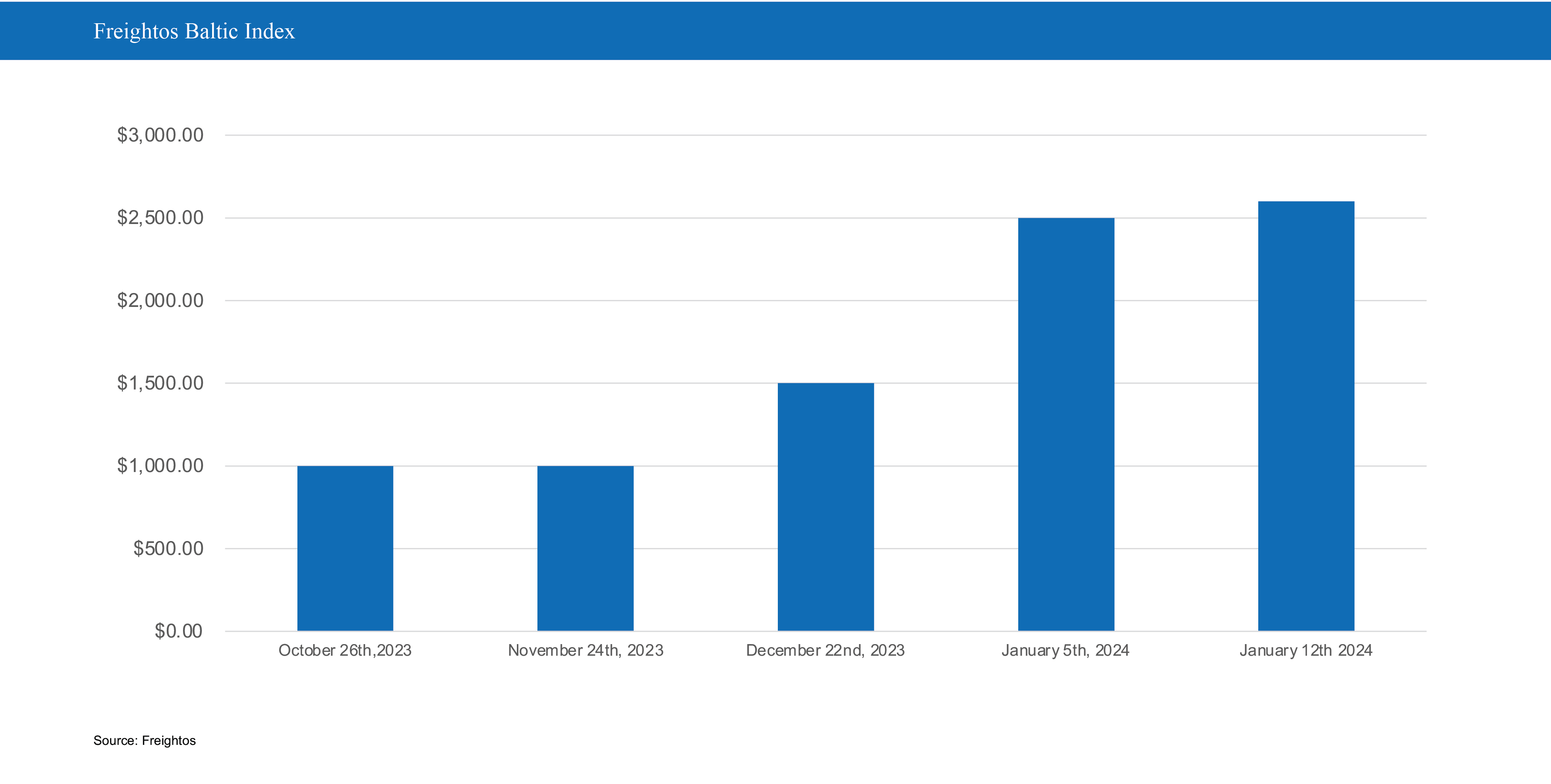

Global Supply Chain Challenges in Early 2024

Via Newmark: “The result of a tumultuous stretch of years for the supply chain is that unpredictability will drive demand for more industrial space due to the need for diversified sourcing and ports of entry to control cost and speed. The immediate impact of these global developments on leased industrial space is likely to be a mild but net positive.”

- Treasury Department Introduces Rule To Crack Down On Real Estate Money Laundering (Bisnow)

- How Definitions Shape the Rural Housing Landscape (Harvard Joint Center for Housing Studies)

- Healthy U.S. Job Market Helps Home Price Growth Continue to Push Forward (CoreLogic)